This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-90005

for the current year.

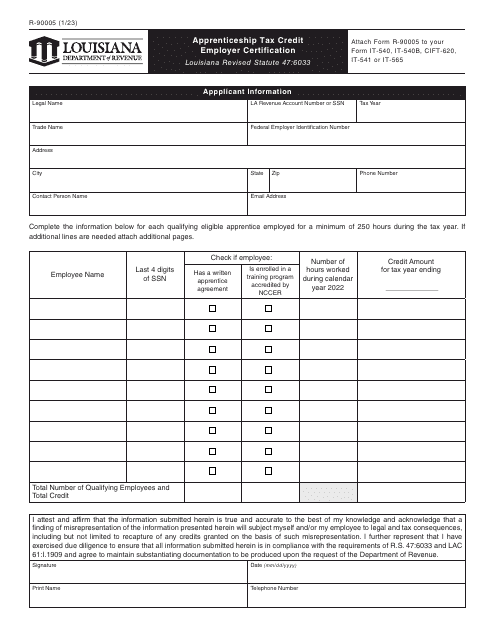

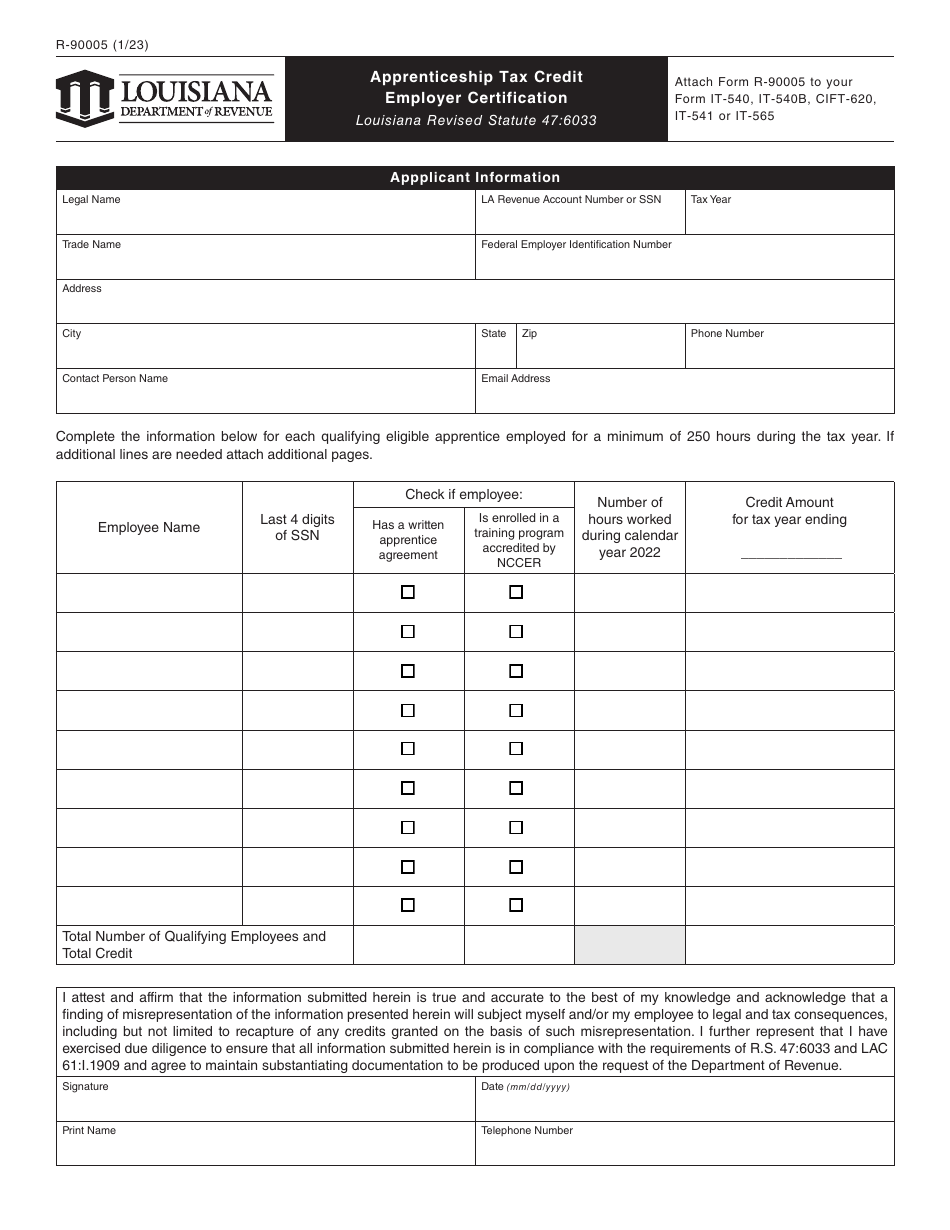

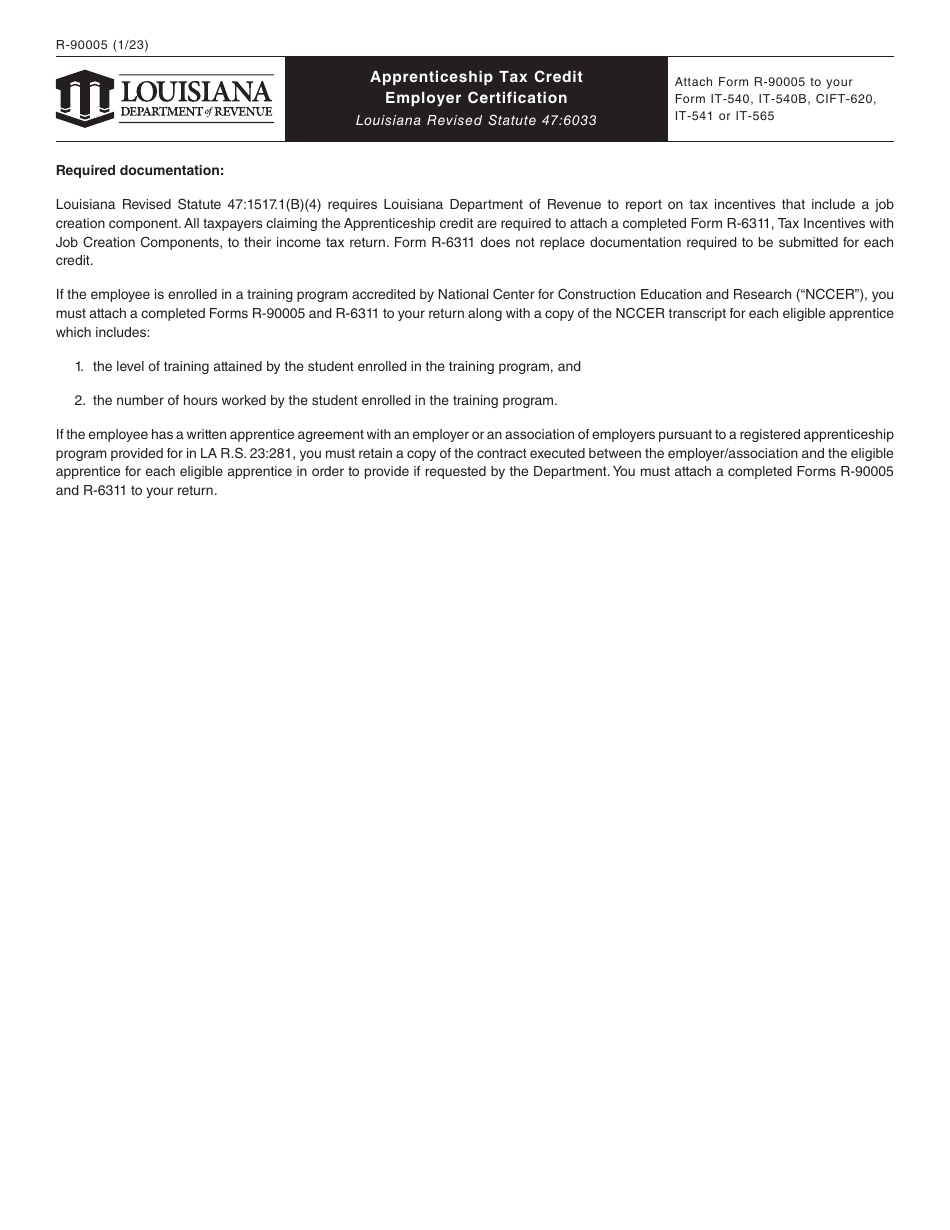

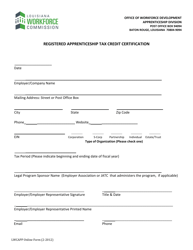

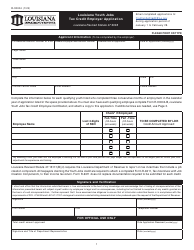

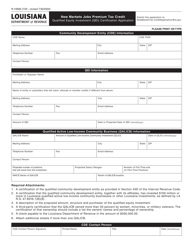

Form R-90005 Apprenticeship Tax Credit Employer Certification - Louisiana

What Is Form R-90005?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-90005?

A: Form R-90005 is the Apprenticeship Tax Credit Employer Certification form in Louisiana.

Q: What is the purpose of Form R-90005?

A: The purpose of Form R-90005 is to certify that an employer is eligible for the Apprenticeship Tax Credit in Louisiana.

Q: Who needs to fill out Form R-90005?

A: Employers in Louisiana who want to claim the Apprenticeship Tax Credit need to fill out Form R-90005.

Q: What information is required on Form R-90005?

A: Form R-90005 requires information such as the employer's name, address, federal employer identification number (EIN), and the number of apprentices employed.

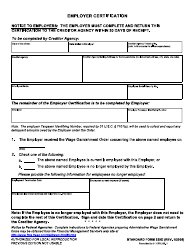

Q: When is the deadline to file Form R-90005?

A: The deadline to file Form R-90005 is the same as the employer's income tax filing deadline, which is generally April 15th.

Q: Is there a fee to file Form R-90005?

A: No, there is no fee to file Form R-90005.

Q: What happens after I file Form R-90005?

A: After filing Form R-90005, the Louisiana Department of Revenue will review the information and determine if the employer is eligible for the Apprenticeship Tax Credit.

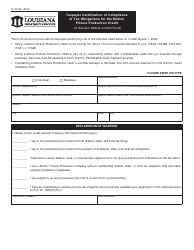

Q: How much is the Apprenticeship Tax Credit in Louisiana?

A: The amount of the Apprenticeship Tax Credit in Louisiana is up to $1,000 per apprentice per year.

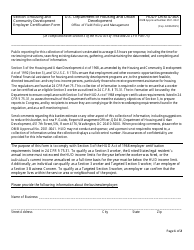

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-90005 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.