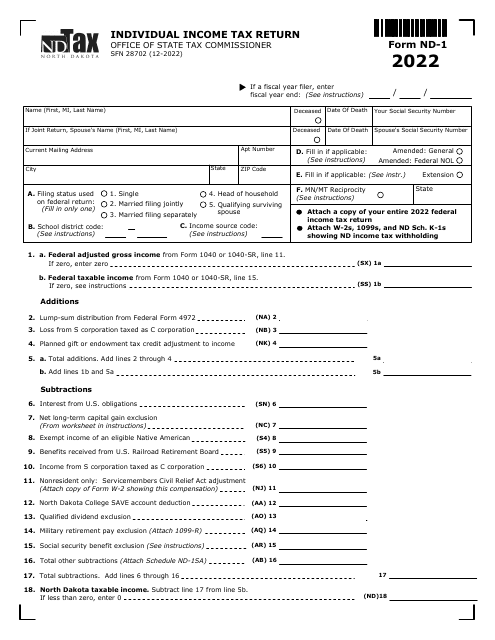

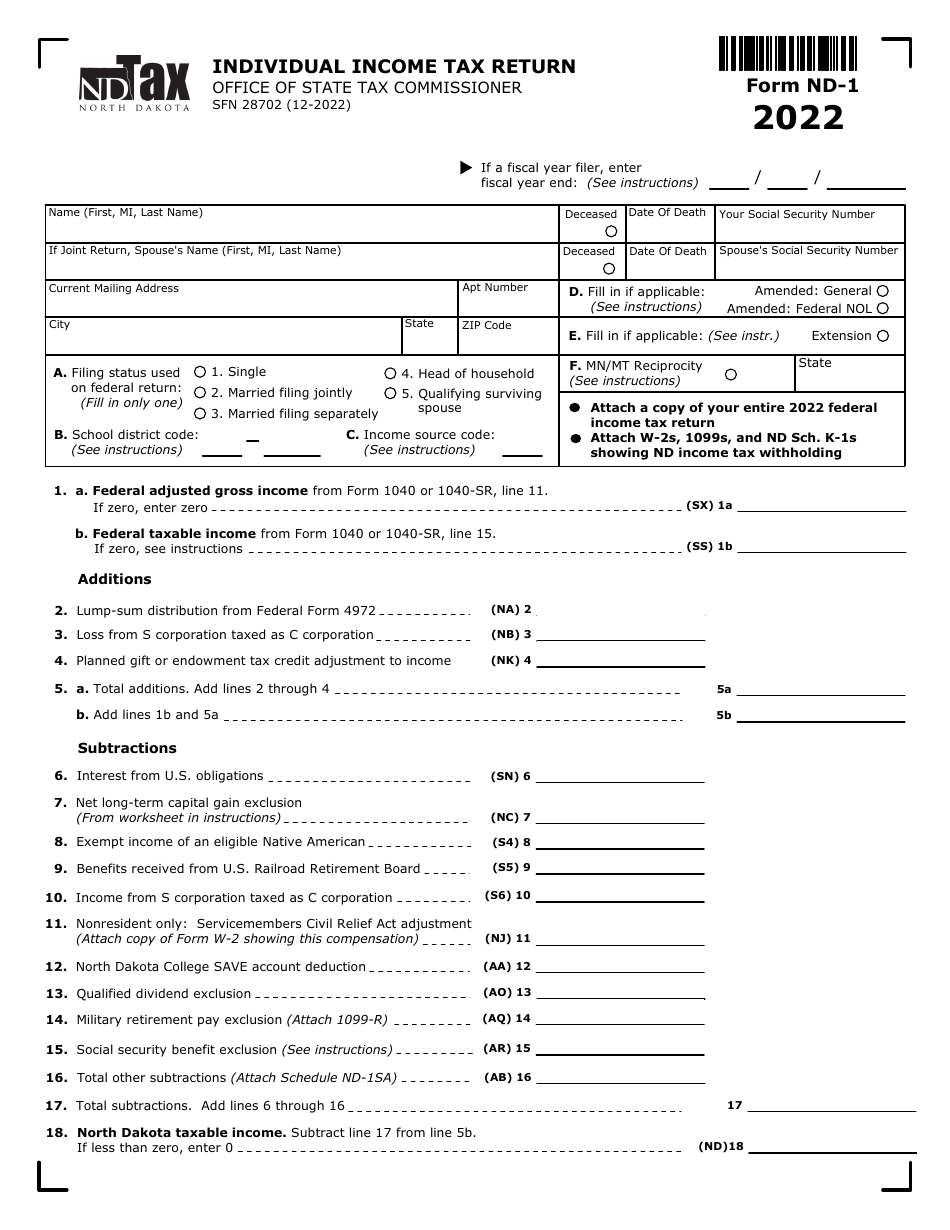

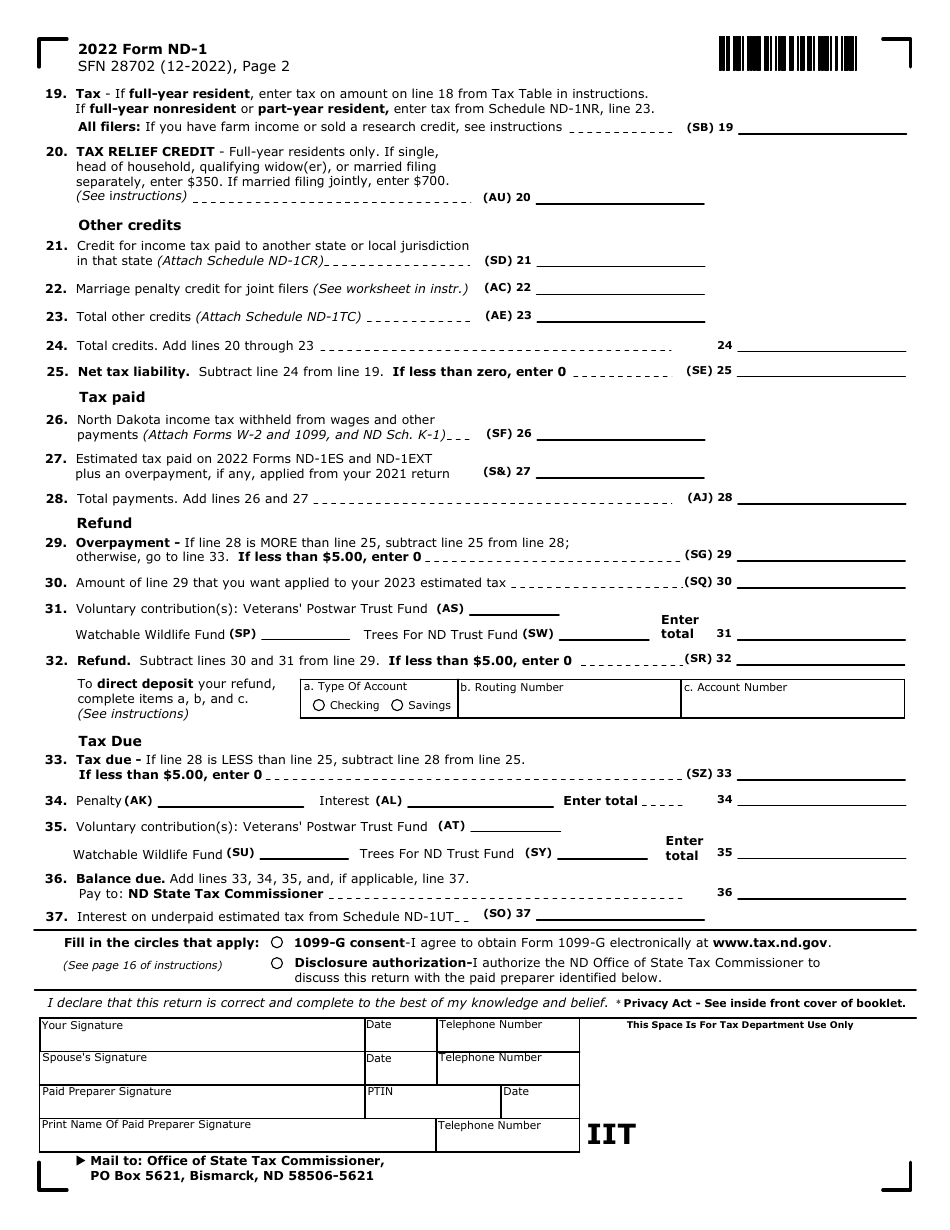

This version of the form is not currently in use and is provided for reference only. Download this version of

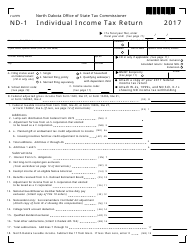

Form ND-1 (SFN28702)

for the current year.

Form ND-1 (SFN28702) Individual Income Tax Return - North Dakota

What Is Form ND-1 (SFN28702)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form ND-1?

A: Form ND-1 is the Individual Income Tax Return for residents of North Dakota.

Q: Who needs to file Form ND-1?

A: Residents of North Dakota who have income that is subject to state income tax need to file Form ND-1.

Q: What is the purpose of Form ND-1?

A: The purpose of Form ND-1 is to report your income, deductions, and calculate the amount of tax you owe or the refund you are entitled to.

Q: When is the deadline to file Form ND-1?

A: The deadline to file Form ND-1 is April 15th, or the next business day if it falls on a weekend or holiday.

Q: Are there any extensions available for filing Form ND-1?

A: Yes, you can request an extension to file Form ND-1. The extension gives you an additional 6 months to file, but any tax owed is still due by the original deadline.

Q: Should I attach any documents to Form ND-1?

A: You should attach copies of your federal tax return, W-2 forms, and any other supporting documents that are relevant to your income and deductions.

Q: Can I file Form ND-1 electronically?

A: Yes, you can file Form ND-1 electronically using the North Dakota Taxpayer Access Point (TAP) system.

Q: What if I need help filling out Form ND-1?

A: If you need help filling out Form ND-1, you can contact the North Dakota Office of State Tax Commissioner or consult a tax professional.

Q: What happens if I don't file Form ND-1?

A: If you are required to file Form ND-1 and fail to do so, you may face penalties and interest on any taxes owed, and it could delay any refund you are entitled to.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28702) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.