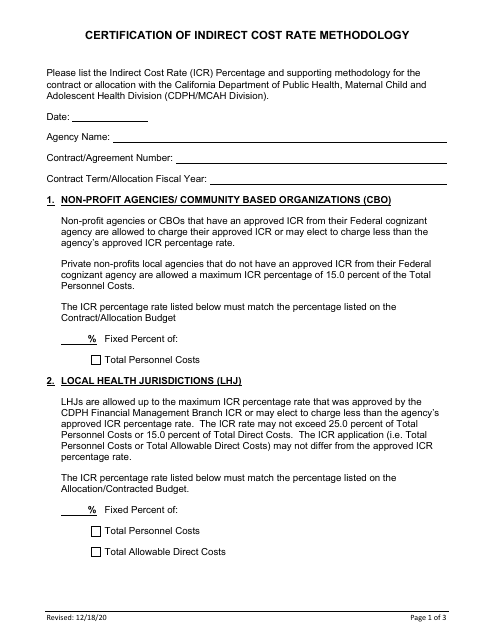

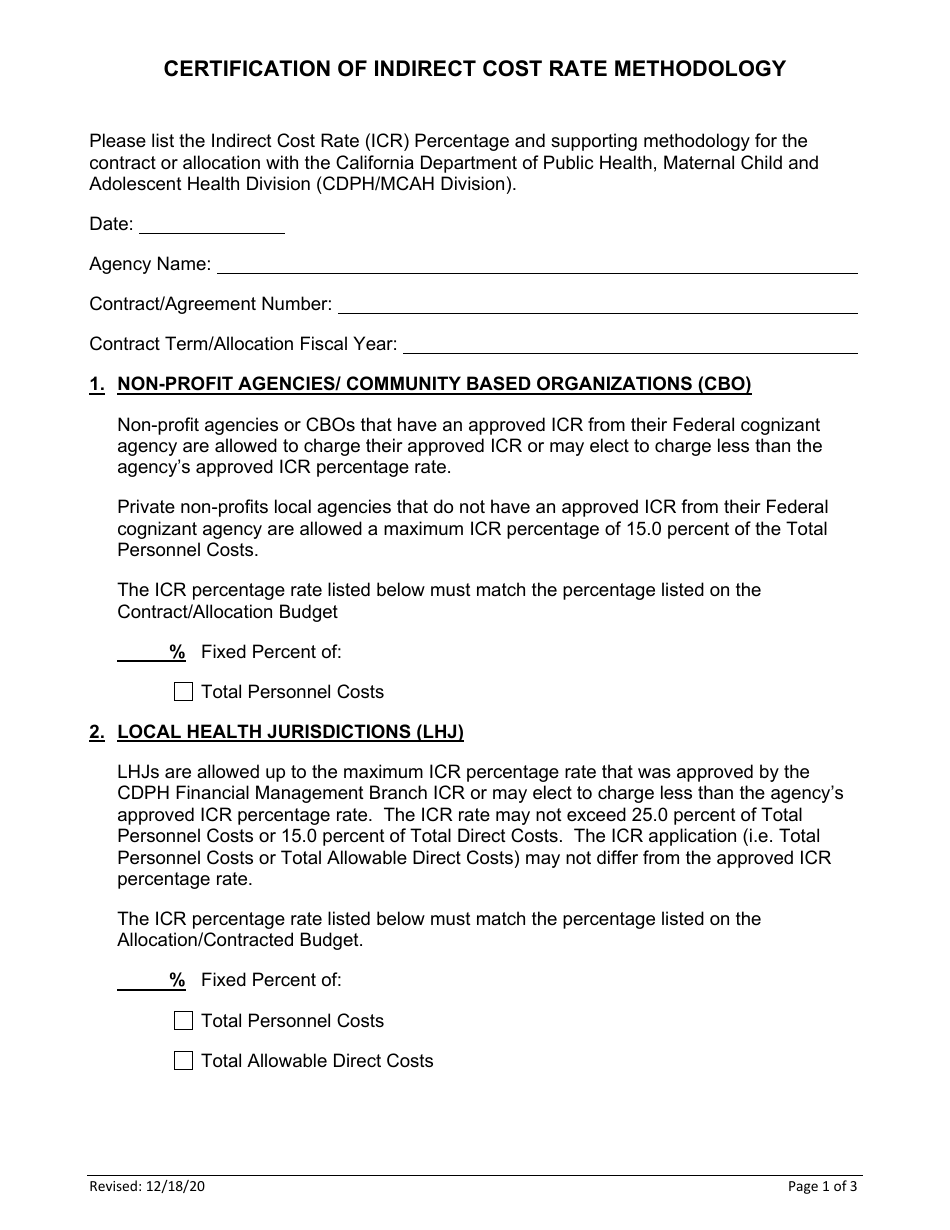

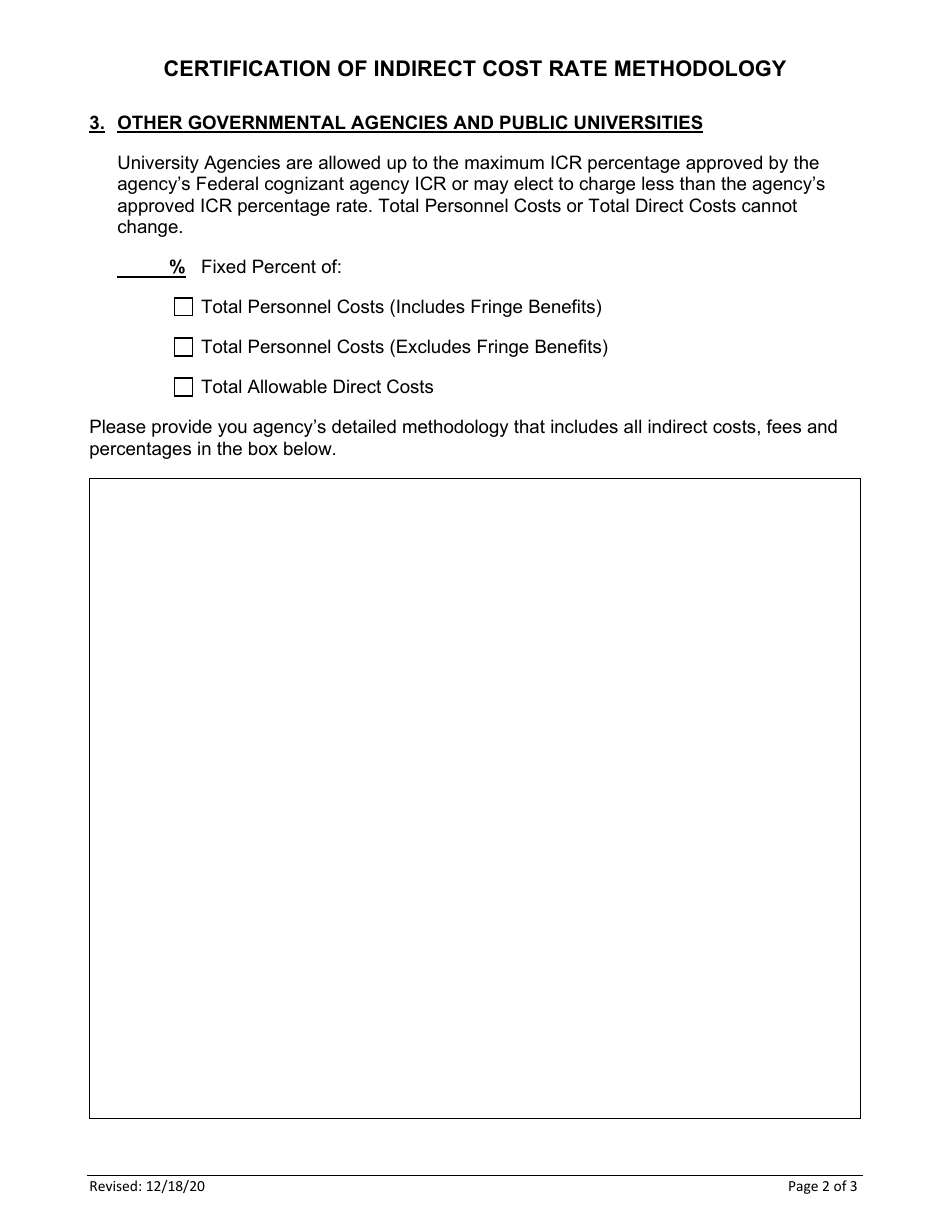

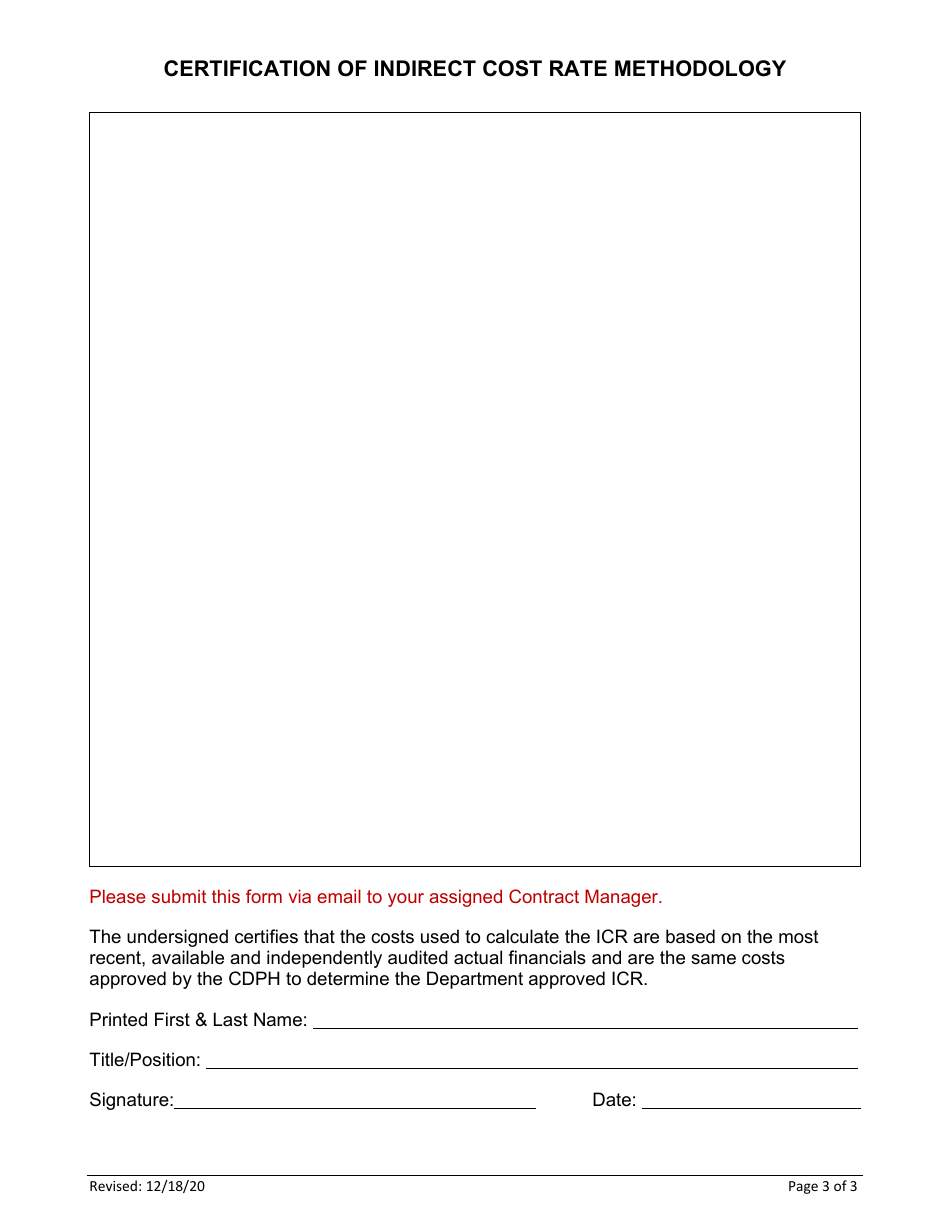

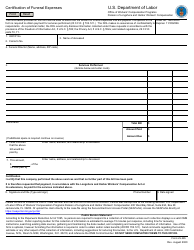

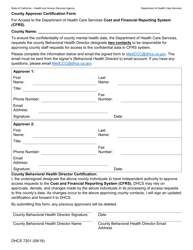

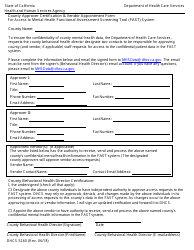

Certification of Indirect Cost Rate Methodology - California

Certification of Indirect Cost Rate Methodology is a legal document that was released by the California Department of Public Health - a government authority operating within California.

FAQ

Q: What is the Certification of Indirect Cost Rate Methodology?

A: The Certification of Indirect Cost Rate Methodology is a process in California where organizations submit their indirect cost rate methodology for review and approval.

Q: Who needs to submit the Certification of Indirect Cost Rate Methodology?

