This version of the form is not currently in use and is provided for reference only. Download this version of

Form NDW-R (SFN28729)

for the current year.

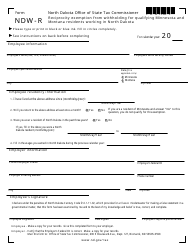

Form NDW-R (SFN28729) Reciprocity Exemption From Withholding for Qualifying Minnesota and Montana Residents Working in North Dakota - North Dakota

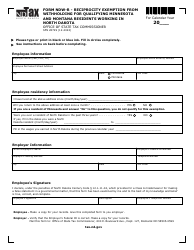

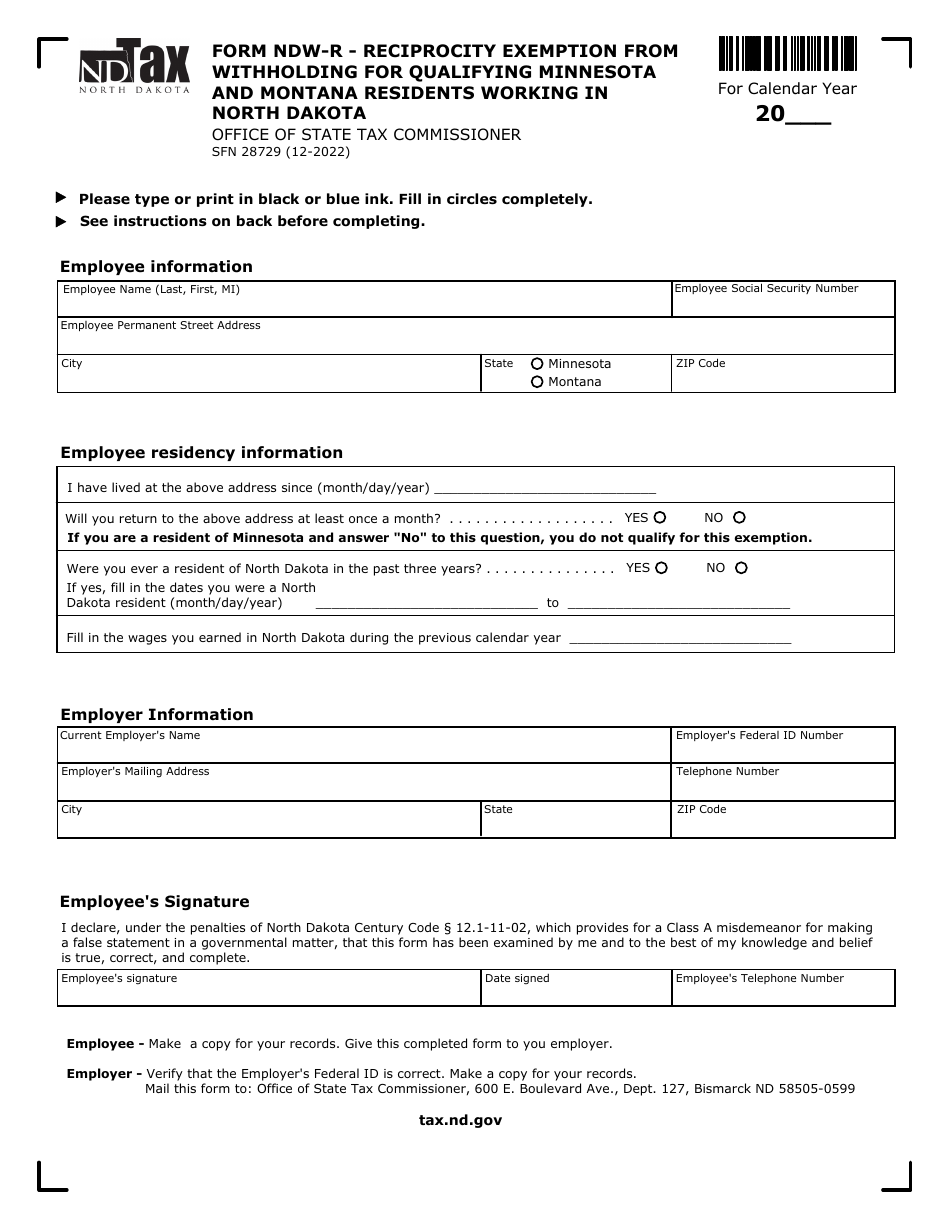

What Is Form NDW-R (SFN28729)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NDW-R?

