This version of the form is not currently in use and is provided for reference only. Download this version of

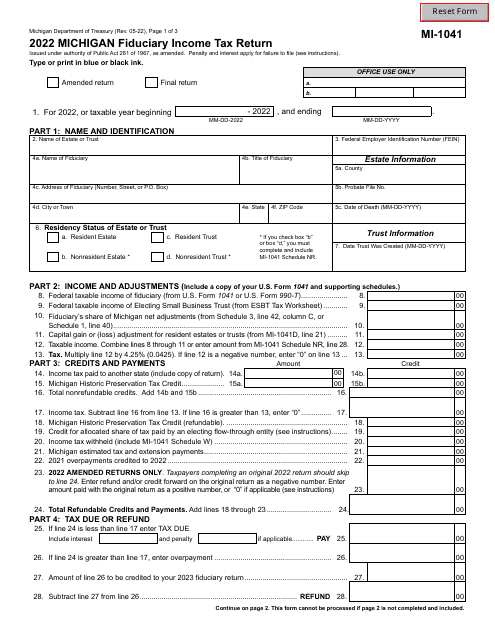

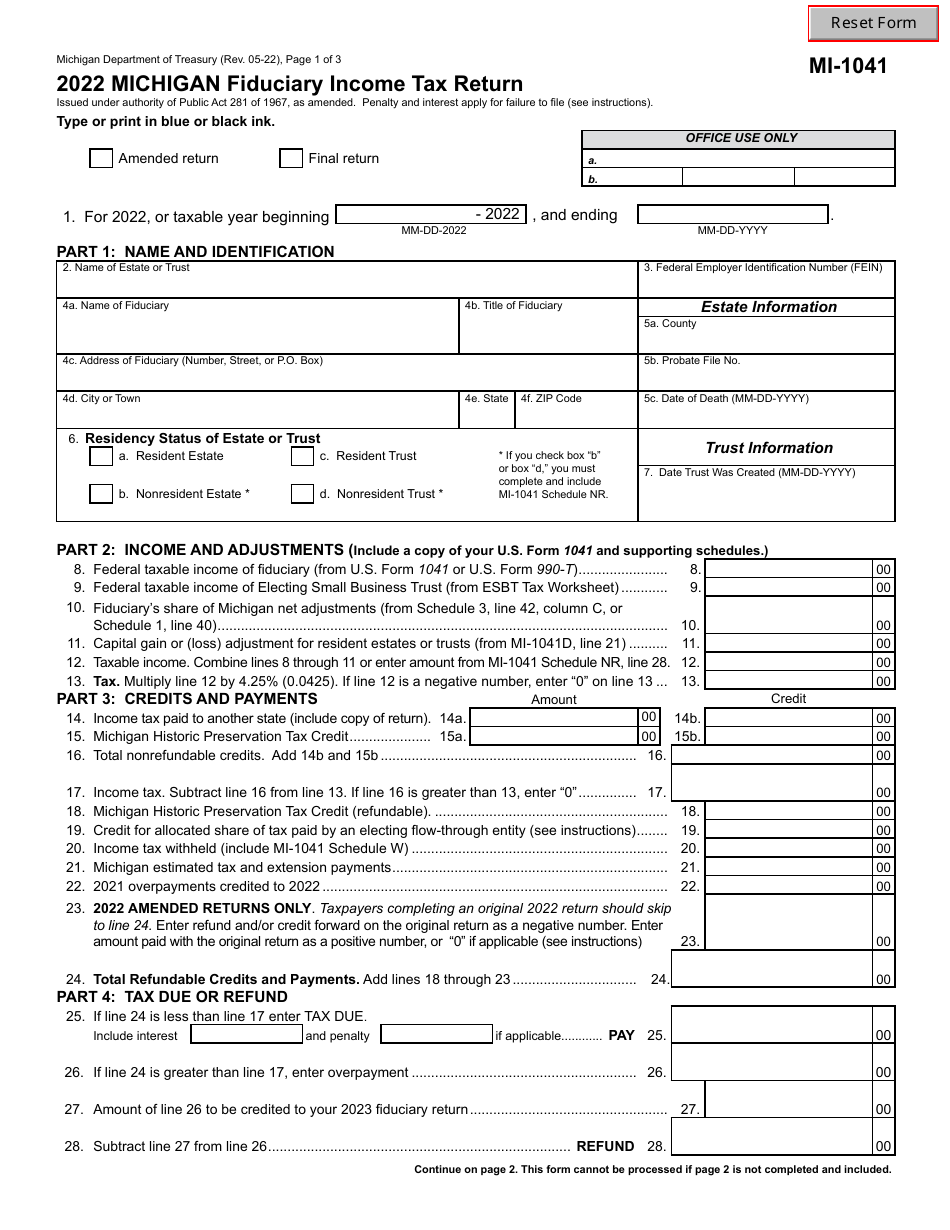

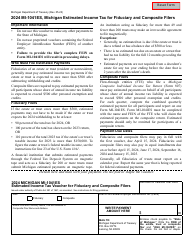

Form MI-1041

for the current year.

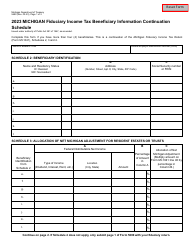

Form MI-1041 Michigan Fiduciary Income Tax Return - Michigan

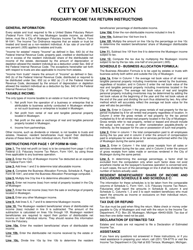

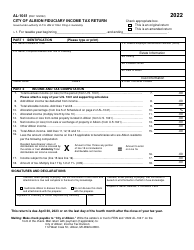

What Is Form MI-1041?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1041?

A: Form MI-1041 is the Michigan Fiduciary Income Tax Return.

Q: Who needs to file Form MI-1041?

A: Form MI-1041 is filed by fiduciaries (such as executors, administrators, trustees, etc.) of estates or trusts that have Michigan taxable income.

Q: What is the purpose of Form MI-1041?

A: The purpose of Form MI-1041 is to report and calculate the fiduciary incometax liability for estates or trusts in Michigan.

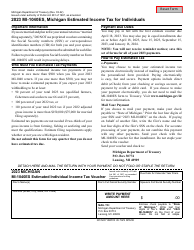

Q: When is the due date for filing Form MI-1041?

A: The due date for filing Form MI-1041 is the 15th day of the fourth month following the close of the tax year. For calendar year filers, it is typically April 15th.

Q: Are there any extensions available for filing Form MI-1041?

A: Yes, you can request an extension of time to file Form MI-1041 by filing Form MI-1041ES. The extension request must be made before the original due date of the return.

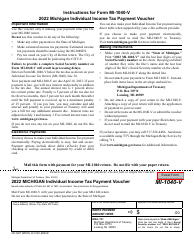

Q: Is there a separate form for paying the tax due with Form MI-1041?

A: No, there is no separate form for paying the tax due. The tax payment should be included with the filed Form MI-1041.

