This version of the form is not currently in use and is provided for reference only. Download this version of

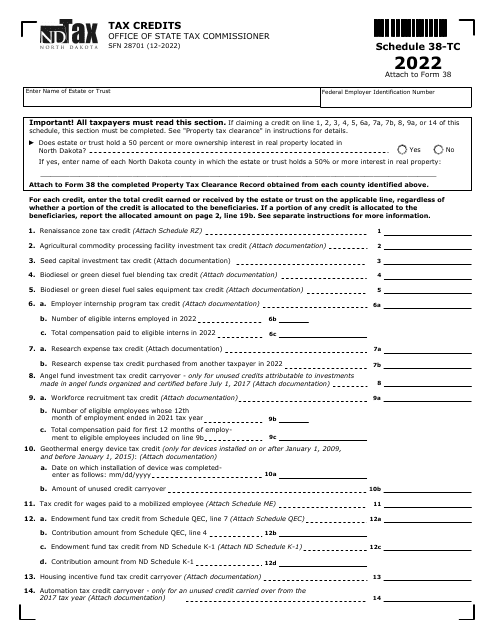

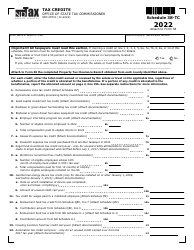

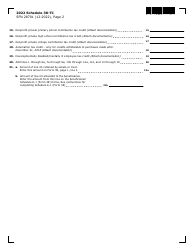

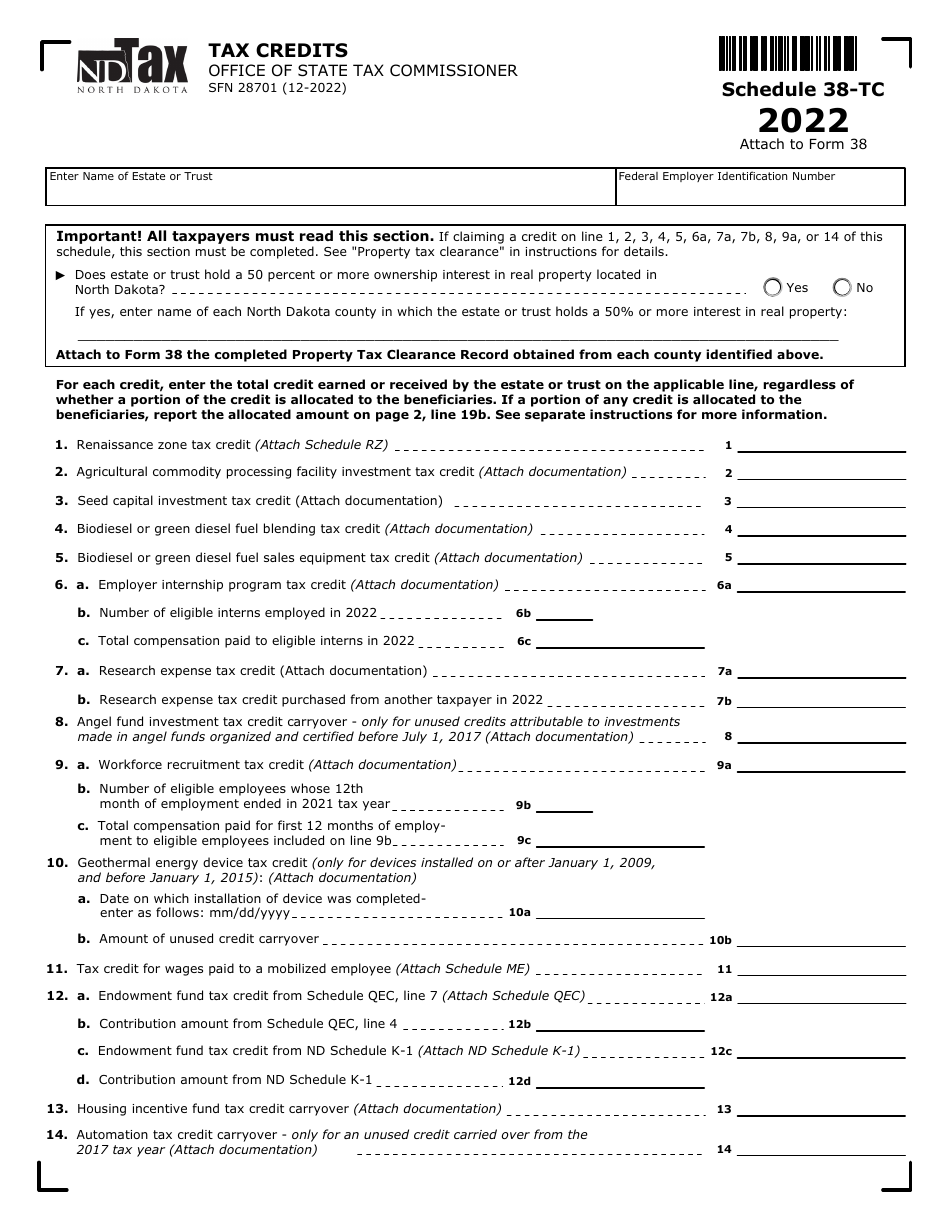

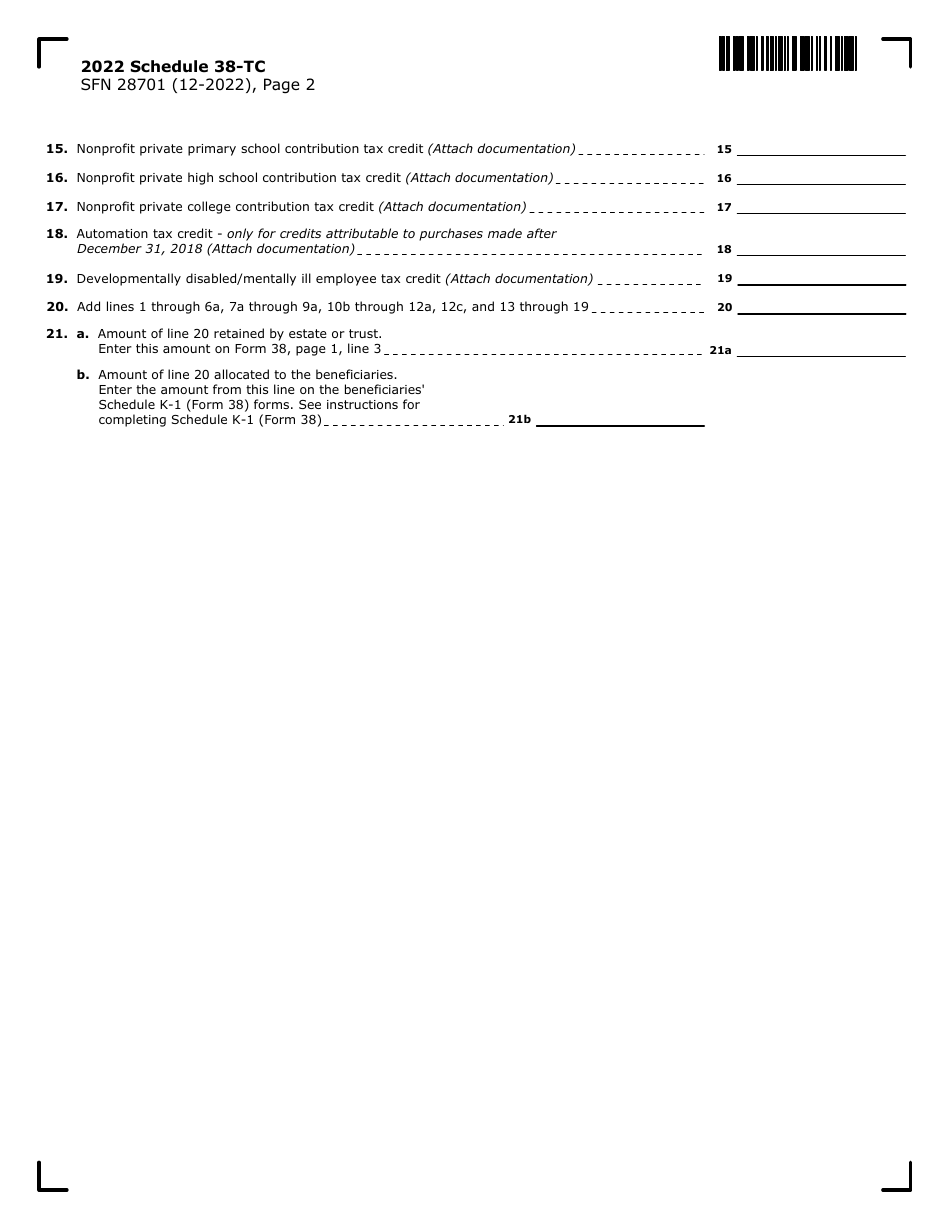

Form SFN28701 Schedule 38-TC

for the current year.

