This version of the form is not currently in use and is provided for reference only. Download this version of

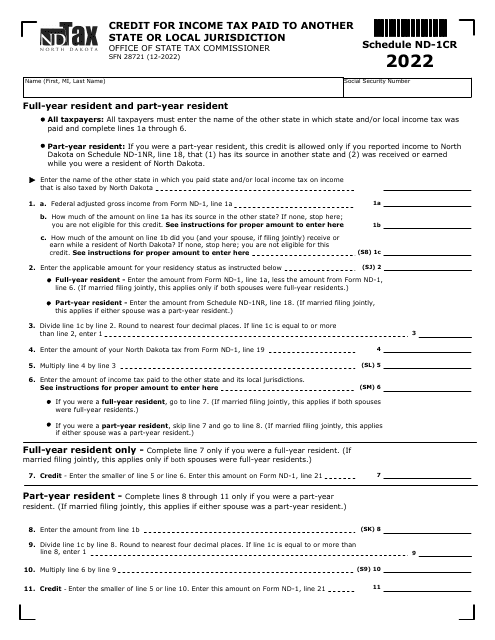

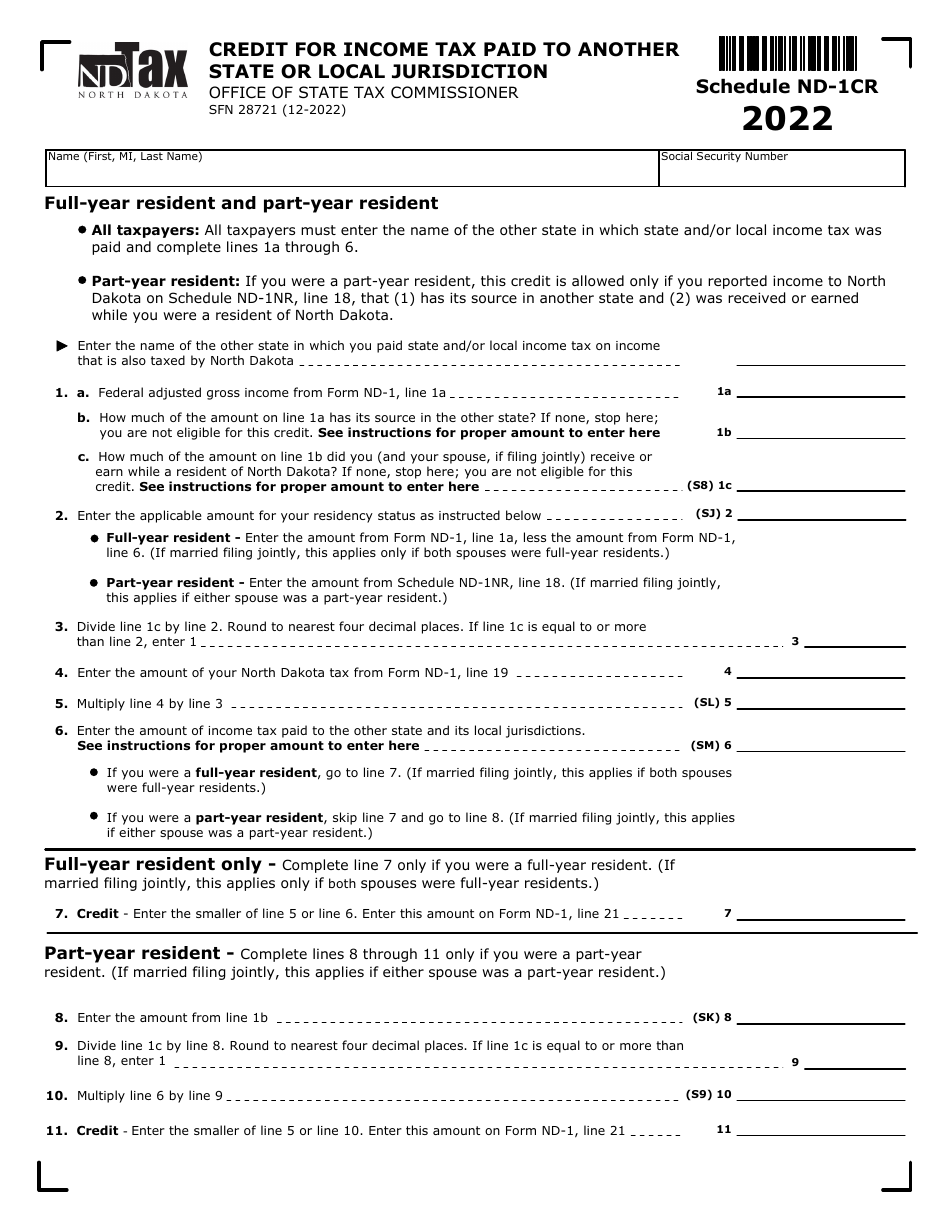

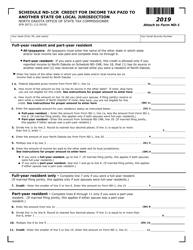

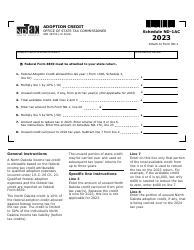

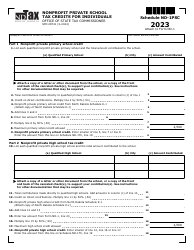

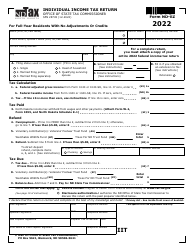

Form SFN28721 Schedule ND-1CR

for the current year.

Form SFN28721 Schedule ND-1CR Credit for Income Tax Paid to Another State or Local Jurisdiction - North Dakota

What Is Form SFN28721 Schedule ND-1CR?

