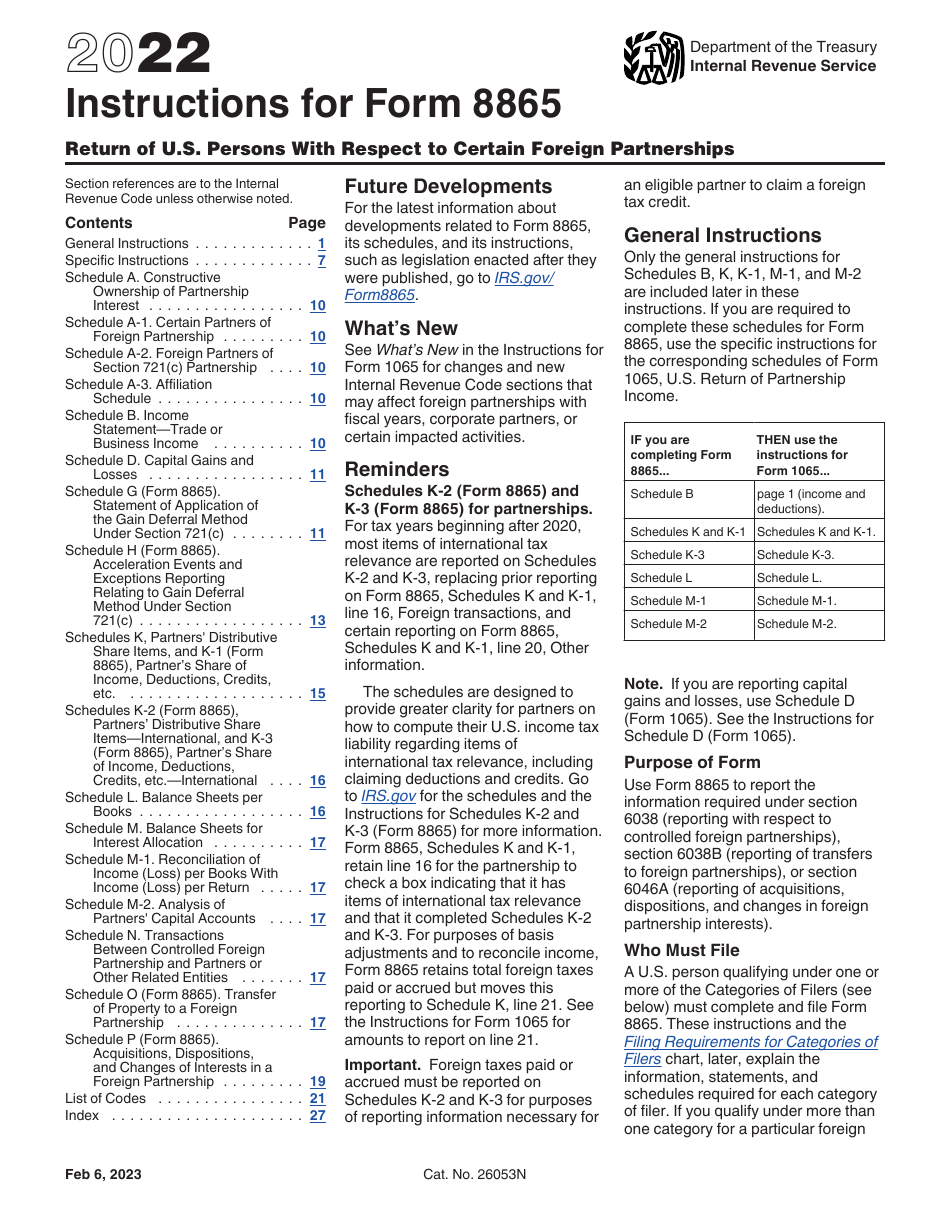

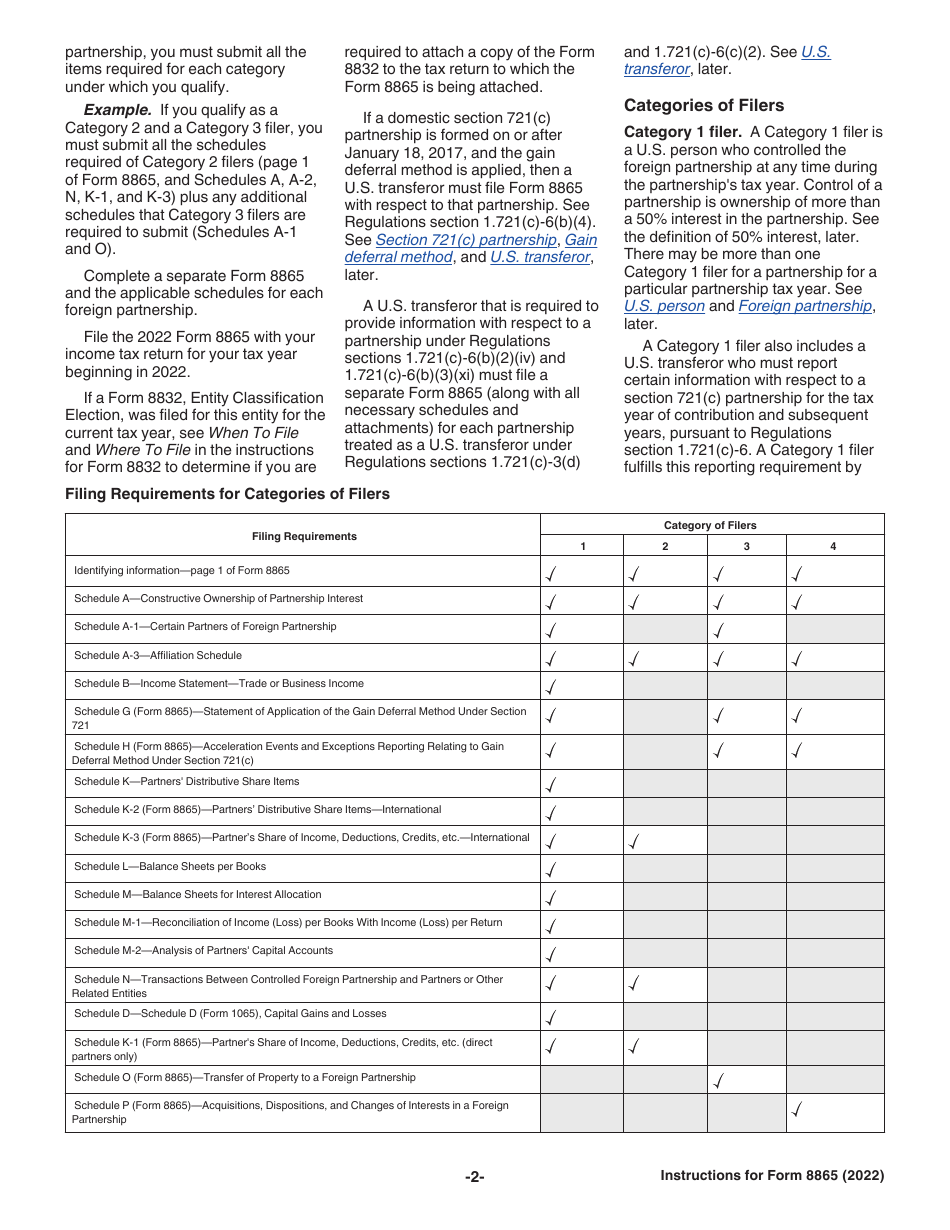

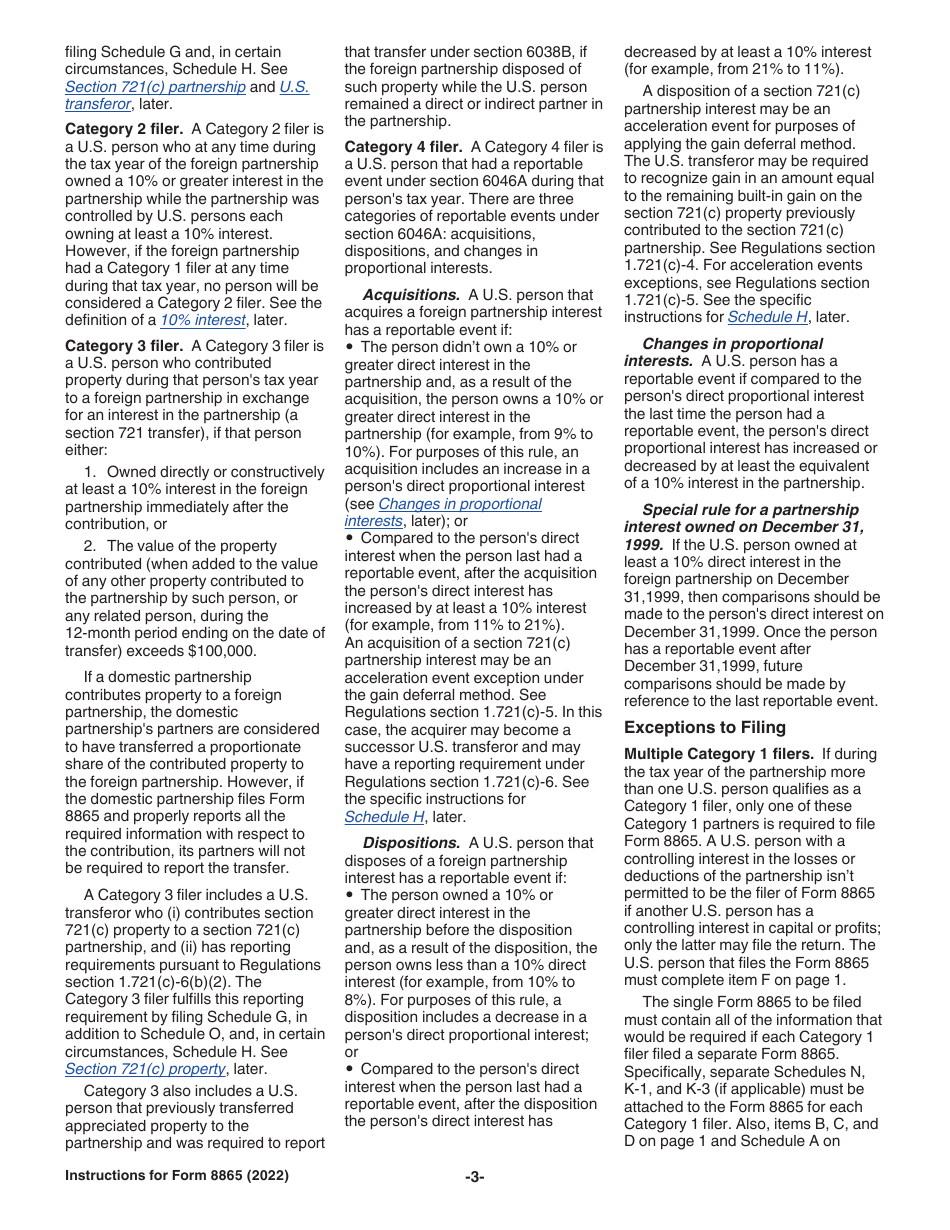

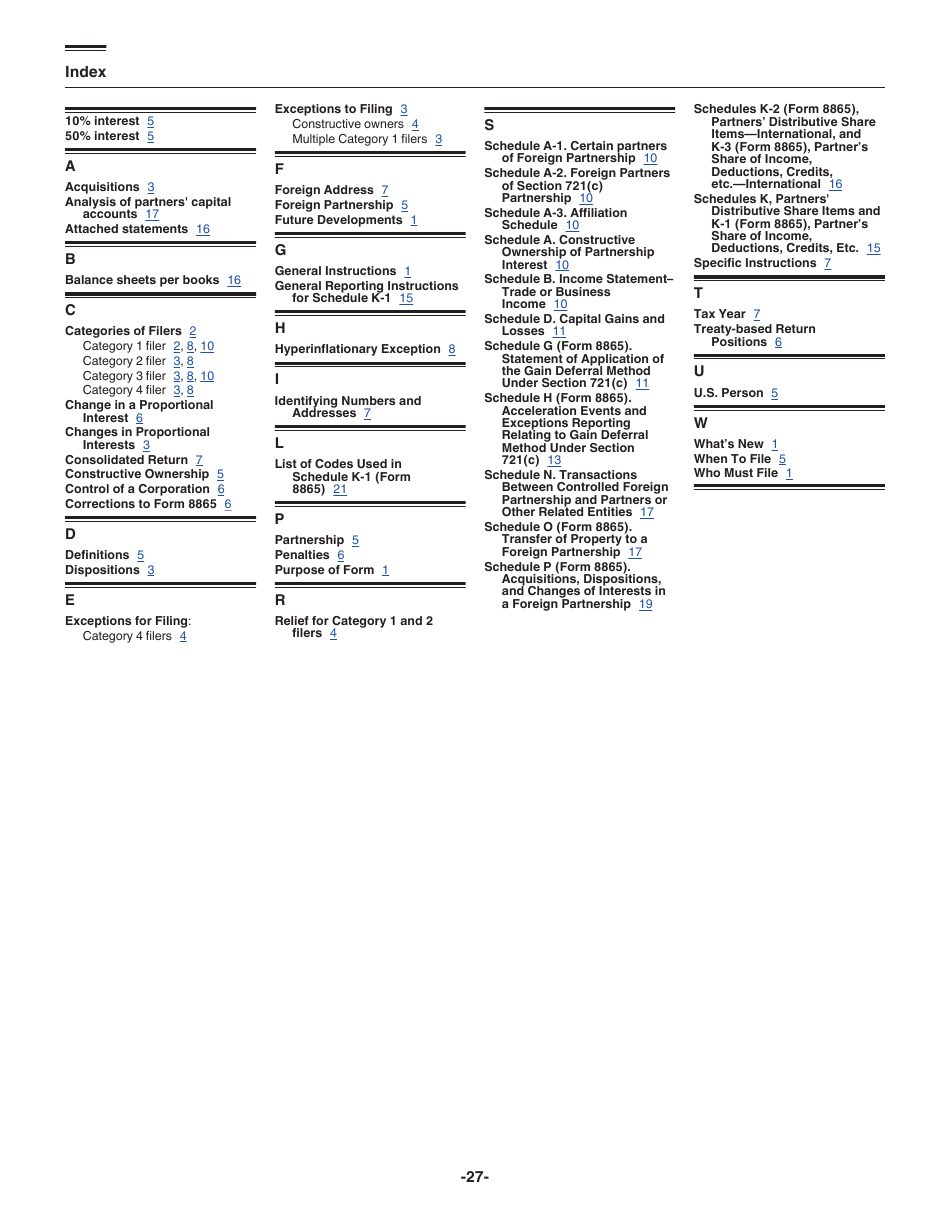

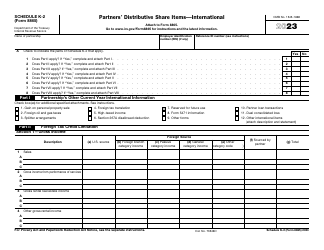

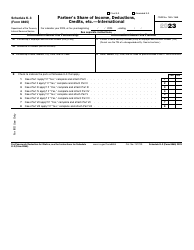

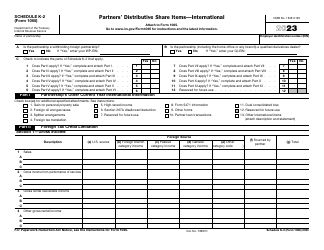

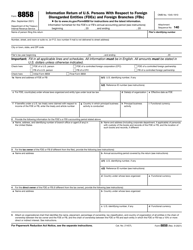

Instructions for Form 8865 Return of U.S. Persons With Respect to Certain Foreign Partnerships

This document contains official instructions for Form 8865 , Return of U.S. Persons With Respect to Certain