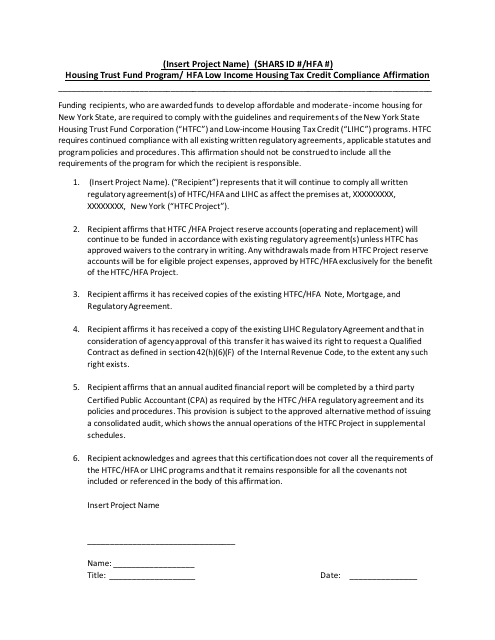

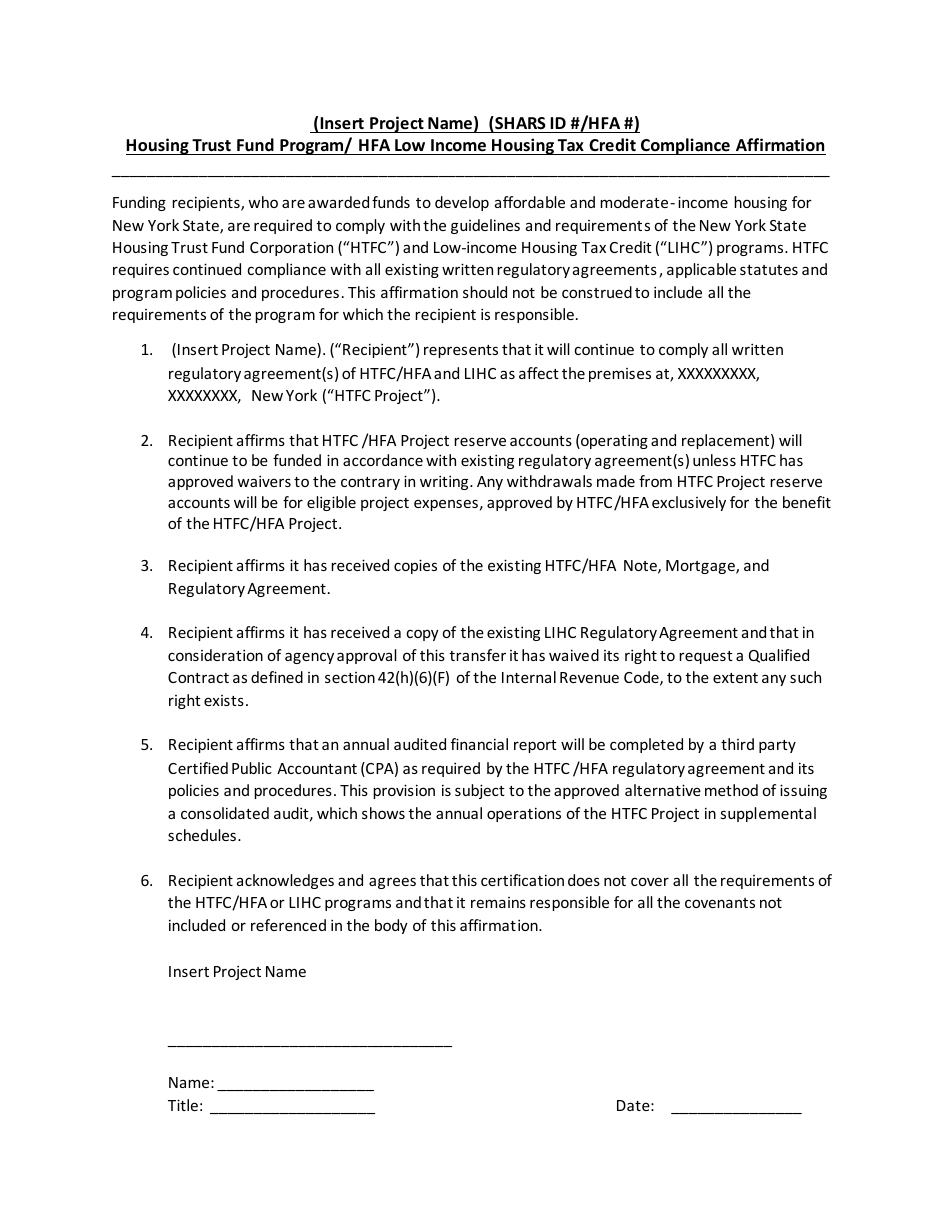

Housing Trust Fund Program / Hfa Low Income Housing Tax Credit Compliance Affirmation - New York

Housing Tax Credit Compliance Affirmation is a legal document that was released by the New York State Homes and Community Renewal - a government authority operating within New York.

FAQ

Q: What is the Housing Trust Fund Program?

A: The Housing Trust Fund Program is a government initiative in New York that provides financial assistance for the development and preservation of affordable housing.

Q: What is HFA Low Income Housing Tax Credit Compliance Affirmation?

A: HFA Low Income Housing Tax Credit Compliance Affirmation is a process in New York where property owners affirm their compliance with low-income housing tax credit rules and regulations.

Q: Who is eligible for the Housing Trust Fund Program?

A: Eligibility for the Housing Trust Fund Program is determined by income and other criteria. Typically, individuals and families with low to moderate incomes are eligible.

Q: What are the benefits of participating in the HFA Low Income Housing Tax Credit Compliance Affirmation?

A: Participating in the HFA Low Income Housing Tax Credit Compliance Affirmation ensures that property owners are complying with the regulations and requirements of the low-income housing tax credit program, which can result in tax benefits and incentives.

Q: How can I apply for the Housing Trust Fund Program?

A: To apply for the Housing Trust Fund Program, you can contact the relevant government agency or organization overseeing the program in your area. They will provide information on eligibility requirements and the application process.

Q: What happens if a property owner fails to comply with the HFA Low Income Housing Tax Credit Compliance Affirmation?

A: If a property owner fails to comply with the HFA Low Income Housing Tax Credit Compliance Affirmation, they may be subject to penalties, fines, and potential loss of tax benefits or incentives.

Form Details:

- The latest edition currently provided by the New York State Homes and Community Renewal;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Homes and Community Renewal.