This version of the form is not currently in use and is provided for reference only. Download this version of

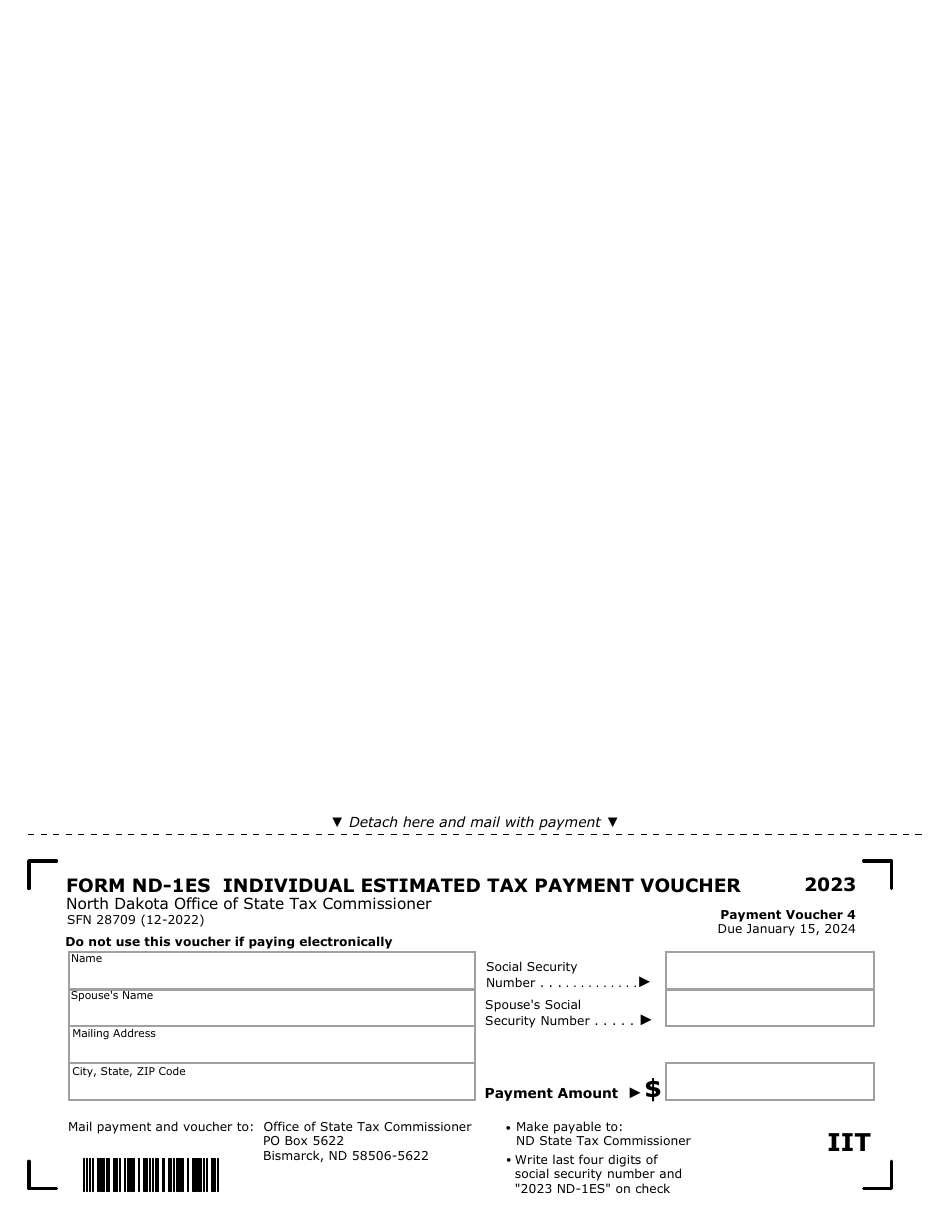

Form ND-1ES (SFN28709)

for the current year.

