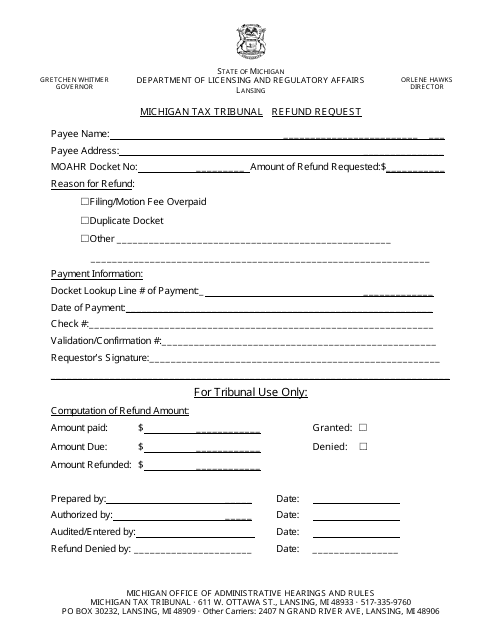

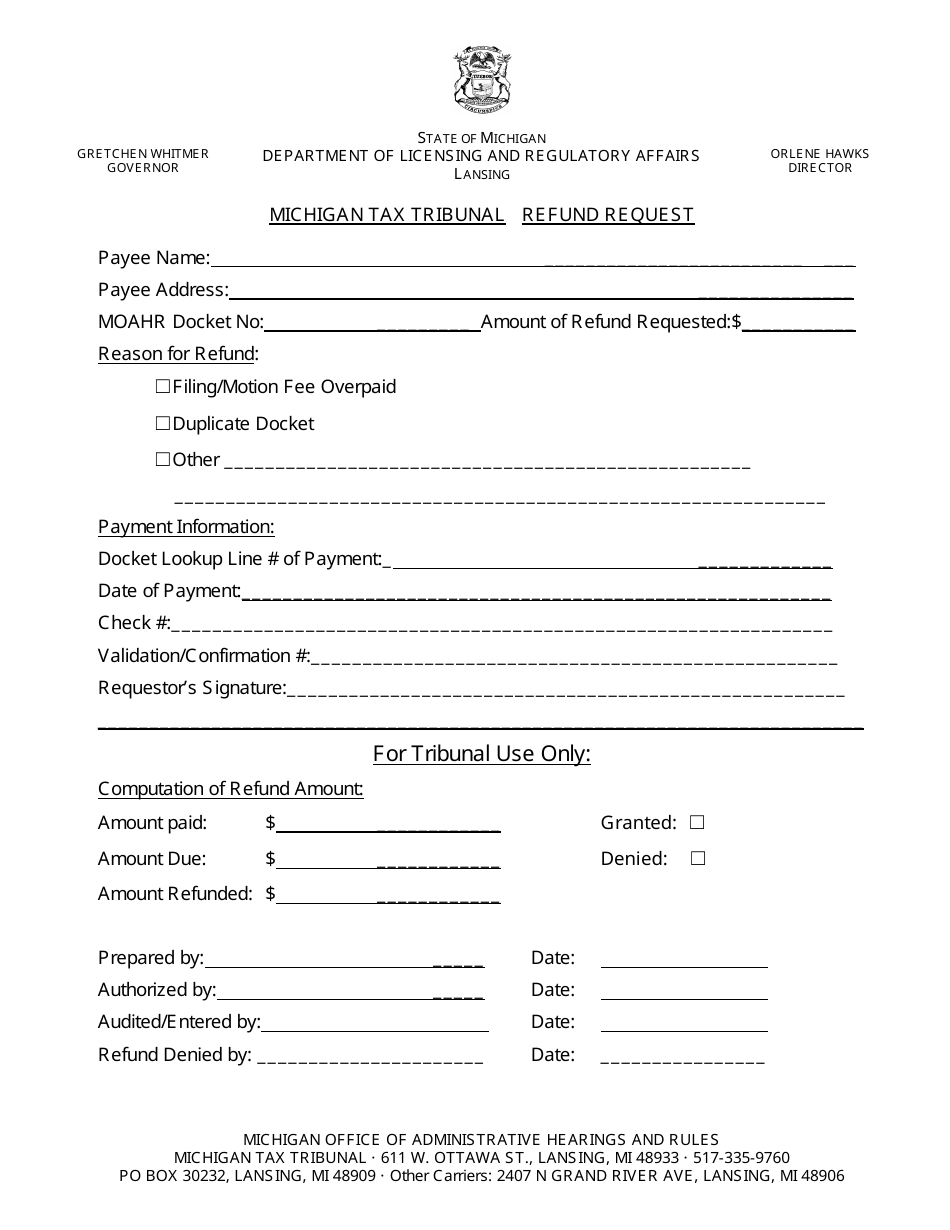

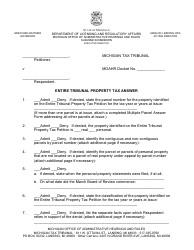

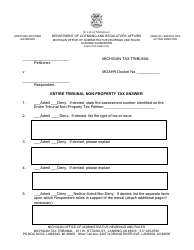

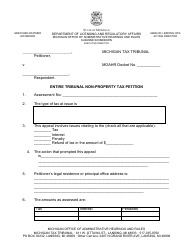

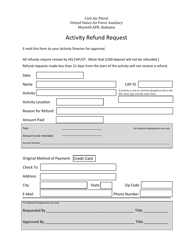

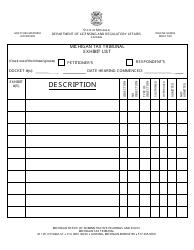

Michigan Tax Tribunal Refund Request - Michigan

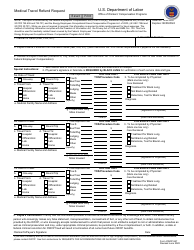

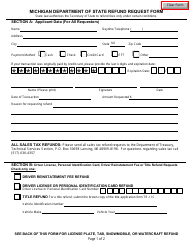

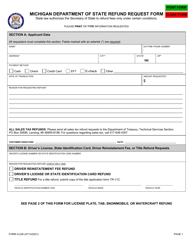

Michigan Tax Tribunal Refund Request is a legal document that was released by the Michigan Department of Licensing and Regulatory Affairs - a government authority operating within Michigan.

FAQ

Q: What is the Michigan Tax Tribunal?

A: The Michigan Tax Tribunal is an administrative court that handles tax-related disputes in the state of Michigan.

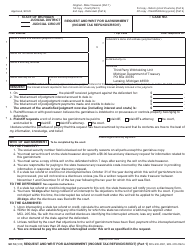

Q: What is a refund request?

A: A refund request is a formal request made to the Michigan Tax Tribunal to obtain a refund of taxes that were overpaid or wrongly assessed.

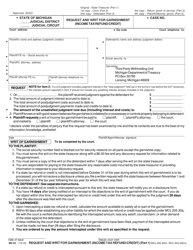

Q: How can I request a refund from the Michigan Tax Tribunal?

A: To request a refund from the Michigan Tax Tribunal, you will need to complete and submit the appropriate refund request form, along with any supporting documents that may be required.

Q: Are there any specific requirements for filing a refund request?

A: Yes, there are specific requirements for filing a refund request, such as filing within the prescribed time limits and providing sufficient evidence to support your claim.

