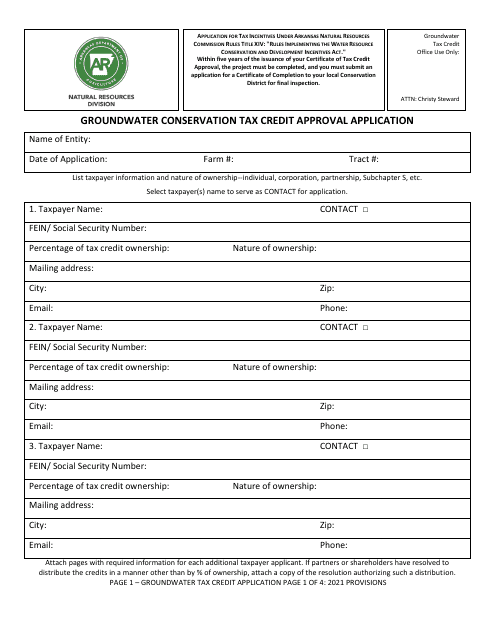

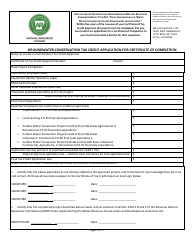

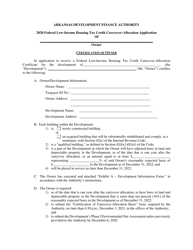

Groundwater Conservation Tax Credit Approval Application - Arkansas

Groundwater Conservation Tax Credit Approval Application is a legal document that was released by the Arkansas Agriculture Department - a government authority operating within Arkansas.

FAQ

Q: What is the Groundwater Conservation Tax Credit Approval Application?

