This version of the form is not currently in use and is provided for reference only. Download this version of

Form CFN:552-0665

for the current year.

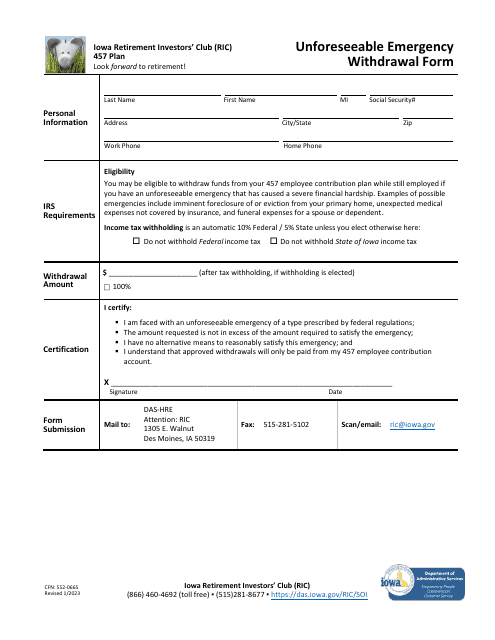

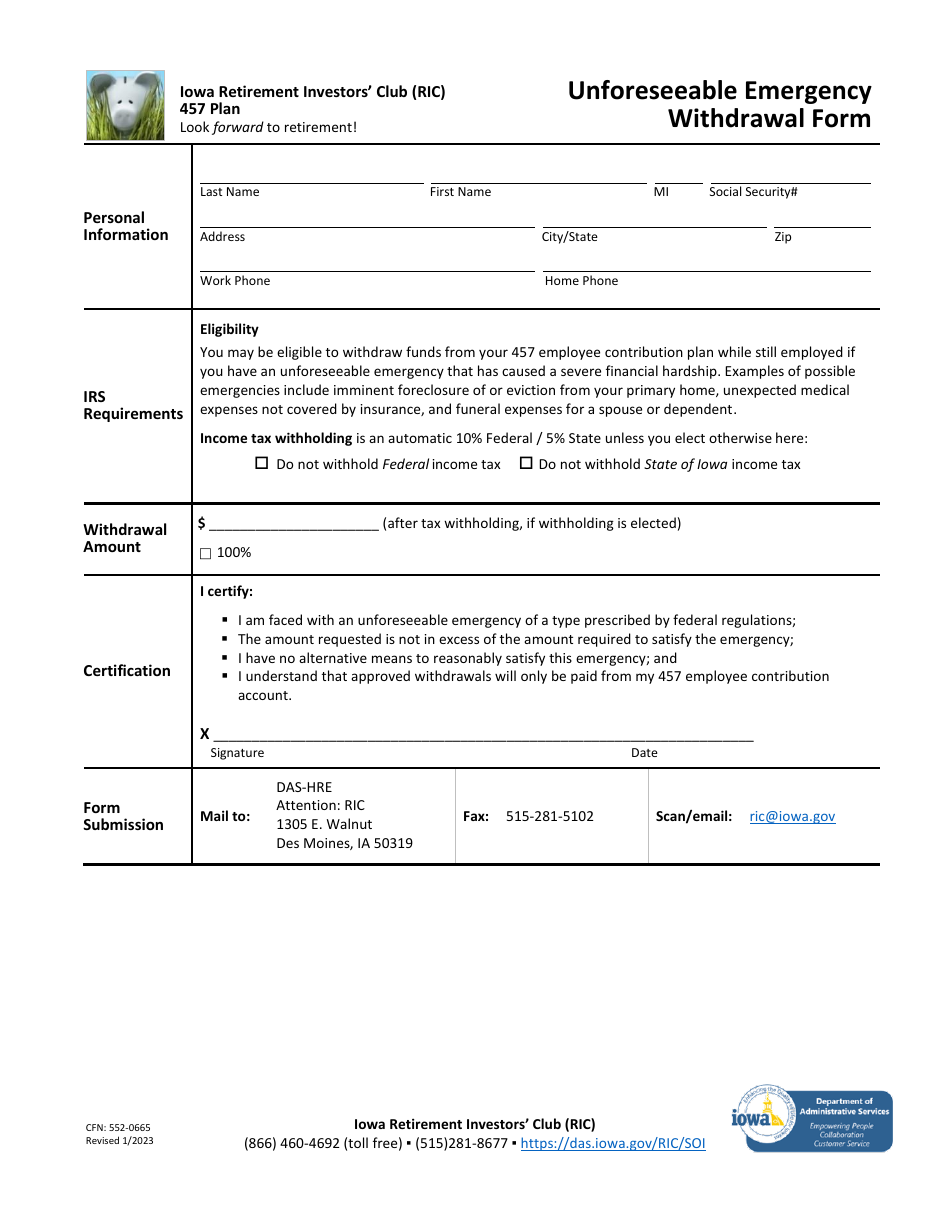

Form CFN:552-0665 Unforeseeable Emergency Withdrawal Form - Iowa Retirement Investors' Club (Ric) 457 Plan - Iowa

What Is Form CFN:552-0665?

This is a legal form that was released by the Iowa Department of Administrative Services - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form CFN:552-0665?

A: It is the Unforeseeable Emergency Withdrawal Form for the Iowa Retirement Investors' Club (RIC) 457 Plan in Iowa.

Q: What is the Iowa Retirement Investors' Club (RIC) 457 Plan?

A: It is a retirement savings plan offered in Iowa.

Q: What is an Unforeseeable Emergency Withdrawal?

A: It is a withdrawal option available in certain retirement plans for individuals facing financial emergencies.

Q: Who is eligible to use the CFN:552-0665 form?

A: Individuals who participate in the Iowa Retirement Investors' Club (RIC) 457 Plan and qualify for an unforeseeable emergency withdrawal.

Q: What types of unforeseeable emergencies qualify for a withdrawal?

A: Examples include severe illness, home repairs due to damage, or funeral expenses.

Q: Is there a penalty for taking an Unforeseeable Emergency Withdrawal?

A: Yes, there may be penalties and taxes applied to the withdrawal amount.

Q: Can the Unforeseeable Emergency Withdrawal be repaid?

A: No, this type of withdrawal cannot be repaid.

Q: Are there any restrictions on the use of funds from an Unforeseeable Emergency Withdrawal?

A: Yes, there may be restrictions on how the funds can be used.

Q: Can I get more information about the Iowa Retirement Investors' Club (RIC) 457 Plan?

A: Yes, you can contact the Iowa Retirement Investors' Club (RIC) for more information.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Iowa Department of Administrative Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CFN:552-0665 by clicking the link below or browse more documents and templates provided by the Iowa Department of Administrative Services.