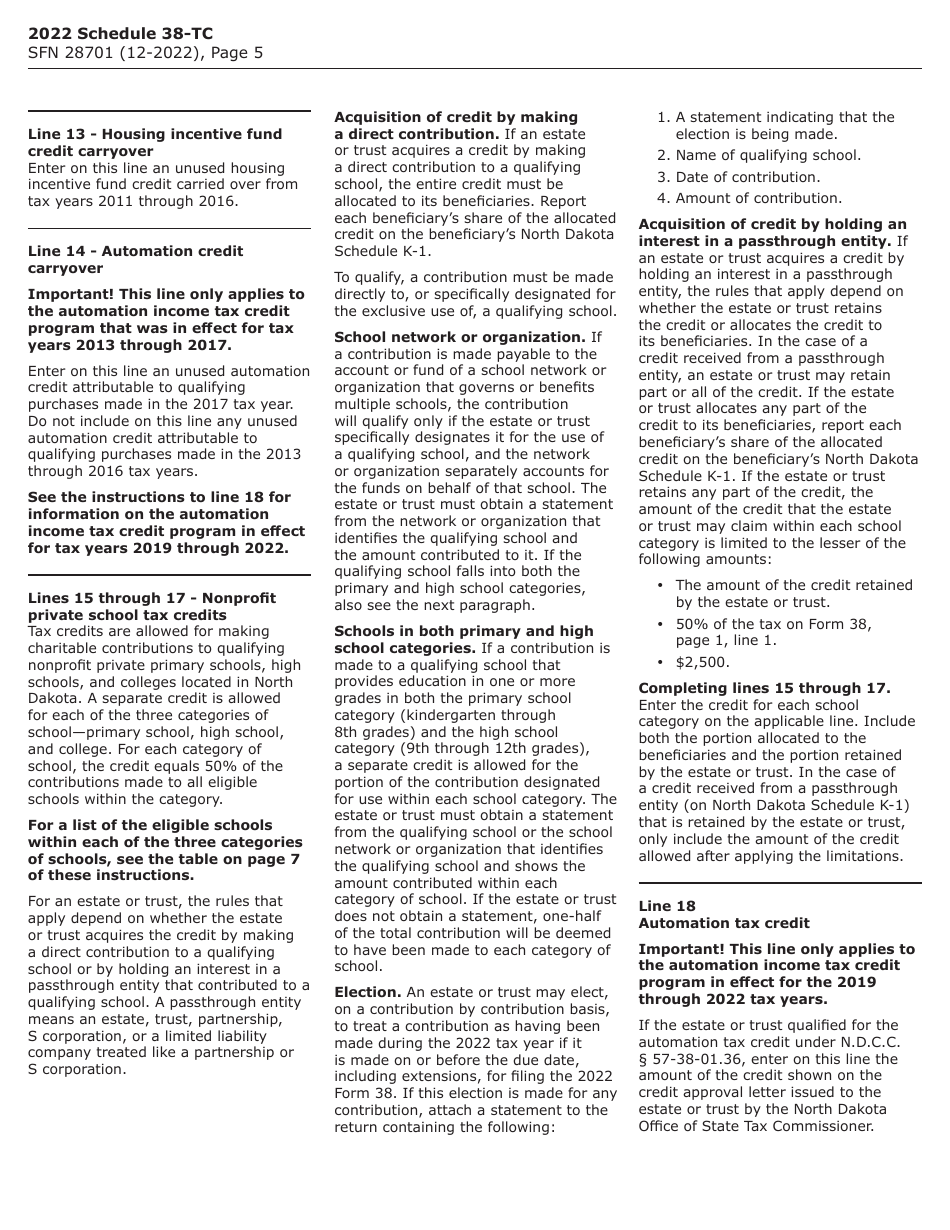

Form SFN28701 Schedule 38-TC Tax Credits - North Dakota

What Is Form SFN28701 Schedule 38-TC?

