This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5082

for the current year.

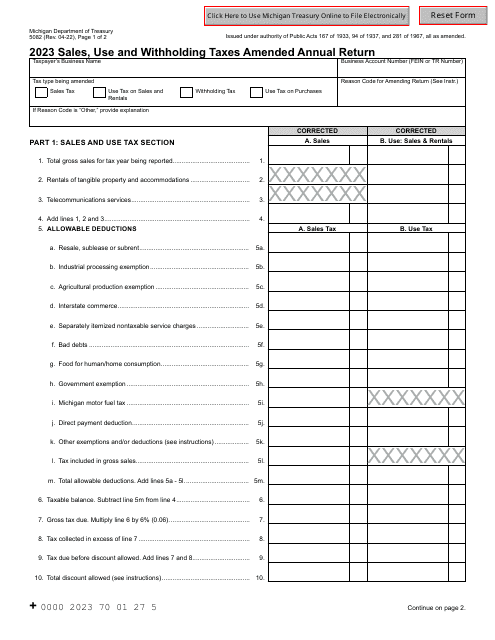

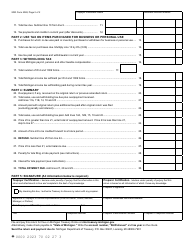

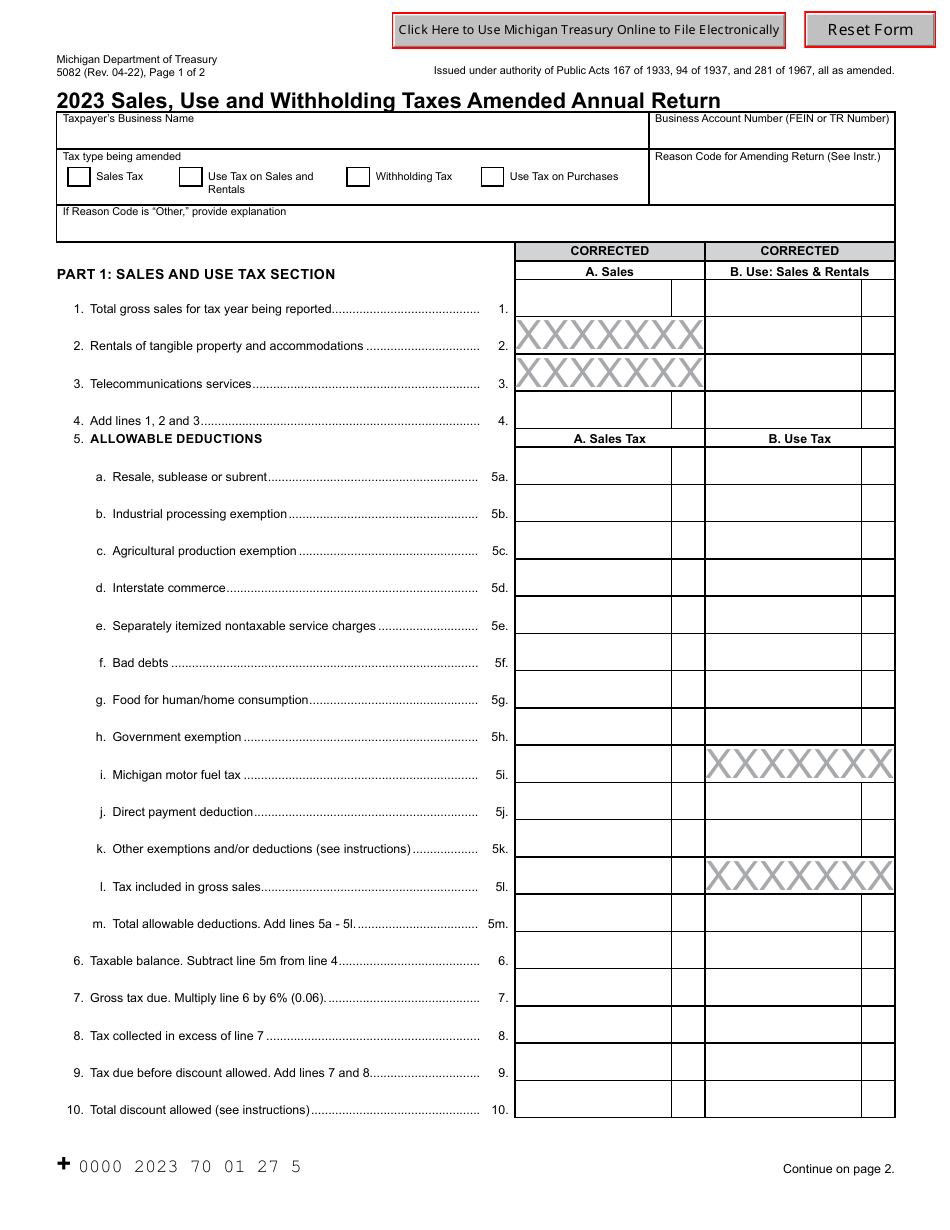

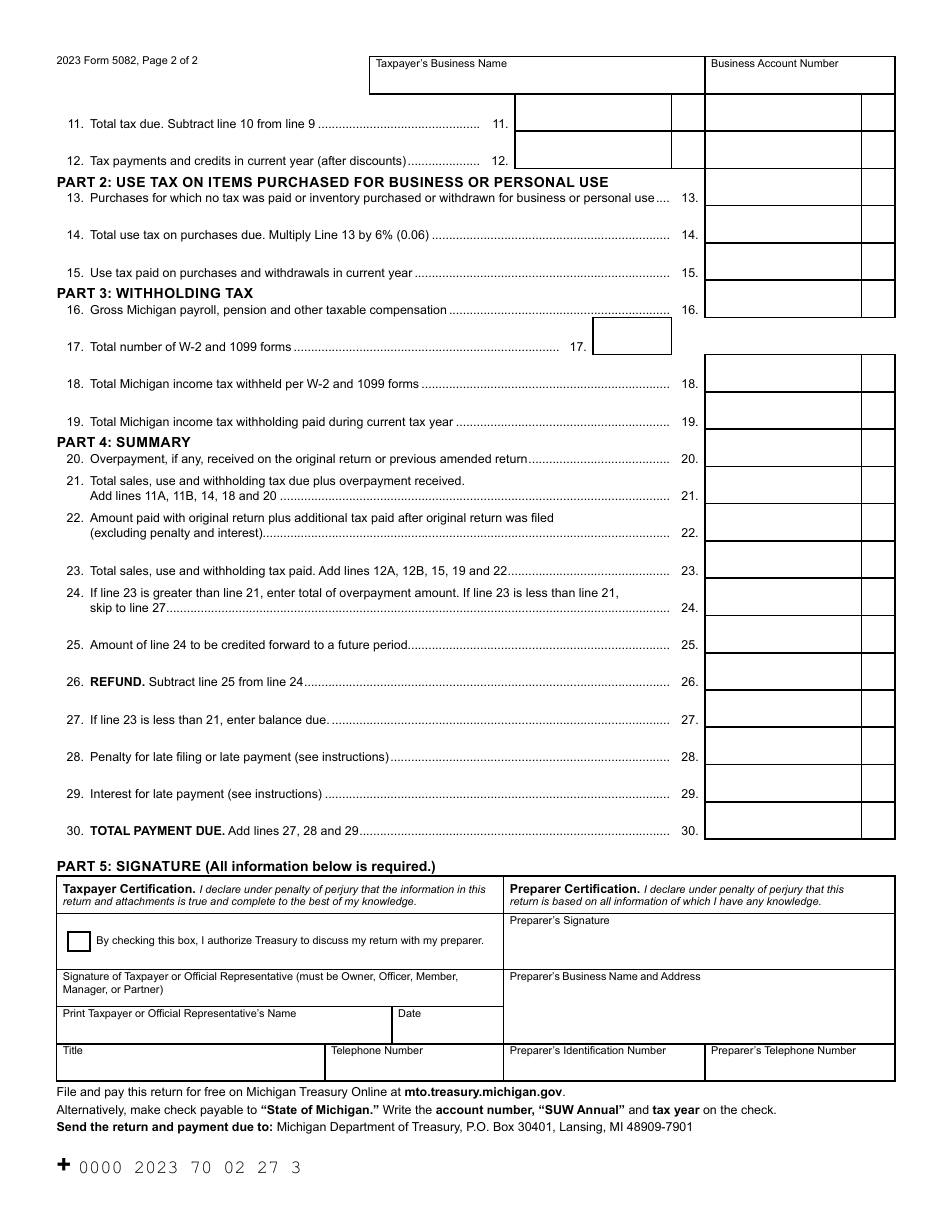

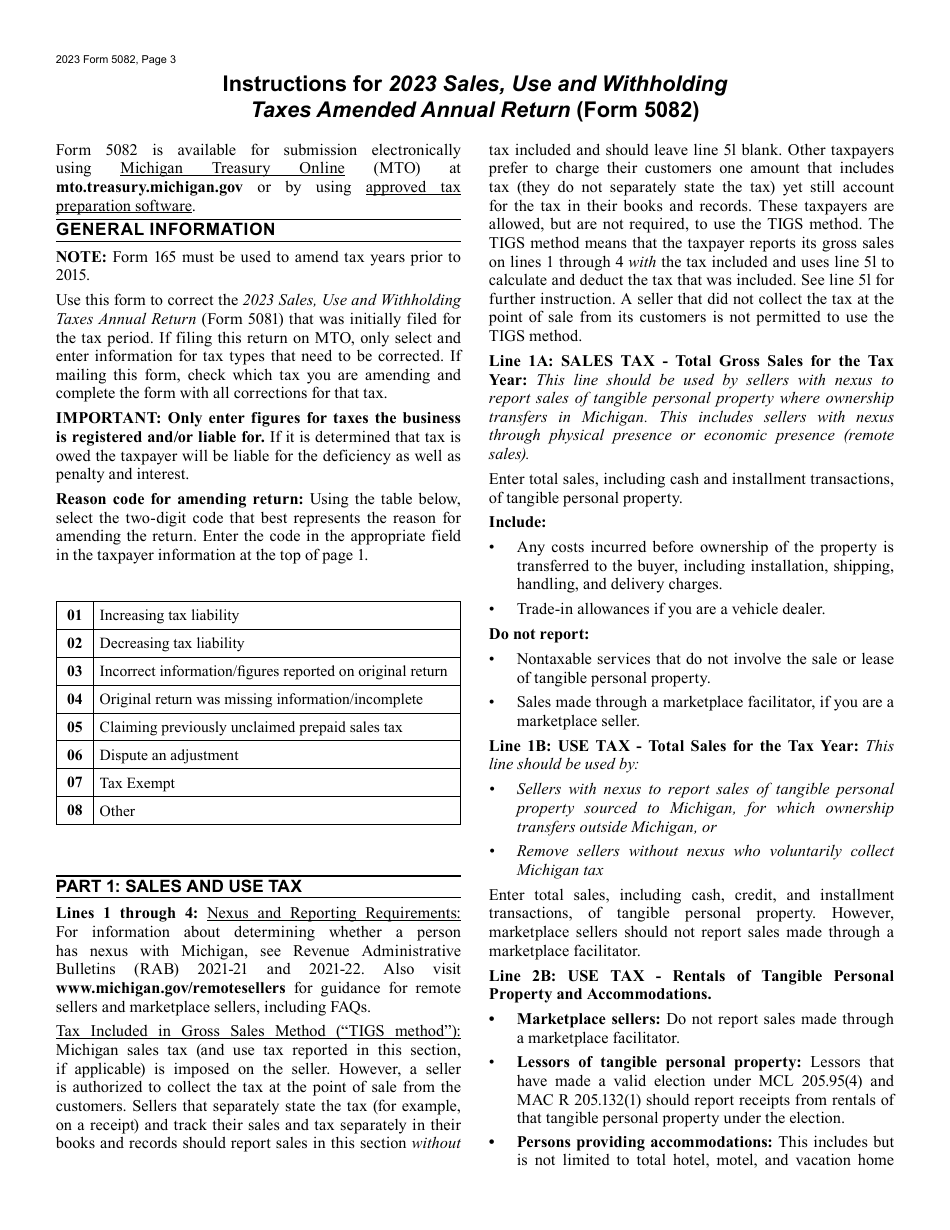

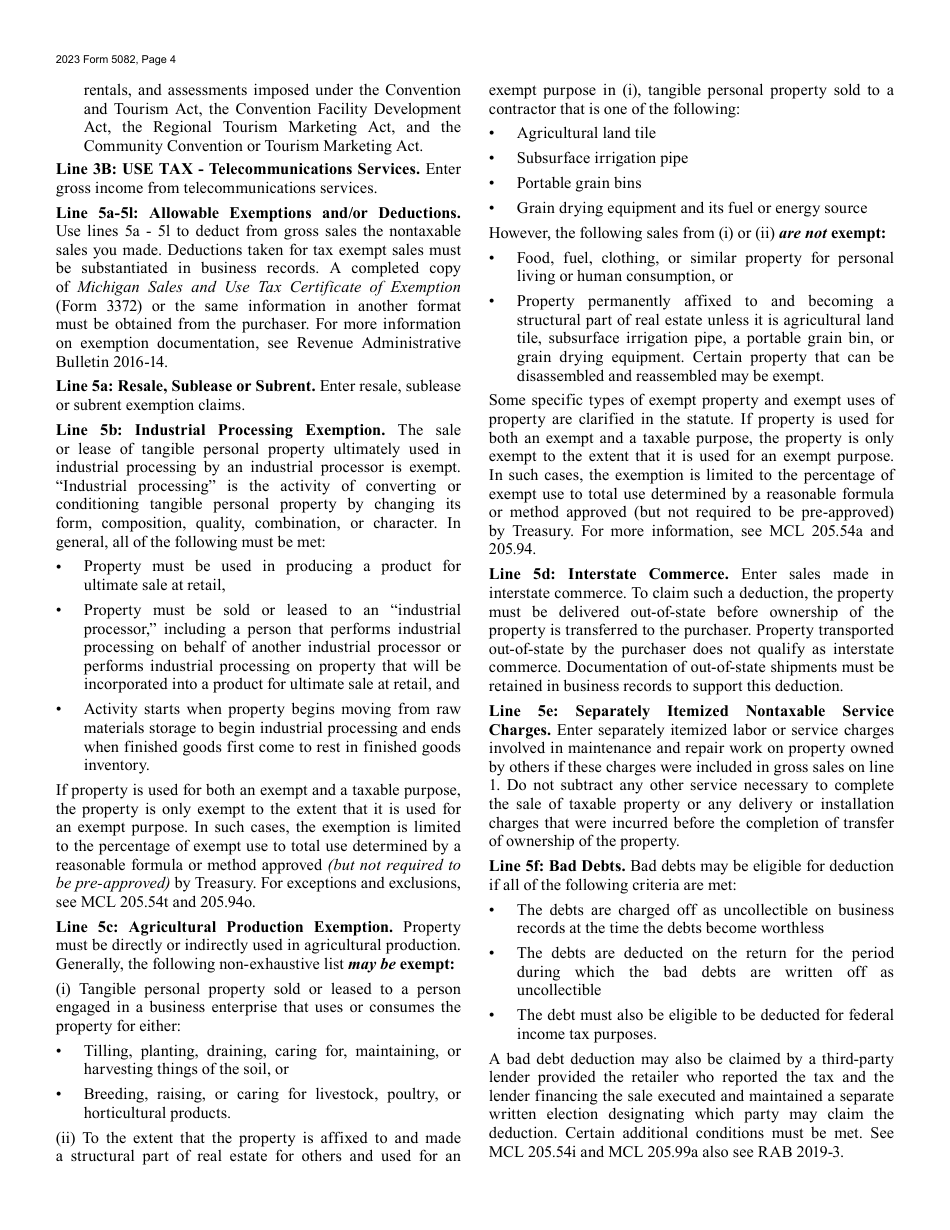

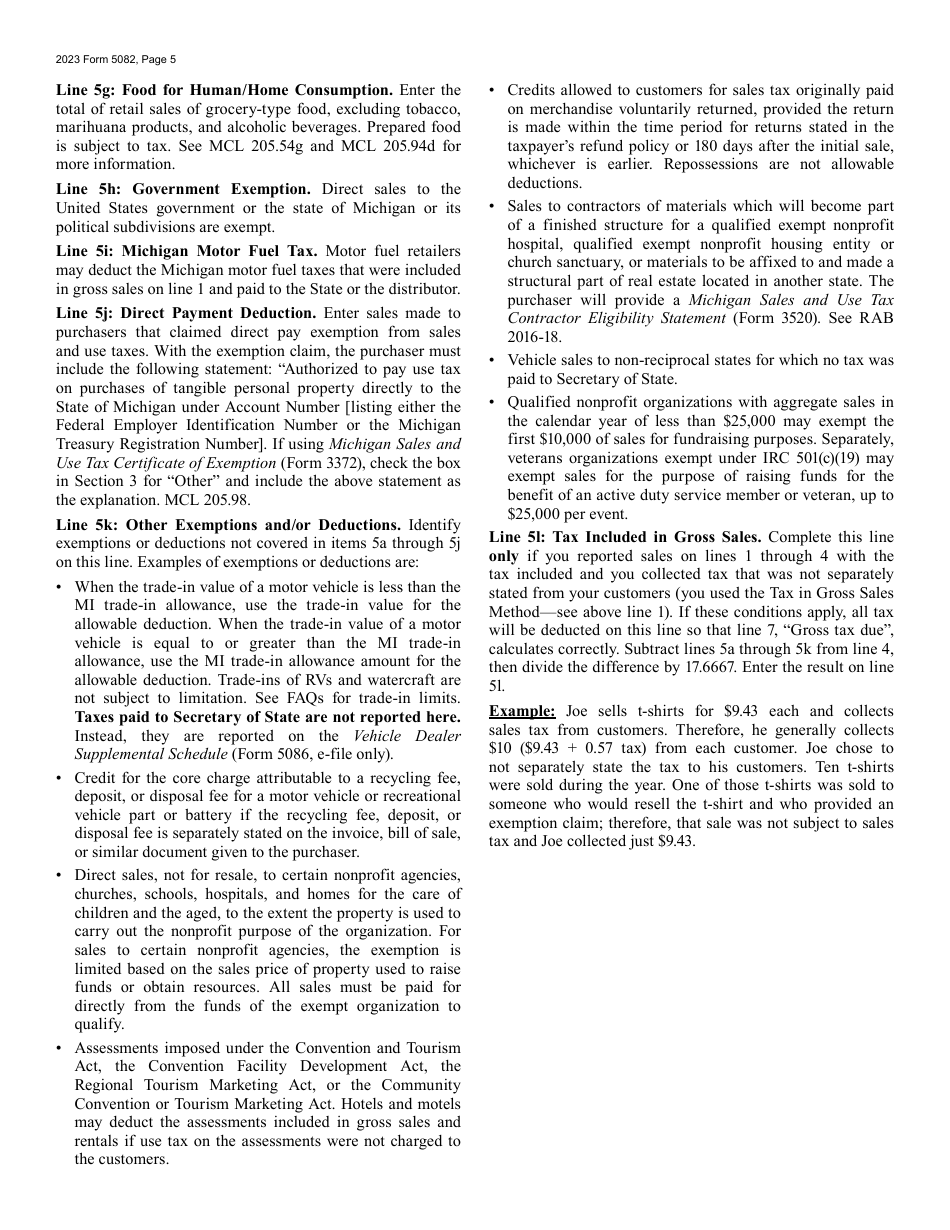

