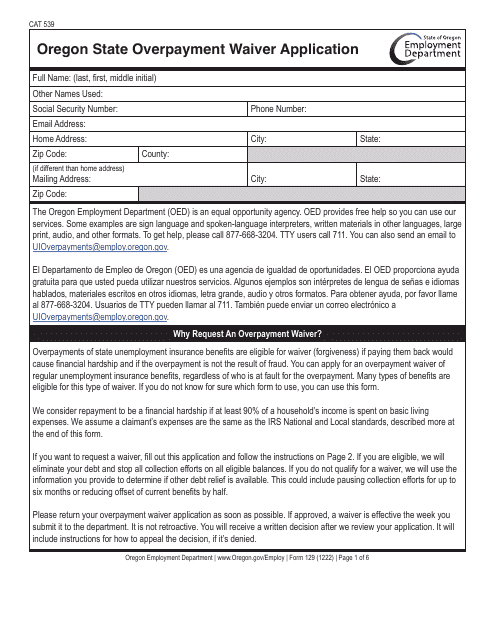

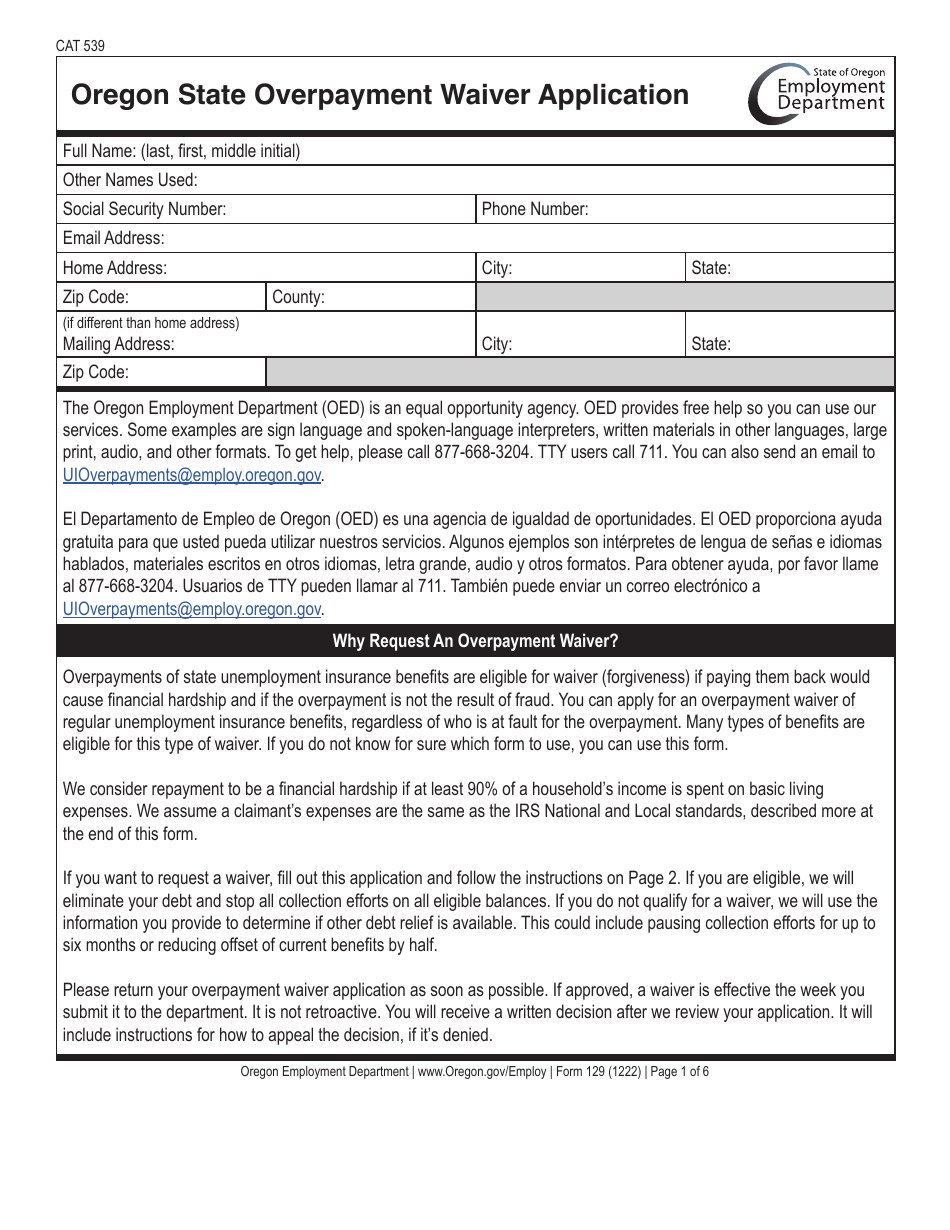

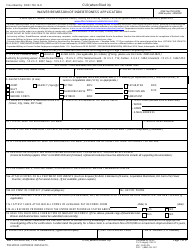

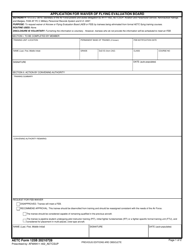

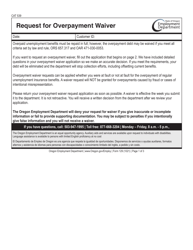

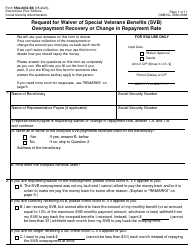