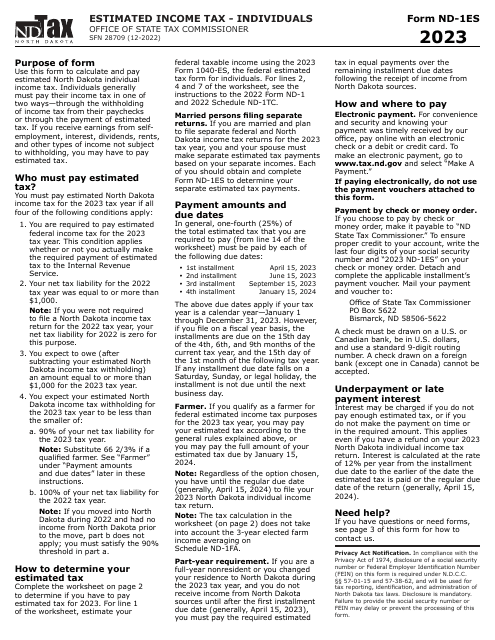

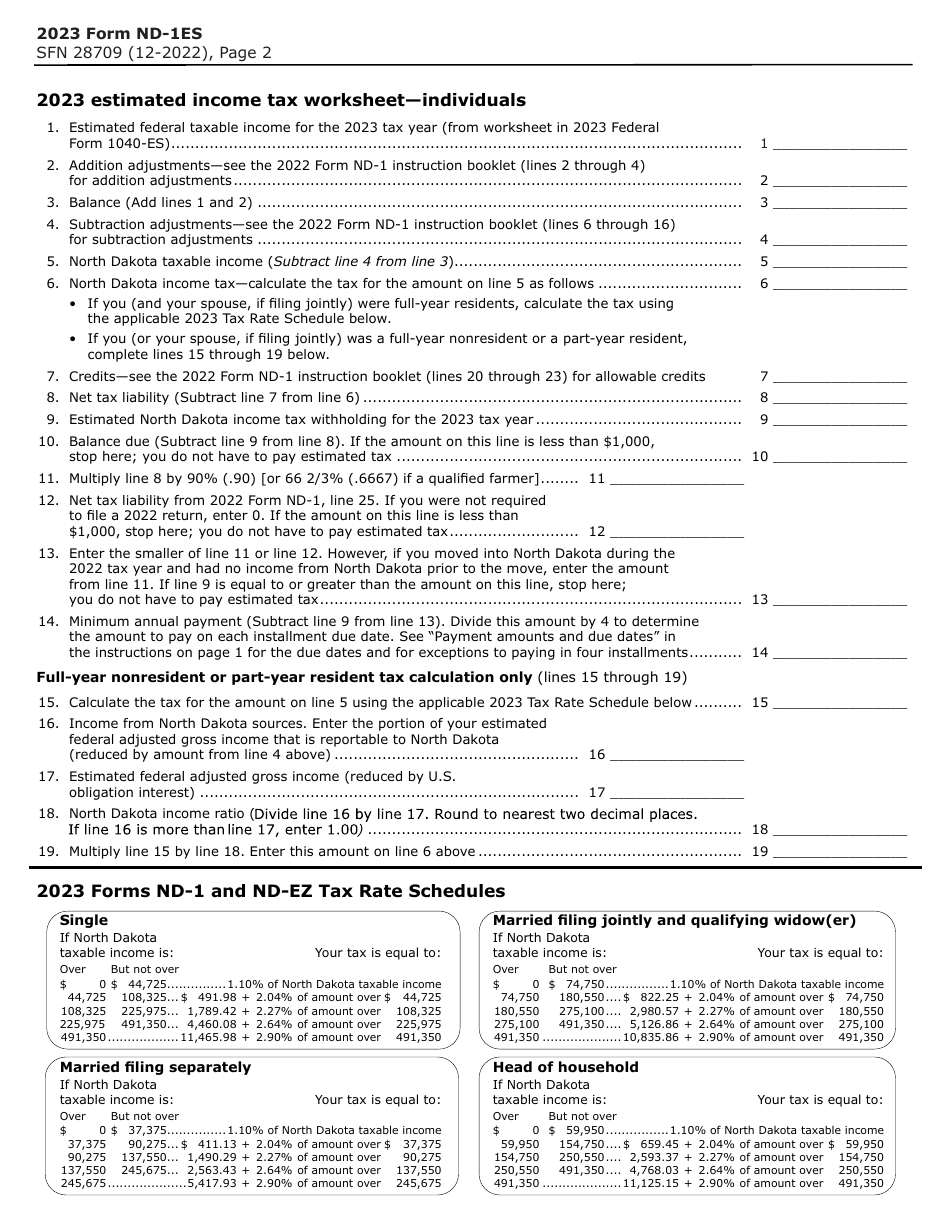

Form ND-1ES (SFN28709) Individual Estimated Tax Payment Voucher - North Dakota

What Is Form ND-1ES (SFN28709)?

