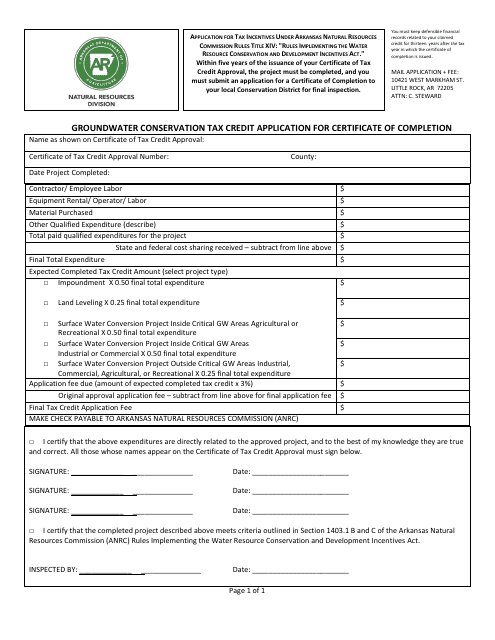

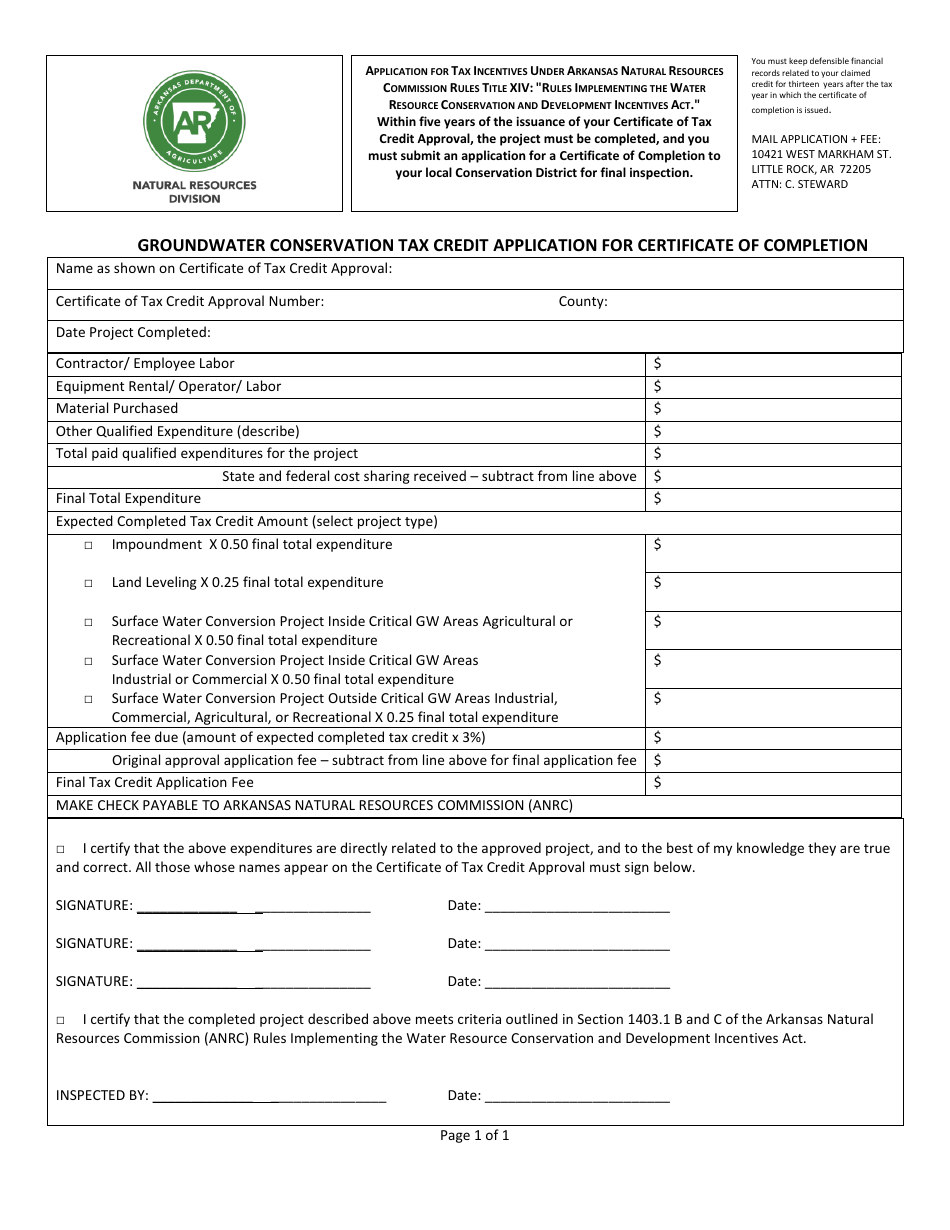

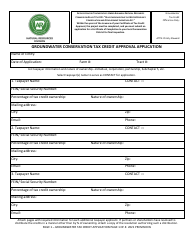

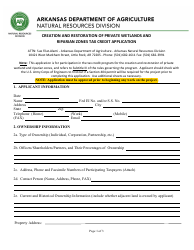

Groundwater Conservation Tax Credit Application for Certificate of Completion - Arkansas

Groundwater Conservation Tax Credit Application for Certificate of Completion is a legal document that was released by the Arkansas Agriculture Department - a government authority operating within Arkansas.

FAQ

Q: What is the Groundwater Conservation Tax Credit Application?

A: The Groundwater Conservation Tax Credit Application is a form that allows individuals or businesses in Arkansas to apply for a tax credit for using groundwater conservation practices.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to incentivize individuals and businesses to implement groundwater conservation practices.

Q: Who is eligible to apply for the tax credit?

A: Any individual or business in Arkansas that implements groundwater conservation practices is eligible to apply for the tax credit.

Q: What are groundwater conservation practices?

A: Groundwater conservation practices refer to actions taken to reduce water usage and improve the sustainability of groundwater resources, such as using efficient irrigation systems or implementing water-saving techniques.

Q: How much is the tax credit?

A: The tax credit amount varies depending on the specific groundwater conservation practices implemented, but it can be up to 30% of the cost of implementing those practices.

Q: How can I apply for the tax credit?

A: To apply for the tax credit, you need to fill out the Groundwater Conservation Tax Credit Application form and submit it to the appropriate state agency in Arkansas.

Q: Are there any deadlines for applying?

A: Yes, there are specific deadlines for submitting the application based on the tax year. It is important to check the current year's deadline to ensure timely submission.

Q: Can I claim the tax credit for past expenses?

A: No, the tax credit can only be claimed for expenses incurred in the current tax year.

Q: What documentation do I need to submit with the application?

A: The application requires supporting documentation, such as invoices or receipts for expenses related to groundwater conservation practices.

Q: How long does it take to receive the tax credit?

A: The processing time for the tax credit application varies, but you can generally expect to receive the credit within a few months after submission.

Form Details:

- The latest edition currently provided by the Arkansas Agriculture Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Agriculture Department.