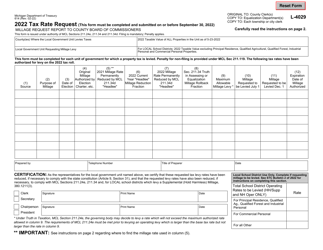

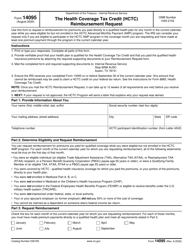

This version of the form is not currently in use and is provided for reference only. Download this version of

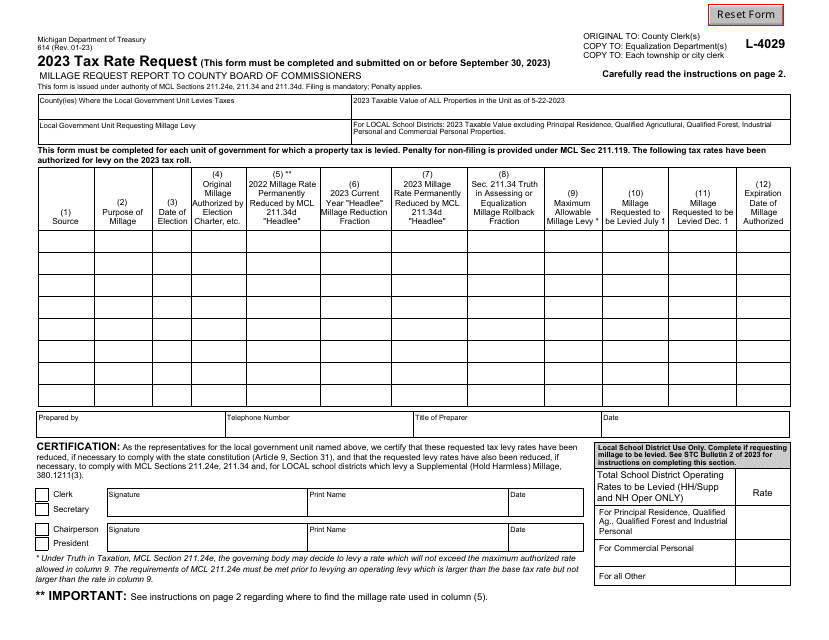

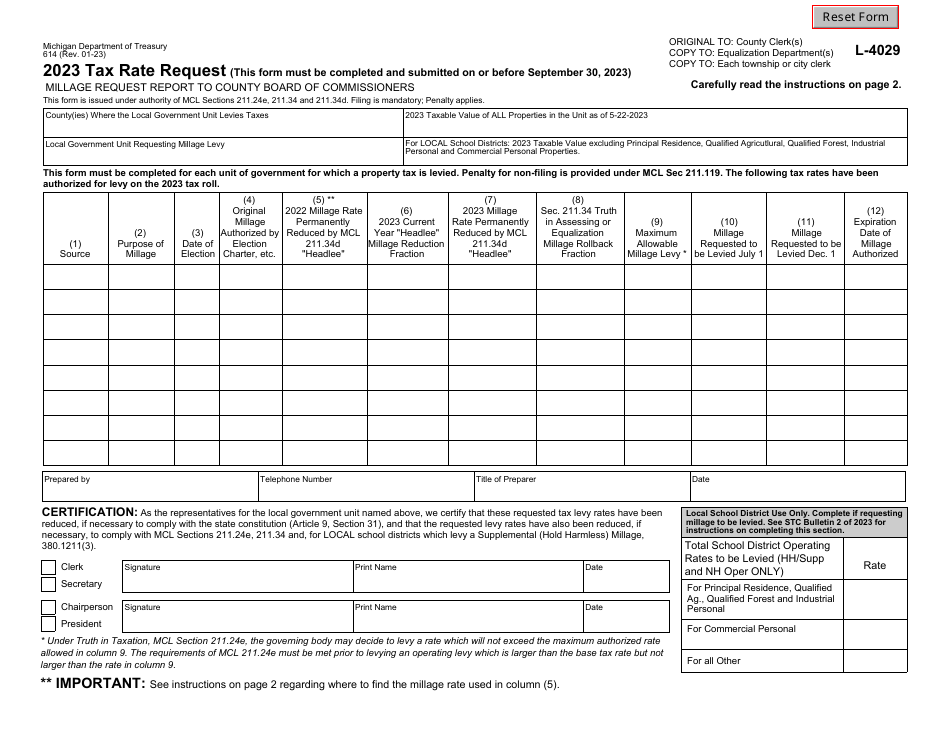

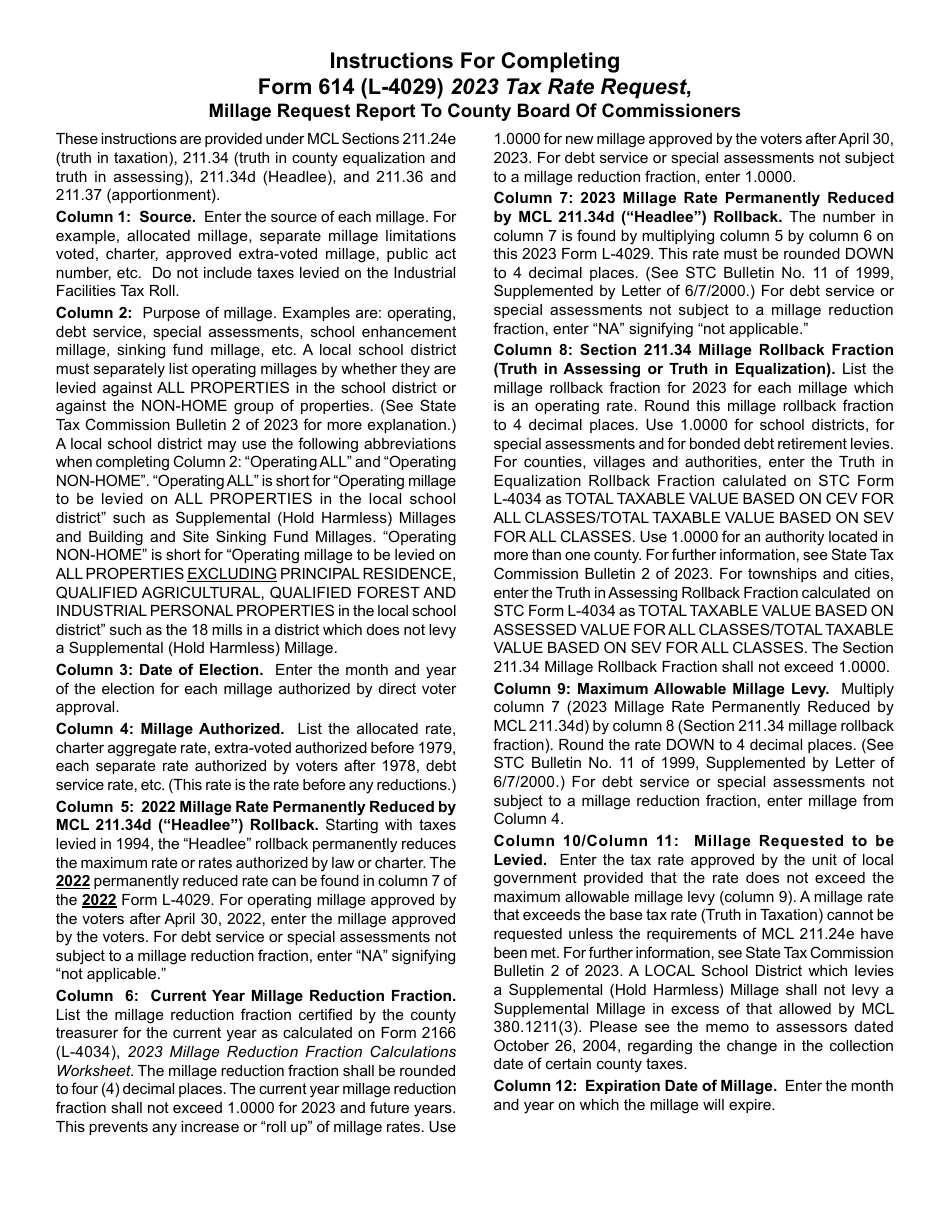

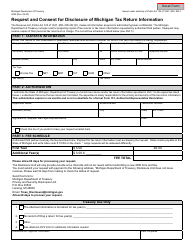

Form 614 (L-4029)

for the current year.

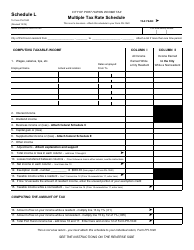

Form 614 (L-4029) Tax Rate Request - Michigan

What Is Form 614 (L-4029)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

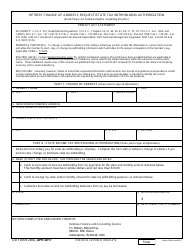

Q: What is Form 614 (L-4029)?

A: Form 614 (L-4029) is a Tax Rate Request form used in Michigan.

Q: Who needs to fill out Form 614 (L-4029)?

A: Form 614 (L-4029) needs to be filled out by employers in Michigan who want to request a tax rate change.

Q: What is the purpose of Form 614 (L-4029)?

A: The purpose of Form 614 (L-4029) is to request a change in the tax rate for unemployment contributions in Michigan.

Q: Is there a deadline for submitting Form 614 (L-4029)?

A: Yes, Form 614 (L-4029) must be filed by September 30th of each year for the upcoming tax year.

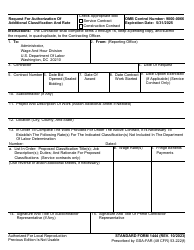

Q: What information is required on Form 614 (L-4029)?

A: Form 614 (L-4029) requires information such as the employer's account number, business name, address, and detailed explanation for the requested rate change.

Q: Can I request a tax rate reduction with Form 614 (L-4029)?

A: Yes, Form 614 (L-4029) can be used to request a reduction in the tax rate for unemployment contributions.

Q: What happens after submitting Form 614 (L-4029)?

A: After submitting Form 614 (L-4029), the Michigan Unemployment Insurance Agency will review the request and determine if the tax rate change is approved.

Q: Can I appeal the decision on my tax rate request?

A: Yes, if your tax rate request is denied, you can appeal the decision by following the instructions provided by the Michigan Unemployment Insurance Agency.

Q: Are there any fees associated with filing Form 614 (L-4029)?

A: No, there are no fees associated with filing Form 614 (L-4029).

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 614 (L-4029) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.