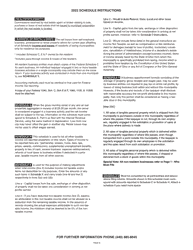

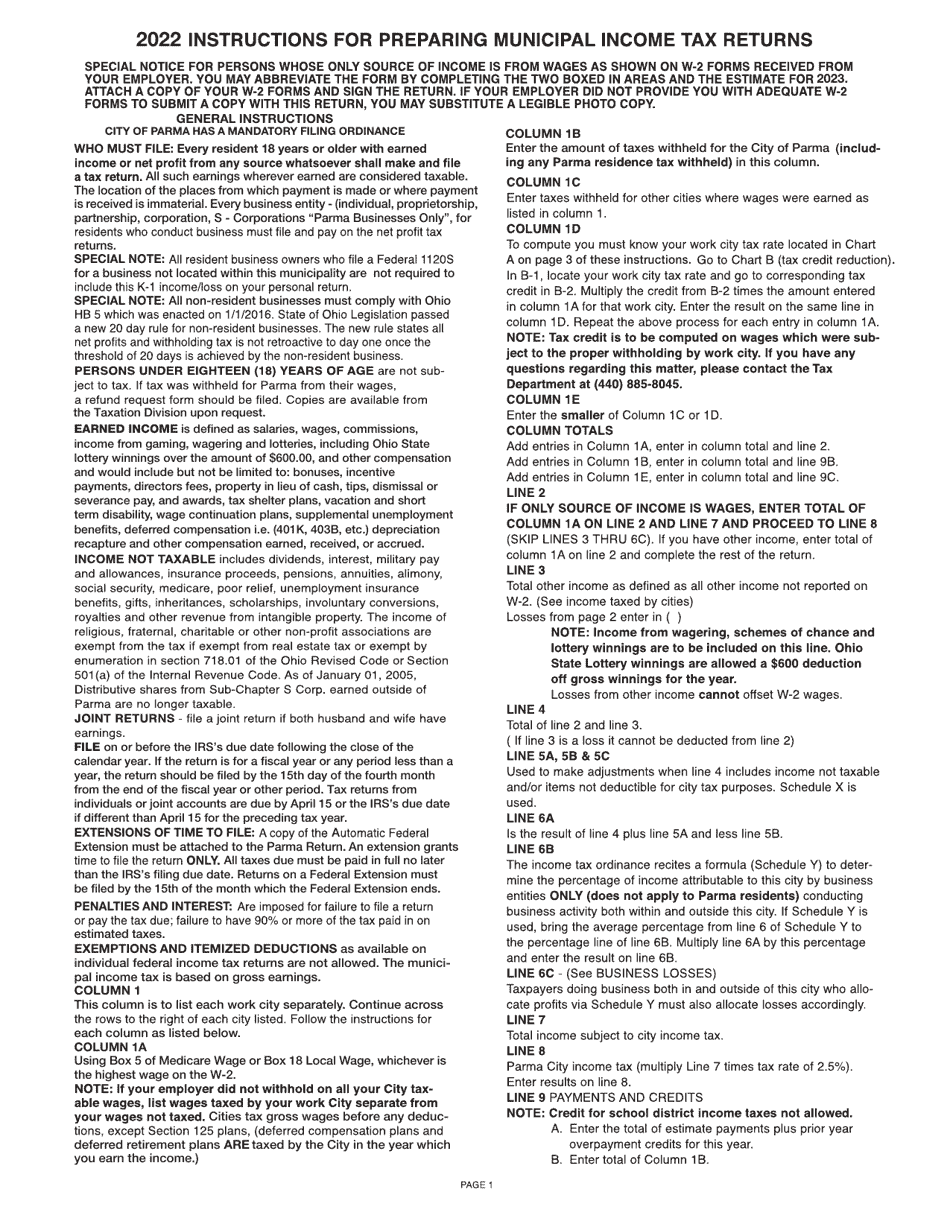

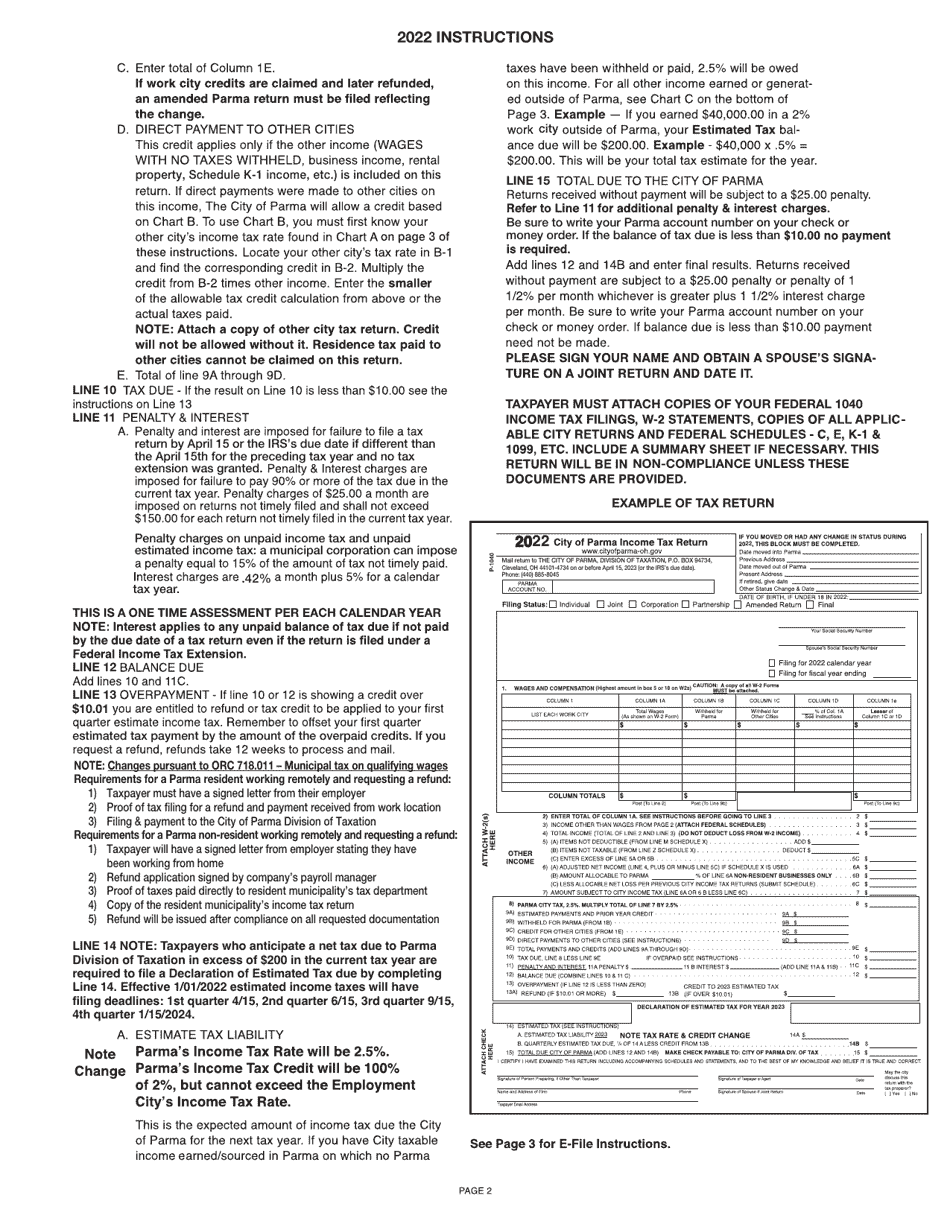

This version of the form is not currently in use and is provided for reference only. Download this version of

