This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 3520

for the current year.

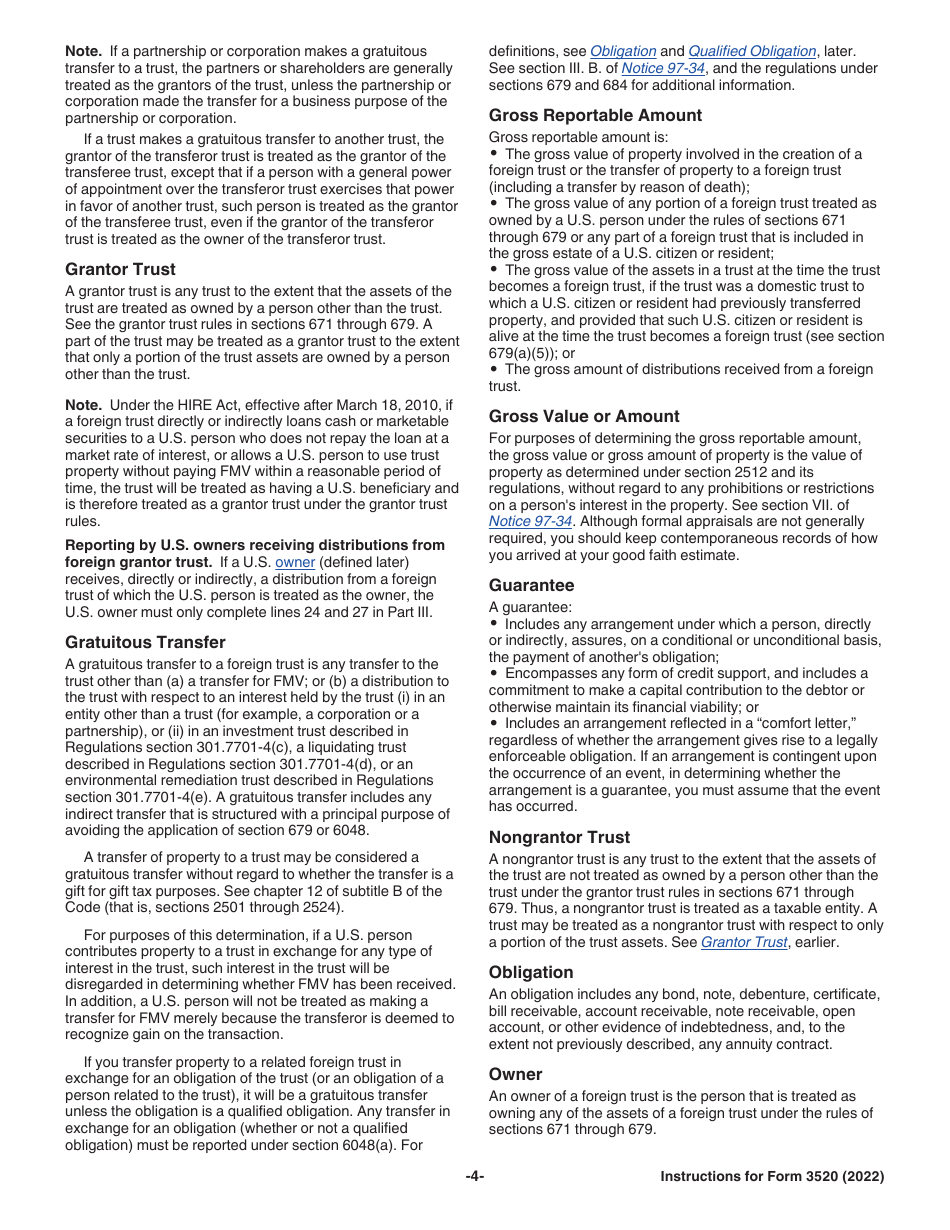

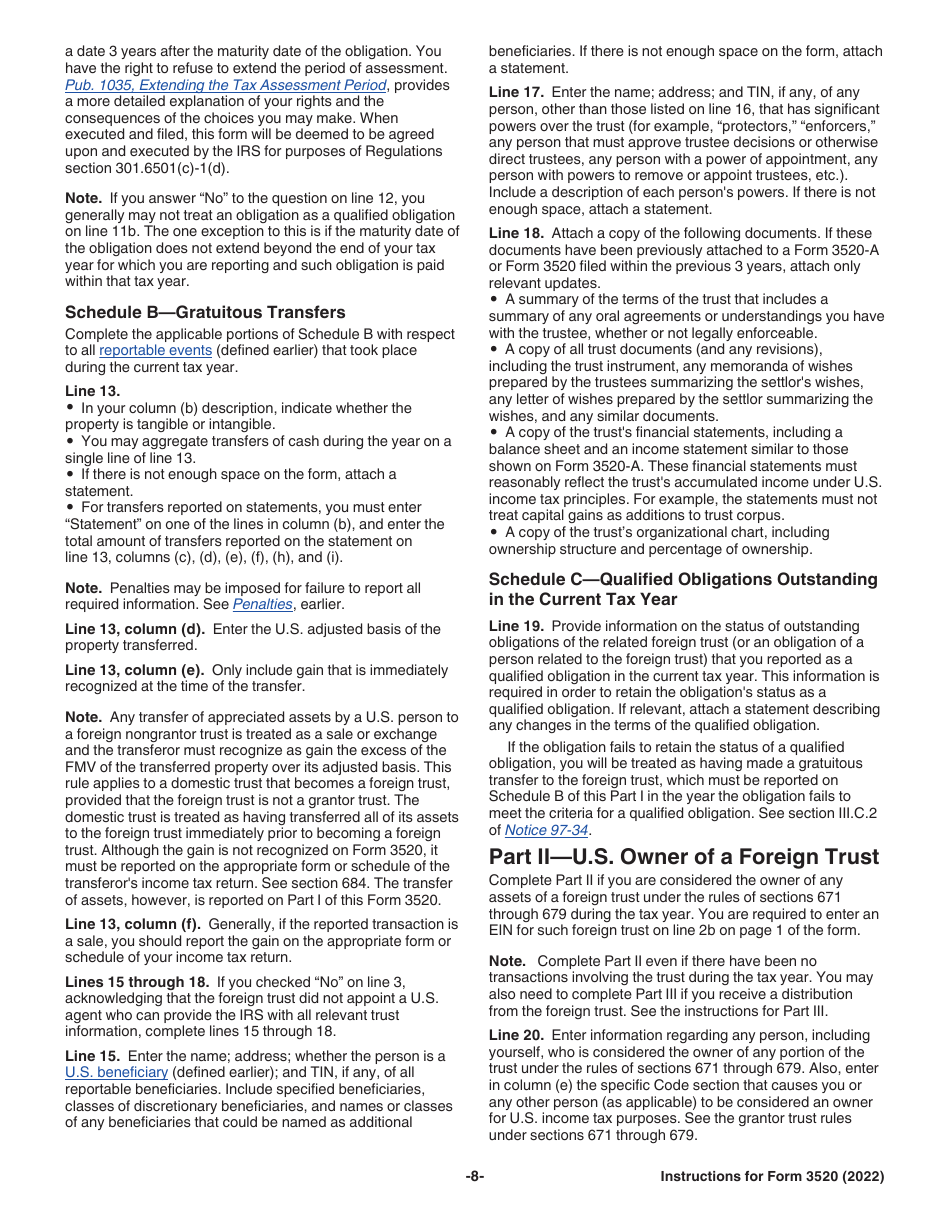

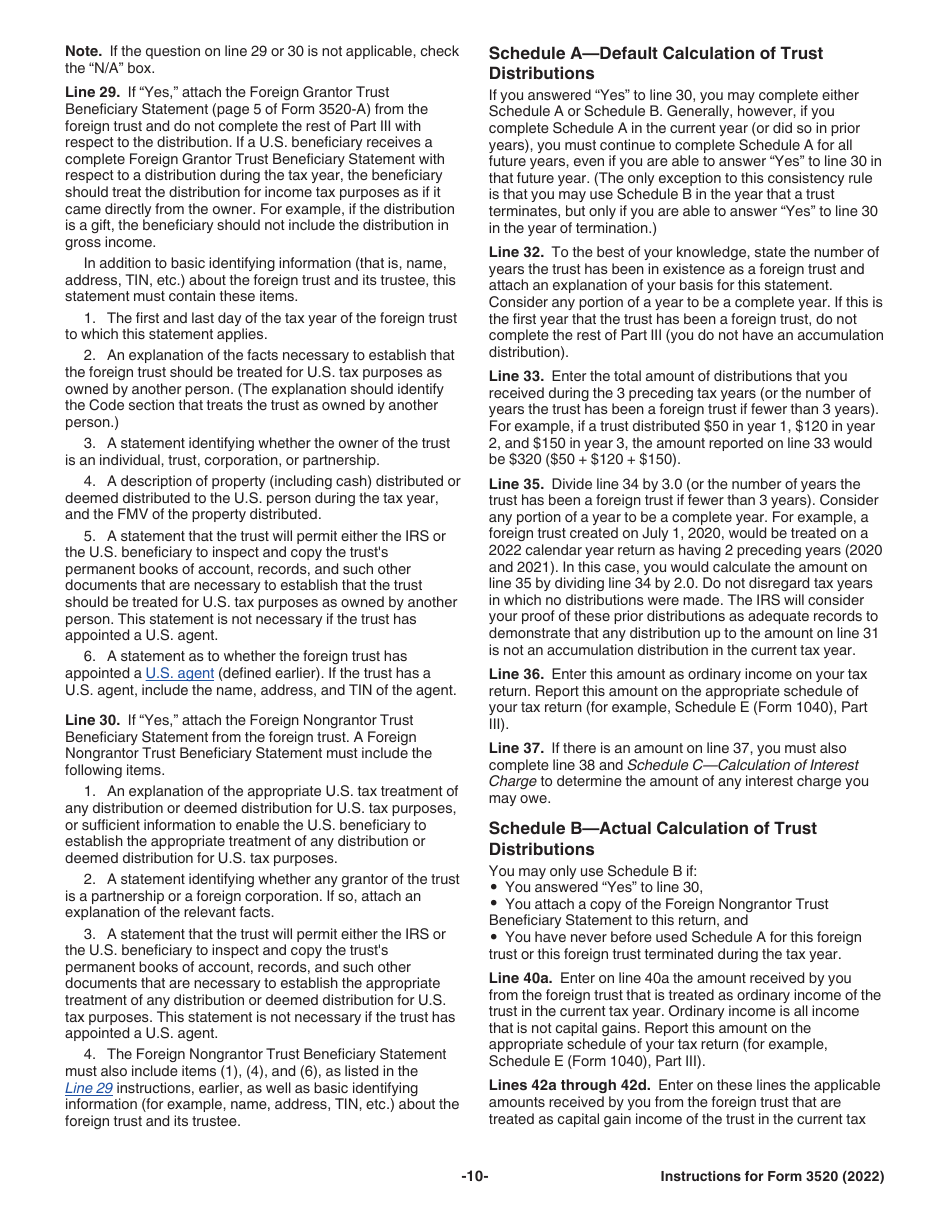

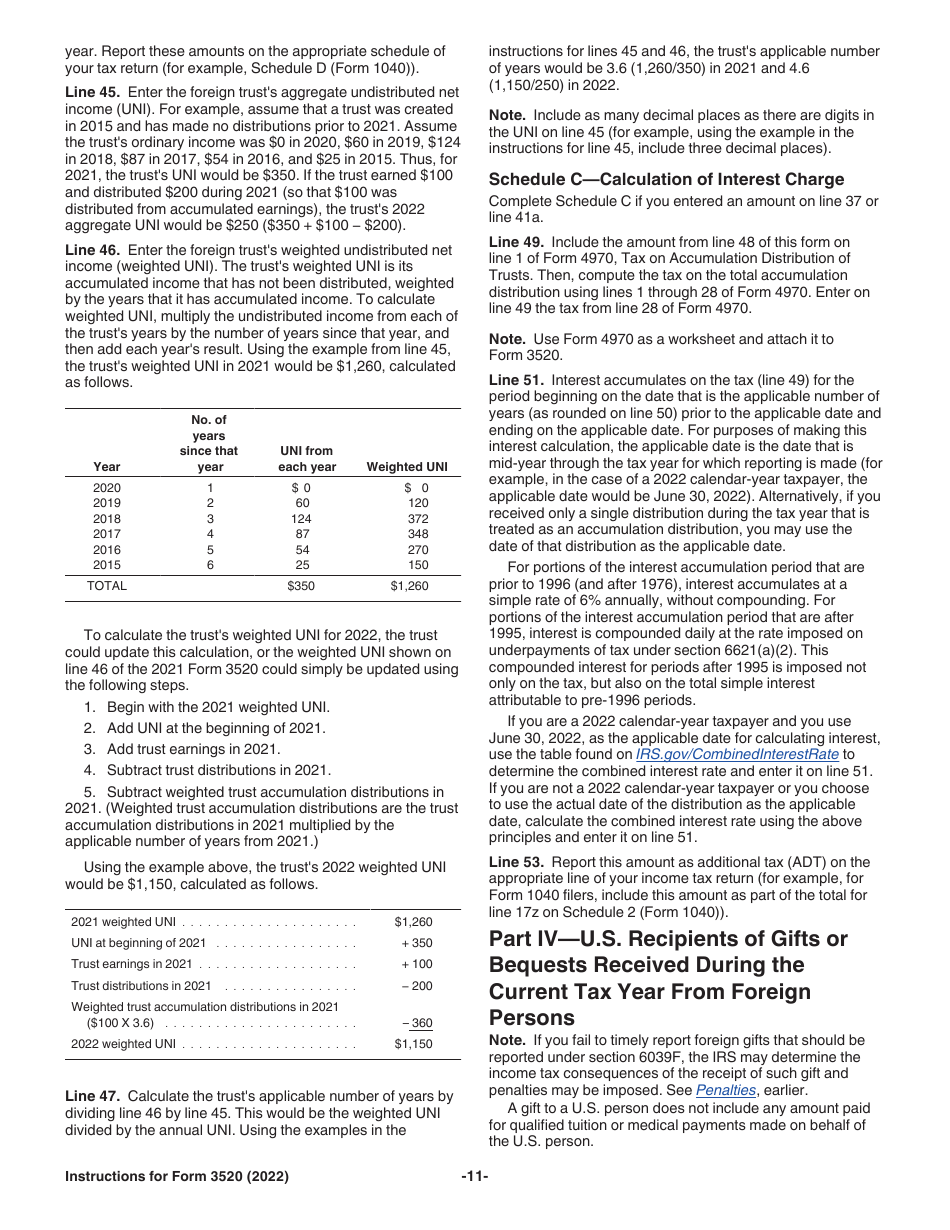

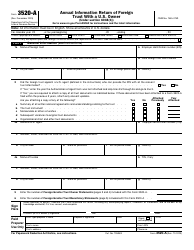

Instructions for IRS Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

This document contains official instructions for IRS Form 3520 , Annual Return to Foreign Trusts and Receipt of Certain Foreign Gifts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 3520 is available for download through this link.

FAQ

Q: What is IRS Form 3520?

A: IRS Form 3520 is an annual return that must be filed to report transactions with foreign trusts and the receipt of certain foreign gifts.

Q: Who is required to file IRS Form 3520?

A: U.S. citizens, residents, and certain estates and trusts are required to file IRS Form 3520.

Q: What transactions with foreign trusts should be reported on IRS Form 3520?

A: Any transactions with foreign trusts, including contributions, distributions, or ownership changes, should be reported on IRS Form 3520.

Q: What foreign gifts should be reported on IRS Form 3520?

A: Foreign gifts exceeding certain thresholds, such as monetary gifts or the receipt of certain large gifts or bequests from foreign individuals or entities, should be reported on IRS Form 3520.

Q: When is IRS Form 3520 due?

A: IRS Form 3520 is generally due on the same day as your federal income tax return. The due date may vary depending on your circumstances, so it's important to check the instructions or consult a tax professional.

Q: What are the penalties for failing to file IRS Form 3520?

A: Penalties for failing to file IRS Form 3520 can be significant, including monetary penalties and potential criminal penalties in certain cases. It's important to timely and accurately file the form to avoid these penalties.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.