A: Form NDW-R is a reciprocity exemption form.

Q: Who is eligible to use Form NDW-R?

A: Qualifying Minnesota and Montana residents working in North Dakota can use Form NDW-R.

Q: What does Form NDW-R do?

A: Form NDW-R allows qualifying residents to claim exemption from withholding taxes in North Dakota.

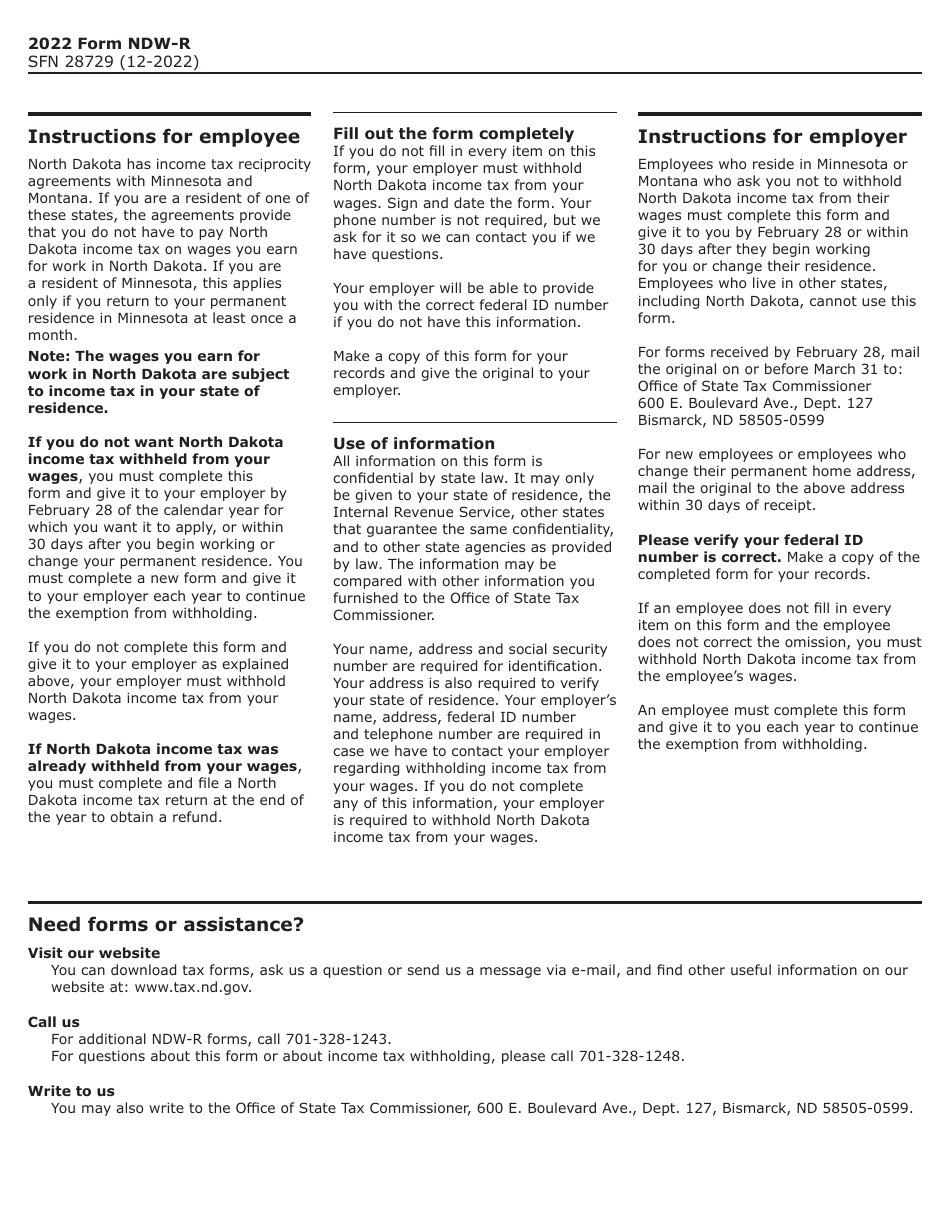

Q: How do I fill out Form NDW-R?

A: You need to provide your personal information and indicate your eligibility for exemption.

Q: Do I need to file Form NDW-R every year?

A: Yes, you need to file Form NDW-R annually to claim the exemption.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NDW-R (SFN28729) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.