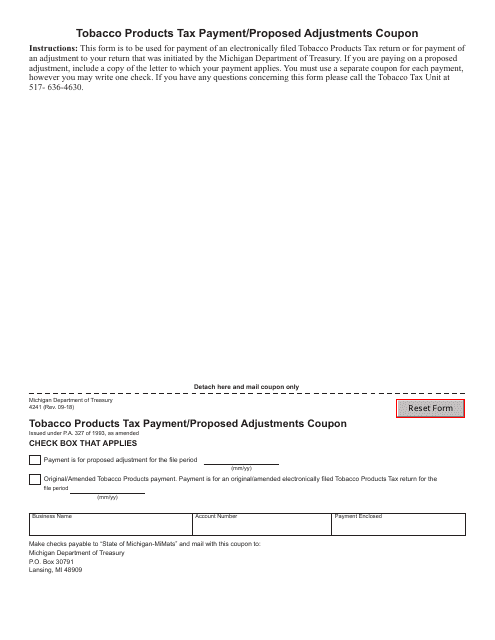

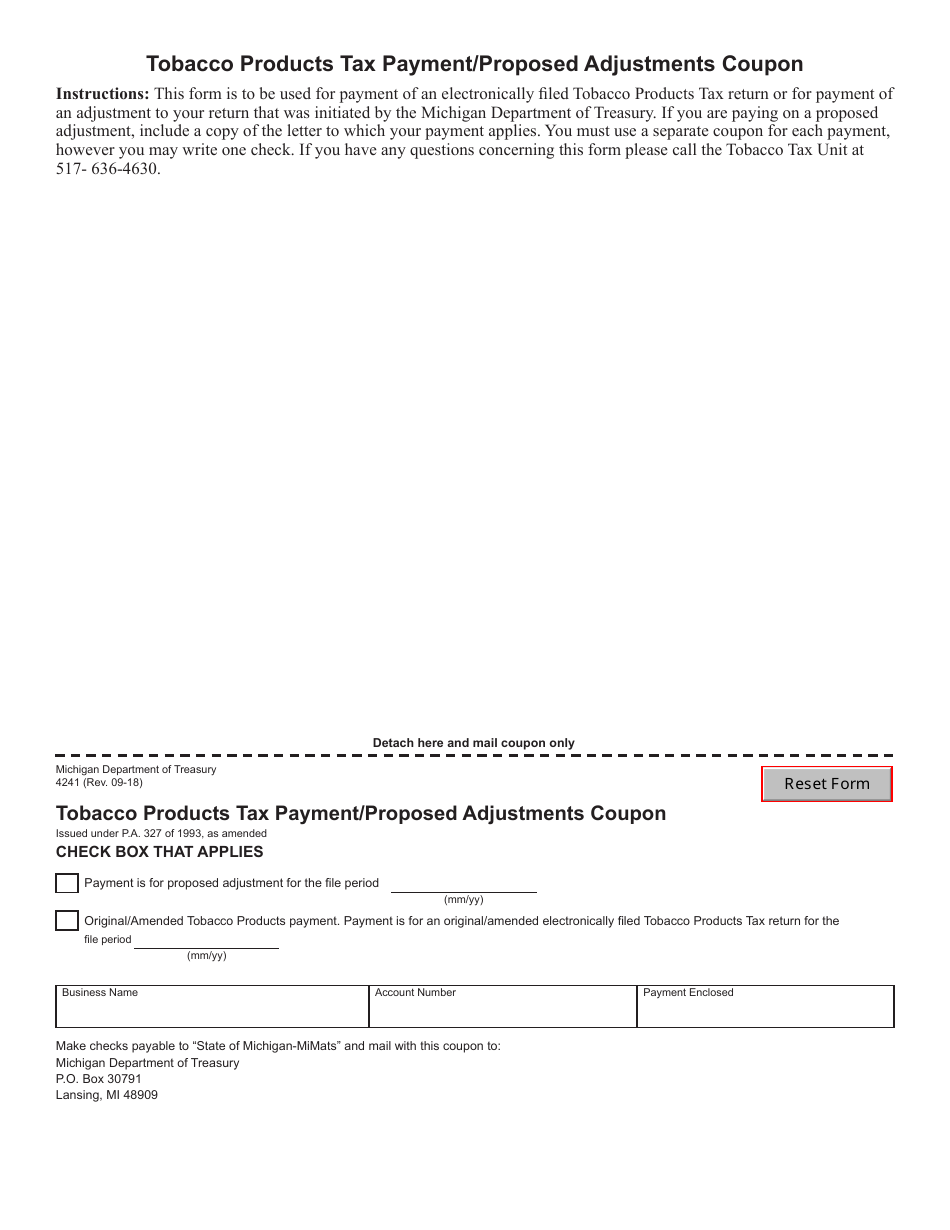

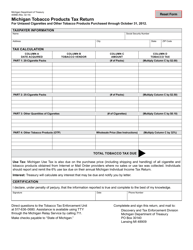

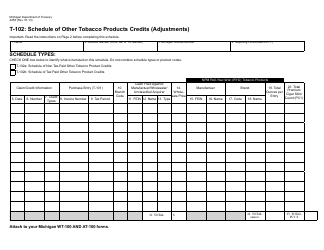

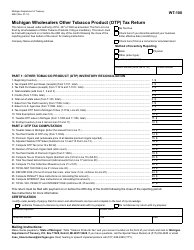

Form 4241 Tobacco Products Tax Payment / Proposed Adjustments Coupon - Michigan

What Is Form 4241?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4241?

A: Form 4241 is a Tobacco Products Tax Payment/Proposed Adjustments Coupon used in Michigan.

Q: What is the purpose of Form 4241?

A: Form 4241 is used to make tobacco products tax payments or propose adjustments for tobacco products in Michigan.

Q: Who needs to use Form 4241?

A: Any business or individual engaged in the sale or distribution of tobacco products in Michigan needs to use Form 4241.

Q: Do I need to file Form 4241 if I don't sell or distribute tobacco products?

A: No, you only need to file Form 4241 if you are engaged in the sale or distribution of tobacco products in Michigan.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4241 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.