This version of the form is not currently in use and is provided for reference only. Download this version of

Form GFA-IPT

for the current year.

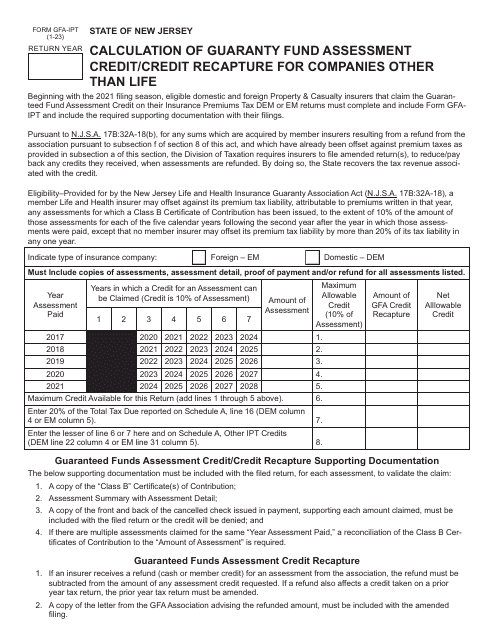

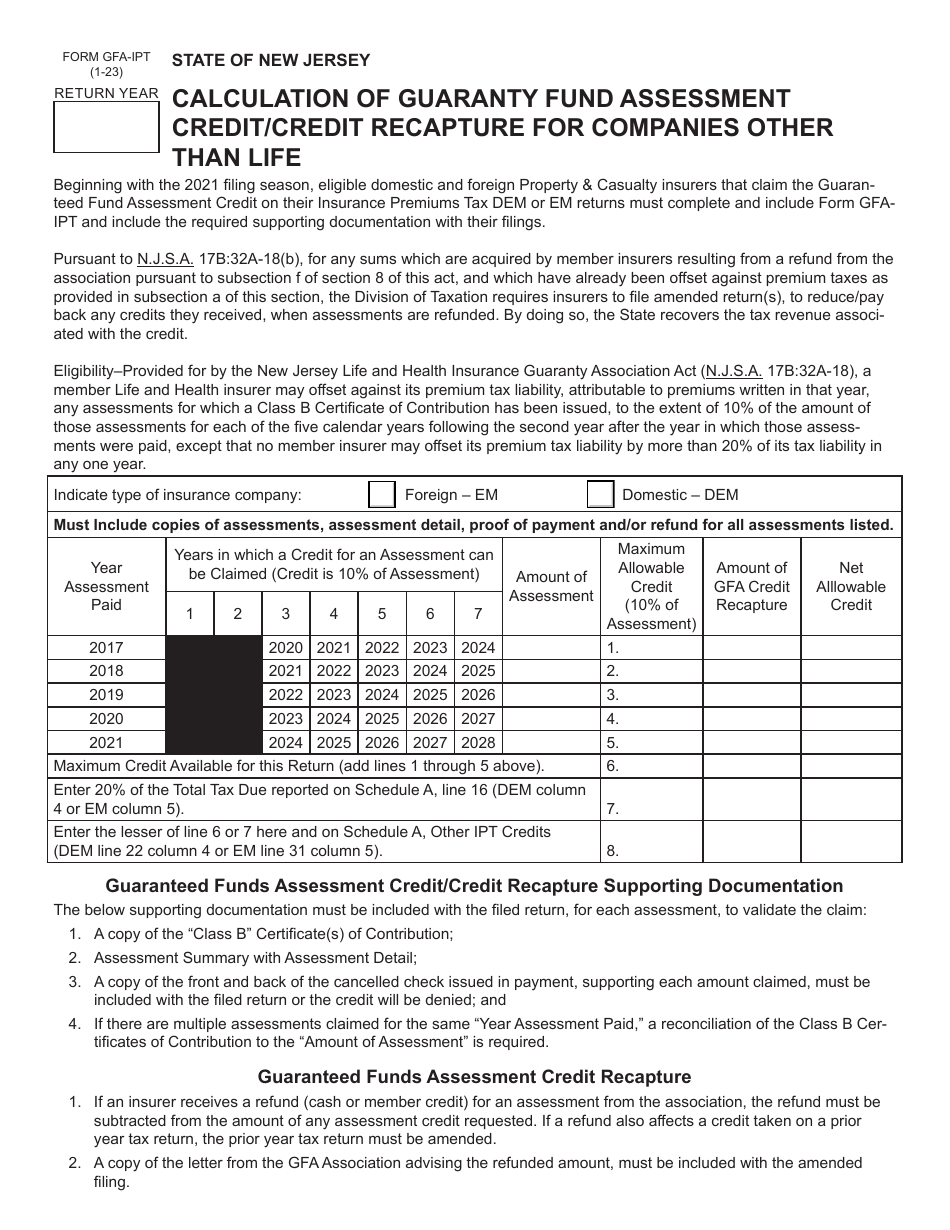

Form GFA-IPT Calculation of Guaranty Fund Assessment Credit / Credit Recapture for Companies Other Than Life - New Jersey

What Is Form GFA-IPT?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GFA-IPT?

A: GFA-IPT stands for Guaranty Fund Assessment - Insurance Premium Tax.

Q: What is the purpose of GFA-IPT?

A: The purpose of GFA-IPT is to calculate the Guaranty Fund Assessment Credit/Credit Recapture for companies other than life in New Jersey.

Q: Who is required to calculate GFA-IPT?

A: Companies other than life in New Jersey are required to calculate GFA-IPT.

Q: What is the Guaranty Fund Assessment Credit/Credit Recapture?

A: It is a credit that can be applied to reduce the guaranty fund assessment.

Q: What are the types of companies covered by GFA-IPT?

A: GFA-IPT covers companies other than life in New Jersey.

Q: What is the calculation method for GFA-IPT?

A: The calculation method for GFA-IPT is specified in the Form GFA-IPT.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GFA-IPT by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.