This version of the form is not currently in use and is provided for reference only. Download this version of

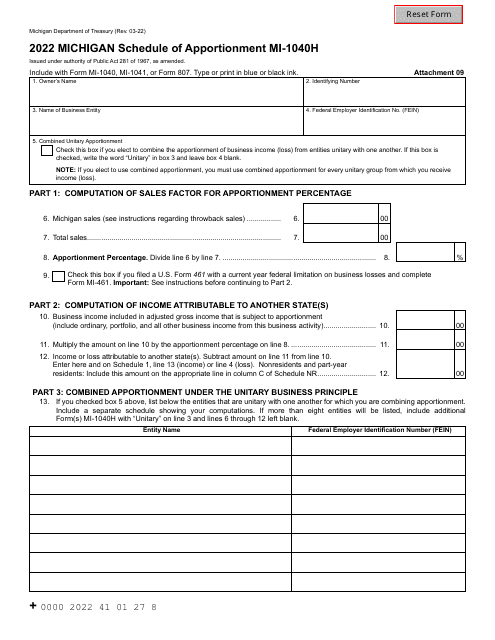

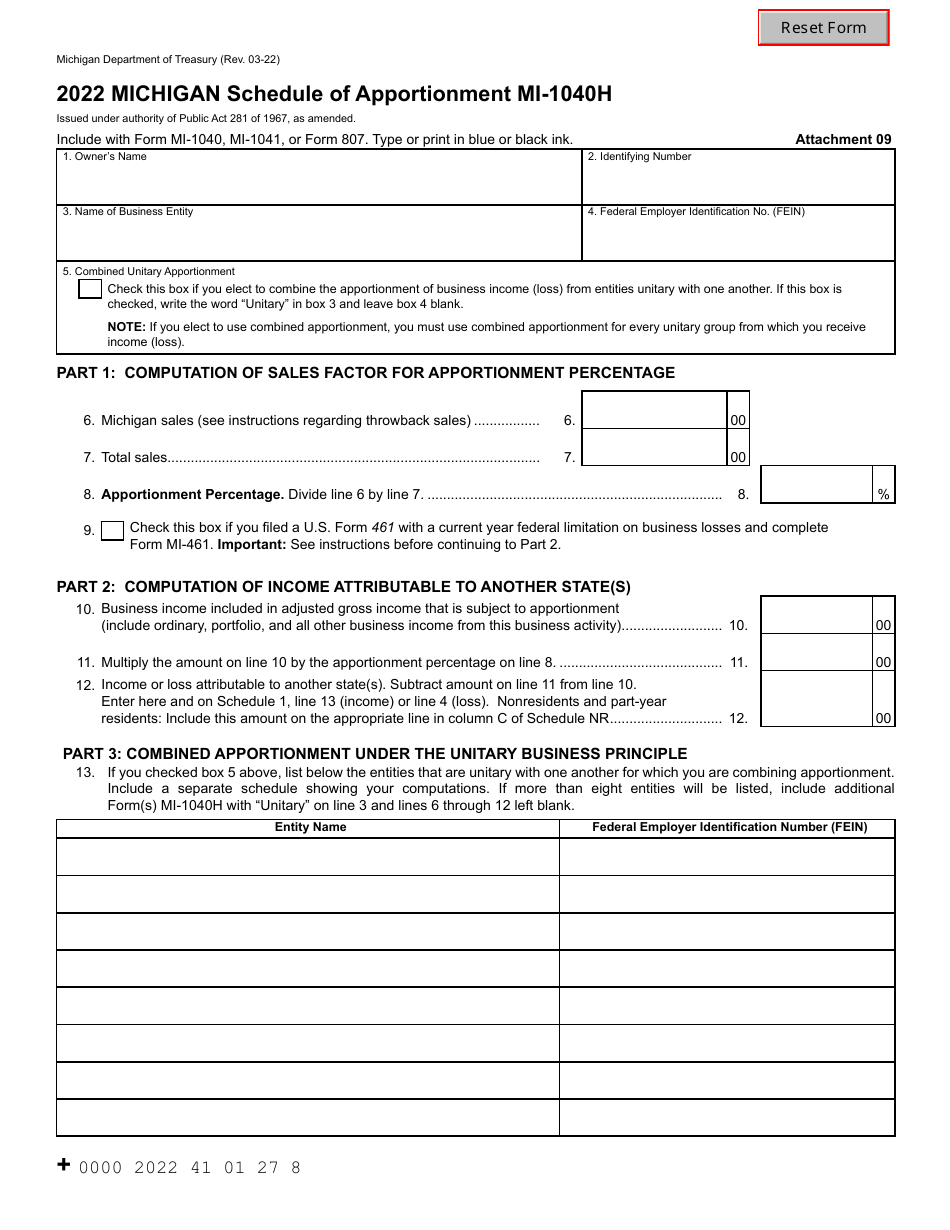

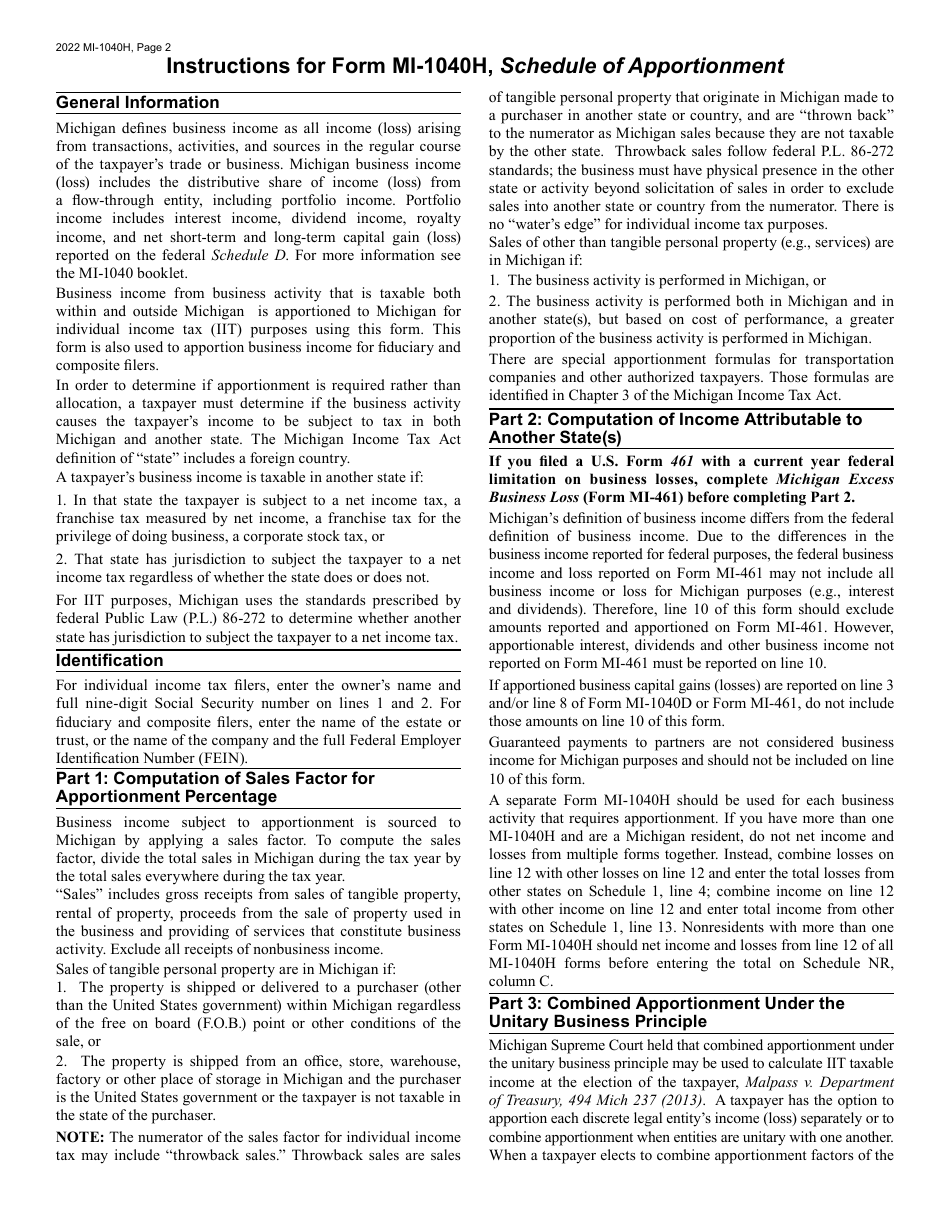

Form MI-1040H

for the current year.