Form CAT539 (129) Oregon State Overpayment Waiver Application - Oregon

What Is Form CAT539 (129)?

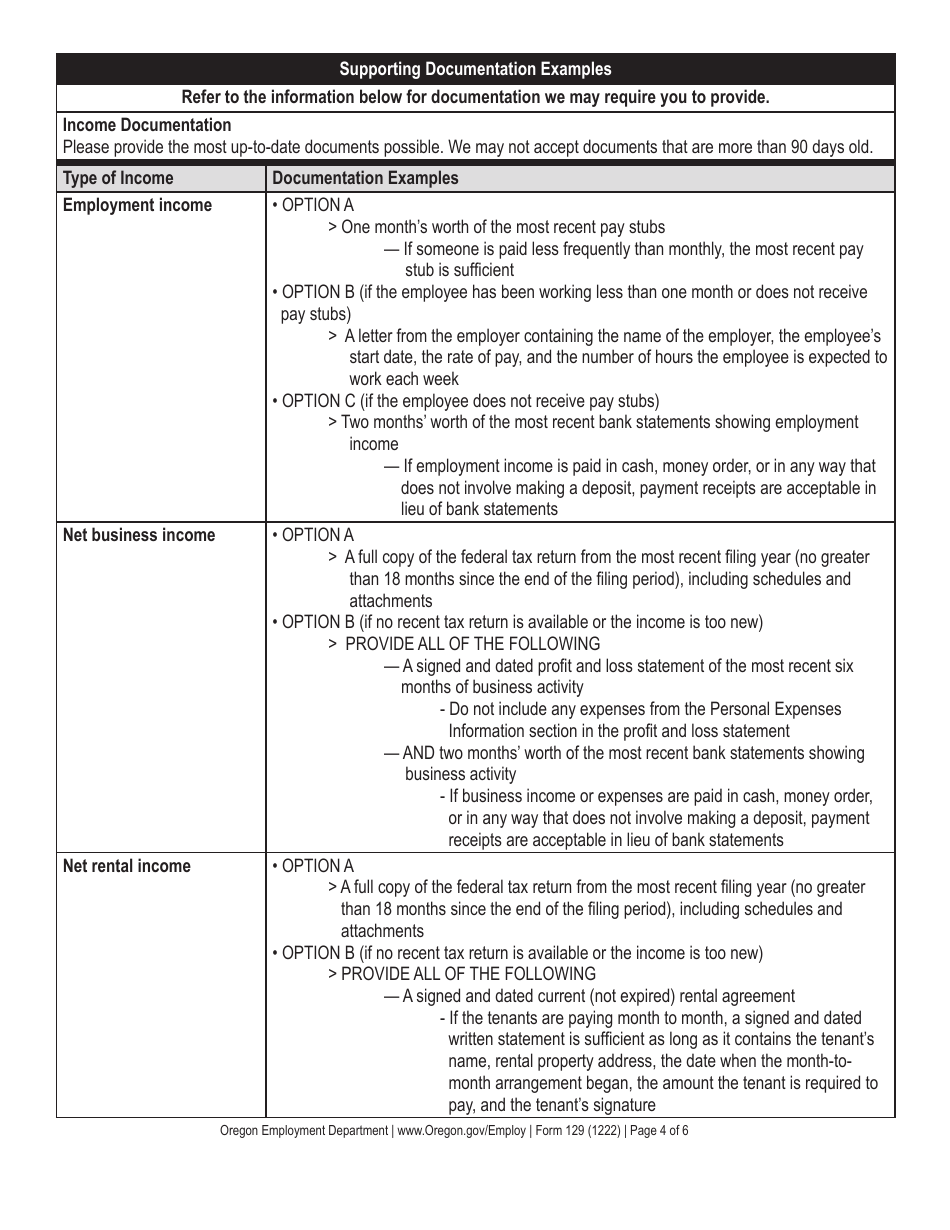

This is a legal form that was released by the Oregon Employment Department - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CAT539?

