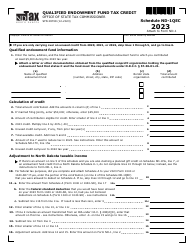

This version of the form is not currently in use and is provided for reference only. Download this version of

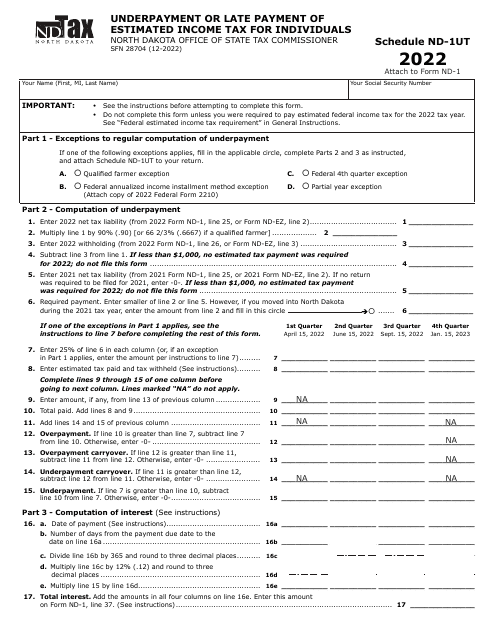

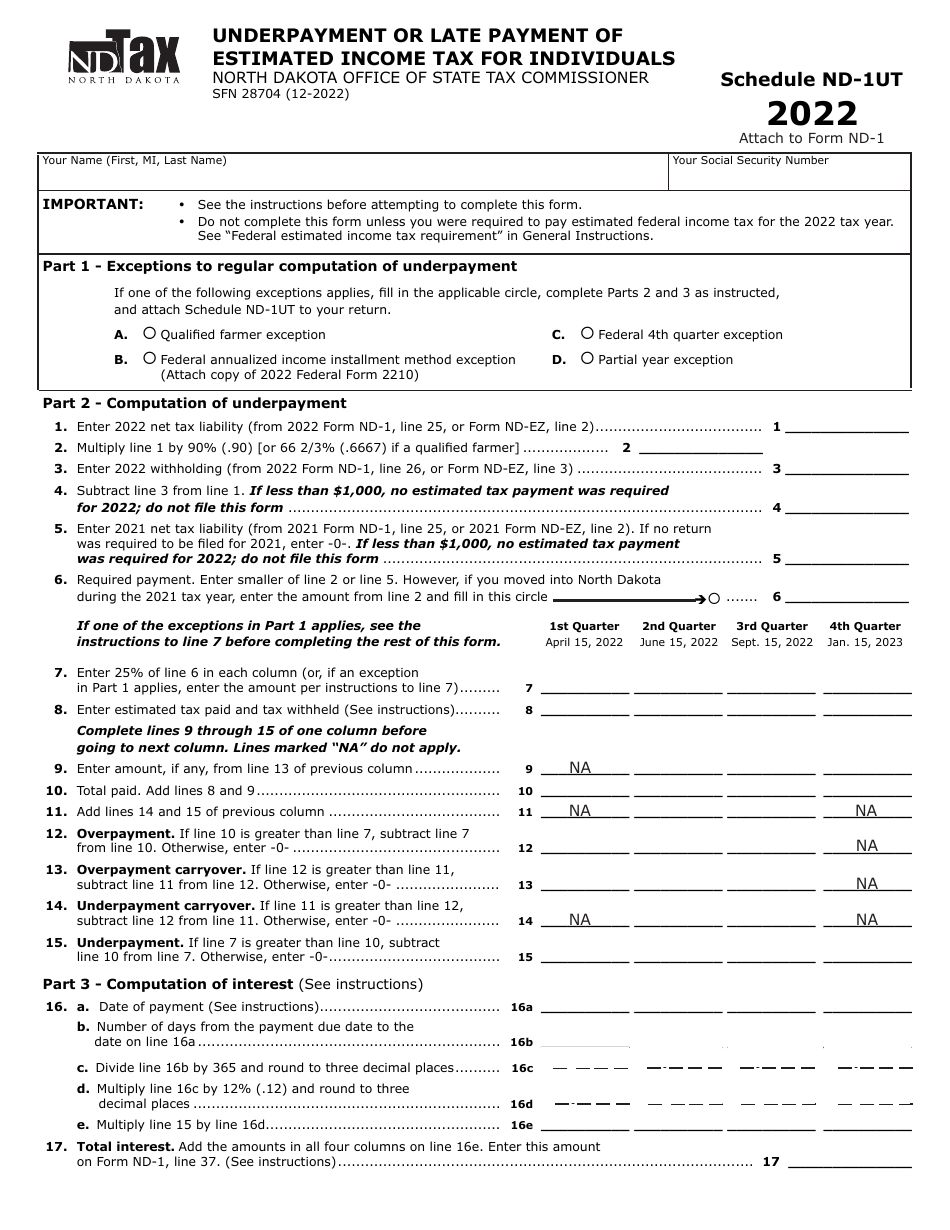

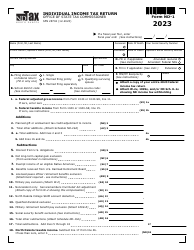

Form SFN28704 Schedule ND-1UT

for the current year.

Form SFN28704 Schedule ND-1UT Underpayment or Late Payment of Estimated Income Tax for Individuals - North Dakota

What Is Form SFN28704 Schedule ND-1UT?