Foreign Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8865 is available for download through this link.

FAQ

Q: What is Form 8865?

A: Form 8865 is a tax form used by U.S. persons who have partnerships with foreign entities.

Q: Who needs to file Form 8865?

A: U.S. persons who have partnerships with foreign entities need to file Form 8865.

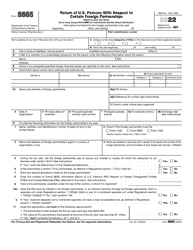

Q: What information is required on Form 8865?

A: Form 8865 requires information about the foreign partnership, including the partners' names, addresses, and ownership percentages.

Q: When is the deadline to file Form 8865?

A: The deadline to file Form 8865 is generally the same as the deadline for individual income tax returns, which is April 15th.

Q: Are there any penalties for not filing Form 8865?

A: Yes, there are penalties for not filing Form 8865, including a monetary penalty and potential criminal charges.

Q: Can I e-file Form 8865?

A: No, Form 8865 cannot be e-filed and must be filed in paper format.

Q: Do I need to file Form 8865 if the partnership did not have any activity or income during the tax year?

A: Yes, you still need to file Form 8865 even if the partnership had no activity or income.

Q: Is there any way to request an extension for filing Form 8865?

A: Yes, you can request an extension to file Form 8865 by filing Form 7004.

Q: Are there any exceptions to filing Form 8865?

A: Yes, there are certain exceptions to filing Form 8865, such as de minimis partnerships or partnerships with only foreign corporations.

Instruction Details:

- This 27-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.