Insurance Requirements for SBA Loans

Insurance Requirements for SBA Loans is a 17-page legal document that was released by the U.S. Small Business Administration and used nation-wide.

FAQ

Q: What is an SBA loan?

A: An SBA loan is a small business loan backed by the U.S. Small Business Administration.

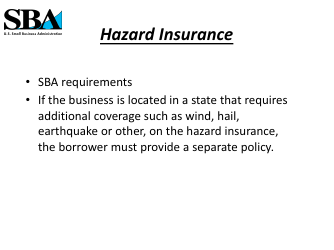

Q: Do I need insurance for an SBA loan?

A: Yes, insurance is required for SBA loans to protect both the borrower and the lender.

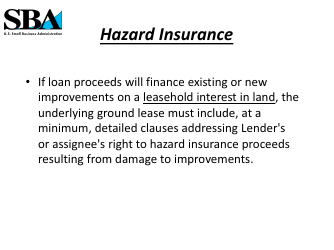

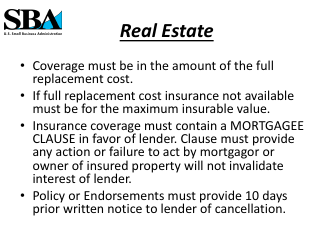

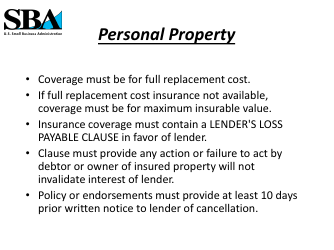

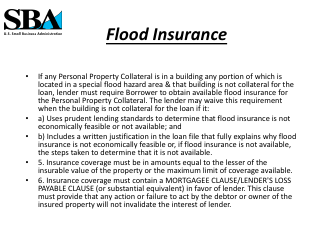

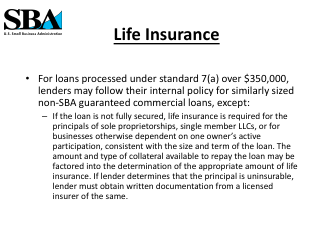

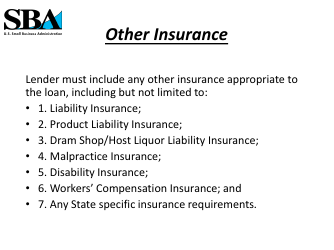

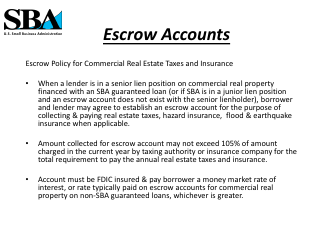

Q: What types of insurance are required for an SBA loan?

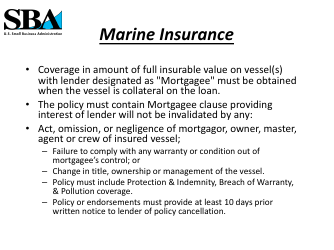

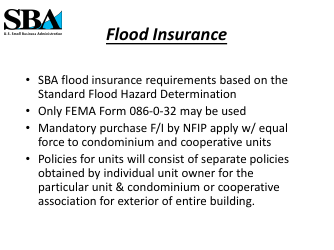

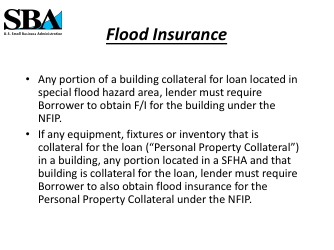

A: The specific insurance requirements may vary, but common types include property insurance, liability insurance, and business interruption insurance.

Q: How much insurance coverage do I need for an SBA loan?

A: The required insurance coverage amount will depend on factors such as the loan amount, type of business, and specific lender requirements.

Q: Can I use my current insurance policy for an SBA loan?

A: In most cases, you will need to obtain separate insurance policies that meet the SBA's requirements for your loan.

Q: Can I shop around for insurance providers?

A: Yes, you can compare insurance offerings from different providers to find the best coverage and rates that meet the SBA's requirements.

Q: What happens if I don't maintain the required insurance for my SBA loan?

A: Failing to maintain the required insurance coverage can put your loan in default, which may have serious consequences such as accelerated repayment or foreclosure.

Q: Who decides the insurance requirements for my SBA loan?

A: The specific insurance requirements are determined by the lender, in accordance with the SBA guidelines.

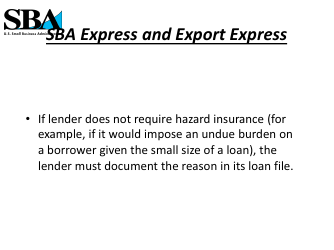

Q: Can I request a waiver or exception to the insurance requirements?

A: It's possible to request a waiver or exception from the lender, but it will be evaluated on a case-by-case basis.

Q: Do I need an insurance agent to help me with SBA loan insurance?

A: While it's not required, working with an experienced insurance agent can help ensure you have the appropriate coverage and navigate the SBA loan insurance process more easily.

Form Details:

- The latest edition currently provided by the U.S. Small Business Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.