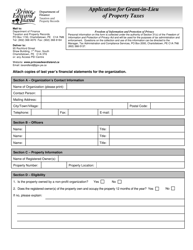

Form 11PT15-30651 Application for Real Property Tax Deferral Program for Senior Citizens - Prince Edward Island, Canada

FAQ

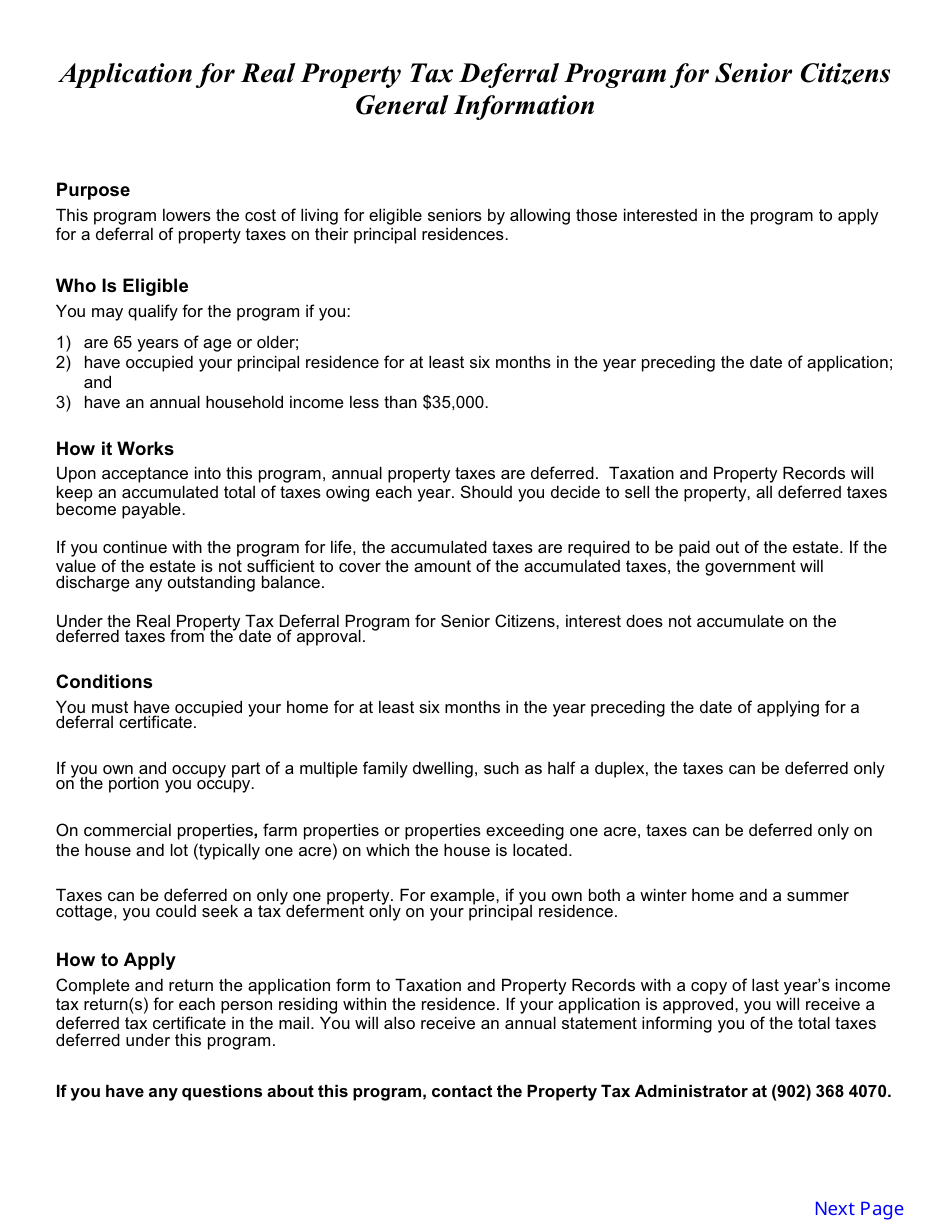

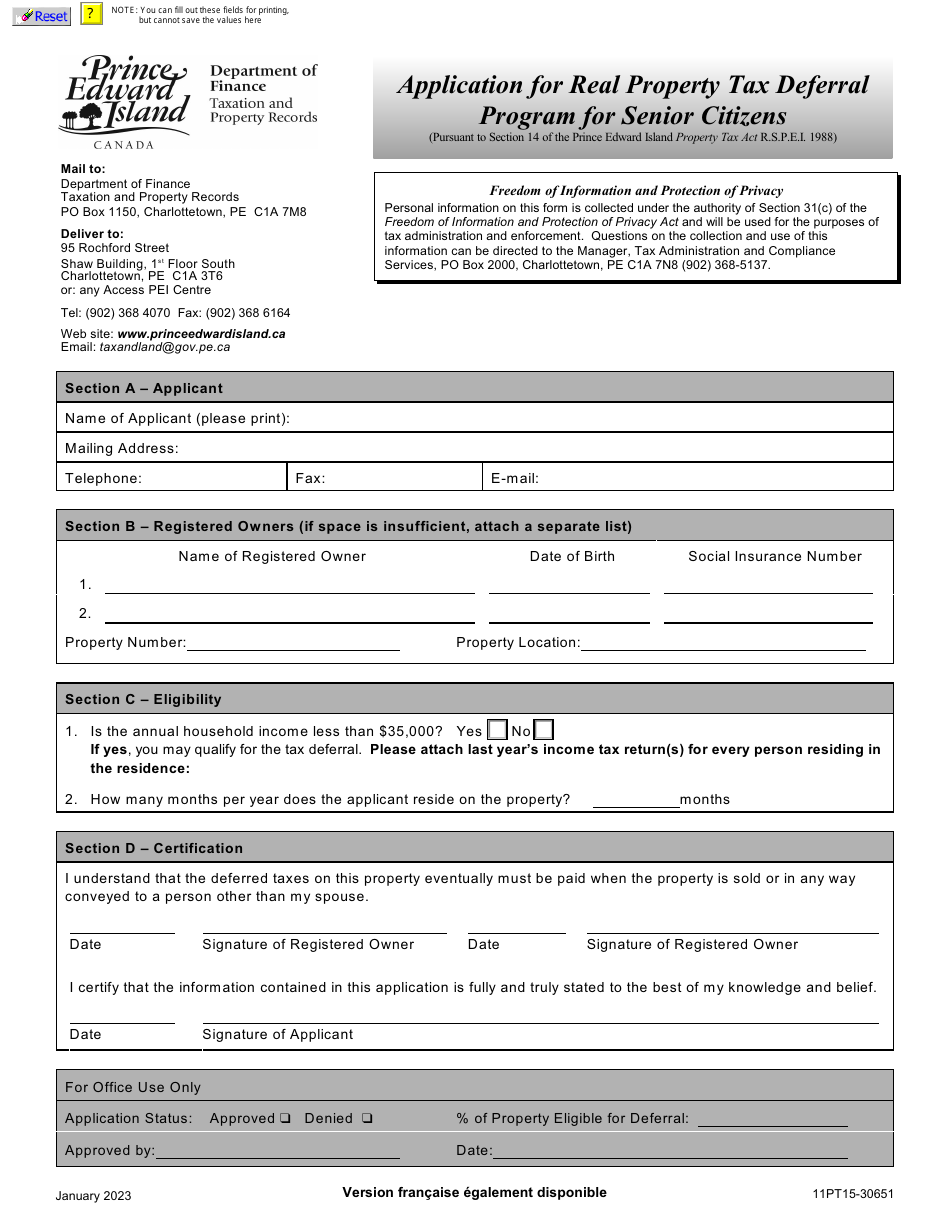

Q: What is Form 11PT15-30651?

A: Form 11PT15-30651 is an application for the Real Property Tax Deferral Program for Senior Citizens in Prince Edward Island, Canada.

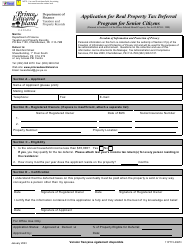

Q: Who is eligible for the Real PropertyTax Deferral Program for Senior Citizens?

A: Senior citizens who are 65 years of age or older and own their principal residence in Prince Edward Island are eligible for the program.

Q: What is the purpose of the Real Property Tax Deferral Program?

A: The program allows eligible senior citizens to defer paying their property tax until the property is sold or transferred.

Q: Are there any income requirements for eligibility?

A: Yes, there are income requirements to be eligible for the program. The specific income thresholds are outlined in the program guidelines.

Q: What documents do I need to include with the application?

A: You will need to include supporting documents such as proof of age, proof of ownership of the property, and income verification documents.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted by a specified deadline, which is typically mentioned in the program guidelines or on the application form itself.

Q: What happens after I submit the application?

A: Once your application is reviewed and approved, your property tax payment will be deferred until the property is sold or transferred. You will be notified of the approval decision.

Q: What if I no longer qualify for the program?

A: If you no longer meet the eligibility criteria, you will be required to repay the deferred property tax amount in accordance with the program rules.