A: Nonprofit organizations that receive government funding and incur indirect costs must submit the Certification of Indirect Cost Rate Methodology.

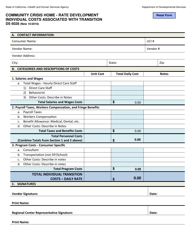

Q: Why is the Certification of Indirect Cost Rate Methodology required?

A: The Certification of Indirect Cost Rate Methodology is required to ensure that the indirect costs charged by nonprofit organizations are reasonable, allowable, and allocable.

Q: How often does the Certification of Indirect Cost Rate Methodology need to be submitted?

A: The Certification of Indirect Cost Rate Methodology needs to be submitted annually for review and approval.

Q: Who reviews the Certification of Indirect Cost Rate Methodology?

A: The California Department of Finance reviews and approves the Certification of Indirect Cost Rate Methodology.

Q: What happens if the Certification of Indirect Cost Rate Methodology is not approved?

A: If the Certification of Indirect Cost Rate Methodology is not approved, the nonprofit organization may need to revise and resubmit their methodology or seek an alternative funding source.

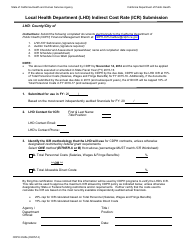

Q: Is there a deadline for submitting the Certification of Indirect Cost Rate Methodology?

A: Yes, there is a deadline for submitting the Certification of Indirect Cost Rate Methodology, which is typically specified by the California Department of Finance.

Form Details:

- Released on December 18, 2020;

- The latest edition currently provided by the California Department of Public Health;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Public Health.