Form MI-1040H Michigan Schedule of Apportionment - Michigan

What Is Form MI-1040H?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

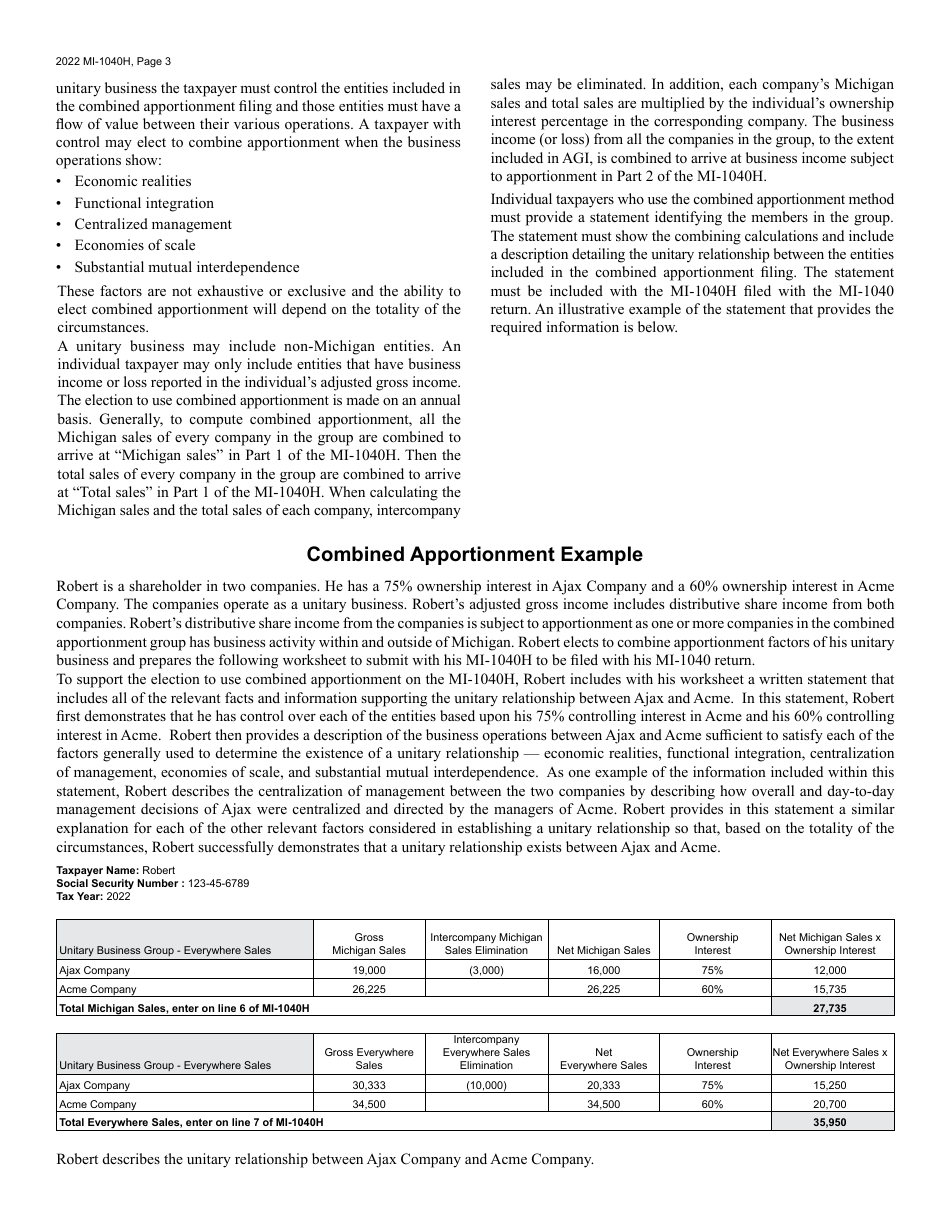

Q: What is Form MI-1040H?

A: Form MI-1040H is Schedule of Apportionment for Michigan residents.

Q: Who needs to file Form MI-1040H?

A: Michigan residents who have income from multiple states must file Form MI-1040H.

Q: What is the purpose of Form MI-1040H?

A: The purpose of Form MI-1040H is to determine the portion of income that is subject to Michigan income tax.

Q: What information is required to complete Form MI-1040H?

A: You will need to provide details of your income from all states, along with information on deductions and exemptions.

Q: When is Form MI-1040H due?

A: Form MI-1040H is generally due on the same date as your Michigan income tax return.

Q: Can I e-file Form MI-1040H?

A: Yes, you can e-file Form MI-1040H along with your Michigan income tax return.

Q: Is there a separate fee for filing Form MI-1040H?

A: No, there is no separate fee for filing Form MI-1040H.

Q: What if I have questions or need help with Form MI-1040H?

A: You can contact the Michigan Department of Treasury for assistance with Form MI-1040H.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040H by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.