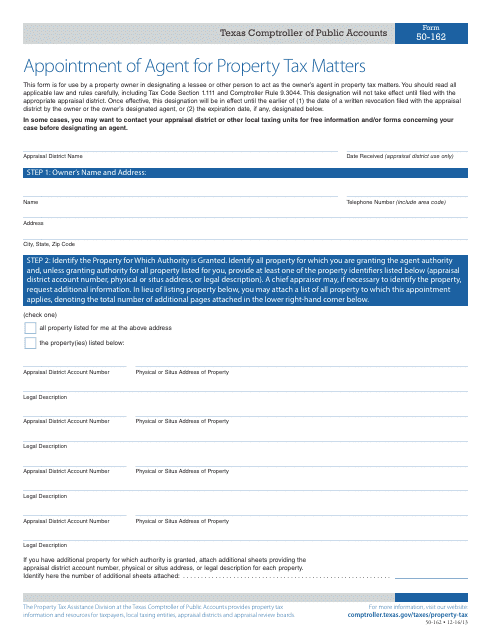

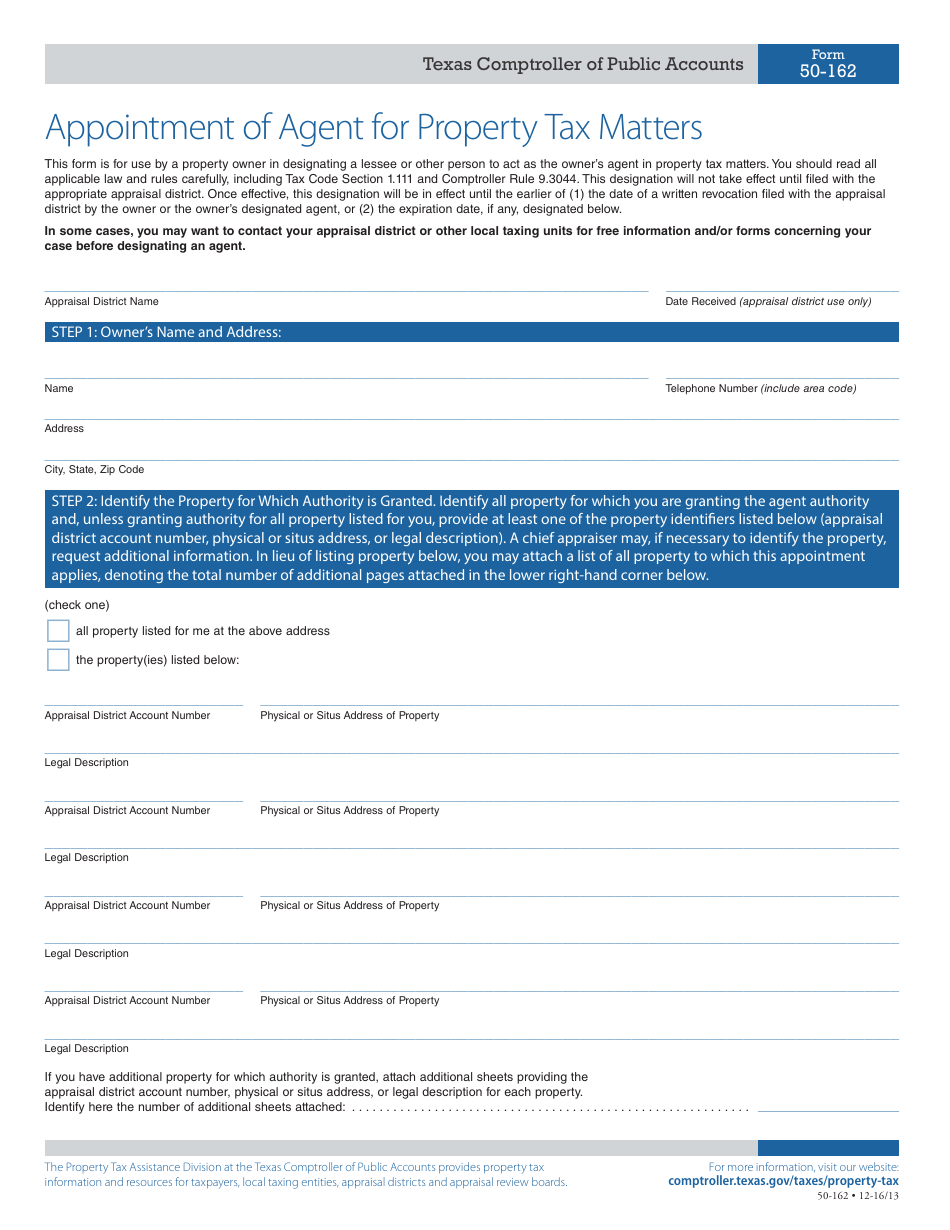

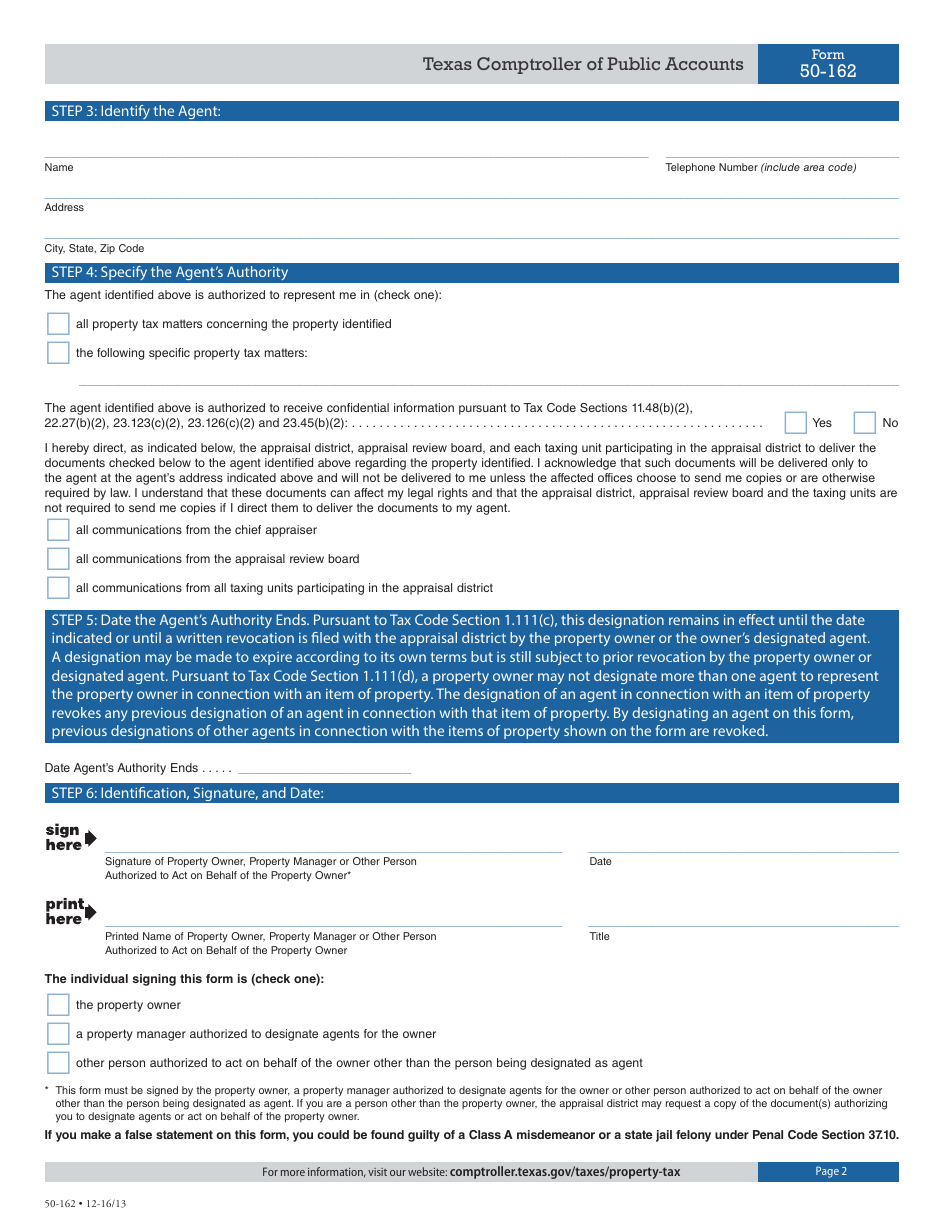

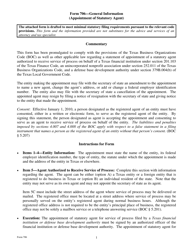

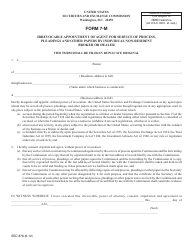

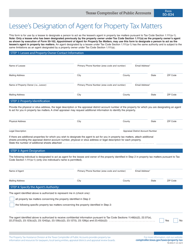

Form 50-162 Appointment of Agent for Property Tax Matters - Texas

What Is Form 50-162?

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

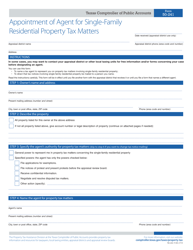

Q: What is Form 50-162?

A: Form 50-162 is the Appointment of Agent for Property Tax Matters form in Texas.

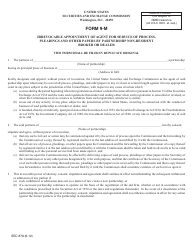

Q: Why would I need to fill out Form 50-162?

A: You would need to fill out Form 50-162 if you want to appoint someone to act as your agent for property tax matters in Texas.

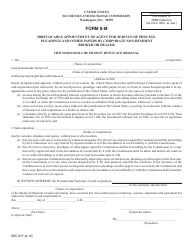

Q: Who can I appoint as my agent for property tax matters?

A: You can appoint any individual or legal entity, such as a company or organization, to be your agent for property tax matters.

Q: What are the responsibilities of an agent for property tax matters?

A: An agent for property tax matters is responsible for representing you in property tax matters, such as filing appeals or responding to tax notices.

Q: Is there a fee for appointing an agent for property tax matters?

A: No, there is no fee for appointing an agent for property tax matters in Texas.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 50-162 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.