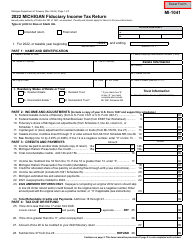

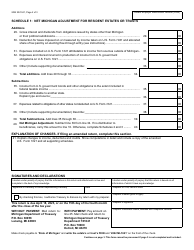

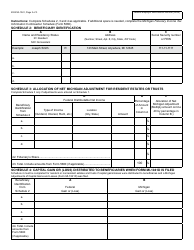

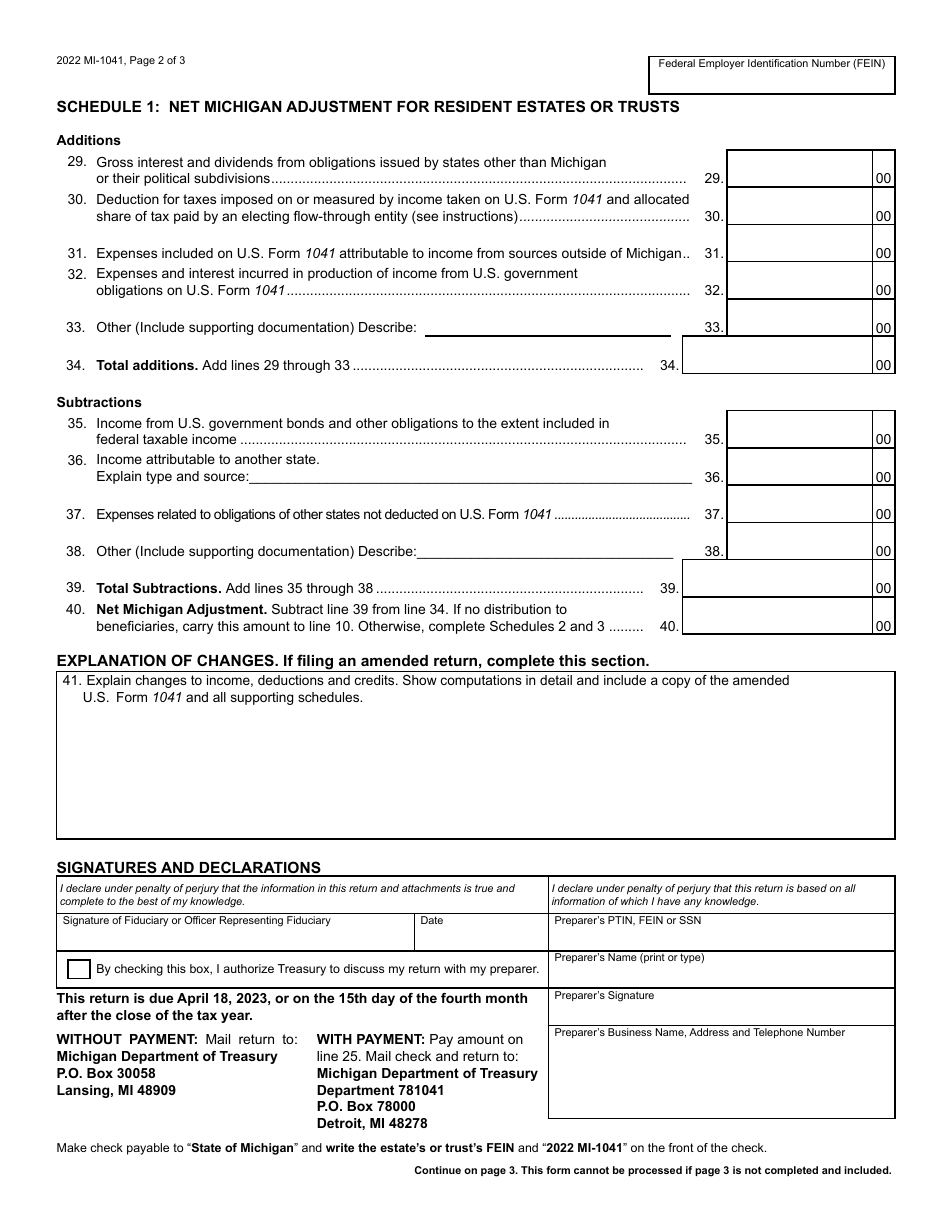

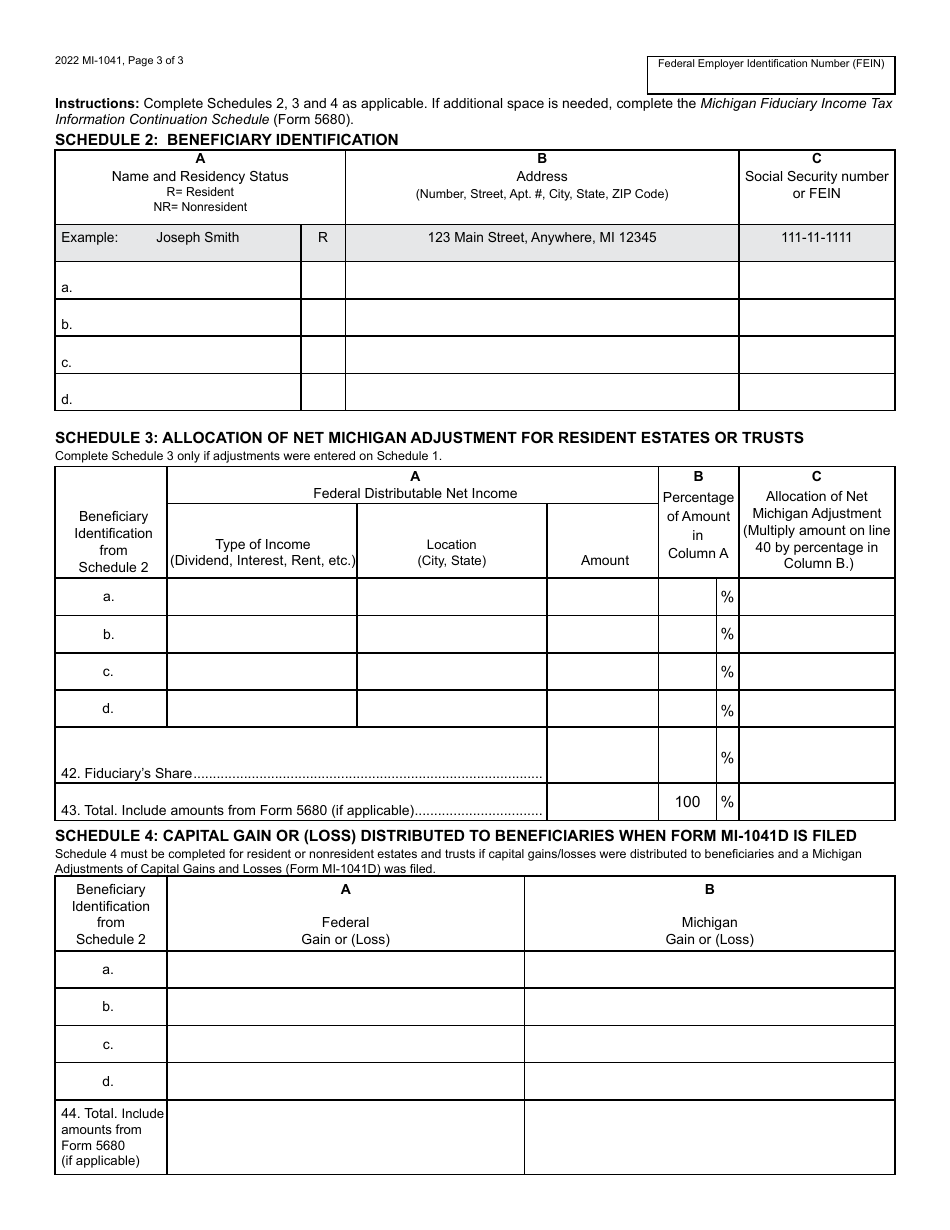

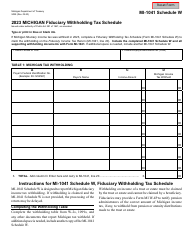

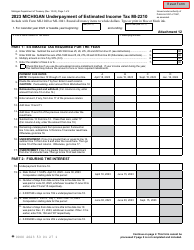

Q: What are the common schedules and forms that accompany Form MI-1041?

A: Some common schedules and forms that may accompany Form MI-1041 include Schedule F, Schedule N, Schedule S, Schedule W, and Form MI-1040CR.

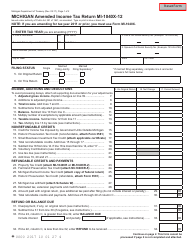

Q: What should I do if I made an error on my filed Form MI-1041?

A: If you made an error on your filed Form MI-1041, you should file an amended return using Form MI-1041X and provide an explanation of the correction.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1041 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.