This version of the form is not currently in use and is provided for reference only. Download this version of

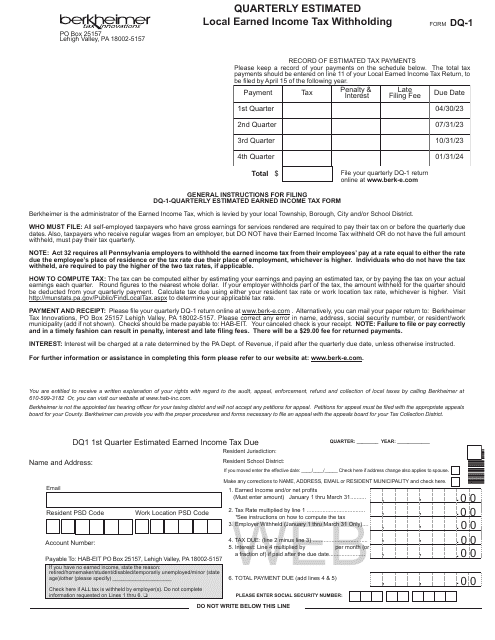

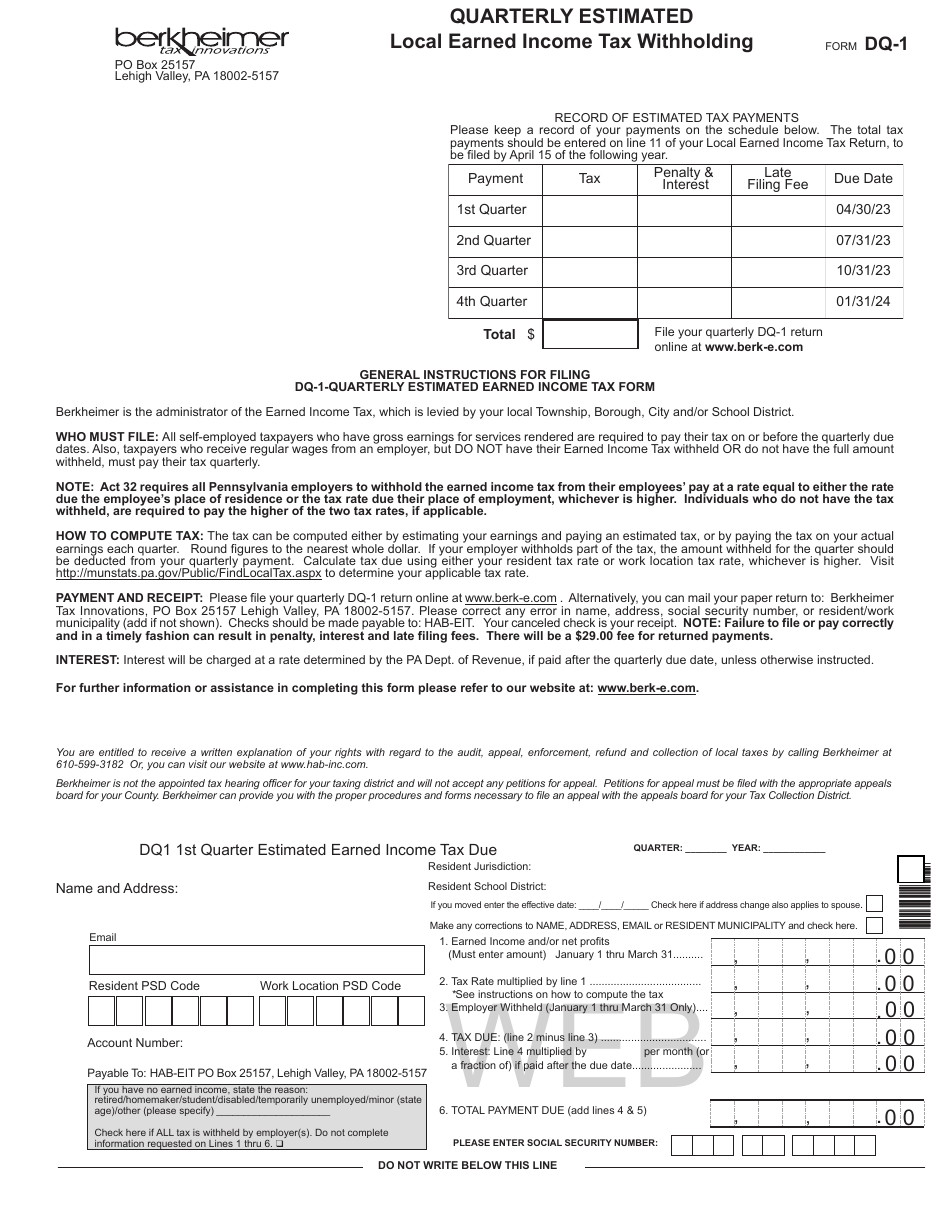

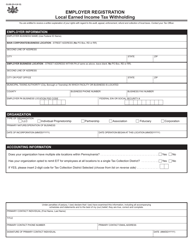

Form DQ-1

for the current year.

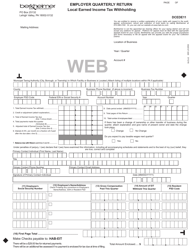

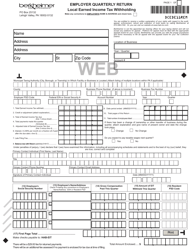

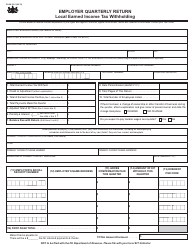

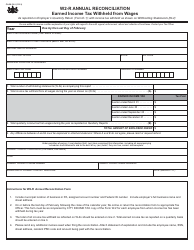

Form DQ-1 Quarterly Estimated Local Earned Income Tax Withholding - Pennsylvania

What Is Form DQ-1?

This is a legal form that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DQ-1?

A: Form DQ-1 is a quarterly estimated local earned incometax withholding form for Pennsylvania.

Q: Who needs to file Form DQ-1?

A: Employers in Pennsylvania who are withholding local earned income tax from their employees' wages need to file Form DQ-1.

Q: What is local earned income tax?

A: Local earned income tax is a tax imposed by local jurisdictions in Pennsylvania on earned income, which includes wages, salaries, and net profits from business or profession.

Q: What is the purpose of Form DQ-1?

A: Form DQ-1 is used to report and remit the local earned income tax withheld from employees' wages to the appropriate local taxing authorities.

Q: When is Form DQ-1 due?

A: Form DQ-1 is due on a quarterly basis, with the due dates falling on the last day of April, July, October, and January.

Q: Are there any penalties for not filing or paying the local earned income tax on time?

A: Yes, there can be penalties for not filing or paying the local earned income tax on time, including interest charges and possible legal actions by the local tax authorities.

Form Details:

- The latest edition provided by the Berkheimer Tax Administrator;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DQ-1 by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.