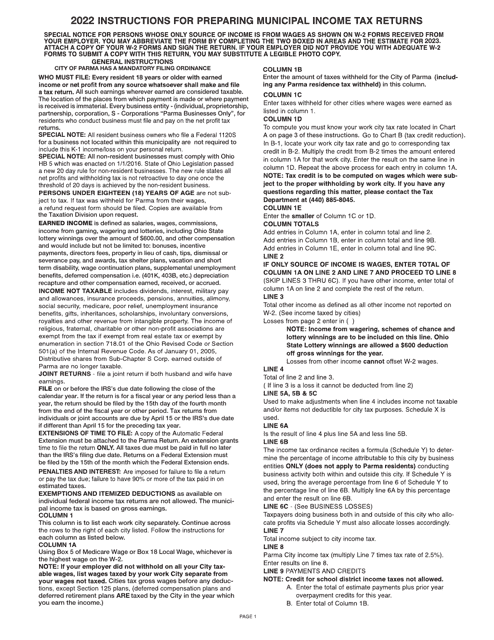

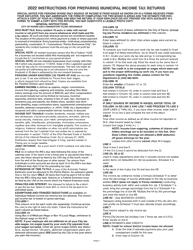

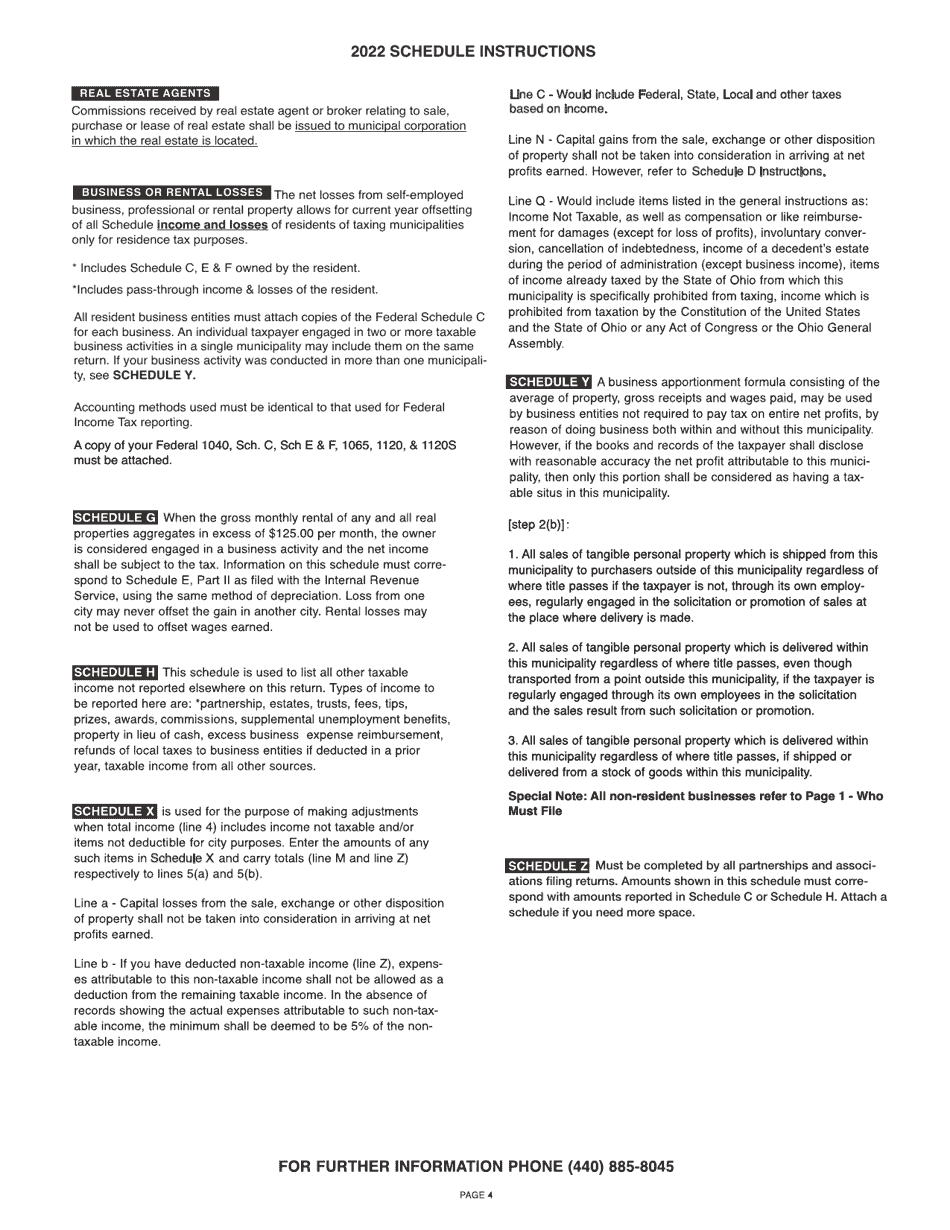

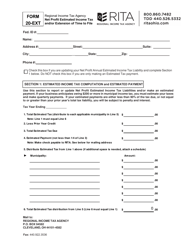

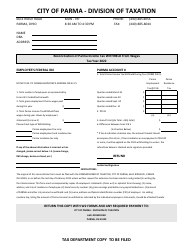

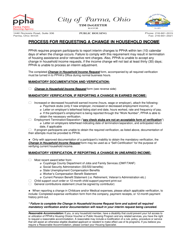

Instructions for Form P-1040

for the current year.

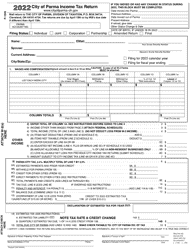

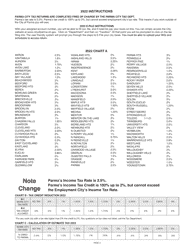

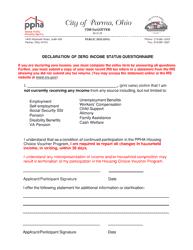

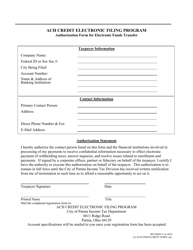

Instructions for Form P-1040 City of Parma Income Tax Return - City of Parma, Ohio

This document contains official instructions for Form P-1040 , City of Parma Income Tax Return - a form released and collected by the Division of Taxation - City of Parma, Ohio. An up-to-date fillable Form P-1040 is available for download through this link.

FAQ

Q: What is Form P-1040?

A: Form P-1040 is the Income Tax Return form for the City of Parma in Ohio.

Q: Who needs to file Form P-1040?

A: Residents of the City of Parma, Ohio who have taxable income need to file Form P-1040.

Q: What information do I need to complete Form P-1040?

A: You will need to gather information about your income, deductions, and any credits or exemptions you may qualify for.

Q: What is the deadline for filing Form P-1040?

A: The deadline for filing Form P-1040 is April 15th, or the same as the federal income tax deadline.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance with the City of Parma income tax requirements. It's important to file and pay on time to avoid penalties and interest.

Q: What if I need help completing Form P-1040?

A: If you need assistance completing Form P-1040, you can contact the City of Parma's Tax Department for guidance.

Q: What other forms or documents should I include with Form P-1040?

A: You may need to include copies of your federal income tax return and any applicable schedules or supporting documents when filing Form P-1040.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Division of Taxation - City of Parma, Ohio.