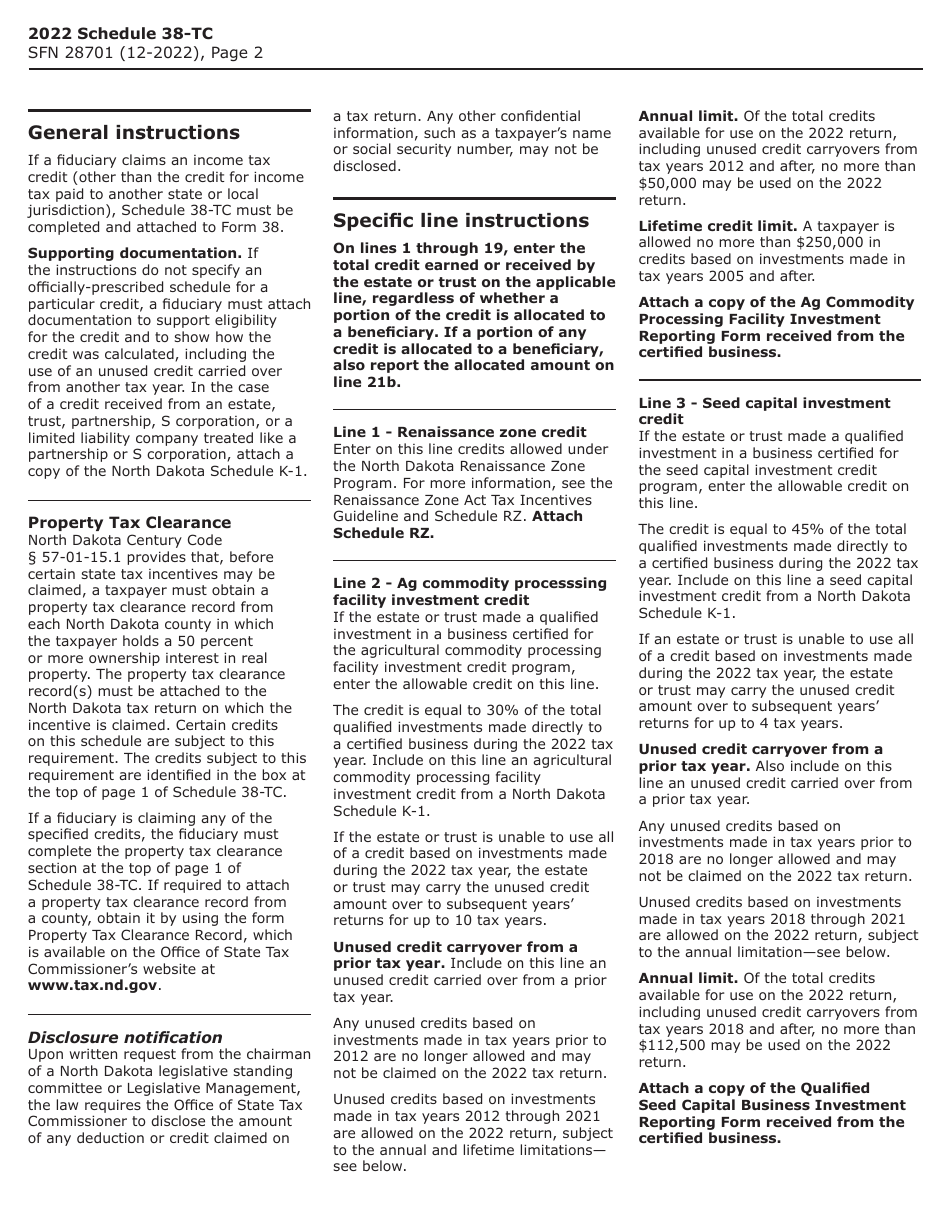

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN28701 Schedule 38-TC?

A: Form SFN28701 Schedule 38-TC is a tax form used in North Dakota to claim tax credits.

Q: What are tax credits?

A: Tax credits are deductions that reduce the amount of tax you owe.

