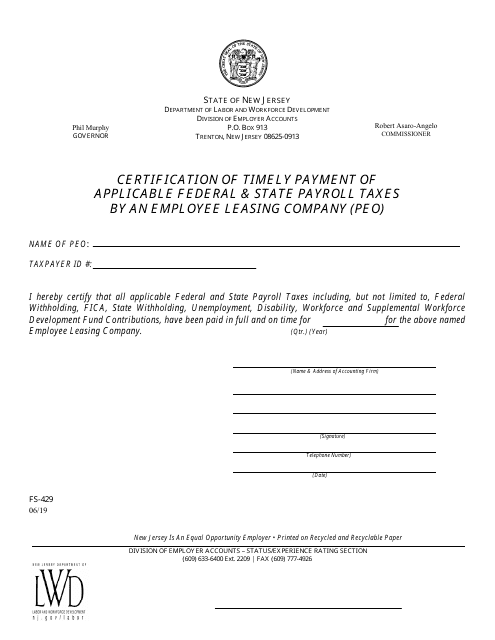

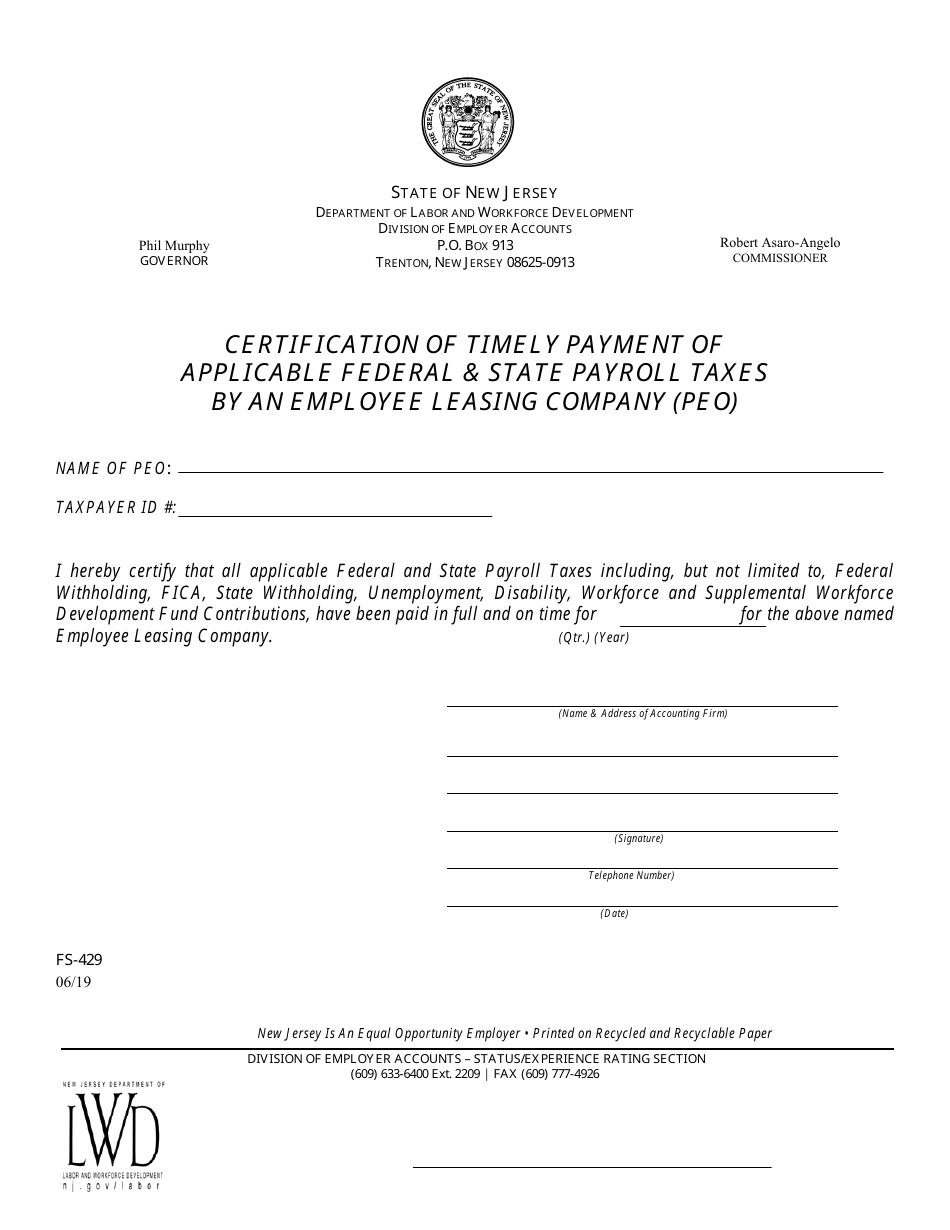

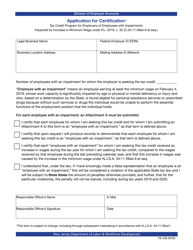

Form FS-429 Certification of Timely Payment of Applicable Federal & State Payroll Taxes by an Employee Leasing Company (Peo) - New Jersey

What Is Form FS-429?

This is a legal form that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FS-429?

A: Form FS-429 is the Certification of Timely Payment of Applicable Federal & State Payroll Taxes by an Employee Leasing Company (PEO).

Q: Who is required to fill out Form FS-429?

A: Employee Leasing Companies (PEOs) in New Jersey are required to fill out Form FS-429.

Q: What does Form FS-429 certify?

A: Form FS-429 certifies the timely payment of applicable federal and state payroll taxes by an Employee Leasing Company.

Q: Why is Form FS-429 necessary?

A: Form FS-429 is necessary to ensure that employee leasing companies (PEOs) are in compliance with tax payment requirements.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the New Jersey Department of Labor & Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FS-429 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.