This version of the form is not currently in use and is provided for reference only. Download this version of

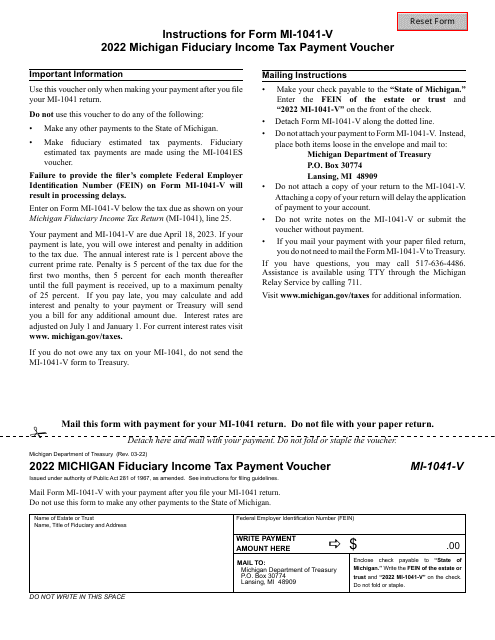

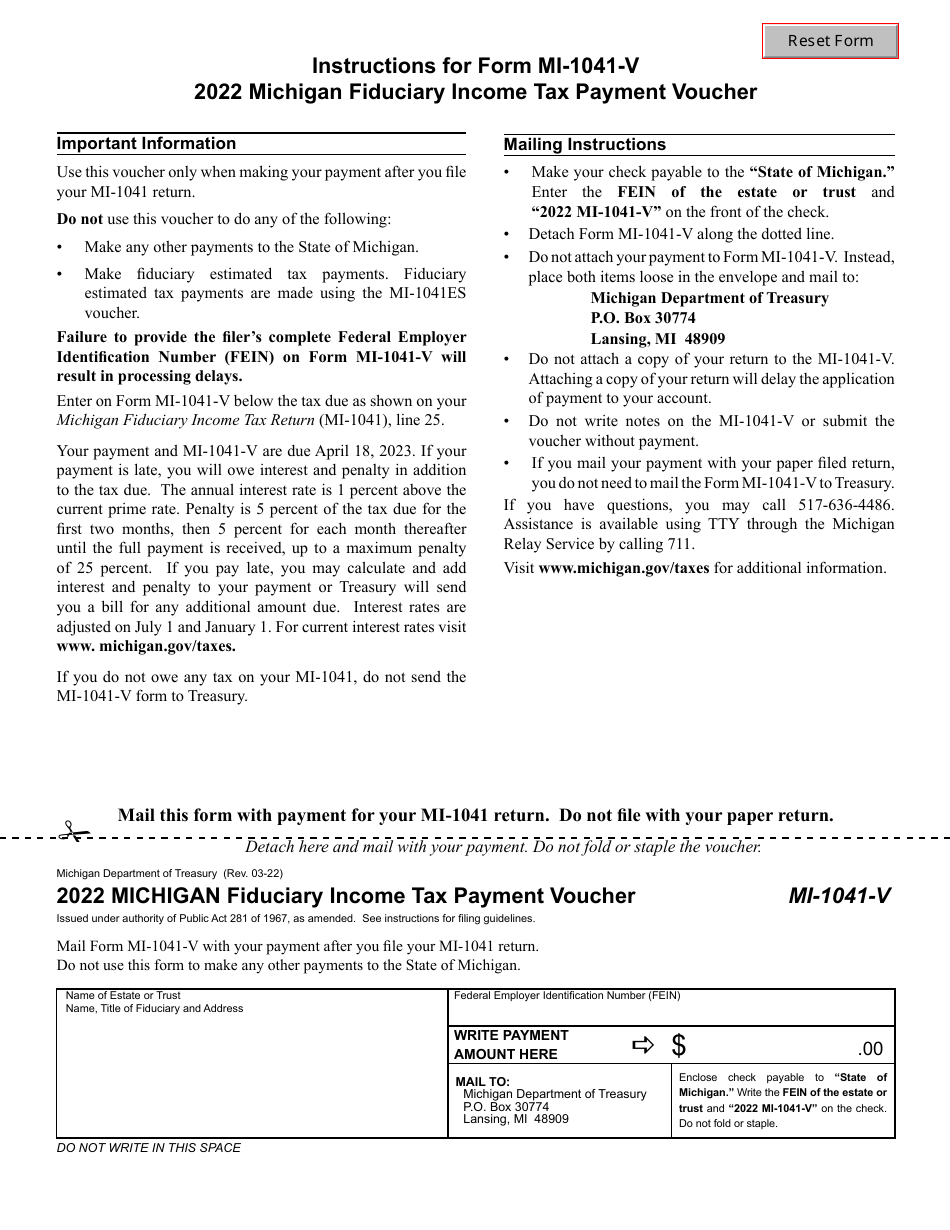

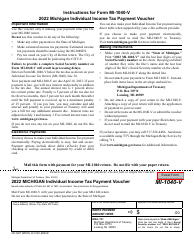

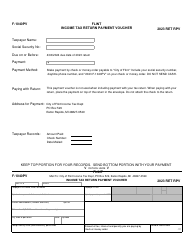

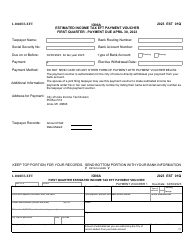

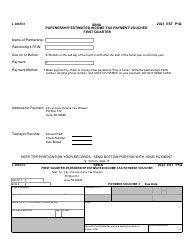

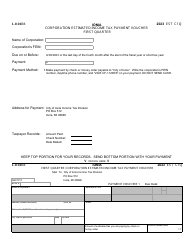

Form MI-1041-V

for the current year.

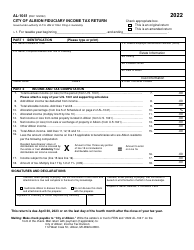

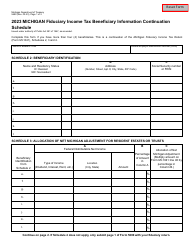

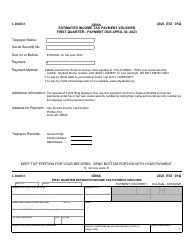

Form MI-1041-V Michigan Fiduciary Income Tax Payment Voucher - Michigan

What Is Form MI-1041-V?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1041-V?

A: Form MI-1041-V is the Michigan Fiduciary Income Tax Payment Voucher.

Q: What is the purpose of Form MI-1041-V?

A: Form MI-1041-V is used to make the payment for Michigan fiduciary income taxes.

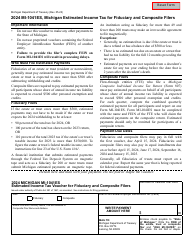

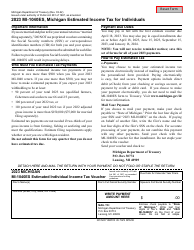

Q: Who needs to file Form MI-1041-V?

A: Anyone who is required to pay Michigan fiduciary income taxes needs to file Form MI-1041-V.

Q: When is Form MI-1041-V due?

A: Form MI-1041-V is due on or before the original due date of the Michigan fiduciary income tax return.

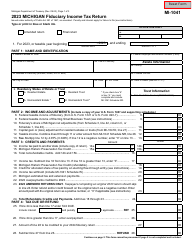

Q: What information is required on Form MI-1041-V?

A: Form MI-1041-V requires the taxpayer's name, address, social security number, taxable year, and the amount of tax payment.

Q: What payment methods are accepted for Form MI-1041-V?

A: Form MI-1041-V accepts payments by electronic funds transfer (EFT), credit card, or check or money order.

Q: Is there a penalty for late payment of Michigan fiduciary income taxes?

A: Yes, there may be a penalty for late payment of Michigan fiduciary income taxes. It is important to make the payment by the due date to avoid penalties and interest.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1041-V by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.