This version of the form is not currently in use and is provided for reference only. Download this version of

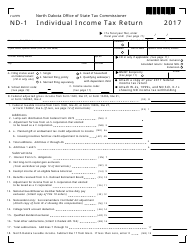

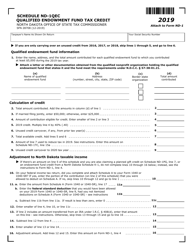

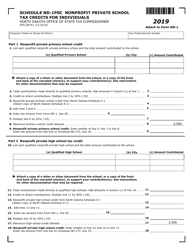

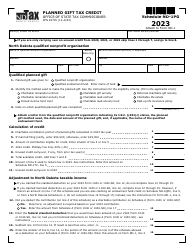

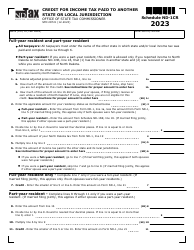

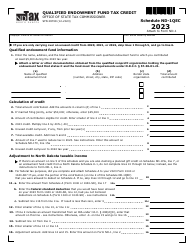

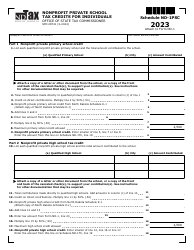

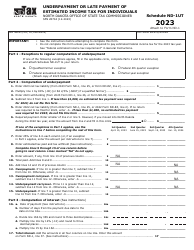

Form SFN28724 Schedule ND-1NR

for the current year.

