This version of the form is not currently in use and is provided for reference only. Download this version of

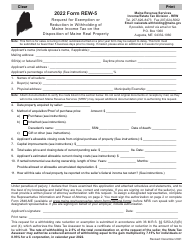

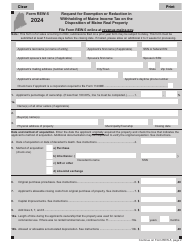

Form REW-5

for the current year.

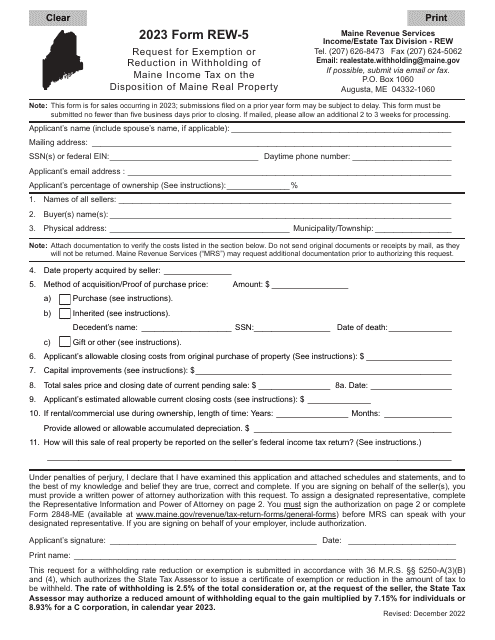

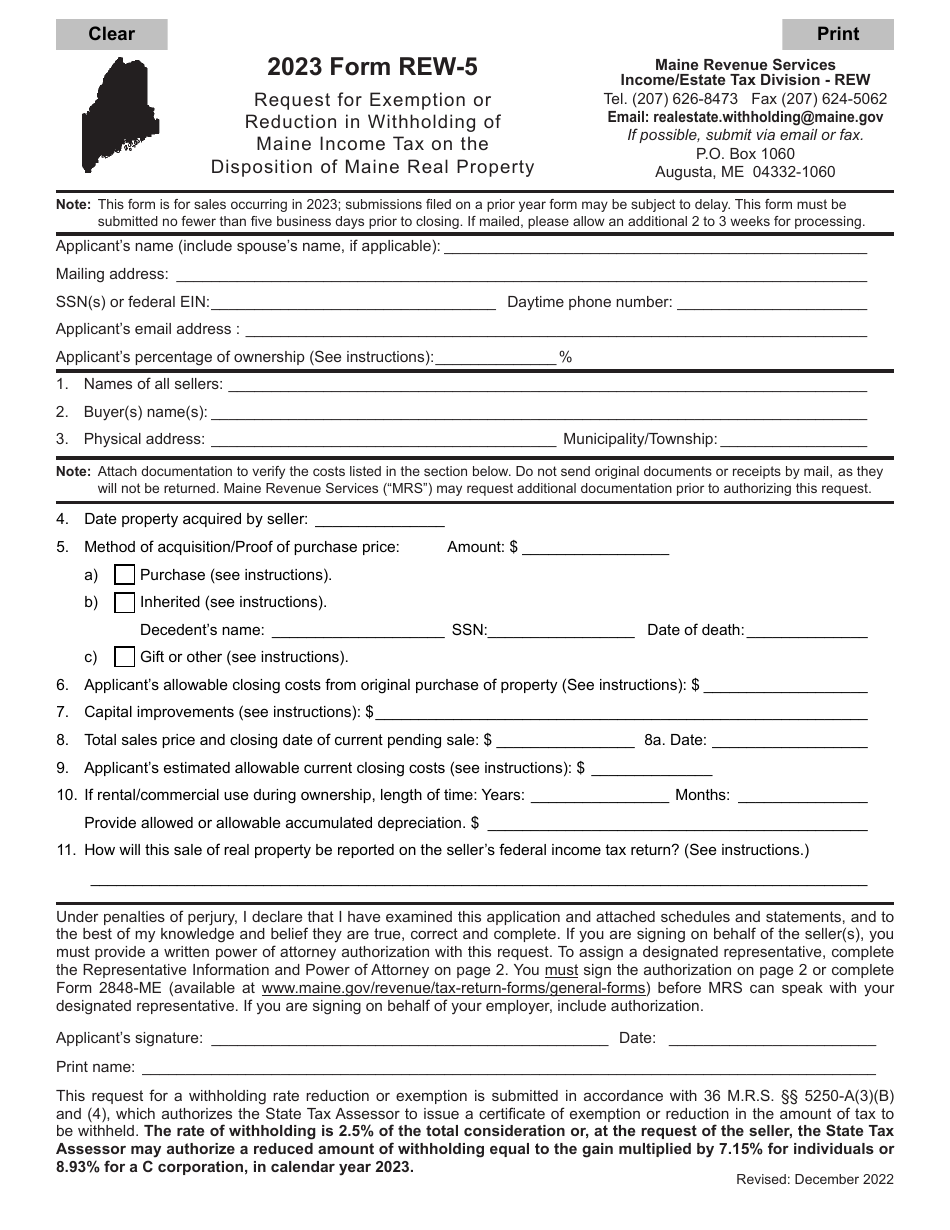

Form REW-5 Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property - Maine

What Is Form REW-5?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REW-5?