Q: How long does it take to receive a refund from the Michigan Tax Tribunal?

A: The time it takes to receive a refund from the Michigan Tax Tribunal can vary depending on various factors, such as the complexity of the case and the workload of the tribunal. It is best to contact the Michigan Tax Tribunal directly for more information.

Q: What should I do if my refund request is denied?

A: If your refund request is denied, you may have the option to appeal the decision to a higher court. It is recommended to consult with a tax professional or legal advisor for guidance on the appeals process.

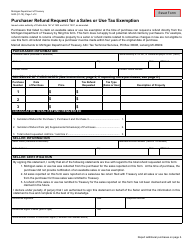

Q: Can I request a refund for taxes paid in a previous tax year?

A: Yes, you can request a refund for taxes paid in a previous tax year, as long as you meet the necessary requirements and file within the prescribed time limits.

Q: Is there a fee for filing a refund request with the Michigan Tax Tribunal?

A: Yes, there is a fee for filing a refund request with the Michigan Tax Tribunal. The fee amount may vary depending on the type and amount of taxes being disputed.

Q: Can I request a refund for property taxes paid in Michigan?

A: Yes, you can request a refund for property taxes paid in Michigan if you believe you have been overcharged or if there are errors in the assessment of your property value. You would need to follow the refund request process outlined by the Michigan Tax Tribunal.

Form Details:

- The latest edition currently provided by the Michigan Department of Licensing and Regulatory Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Licensing and Regulatory Affairs.