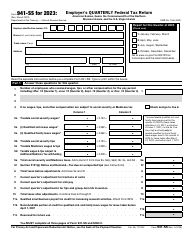

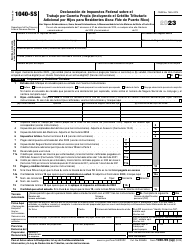

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040-SS

for the current year.

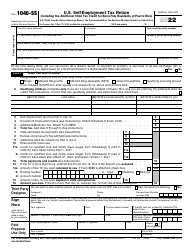

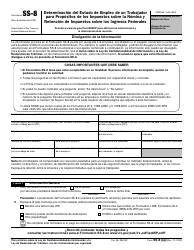

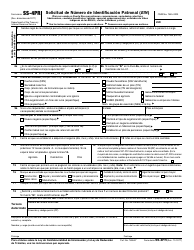

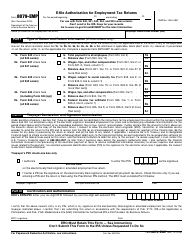

Instructions for IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

This document contains official instructions for IRS Form 1040-SS , U.S. Self-employment Tax Return (Including the Bona Fide Residents of Puerto Rico) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-SS is available for download through this link.

FAQ

Q: What is IRS Form 1040-SS?

A: IRS Form 1040-SS is a U.S. Self-employment Tax Return for individuals who are self-employed or have self-employment income in Puerto Rico.

Q: Who needs to file IRS Form 1040-SS?

A: Individuals who are self-employed or have self-employment income in Puerto Rico need to file IRS Form 1040-SS.

Q: What is the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico?

A: The Additional Child Tax Credit is a tax credit available to qualifying individuals in Puerto Rico who have children.

Q: Who qualifies as a bona fide resident of Puerto Rico?

A: To qualify as a bona fide resident of Puerto Rico, you must have lived in Puerto Rico for the entire tax year and have not established a tax home elsewhere.

Q: What is self-employment tax?

A: Self-employment tax is a tax that self-employed individuals pay on their net earnings from self-employment. It is similar to Social Security and Medicare taxes.

Q: How do I calculate self-employment tax?

A: To calculate self-employment tax, you need to multiply your net earnings from self-employment by the self-employment tax rate. The rate for 2021 is 15.3%.

Q: Can I claim the Additional Child Tax Credit if I live in Puerto Rico?

A: Yes, if you are a bona fide resident of Puerto Rico and meet the eligibility requirements, you can claim the Additional Child Tax Credit.

Q: Are there any specific deductions or credits for self-employed individuals in Puerto Rico?

A: Yes, there are specific deductions and credits available for self-employed individuals in Puerto Rico. Consult the instructions for Form 1040-SS for more information.

Instruction Details:

- This 24-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.