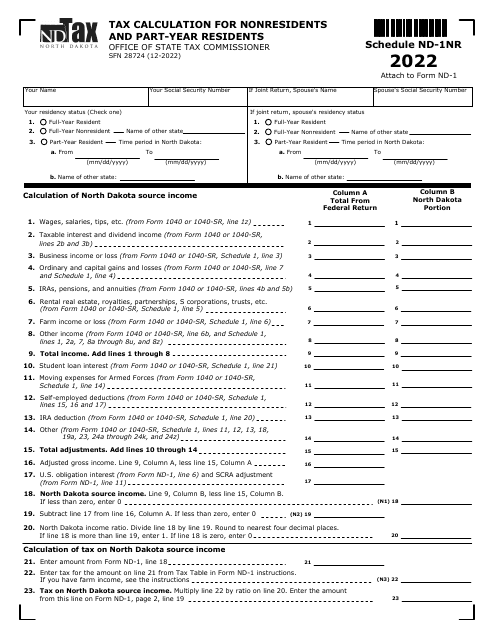

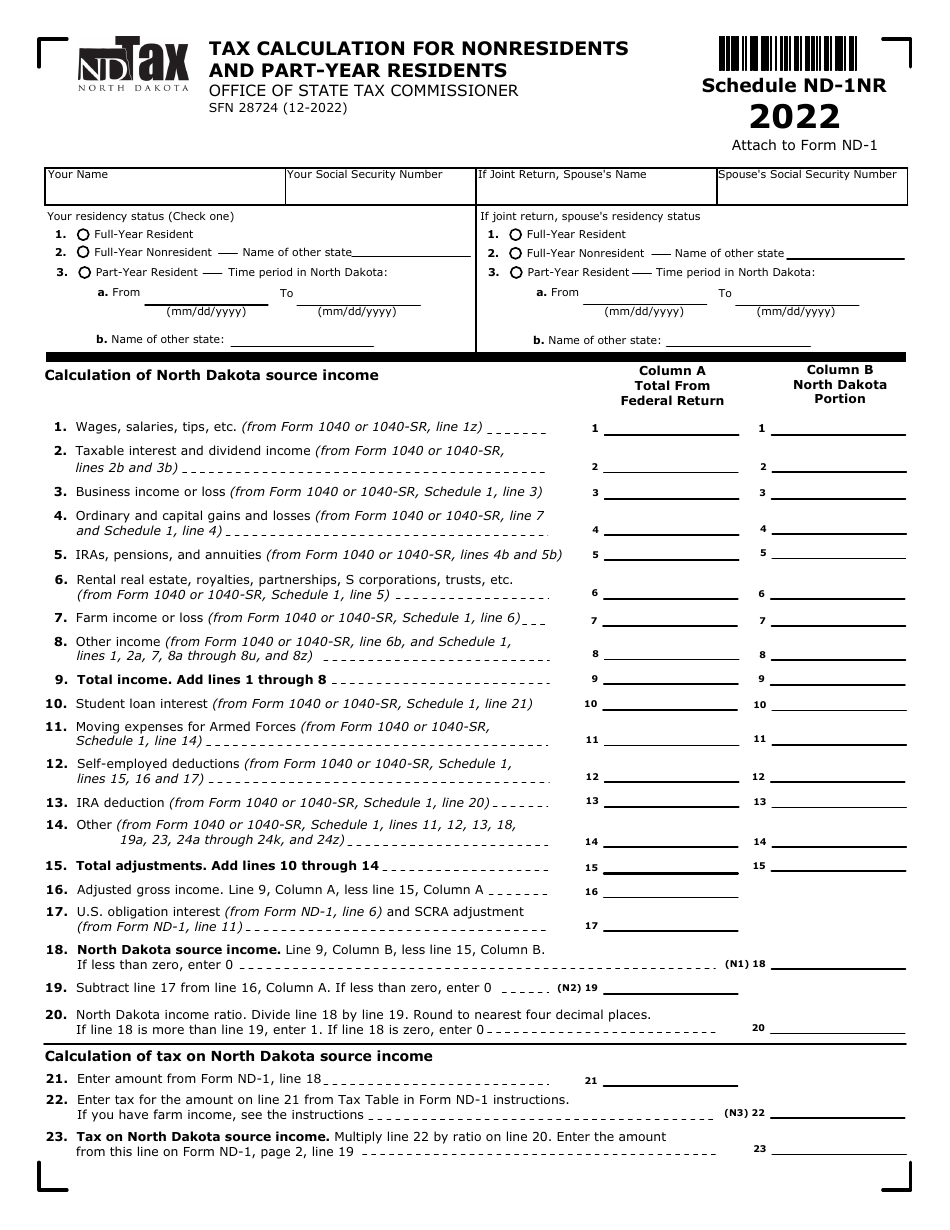

Form SFN28724 Schedule ND-1NR Tax Calculation for Nonresidents and Part-Year Residents - North Dakota

What Is Form SFN28724 Schedule ND-1NR?

