This version of the form is not currently in use and is provided for reference only. Download this version of

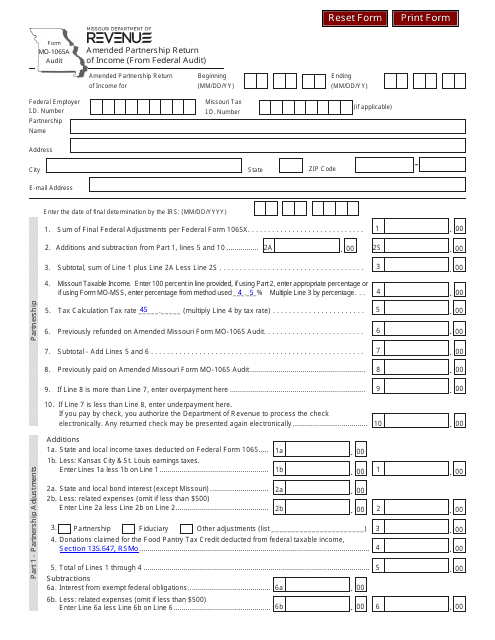

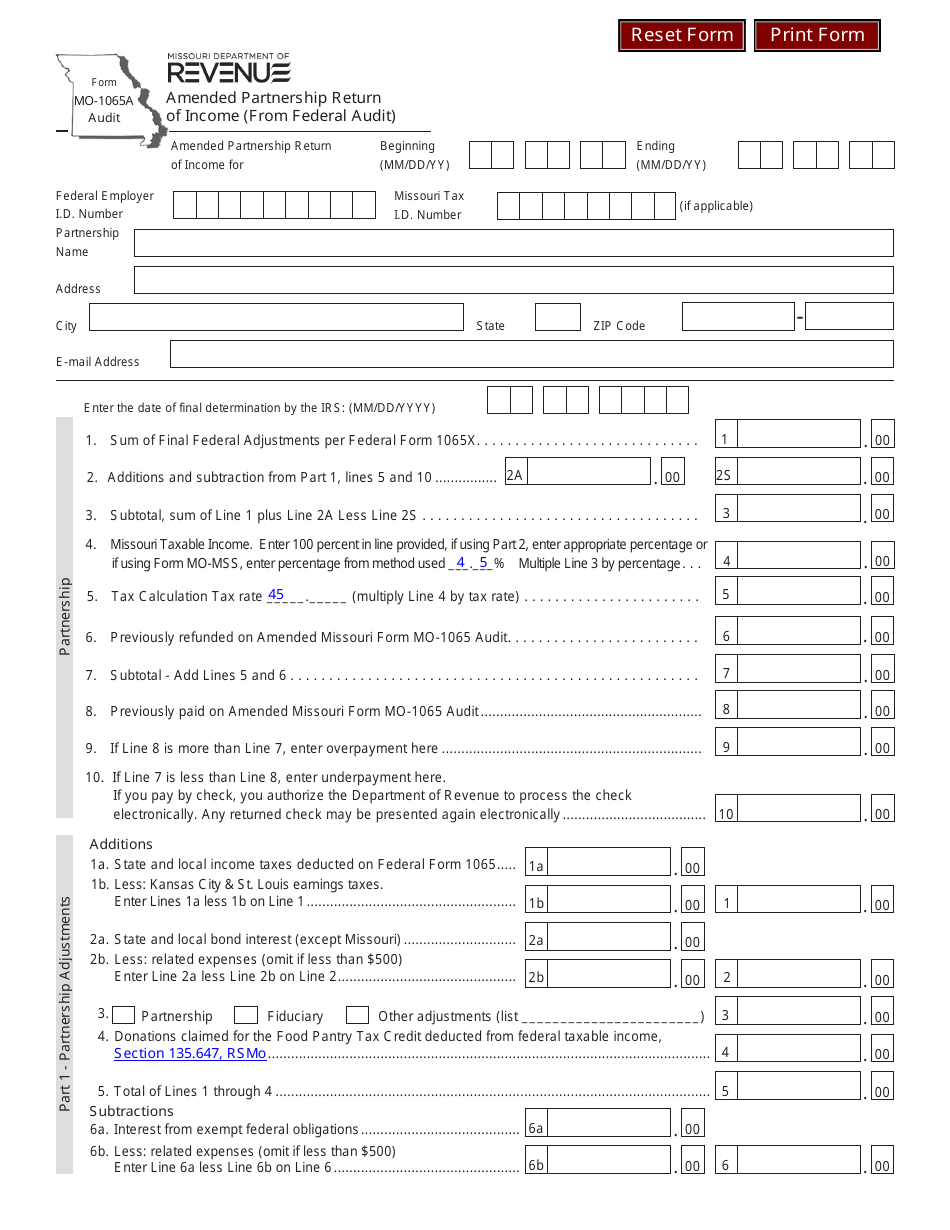

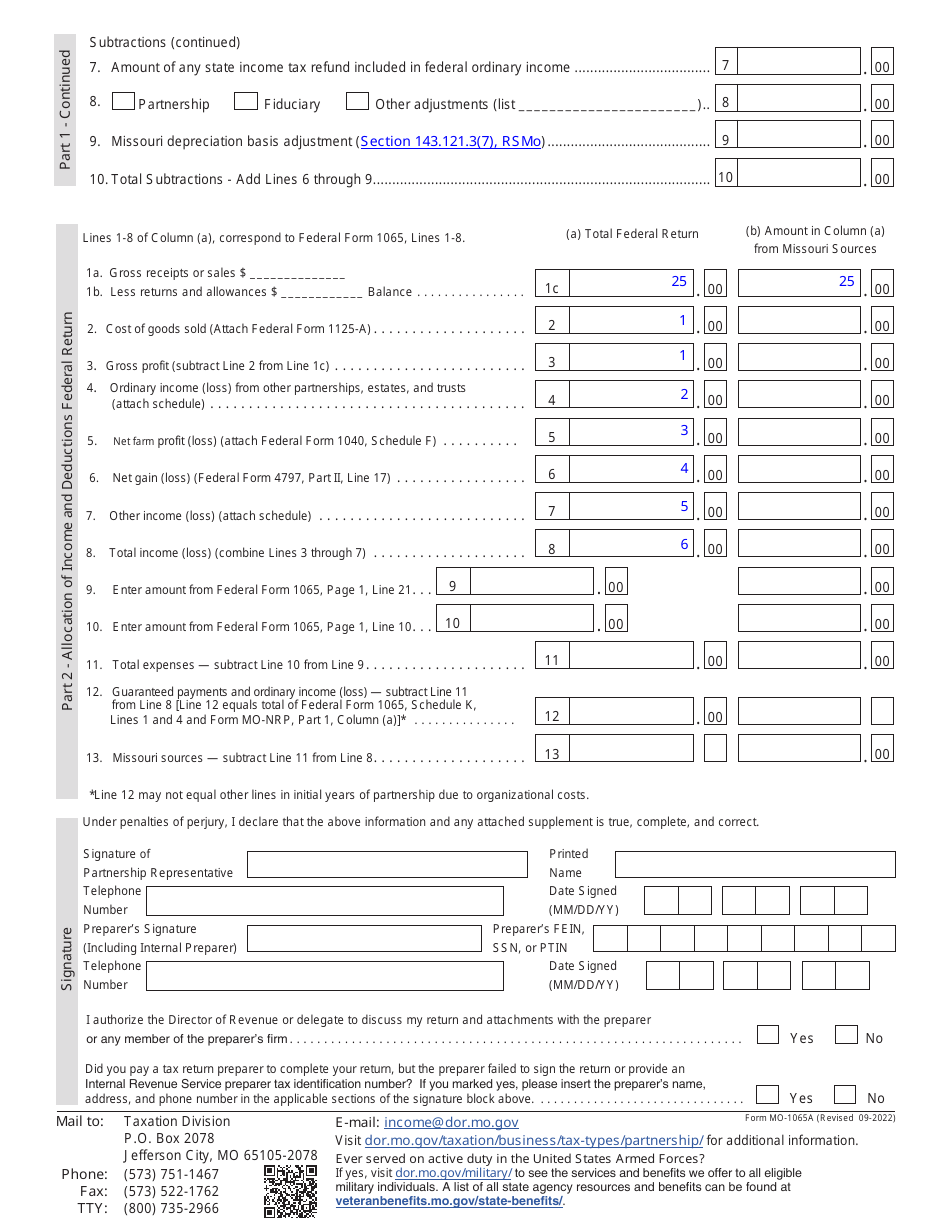

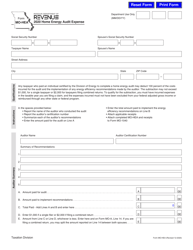

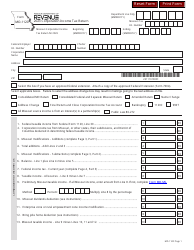

Form MO-1065A AUDIT

for the current year.

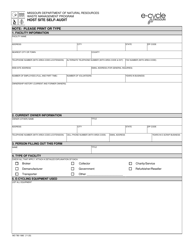

Form MO-1065A AUDIT Amended Partnership Return of Income (From Federal Audit) - Missouri