Q: What type of tax credits can be claimed on this form?

A: Form SFN28701 Schedule 38-TC is specifically for claiming tax credits related to North Dakota.

Q: When is Form SFN28701 Schedule 38-TC due?

A: The due date for Form SFN28701 Schedule 38-TC varies each year and is determined by the North Dakota Department of Revenue.

Q: Can I claim tax credits if I don't live in North Dakota?

A: Form SFN28701 Schedule 38-TC is specific to tax credits in North Dakota, so you can only claim them if you have a tax liability in North Dakota.

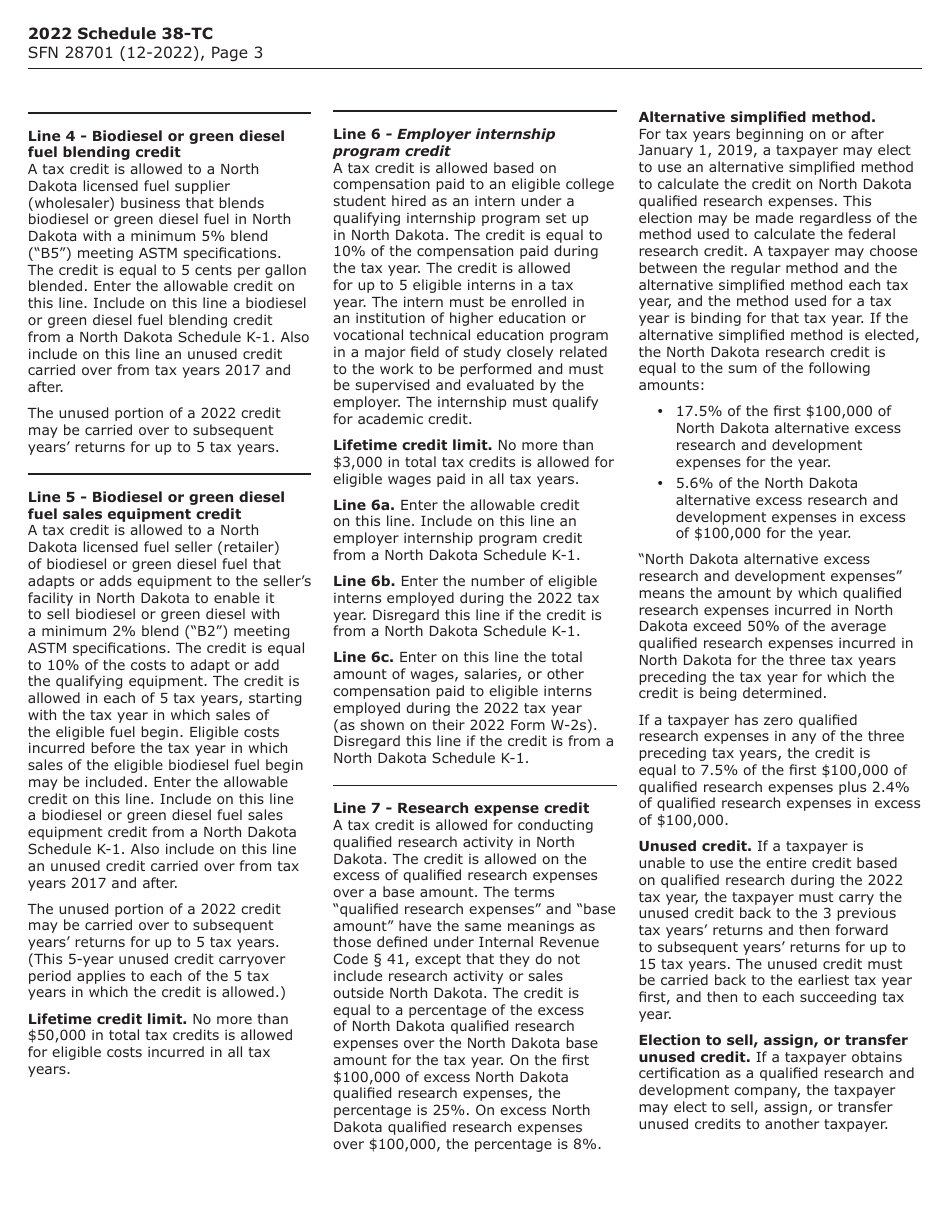

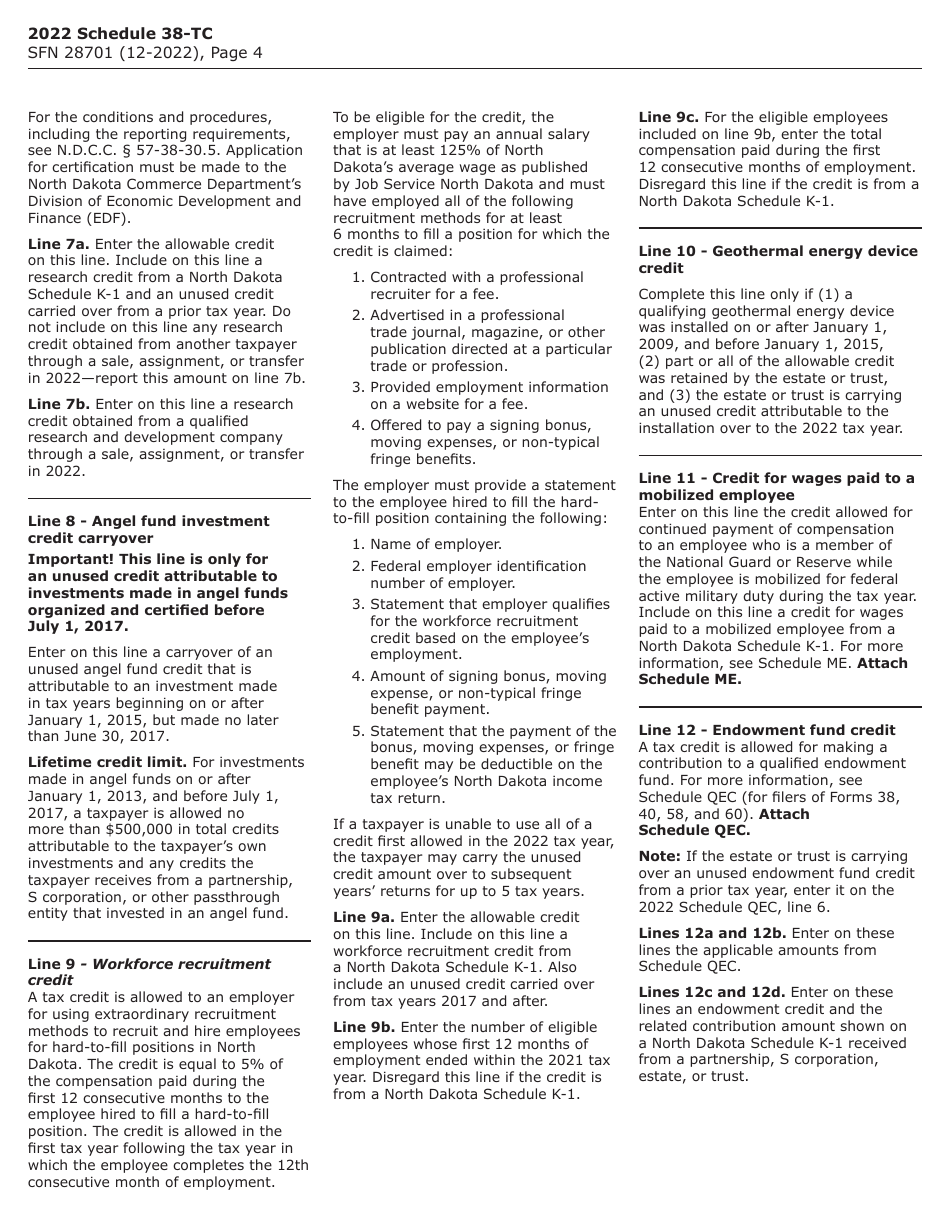

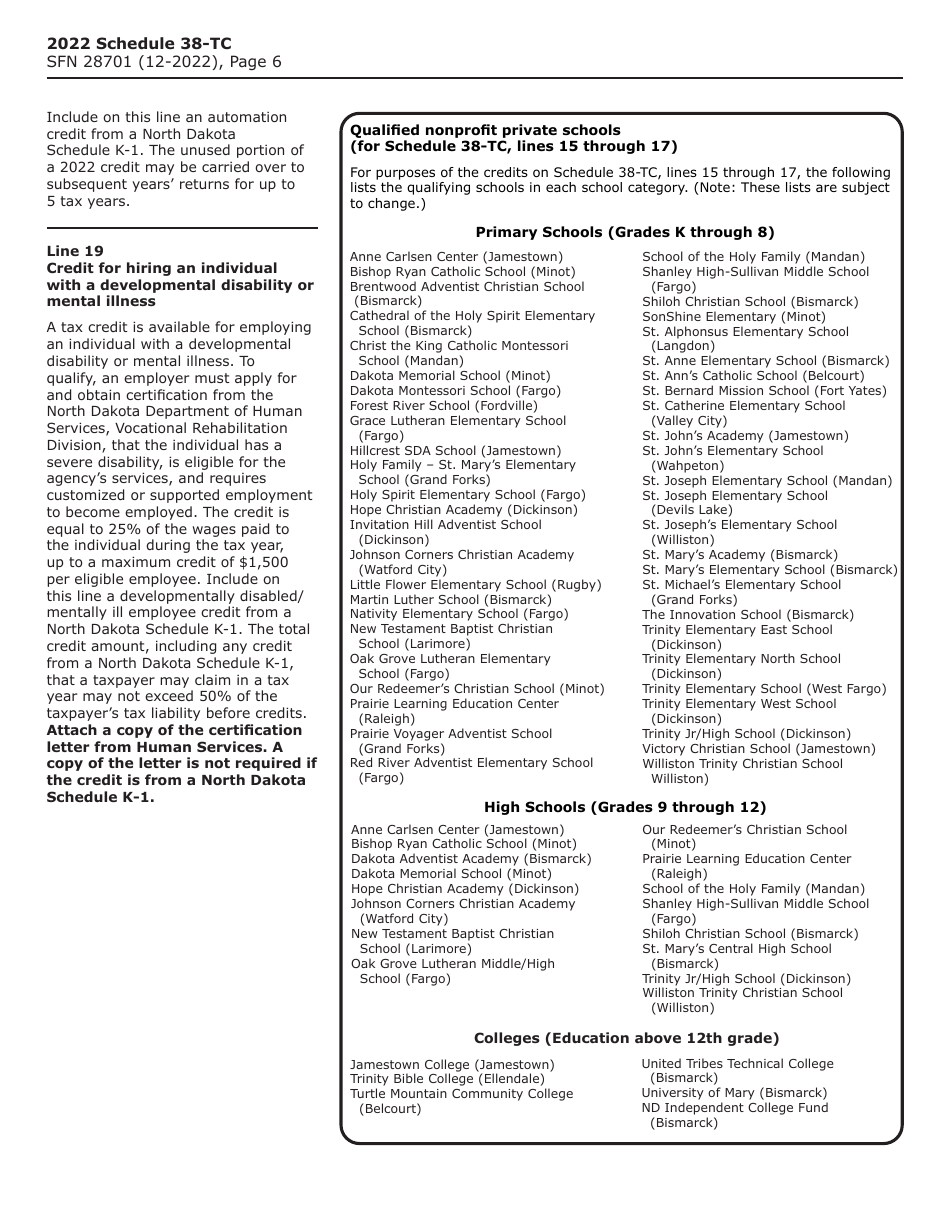

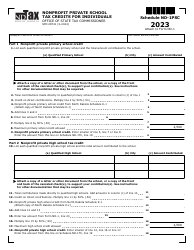

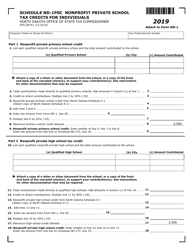

Q: Are there any specific requirements or qualifications to claim tax credits on this form?

A: Yes, there may be specific requirements or qualifications for each tax credit listed on Form SFN28701 Schedule 38-TC. You should refer to the instructions provided with the form for more information.

Q: What should I do if I have questions or need assistance with Form SFN28701 Schedule 38-TC?

A: If you have questions or need assistance with Form SFN28701 Schedule 38-TC, you should contact the North Dakota Department of Revenue or consult a tax professional.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN28701 Schedule 38-TC by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.