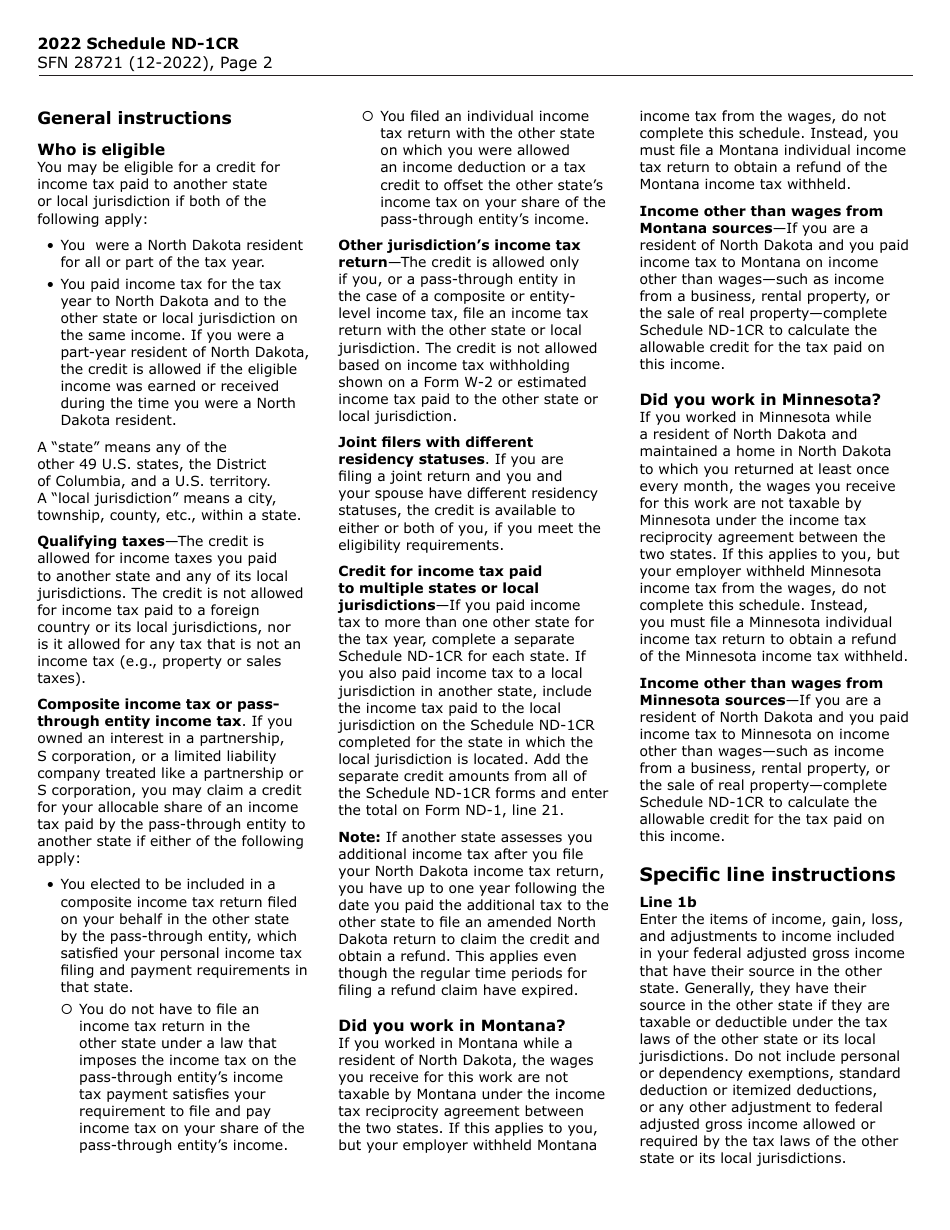

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28721?

A: Form SFN28721 is the Schedule ND-1CR, which is used in North Dakota to claim a credit for income tax paid to another state or local jurisdiction.

Q: What is the purpose of Schedule ND-1CR?

A: The purpose of Schedule ND-1CR is to calculate and claim a credit for income tax paid to another state or local jurisdiction.

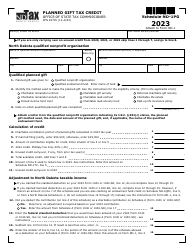

Q: Who is eligible to use Schedule ND-1CR?

A: Any North Dakota resident or part-year resident who paid income tax to another state or local jurisdiction is eligible to use Schedule ND-1CR.

Q: What types of taxes can be claimed as a credit on Schedule ND-1CR?

A: You can claim a credit for income tax paid to another state or local jurisdiction on Schedule ND-1CR.

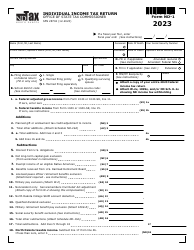

Q: How do I file Schedule ND-1CR?

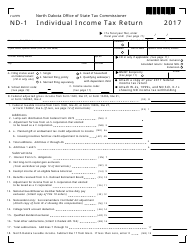

A: You can file Schedule ND-1CR by attaching it to your North Dakota individual income tax return (Form ND-1).

Q: What supporting documents do I need to include with Schedule ND-1CR?

A: You will need to include copies of your other state or local tax returns and any other supporting documentation showing the taxes paid.

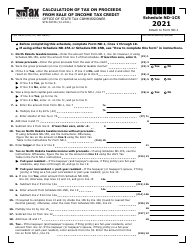

Q: Is there a deadline for filing Schedule ND-1CR?

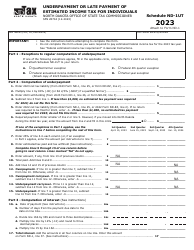

A: Schedule ND-1CR must be filed by the same deadline as your North Dakota individual income tax return, which is April 15th (or the next business day if April 15th falls on a weekend or holiday).

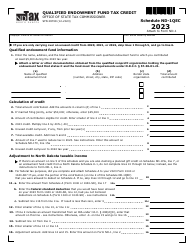

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28721 Schedule ND-1CR by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.