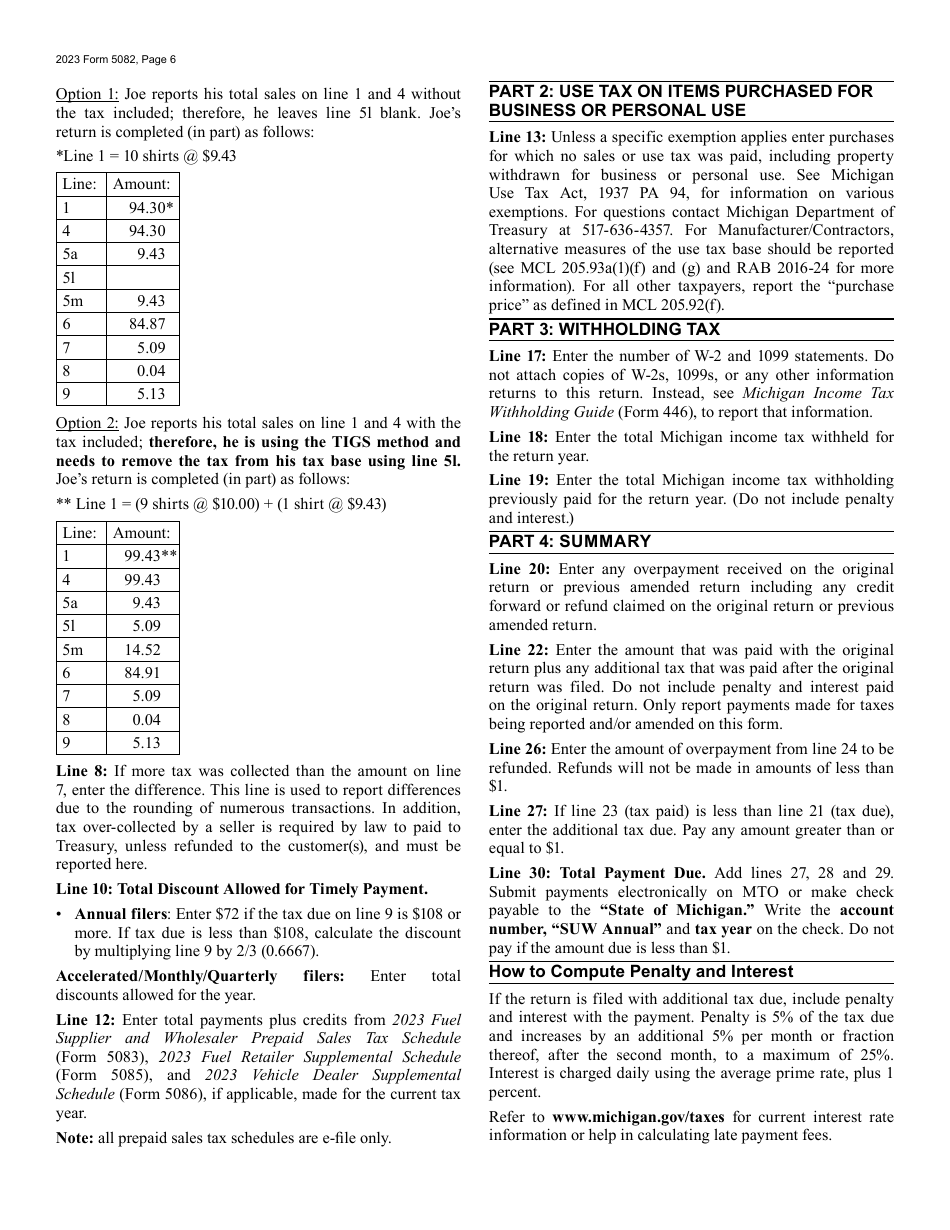

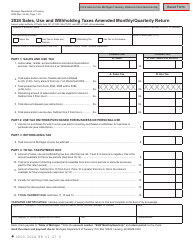

Form 5082 Sales, Use and Withholding Taxes Amended Annual Return - Michigan

What Is Form 5082?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5082?

A: Form 5082 is the Sales, Use and Withholding Taxes Amended Annual Return in Michigan.

Q: Who should use Form 5082?

A: This form should be used by businesses or individuals who need to amend their sales, use, or withholding tax return in Michigan.

Q: What taxes does Form 5082 cover?

A: Form 5082 covers sales tax, use tax, and withholding tax.

Q: When should Form 5082 be filed?

A: Form 5082 should be filed to amend a previously filed sales, use, or withholding tax return in Michigan.

Q: What should I do if I made an error on my tax return?

A: If you made an error on your tax return, you should use Form 5082 to amend the return and correct the error.

Q: Are there any penalties for filing an amended return?

A: Penalties may apply if you knowingly or intentionally filed an incorrect return. It is important to correct any errors as soon as possible.

Q: Can I file Form 5082 electronically?

A: Yes, you can file Form 5082 electronically using the Michigan Department of Treasury's e-file system.

Q: What supporting documents do I need to include with Form 5082?

A: You should include any supporting documentation that is relevant to the amendment you are making, such as receipts or additional tax forms.

Q: Is there a deadline for filing Form 5082?

A: Form 5082 should be filed as soon as you discover an error on your original tax return. There is no specific deadline, but it is recommended to file the amendment promptly.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5082 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.