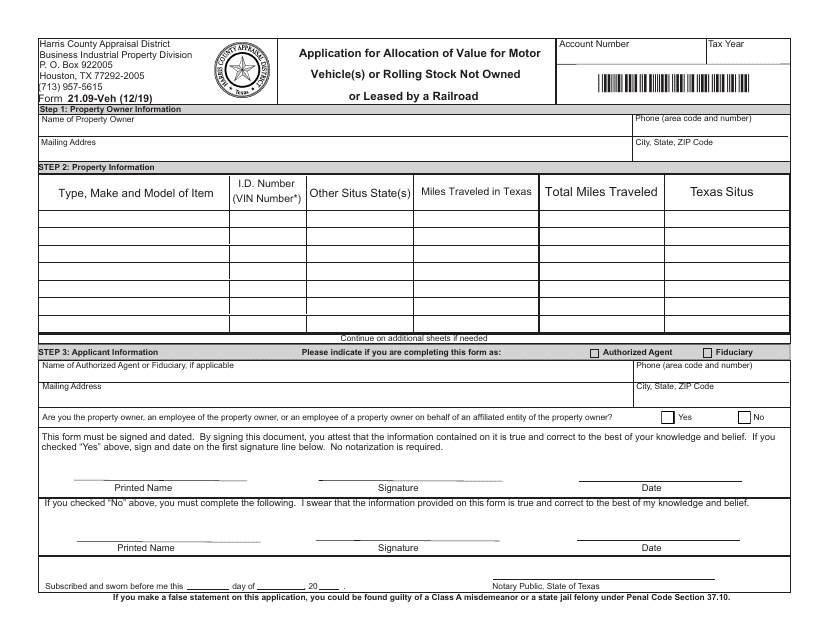

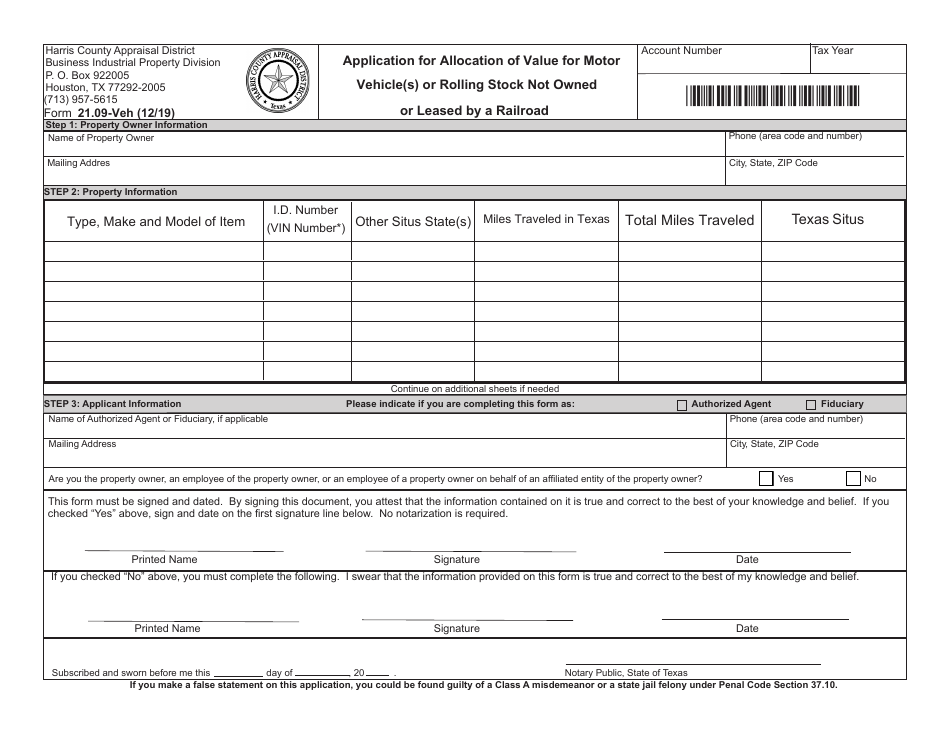

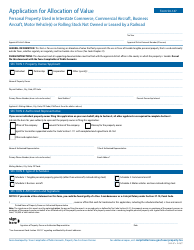

Form 21.09-VEH Application for Allocation of Value for Motor Vehicle(S) or Rolling Stock Not Owned or Leased by a Railroad - Harris County, Texas

What Is Form 21.09-VEH?

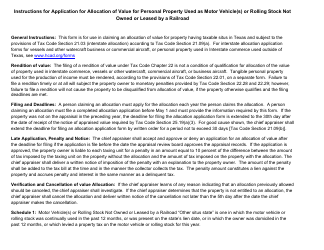

This is a legal form that was released by the Appraisal District - Harris County, Texas - a government authority operating within Texas. The form may be used strictly within Harris County. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 21.09-VEH?

A: Form 21.09-VEH is an application for allocation of value for motor vehicles or rolling stock in Harris County, Texas, that are not owned or leased by a railroad.

Q: What is the purpose of Form 21.09-VEH?

A: The purpose of Form 21.09-VEH is to request an allocation of value for motor vehicles or rolling stock that are not owned or leased by a railroad in Harris County, Texas.

Q: Who needs to fill out Form 21.09-VEH?

A: Anyone who wants to request an allocation of value for motor vehicles or rolling stock not owned or leased by a railroad in Harris County, Texas needs to fill out Form 21.09-VEH.

Q: Are there any fees associated with Form 21.09-VEH?

A: There may be fees associated with filing Form 21.09-VEH. Please contact the Harris County Appraisal District for more information on fees.

Q: Is Form 21.09-VEH specific to Harris County, Texas?

A: Yes, Form 21.09-VEH is specific to Harris County, Texas and is used for requesting an allocation of value for motor vehicles or rolling stock in that county.

Q: What is meant by 'allocation of value' in Form 21.09-VEH?

A: An 'allocation of value' refers to the assessment of the value of motor vehicles or rolling stock that are not owned or leased by a railroad in Harris County, Texas.

Q: What is rolling stock?

A: Rolling stock refers to the locomotives, train cars, and other vehicles used in the operation of a railroad or railway system.

Q: Can I use Form 21.09-VEH for vehicles or rolling stock owned or leased by a railroad?

A: No, Form 21.09-VEH is specifically for motor vehicles or rolling stock that are not owned or leased by a railroad.

Q: What should I do if I have more questions about Form 21.09-VEH?

A: If you have more questions about Form 21.09-VEH, you should contact the Harris County Appraisal District for assistance.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Appraisal District - Harris County, Texas;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 21.09-VEH by clicking the link below or browse more documents and templates provided by the Appraisal District - Harris County, Texas.