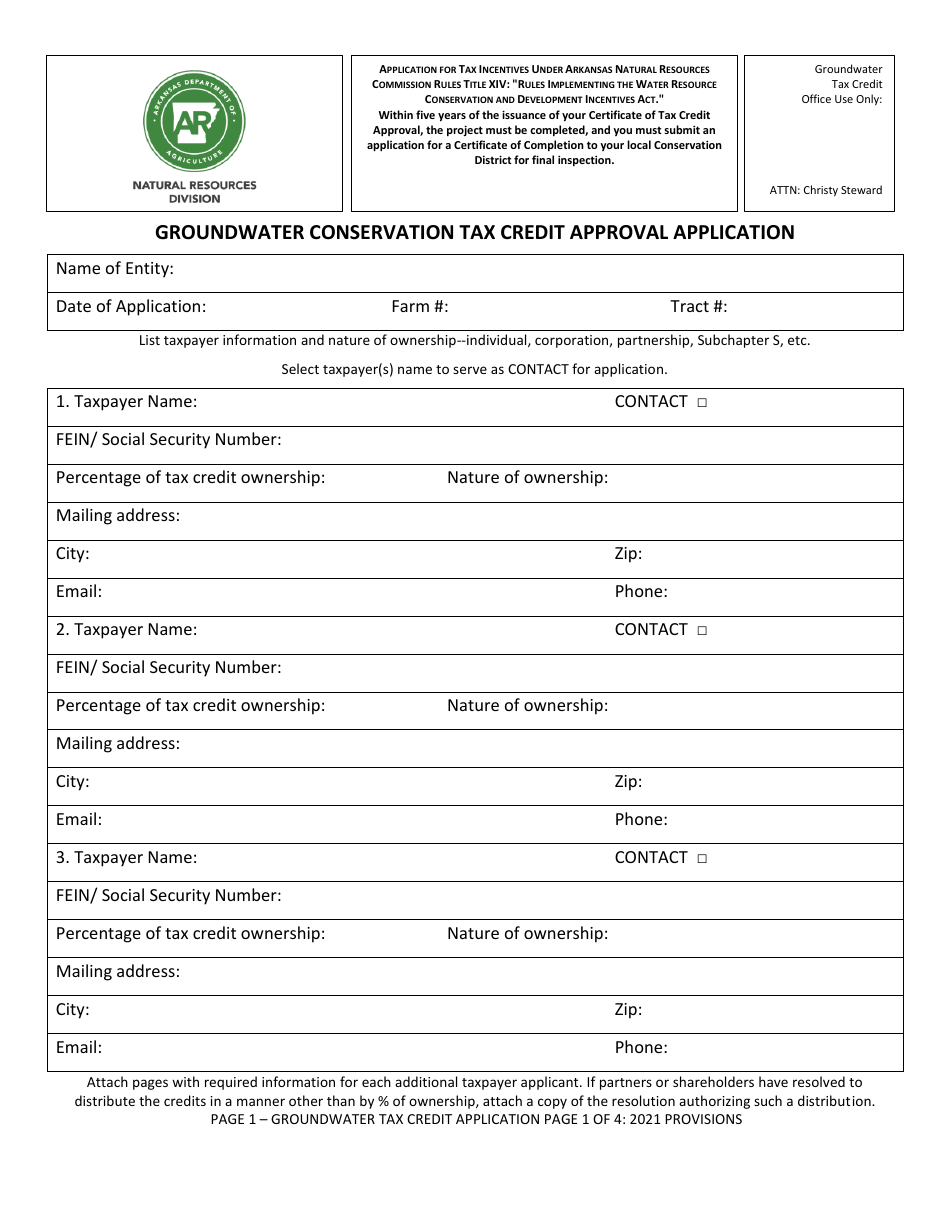

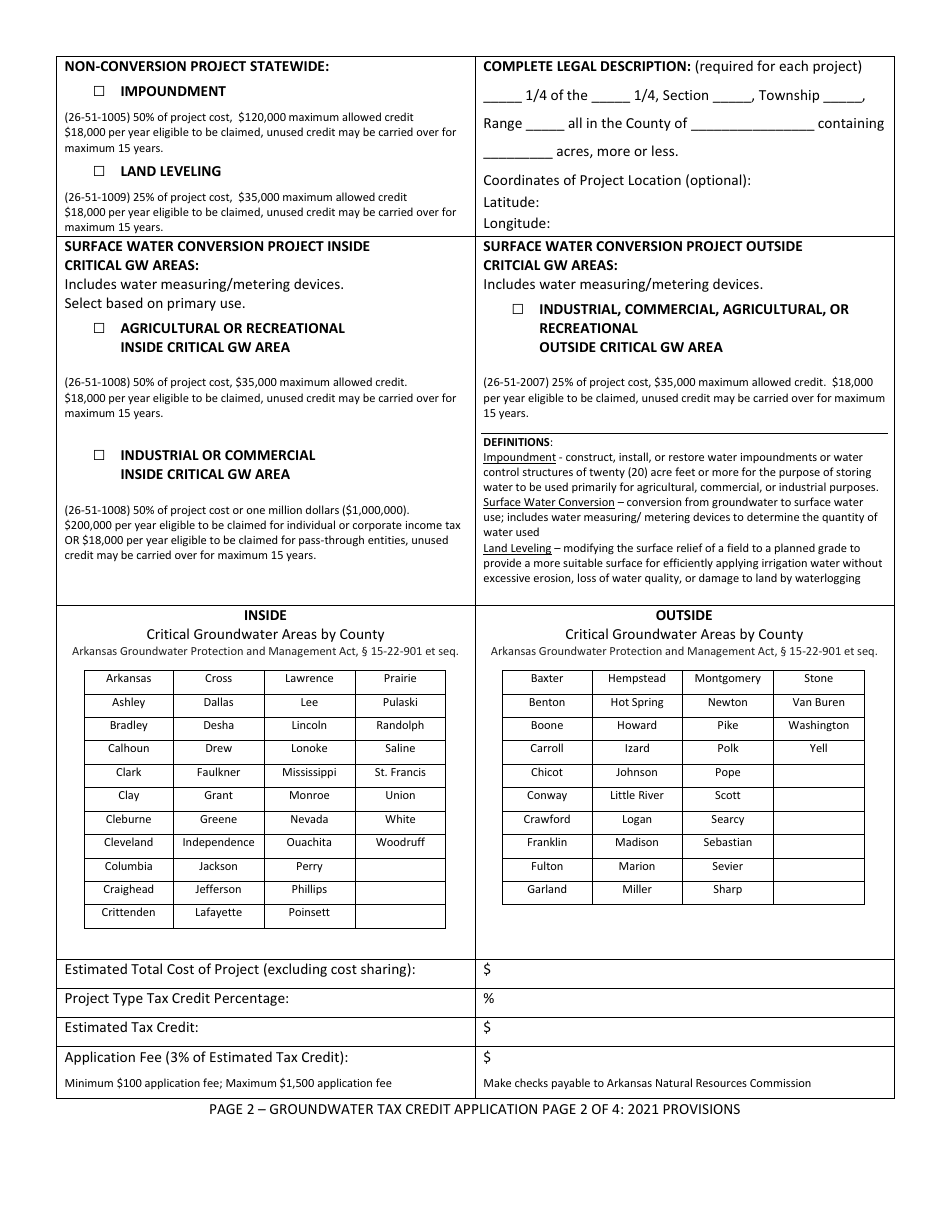

A: The Groundwater Conservation Tax Credit Approval Application is a form used in Arkansas to apply for a tax credit related to groundwater conservation.

Q: Who can apply for the Groundwater Conservation Tax Credit?

A: Individuals, corporations, partnerships, and other entities that have incurred costs for developing or implementing groundwater conservation projects in Arkansas can apply for the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit aims to incentivize and promote groundwater conservation efforts in Arkansas by providing financial relief to individuals and entities that invest in such projects.

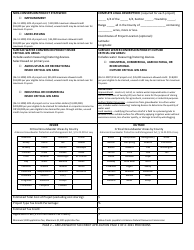

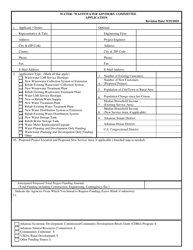

Q: What costs are eligible for the tax credit?