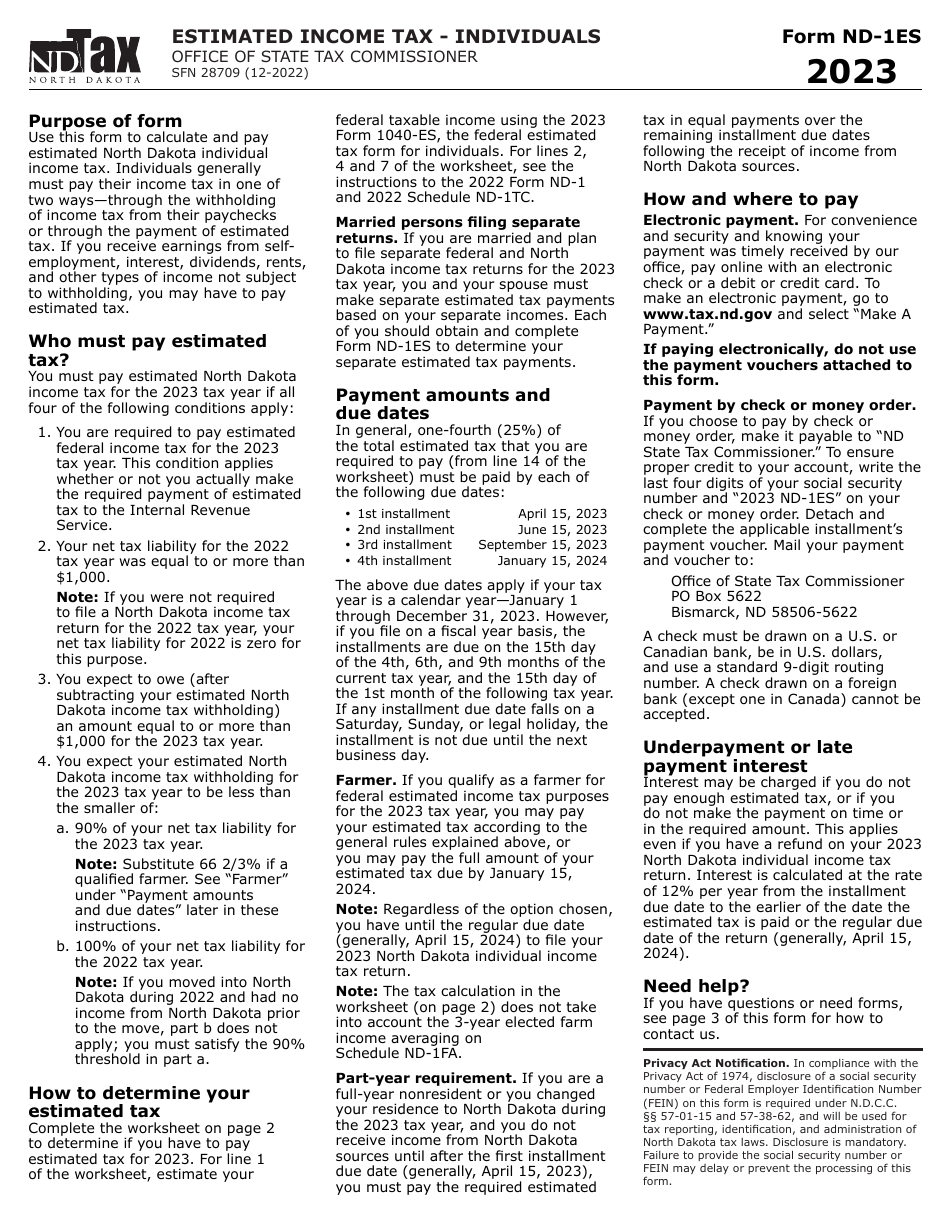

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1ES?

A: Form ND-1ES is the Individual Estimated Tax Payment Voucher for residents of North Dakota.

Q: What is the purpose of Form ND-1ES?

