This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-PC

for the current year.

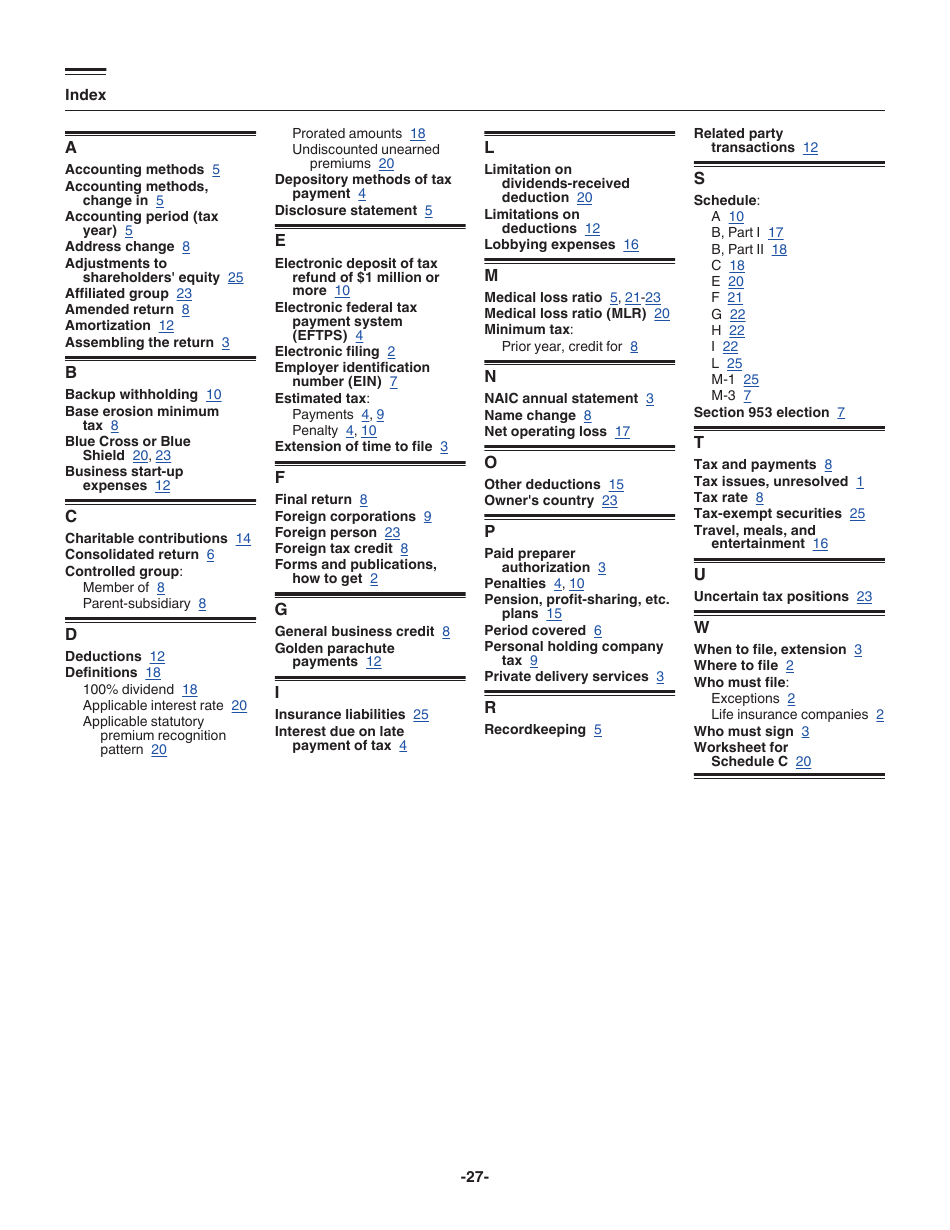

Instructions for IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

This document contains official instructions for IRS Form 1120-PC , U.S. Property and Casualty Insurance Company Income Tax Return - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-PC is available for download through this link.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is the U.S. Property and Casualty Insurance Company Income Tax Return.

Q: Who needs to file IRS Form 1120-PC?

A: U.S. Property and Casualty insurance companies need to file IRS Form 1120-PC.

Q: What information is required on IRS Form 1120-PC?

A: IRS Form 1120-PC requires information about the company's income, deductions, credits, and other relevant financial details.

Q: When is the deadline to file IRS Form 1120-PC?

A: The deadline to file IRS Form 1120-PC is generally March 15th for calendar year taxpayers, or the 15th day of the 3rd month following the end of the company's tax year.

Q: Can IRS Form 1120-PC be filed electronically?

A: Yes, IRS Form 1120-PC can be filed electronically using the e-file system.

Q: Are there any penalties for late filing of IRS Form 1120-PC?

A: Yes, there are penalties for late filing of IRS Form 1120-PC, so it is important to file on time.

Instruction Details:

- This 27-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.