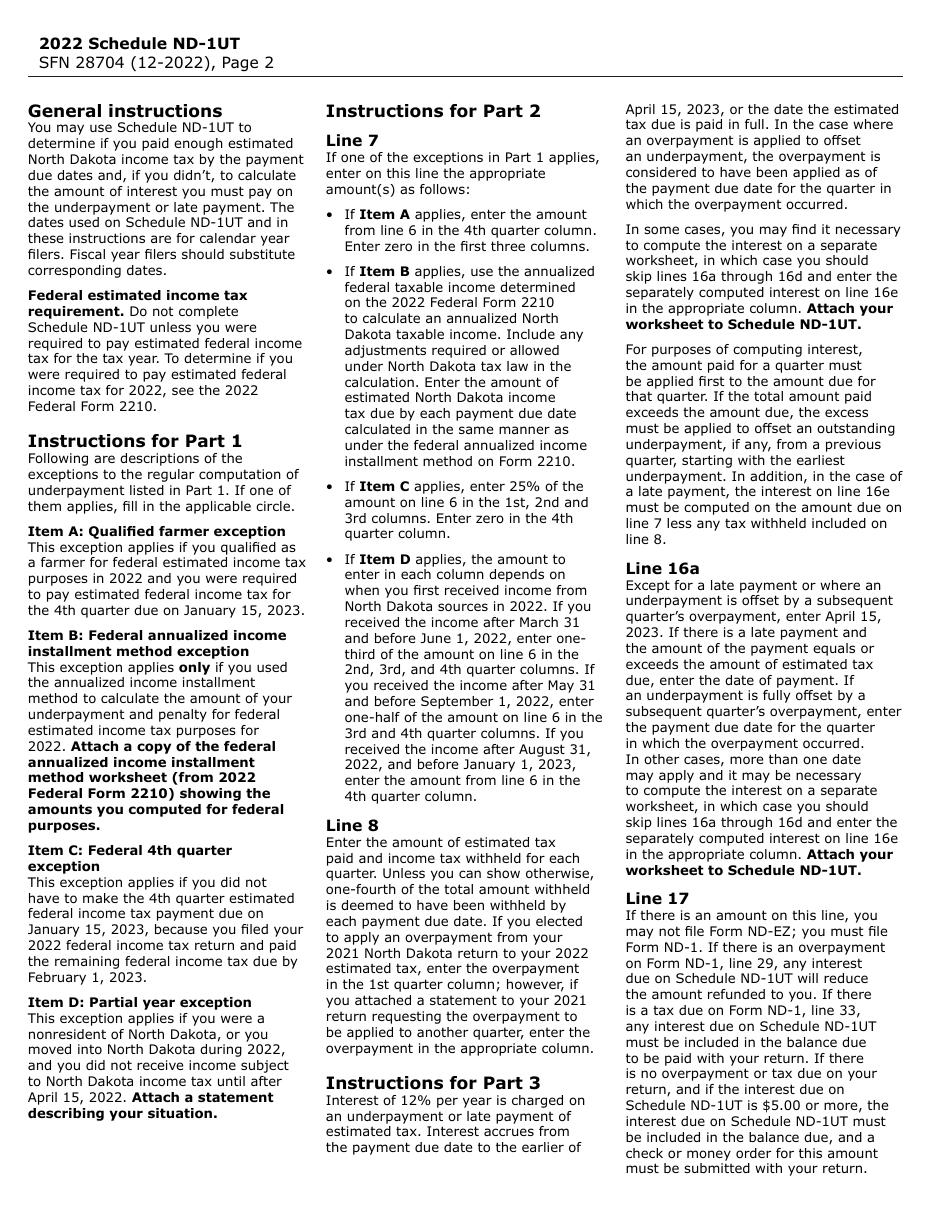

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

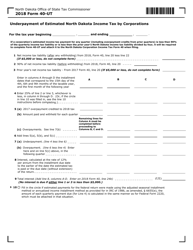

Q: What is SFN28704?

A: SFN28704 is the form for Schedule ND-1UT - Underpayment or Late Payment of Estimated Income Tax for individuals in North Dakota.

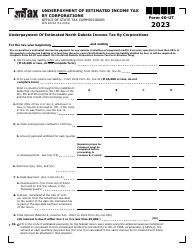

Q: Who needs to file SFN28704?

A: Individuals in North Dakota who underpaid or made a late payment of their estimated income tax need to file SFN28704 - Schedule ND-1UT.

Q: What is the purpose of SFN28704?

A: The purpose of SFN28704 - Schedule ND-1UT is to determine if an individual owes any penalties or interest for underpaying or making a late payment of their estimated income tax.

Q: How do I fill out SFN28704?

A: To fill out SFN28704 - Schedule ND-1UT, you will need to provide information about your estimated income tax payments and calculate any penalties or interest owed.

Q: When is the deadline to file SFN28704?

A: The deadline to file SFN28704 - Schedule ND-1UT is typically the same as the deadline for filing your North Dakota state income tax return, which is April 15th.

Q: What happens if I don't file SFN28704?

A: If you are required to file SFN28704 - Schedule ND-1UT and you fail to do so, you may be subject to penalties and interest on any underpaid or late-paid estimated income tax.

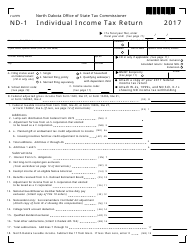

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28704 Schedule ND-1UT by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.