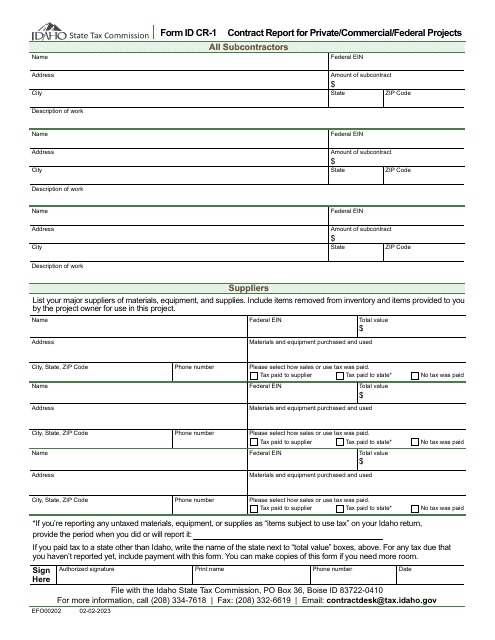

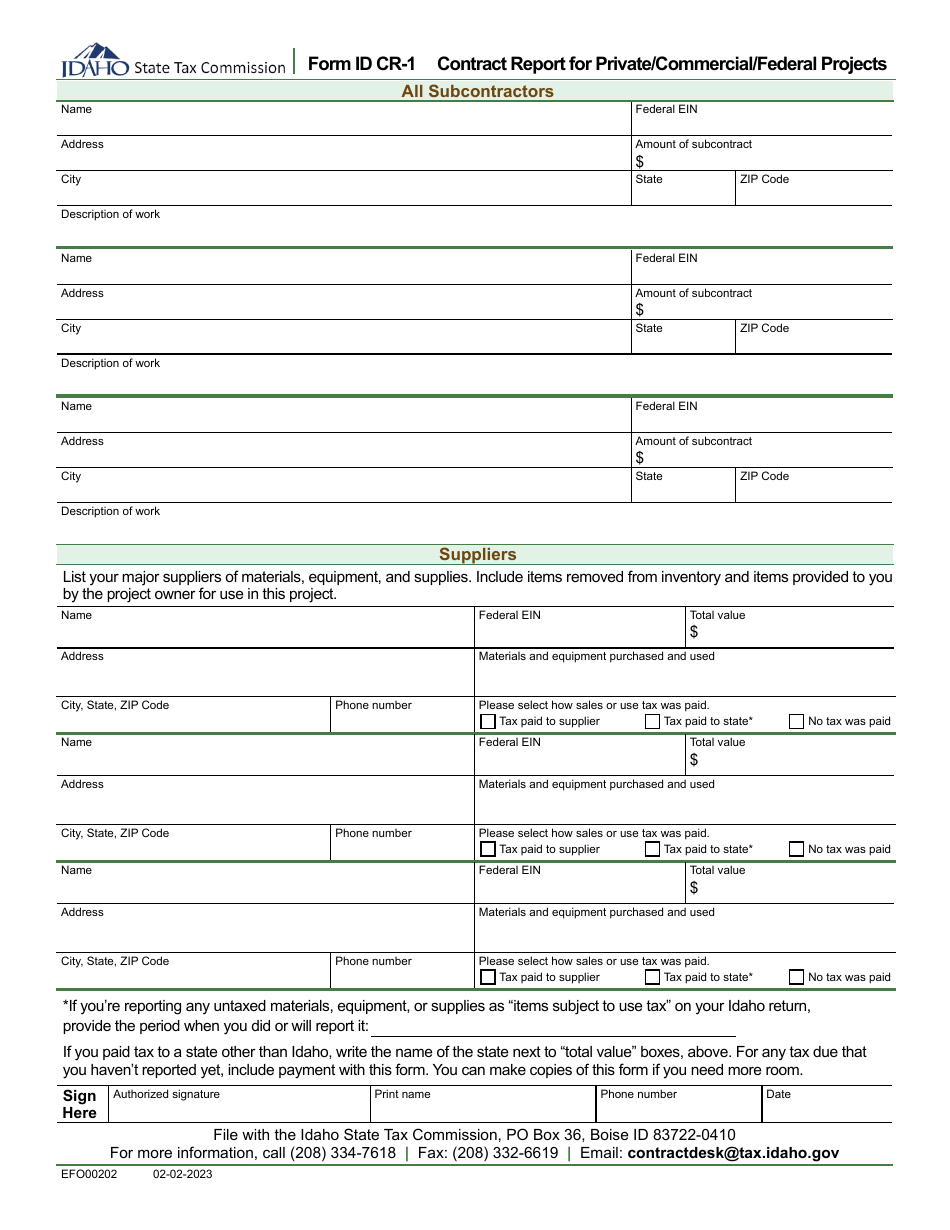

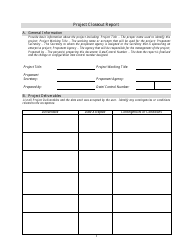

Form ID CR-1 (EFO00202) Contract Report for Private / Commercial / Federal Projects - Idaho

What Is Form ID CR-1 (EFO00202)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ID CR-1?

A: Form ID CR-1 is a Contract Report for Private/Commercial/Federal Projects in Idaho.

Q: What is the purpose of Form ID CR-1?

A: The purpose of Form ID CR-1 is to report contract information for private, commercial, and federal projects in Idaho.

Q: Who needs to complete Form ID CR-1?

A: Contractors involved in private, commercial, and federal projects in Idaho need to complete Form ID CR-1.

Q: When should Form ID CR-1 be completed?

A: Form ID CR-1 should be completed and submitted after the completion of the project or at the end of each calendar year, as required.

Q: Are there any fees associated with Form ID CR-1?

A: There are no fees associated with filing Form ID CR-1.

Q: What information is required on Form ID CR-1?

A: Form ID CR-1 requires information such as project details, contractor information, subcontractor information, and payment details.

Q: Are there any penalties for not filing Form ID CR-1?

A: Failure to file Form ID CR-1 may result in penalties, including monetary fines.

Q: Who can I contact for assistance with Form ID CR-1?

A: For assistance with Form ID CR-1, you can contact the Idaho State Tax Commission.

Form Details:

- Released on February 2, 2023;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ID CR-1 (EFO00202) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.