This version of the form is not currently in use and is provided for reference only. Download this version of

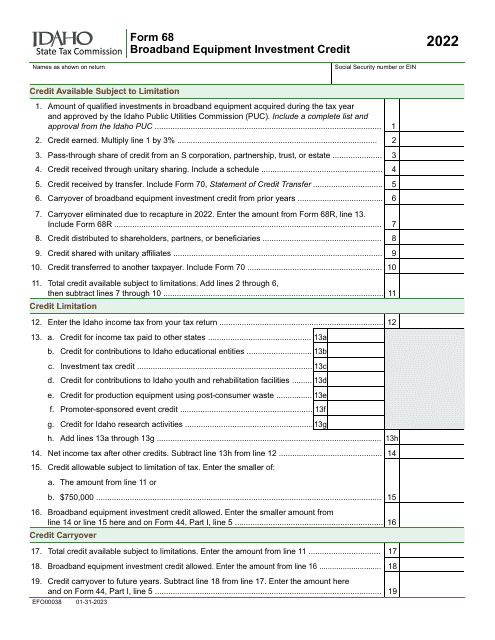

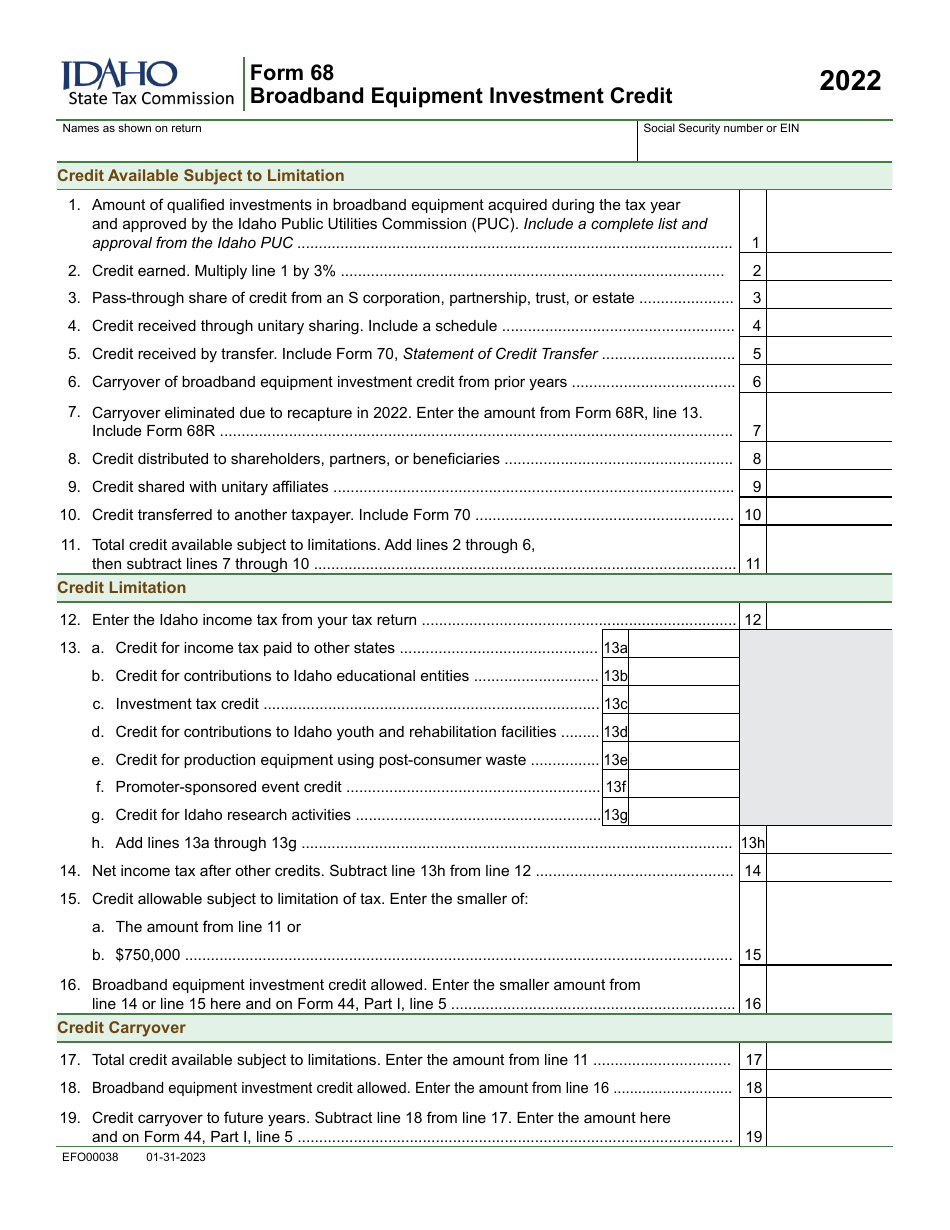

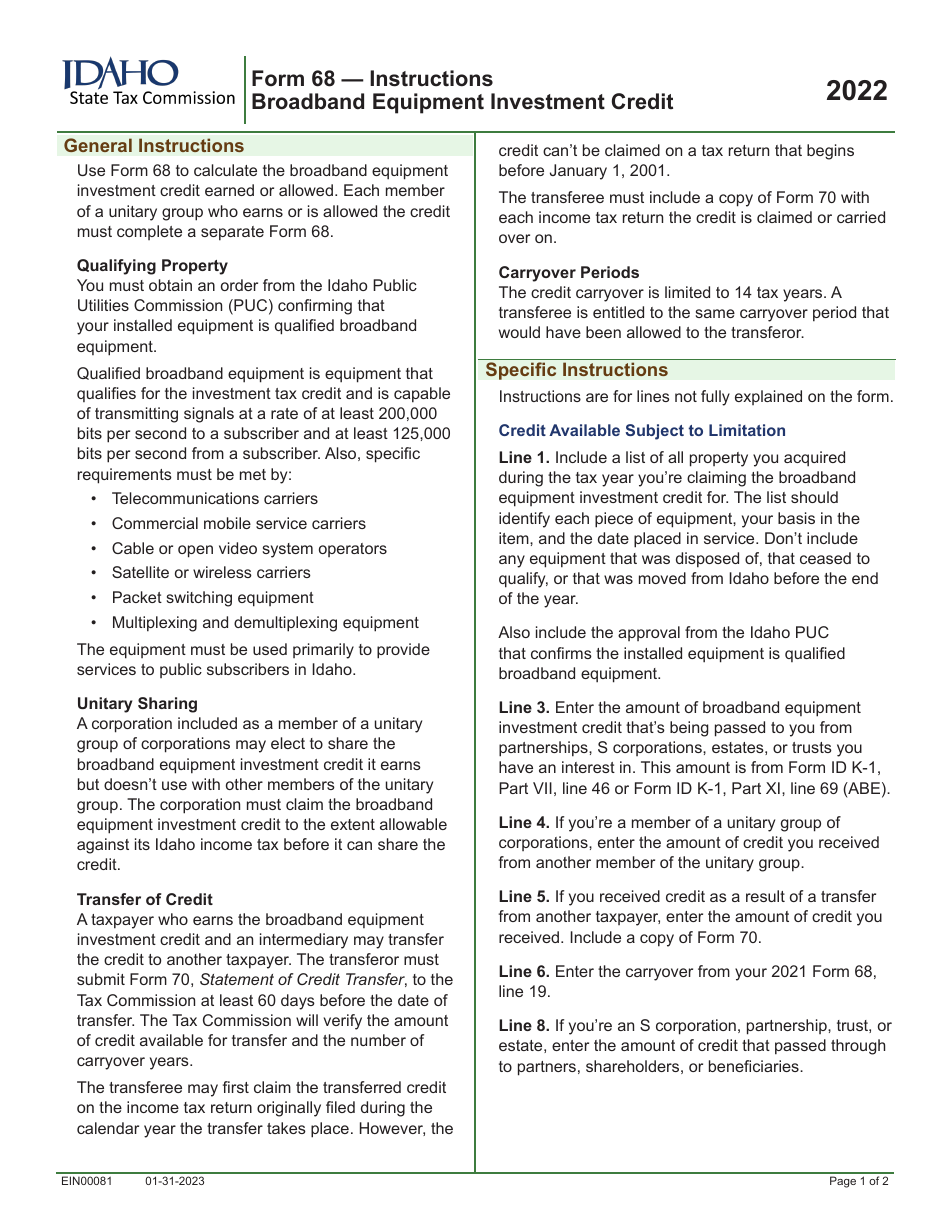

Form 68 (EFO00038)

for the current year.

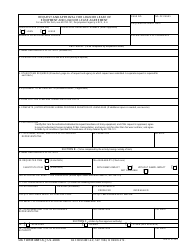

Form 68 (EFO00038) Broadband Equipment Investment Credit - Idaho

What Is Form 68 (EFO00038)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 68 (EFO00038)?

A: Form 68 (EFO00038) is a tax form related to the Broadband Equipment Investment Credit in Idaho.

Q: What is the Broadband Equipment Investment Credit?

A: The Broadband Equipment Investment Credit is a tax credit offered in Idaho to incentivize the investment in broadband equipment.

Q: Who is eligible for the Broadband Equipment Investment Credit?

A: Eligibility for the Broadband Equipment Investment Credit in Idaho depends on various factors. Please refer to the specific requirements outlined in Form 68 (EFO00038) and consult with a tax professional.

Q: Is the Broadband Equipment Investment Credit available in other states?

A: The Broadband Equipment Investment Credit is specific to Idaho. Other states may have their own similar credits or incentives for broadband equipment investment. Please consult with the tax authorities of each respective state for more information.

Q: Are there any deadlines for filing Form 68 (EFO00038)?

A: Specific deadlines for filing Form 68 (EFO00038) may vary. It is recommended to refer to the official instructions provided with the form or consult with a tax professional to ensure timely filing.

Q: How much is the Broadband Equipment Investment Credit worth?

A: The value of the Broadband Equipment Investment Credit in Idaho may vary based on the qualifying investments. Please refer to the specific instructions on Form 68 (EFO00038) or consult with a tax professional for more accurate information.

Q: Can I claim the Broadband Equipment Investment Credit if I don't live in Idaho?

A: The Broadband Equipment Investment Credit is only available to individuals or businesses who have made qualifying investments in broadband equipment in Idaho. It is specific to the state and not applicable for residents of other states.

Form Details:

- Released on January 31, 2023;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 68 (EFO00038) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.