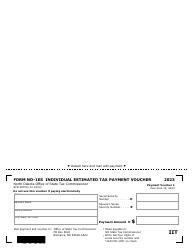

A: Form ND-1ES is used to make estimated tax payments to the state of North Dakota.

Q: Who needs to file Form ND-1ES?

A: Residents of North Dakota who need to make estimated tax payments should file Form ND-1ES.

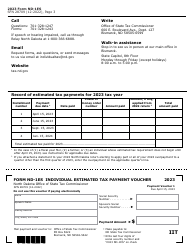

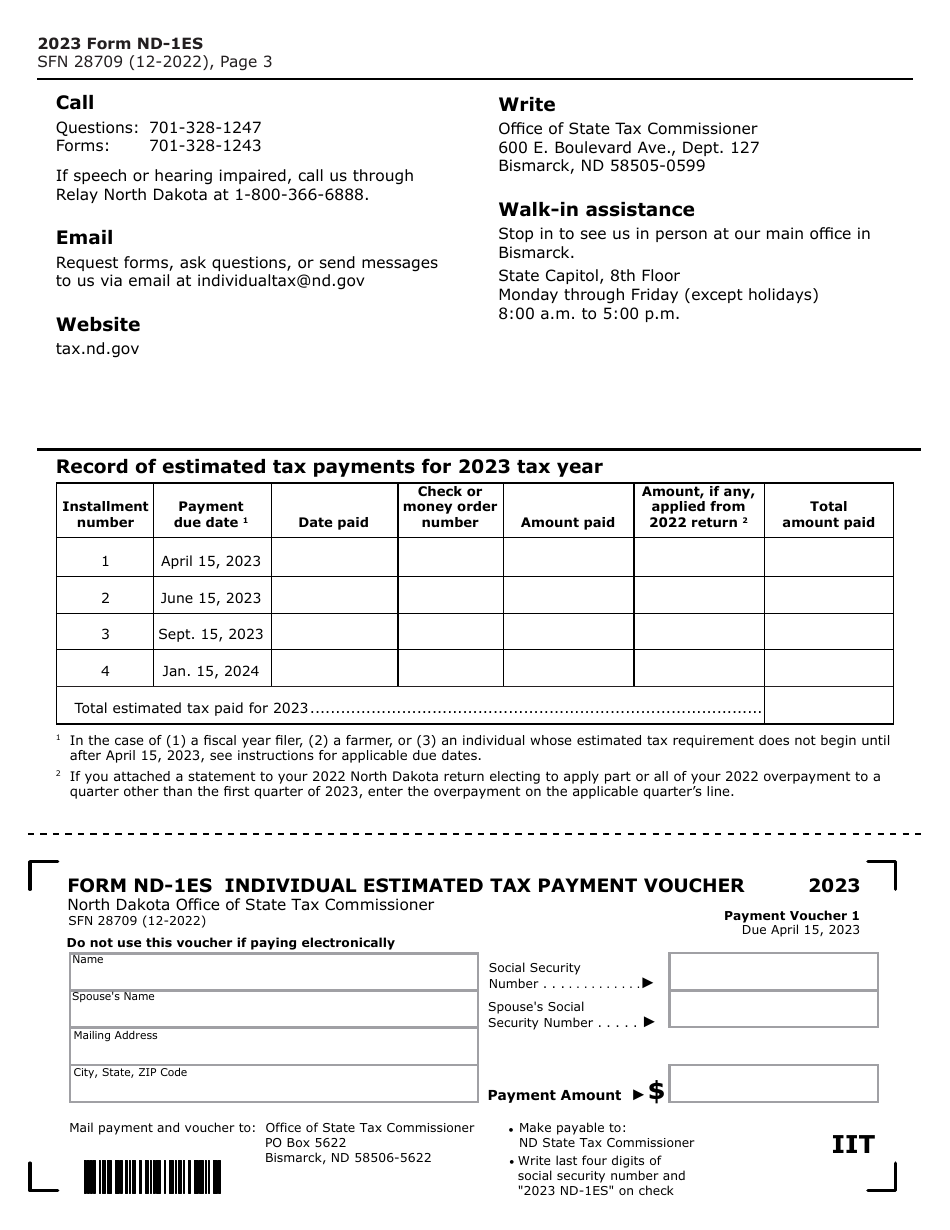

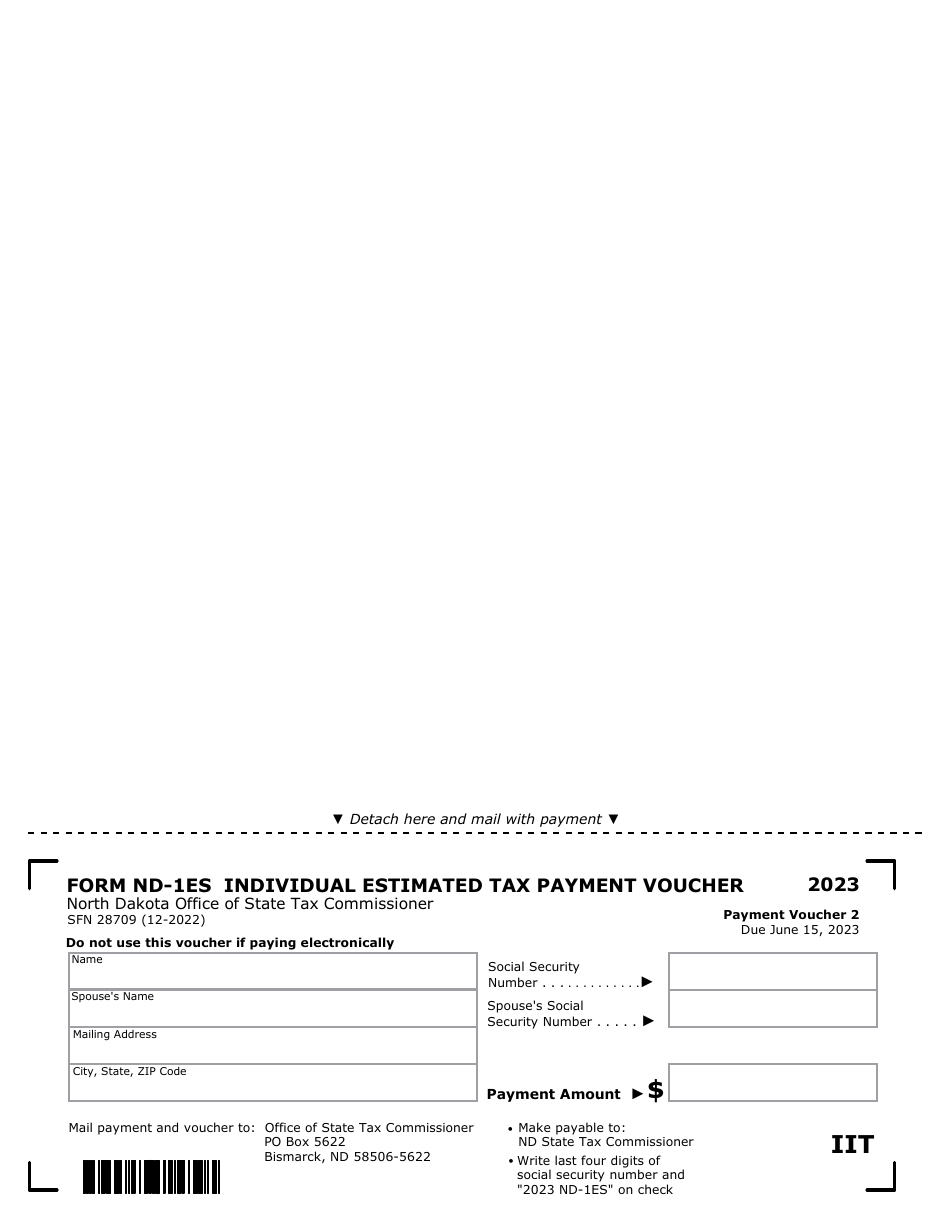

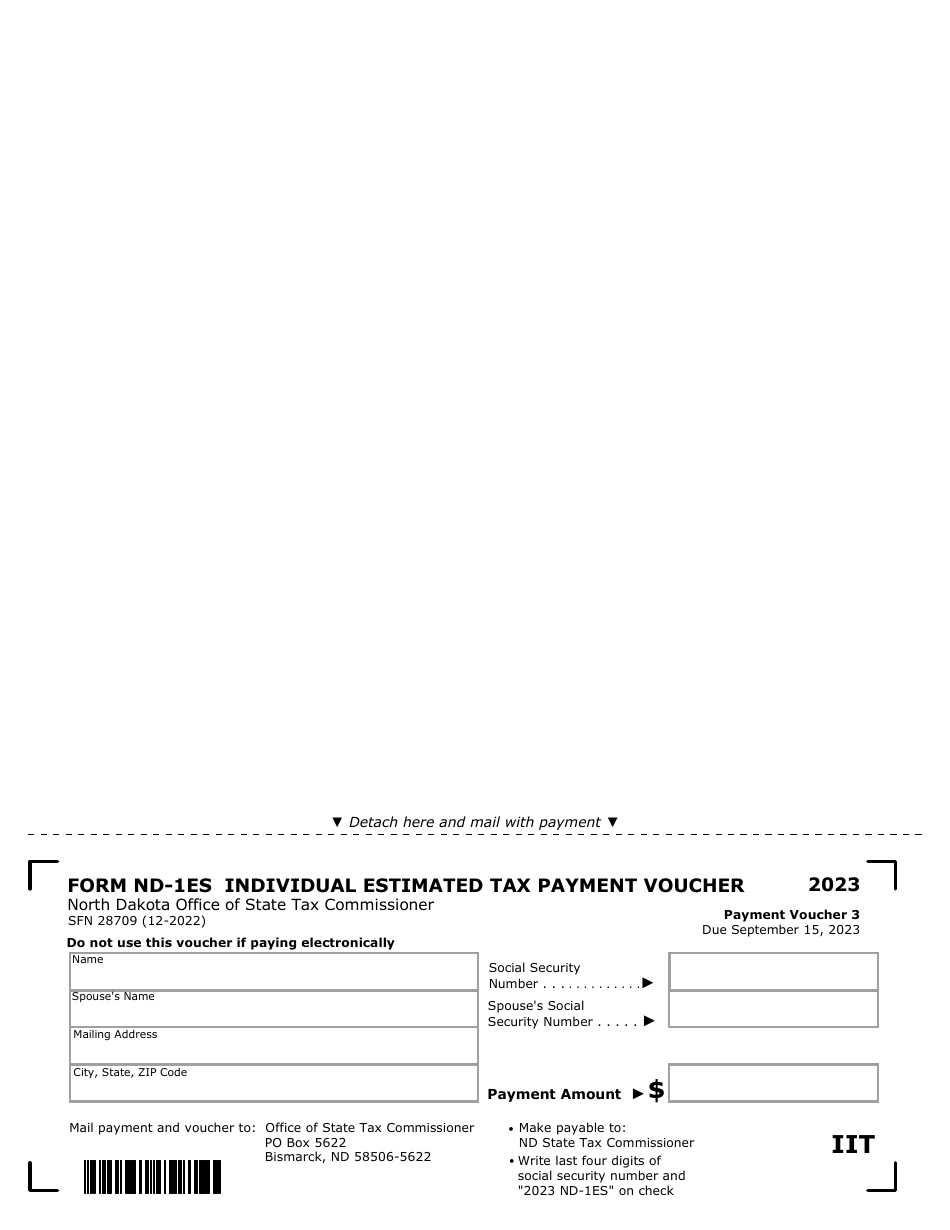

Q: How often do I need to file Form ND-1ES?

A: Form ND-1ES should be filed quarterly, with payments due on April 15, June 15, September 15, and January 15.

Q: What information do I need to complete Form ND-1ES?

A: You will need your personal information, estimated income, and estimated tax liability to complete Form ND-1ES.

Q: Are there any penalties for not filing Form ND-1ES?

A: Yes, there may be penalties for failing to file Form ND-1ES or underpaying estimated taxes. It is important to timely file and pay your estimated taxes to avoid penalties.

Q: What is the deadline for filing Form ND-1ES?

A: Quarterly payments are due on April 15, June 15, September 15, and January 15.

Q: Do I need to file Form ND-1ES if I am not a resident of North Dakota?

A: No, Form ND-1ES is only for residents of North Dakota. If you are not a resident, you should check with your state's tax agency for the appropriate forms and instructions.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1ES (SFN28709) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.