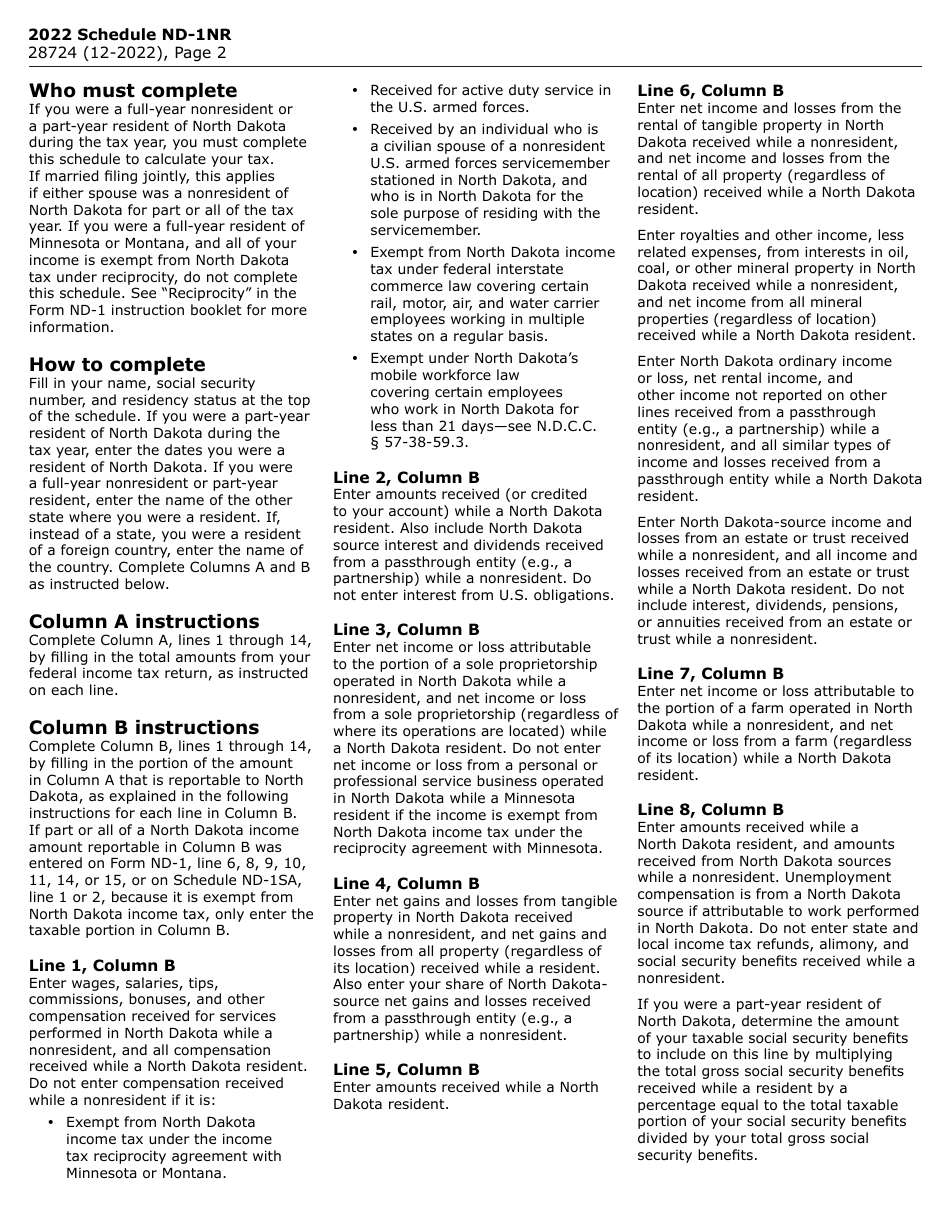

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

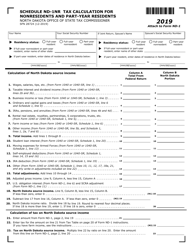

Q: Who is the Form SFN28724 Schedule ND-1NR for?

A: The Form SFN28724 Schedule ND-1NR is for nonresidents and part-year residents of North Dakota.

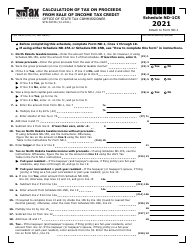

Q: What is the purpose of the Form SFN28724 Schedule ND-1NR?

A: The Form SFN28724 Schedule ND-1NR is used to calculate the tax liability for nonresidents and part-year residents of North Dakota.

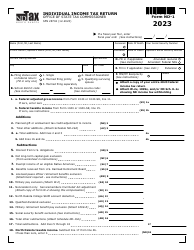

Q: What information do I need to complete the Form SFN28724 Schedule ND-1NR?

A: You will need to provide information about your income, deductions, and credits for the tax year.

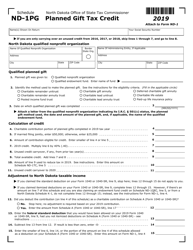

Q: When is the deadline to file the Form SFN28724 Schedule ND-1NR?

A: The deadline to file the Form SFN28724 Schedule ND-1NR is the same as the North Dakota individual income tax return deadline, which is usually April 15th.

Q: Can I e-file the Form SFN28724 Schedule ND-1NR?

A: No, the Form SFN28724 Schedule ND-1NR cannot be e-filed. It must be filed by mail or in person.

Q: Do I need to include any additional forms or documents with the Form SFN28724 Schedule ND-1NR?

A: You may need to include copies of your federal tax return or other supporting documents, depending on your specific circumstances.

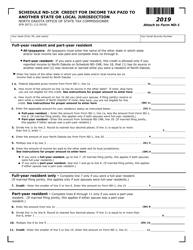

Q: What should I do if I have questions or need help with the Form SFN28724 Schedule ND-1NR?

A: If you have questions or need assistance with the Form SFN28724 Schedule ND-1NR, you should contact the North Dakota Tax Department or consult a tax professional.

Q: What are the consequences of not filing the Form SFN28724 Schedule ND-1NR?

A: Failure to file the Form SFN28724 Schedule ND-1NR may result in penalties, interest, and potential legal consequences.

Q: Can I amend the Form SFN28724 Schedule ND-1NR if I made a mistake?

A: Yes, if you made a mistake on the Form SFN28724 Schedule ND-1NR, you can file an amended return to correct the error.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28724 Schedule ND-1NR by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.