A: Costs related to the development, construction, installation, operation, management, or maintenance of groundwater conservation projects in Arkansas are eligible for the tax credit.

Q: How much tax credit can be received through the application?

A: The tax credit can amount to 50% of the total eligible costs, up to a maximum of $250,000 per taxpayer per year.

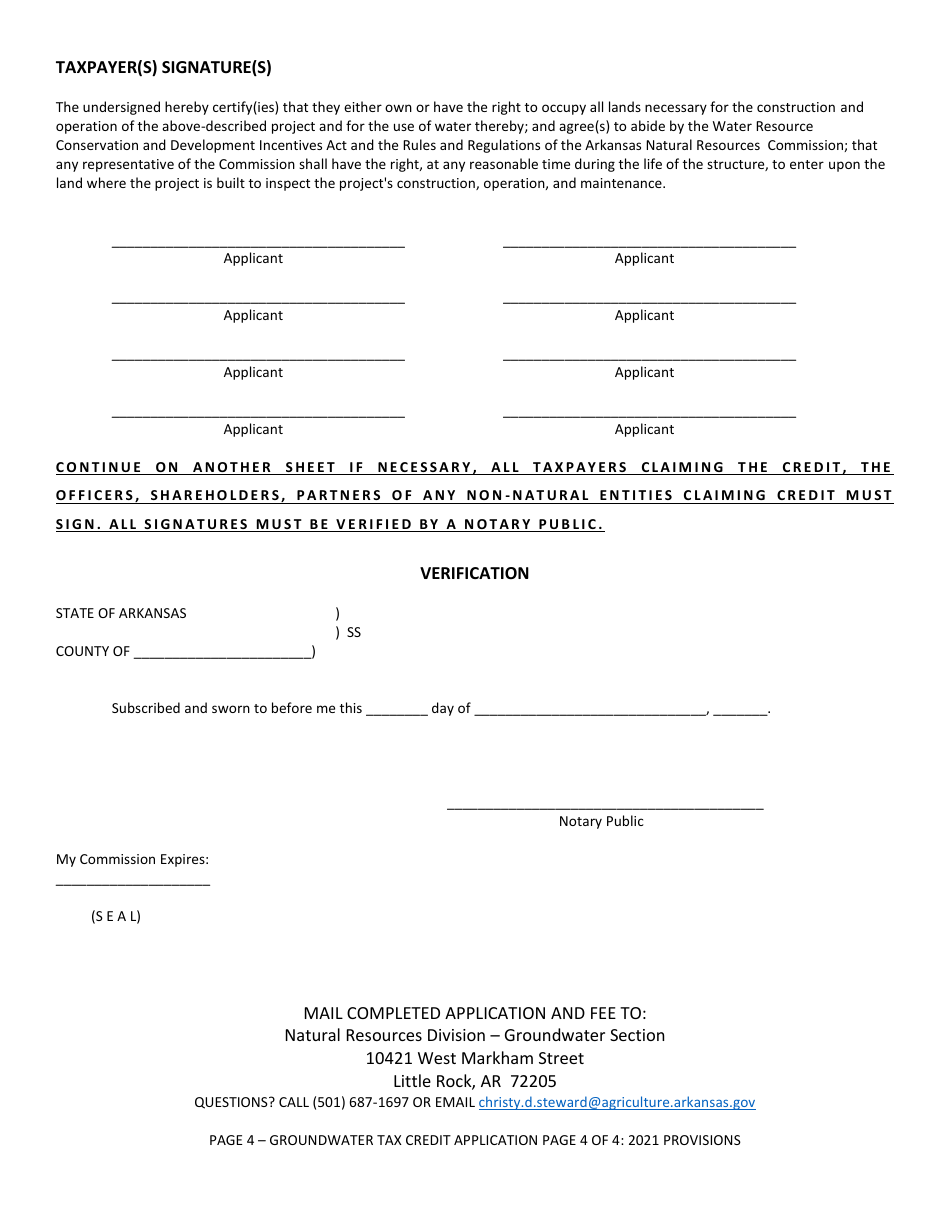

Q: What documentation is required to submit with the application?

A: Applicants need to provide detailed project information, including a description of the project, its location, the estimated cost breakdown, and any supporting documentation or receipts.

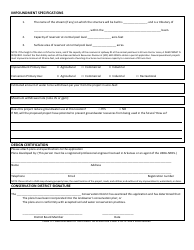

Q: How can I submit the Groundwater Conservation Tax Credit Approval Application?

A: The application can be submitted by mail or in-person to the Arkansas Department of Finance and Administration, Office of Excise Tax Administration.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted by the taxpayer within 4 years from the date that the costs were incurred.

Form Details:

- The latest edition currently provided by the Arkansas Agriculture Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Agriculture Department.