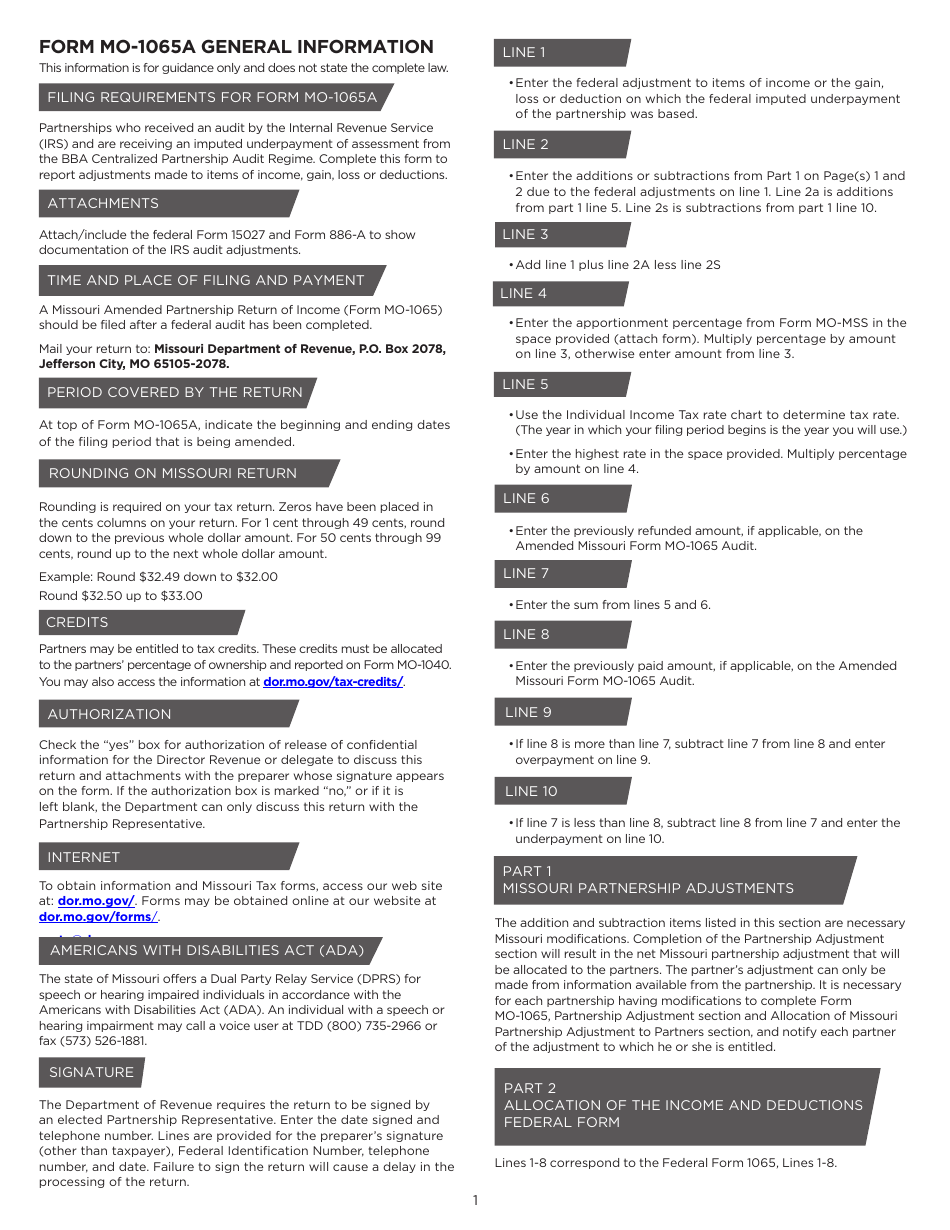

What Is Form MO-1065A AUDIT?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

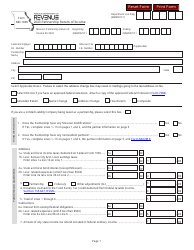

Q: What is Form MO-1065A?

A: Form MO-1065A is the Amended Partnership Return of Income (From Federal Audit) for Missouri.

Q: Who needs to file Form MO-1065A?

A: Partnerships that need to amend their federal audit information for Missouri taxes must file Form MO-1065A.

Q: What is the purpose of Form MO-1065A?

A: Form MO-1065A is used to report any changes or corrections to a partnership's federal audit results for Missouri tax purposes.

Q: When should Form MO-1065A be filed?

A: Form MO-1065A should be filed as soon as possible after the federal audit changes or corrections have been finalized.

Q: Is there a deadline to file Form MO-1065A?

A: Yes, Form MO-1065A must be filed within three years from the original due date of the partnership's tax return or the date the return was filed, whichever is later.

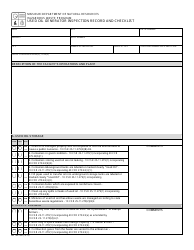

Q: Are there any penalties for not filing Form MO-1065A?

A: Yes, failure to file Form MO-1065A may result in penalties and interest on the underpaid tax amount.

Q: Can Form MO-1065A be e-filed?

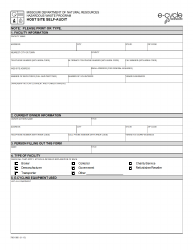

A: No, Form MO-1065A must be filed by mail.

Q: What other forms are required to be submitted with Form MO-1065A?

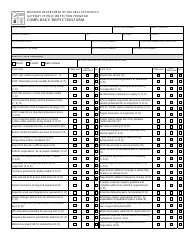

A: Form MO-1065A should be accompanied by a complete copy of the final federal audit adjustment report, as well as any necessary explanations and supporting documentation.

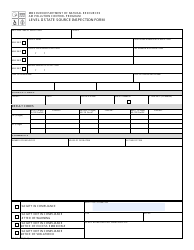

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1065A AUDIT by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.