A: Form REW-5 is a form used in Maine to request an exemption or reduction in withholding of Maine income tax on the disposal of Maine real property.

Q: Who needs to file Form REW-5?

A: Anyone who is selling or transferring Maine real property and wants to request an exemption or reduction in withholding of Maine income tax needs to file Form REW-5.

Q: What is the purpose of Form REW-5?

A: The purpose of Form REW-5 is to request an exemption or reduction in withholding of Maine income tax on the sale or transfer of Maine real property.

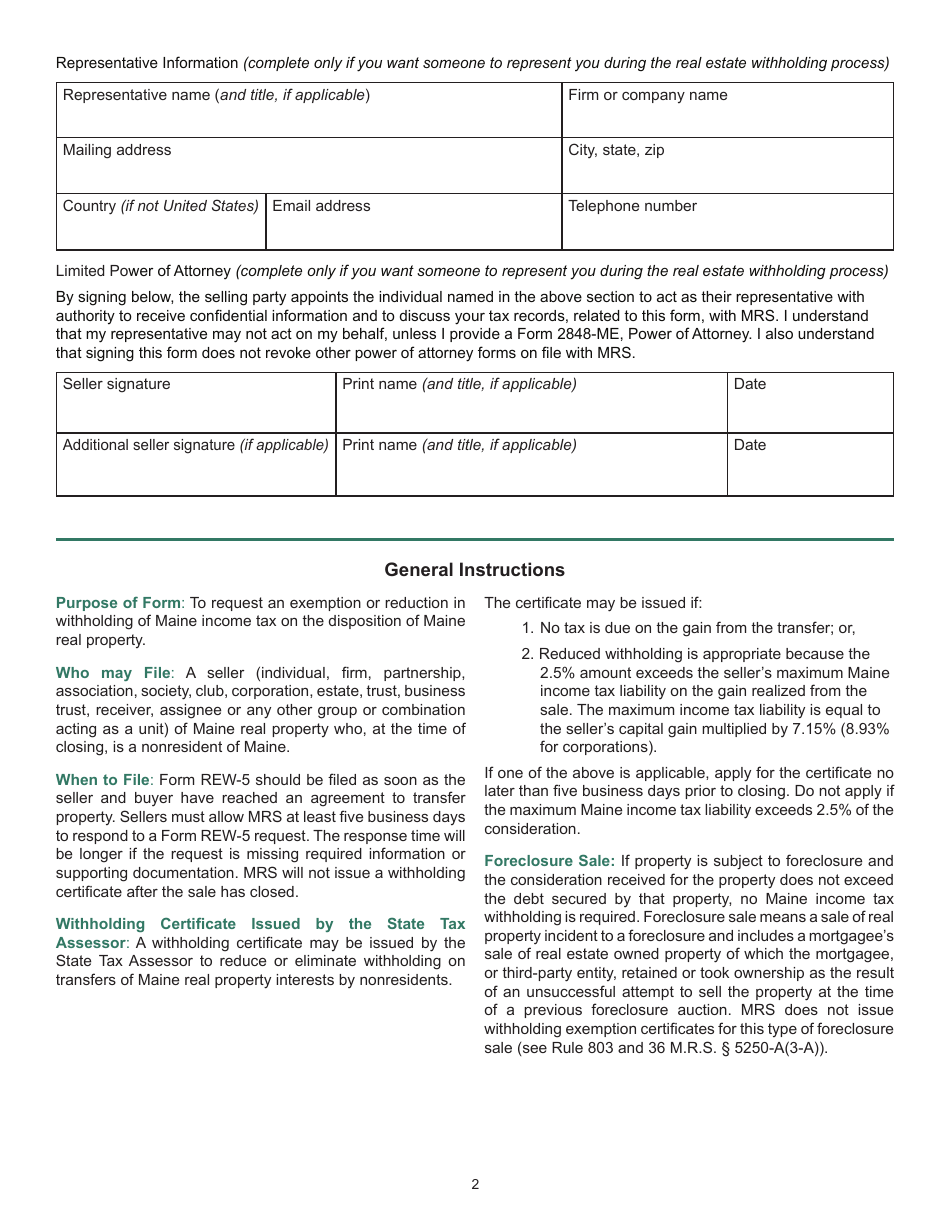

Q: How do I fill out Form REW-5?

A: You need to fill out the relevant sections of Form REW-5 with accurate information about the property being sold or transferred, and provide any necessary supporting documentation.

Q: When is Form REW-5 due?

A: Form REW-5 must be filed at least 10 days before the disposition of the Maine real property.

Q: What happens after I file Form REW-5?

A: After you file Form REW-5, the Maine Revenue Services will review your request and determine if you qualify for an exemption or reduction in withholding of Maine income tax.

Q: Is there a fee to file Form REW-5?

A: No, there is no fee to file Form REW-5.

Q: What should I do if I have questions about Form REW-5?

A: If you have any questions about Form REW-5, you should contact the Maine Revenue Services for assistance.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-5 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.