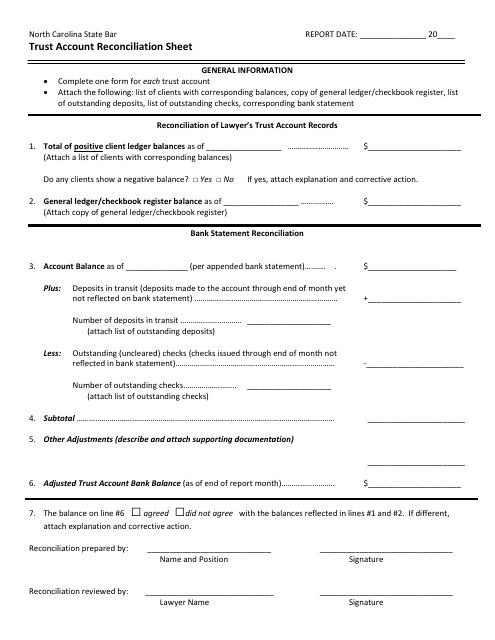

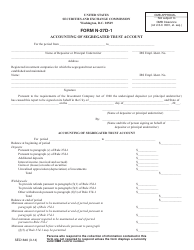

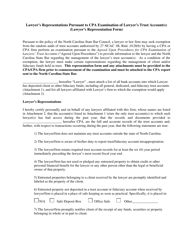

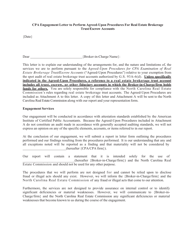

Trust Account Reconciliation Sheet - North Carolina

Trust Account Reconciliation Sheet is a legal document that was released by the North Carolina State Bar - a government authority operating within North Carolina.

FAQ

Q: What is a Trust Account Reconciliation Sheet?

A: A Trust Account Reconciliation Sheet is a document used in North Carolina to reconcile the transactions and balances of a trust account.

Q: Why is it important to reconcile a trust account?

A: Reconciling a trust account is important to ensure accuracy and accountability of the funds held in the account.

Q: Who is required to reconcile a trust account in North Carolina?

A: Attorneys in North Carolina who hold trust funds are required to reconcile their trust accounts.

Q: What information is included in a Trust Account Reconciliation Sheet?

A: A Trust Account Reconciliation Sheet typically includes information about the beginning and ending balances, all deposits, withdrawals, and any outstanding checks or discrepancies.

Q: How often should a trust account be reconciled?

A: In North Carolina, trust accounts should be reconciled at least monthly.

Q: Are attorneys required to keep records of their trust account reconciliations?

A: Yes, attorneys are required to keep records of their trust account reconciliations for at least six years.

Form Details:

- The latest edition currently provided by the North Carolina State Bar;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the North Carolina State Bar.