This version of the form is not currently in use and is provided for reference only. Download this version of

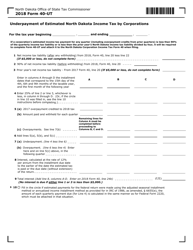

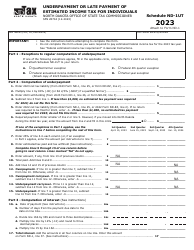

Form SFN28711 Schedule 38-UT

for the current year.

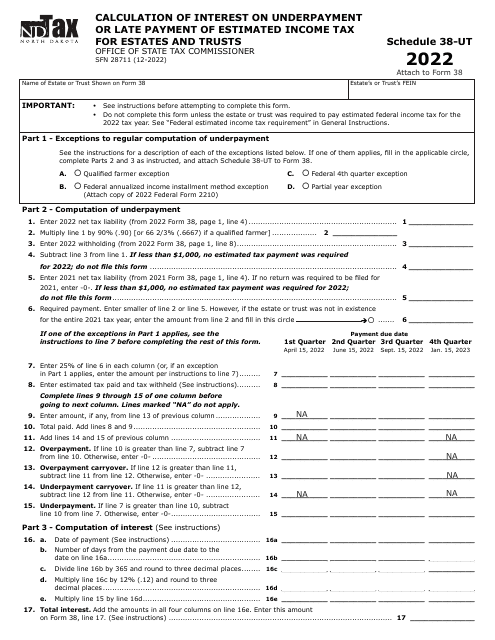

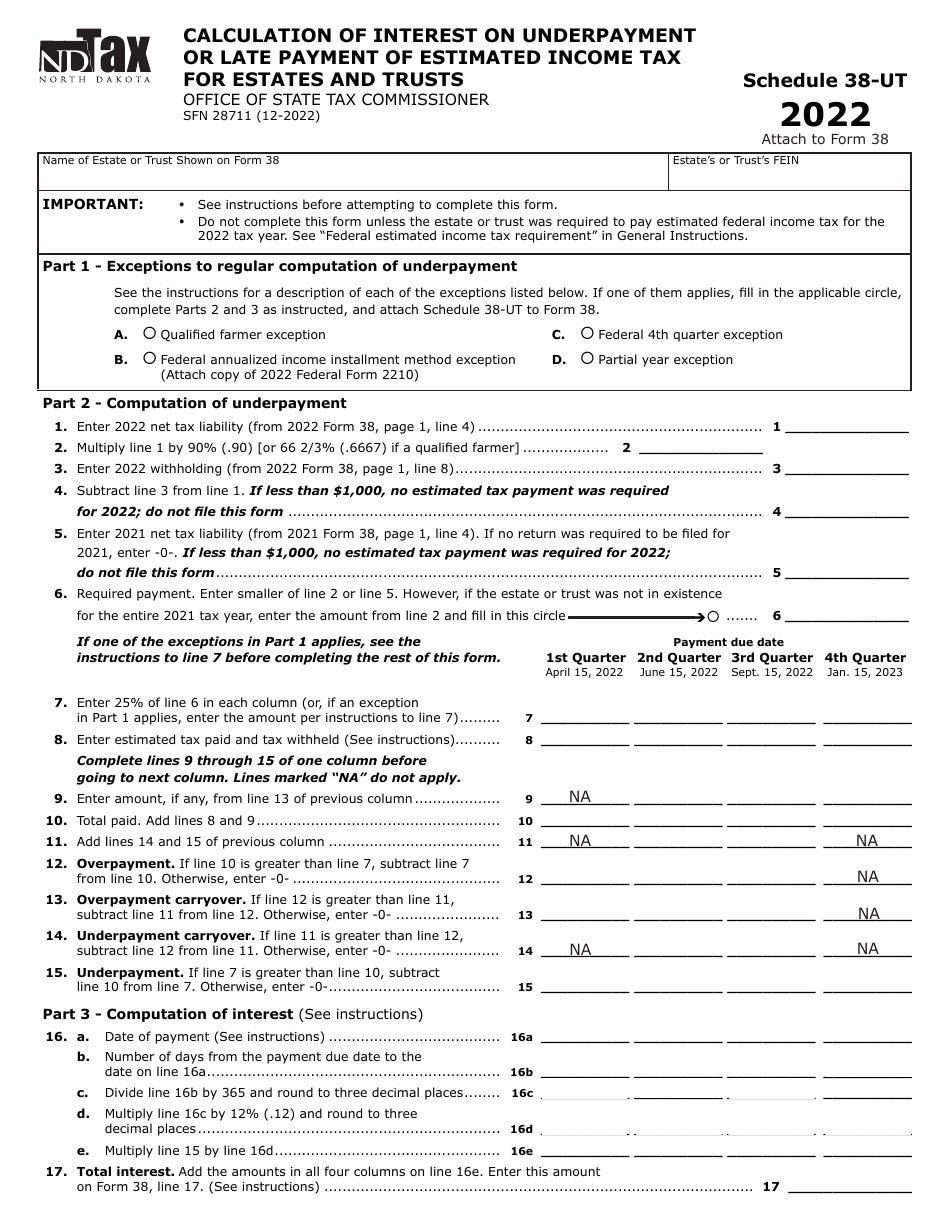

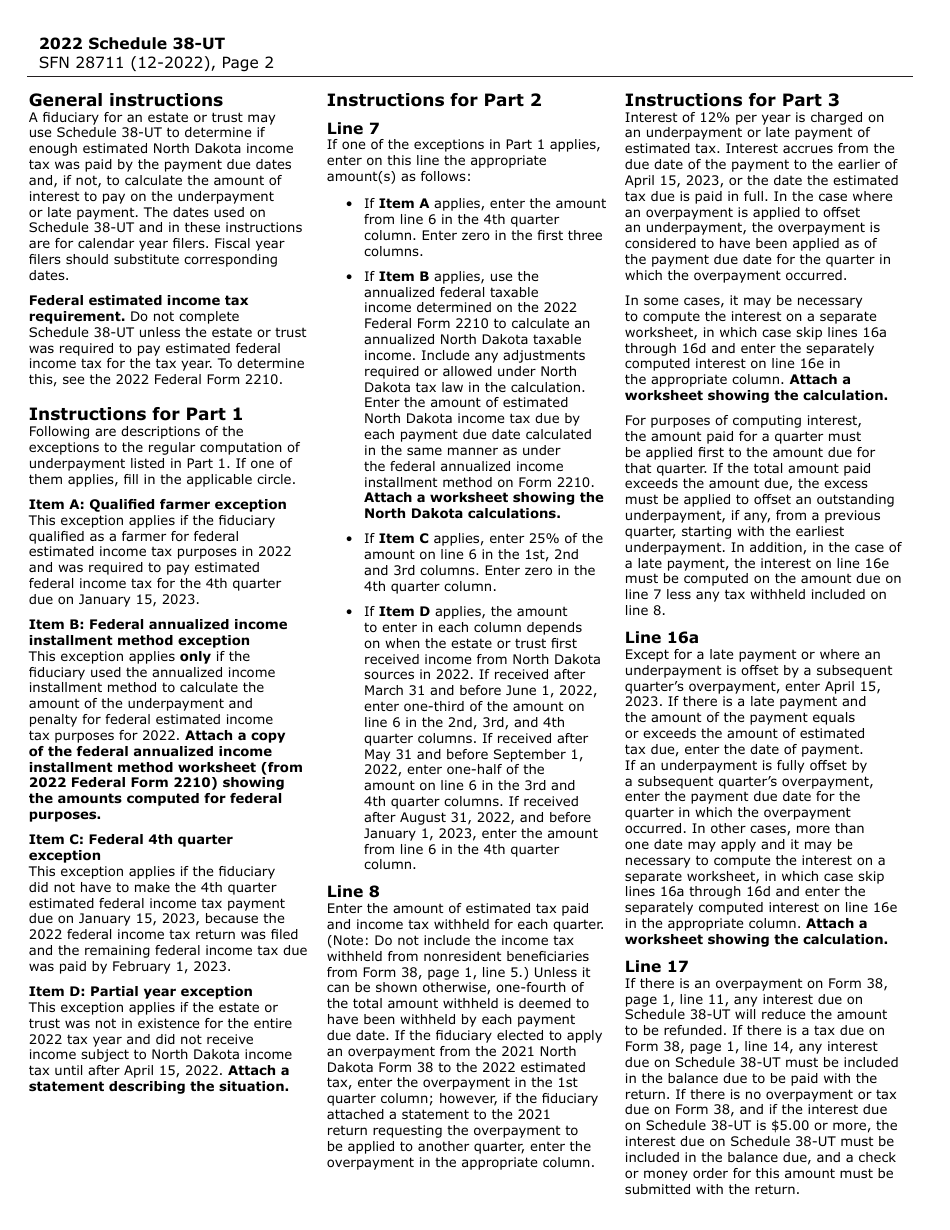

Form SFN28711 Schedule 38-UT Calculation of Interest on Underpayment or Late Payment of Estimated Income Tax for Estates and Trusts - North Dakota

What Is Form SFN28711 Schedule 38-UT?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28711?

A: Form SFN28711 is the Schedule 38-UT Calculation of Interest on Underpayment or Late Payment of Estimated Income Tax for Estates and Trusts for North Dakota.

Q: Who needs to file Form SFN28711?

A: Estates and trusts in North Dakota that have underpaid or made late payment of estimated income tax need to file Form SFN28711.

Q: What is Schedule 38-UT?

A: Schedule 38-UT is a calculation of interest on underpayment or late payment of estimated income tax for estates and trusts in North Dakota.

Q: What is the purpose of Form SFN28711?

A: The purpose of Form SFN28711 is to determine the interest owed on underpayment or late payment of estimated income tax for estates and trusts in North Dakota.

Form Details:

- Released on December 1, 2023;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28711 Schedule 38-UT by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.