This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-X

for the current year.

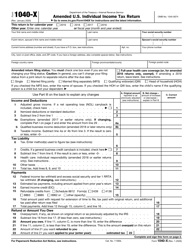

Instructions for IRS Form 1040-X Amended U.S. Individual Income Tax Return

This document contains official instructions for IRS Form 1040-X , Amended U.S. Individual Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-X is available for download through this link.

FAQ

Q: What is IRS Form 1040-X?

A: IRS Form 1040-X is the form used to amend your U.S. Individual Income Tax Return.

Q: When should I file Form 1040-X?

A: You should file Form 1040-X to amend your tax return if you need to make changes to your original return after filing it.

Q: What changes can I make with Form 1040-X?

A: You can make changes to your income, deductions, credits, or filing status using Form 1040-X.

Q: How do I file Form 1040-X?

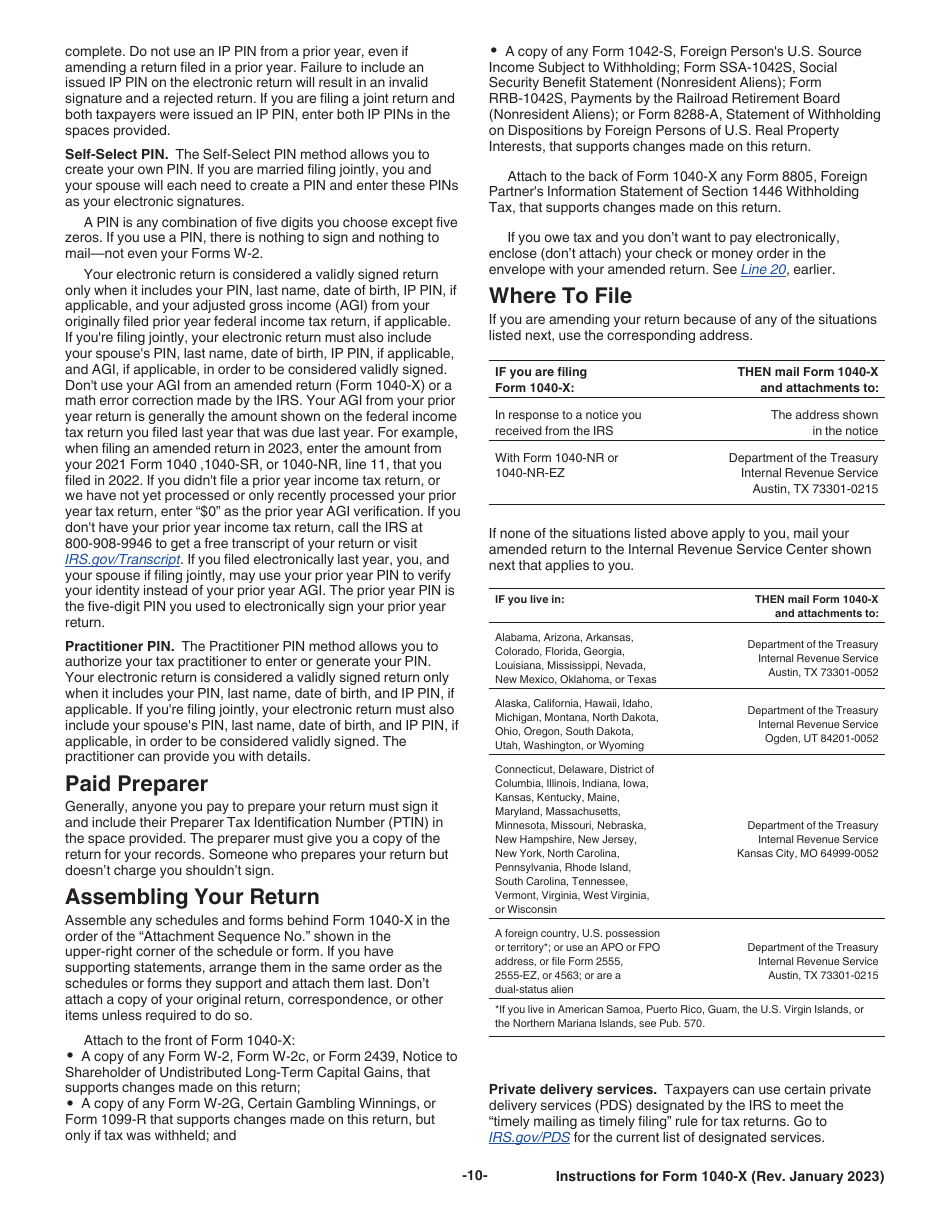

A: To file Form 1040-X, you need to complete the form and mail it to the address provided in the instructions.

Q: Can I e-file Form 1040-X?

A: No, you cannot e-file Form 1040-X. It must be filed by mail.

Q: Do I need to include any supporting documents with Form 1040-X?

A: Yes, you may need to include supporting documents such as a corrected W-2 or additional schedules with Form 1040-X.

Q: Is there a deadline to file Form 1040-X?

A: Yes, you generally have three years from the date you filed your original return, or two years from the date you paid the tax, to file Form 1040-X.

Q: What happens after I file Form 1040-X?

A: After you file Form 1040-X, the IRS will review your amended return and notify you if any additional actions or payments are required.

Q: What if I made a mistake on my Form 1040-X?

A: If you made a mistake on your Form 1040-X, you can file another amended return with the correct information or wait for the IRS to contact you for additional information.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.