A: Form CAT539 is the Oregon State Overpayment Waiver Application.

Q: What is the purpose of Form CAT539?

A: The purpose of Form CAT539 is to apply for a waiver of an overpayment of taxes to the State of Oregon.

Q: Who needs to fill out Form CAT539?

A: Anyone who has overpaid taxes to the State of Oregon and wants to request a waiver of the overpayment needs to fill out Form CAT539.

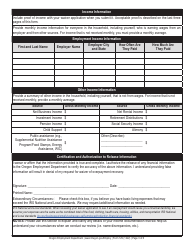

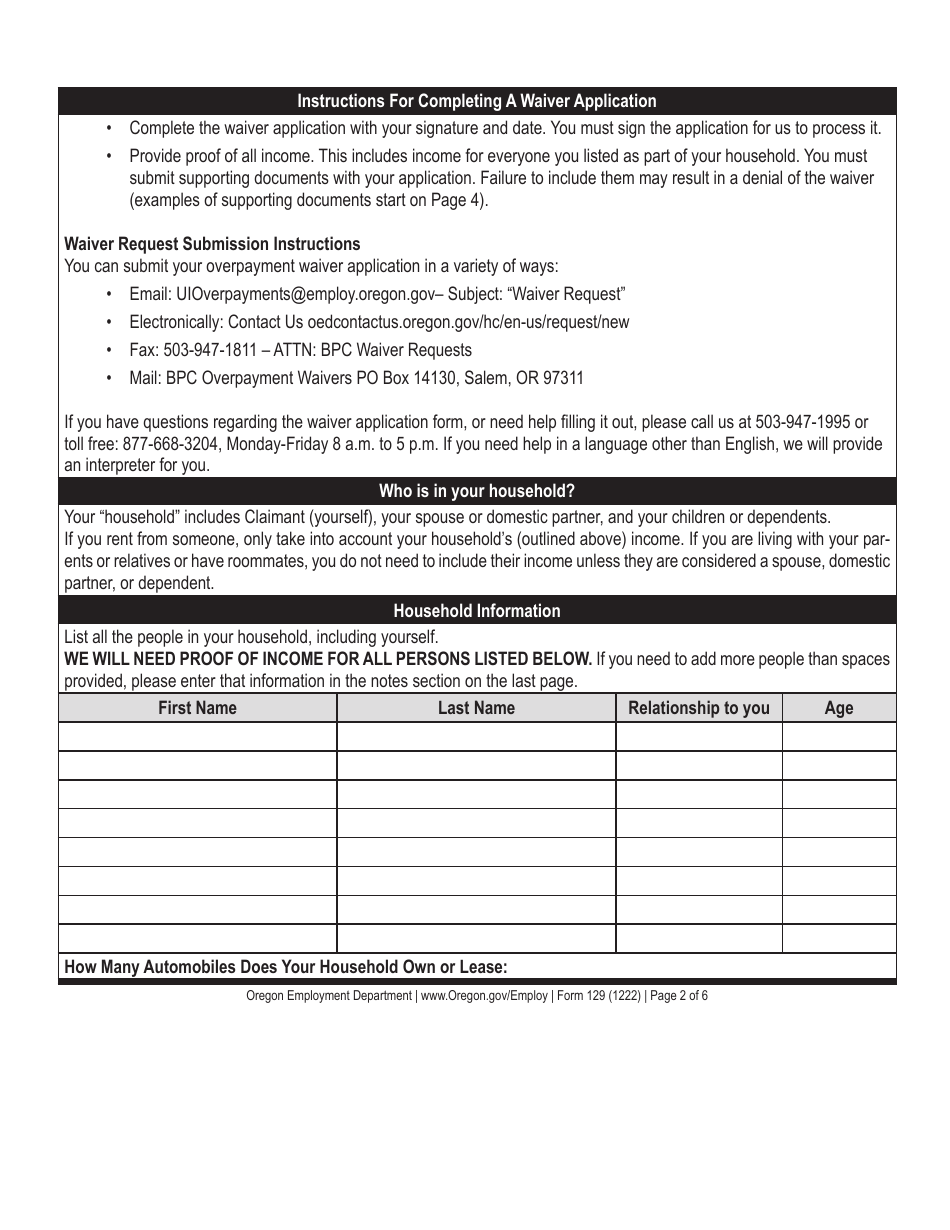

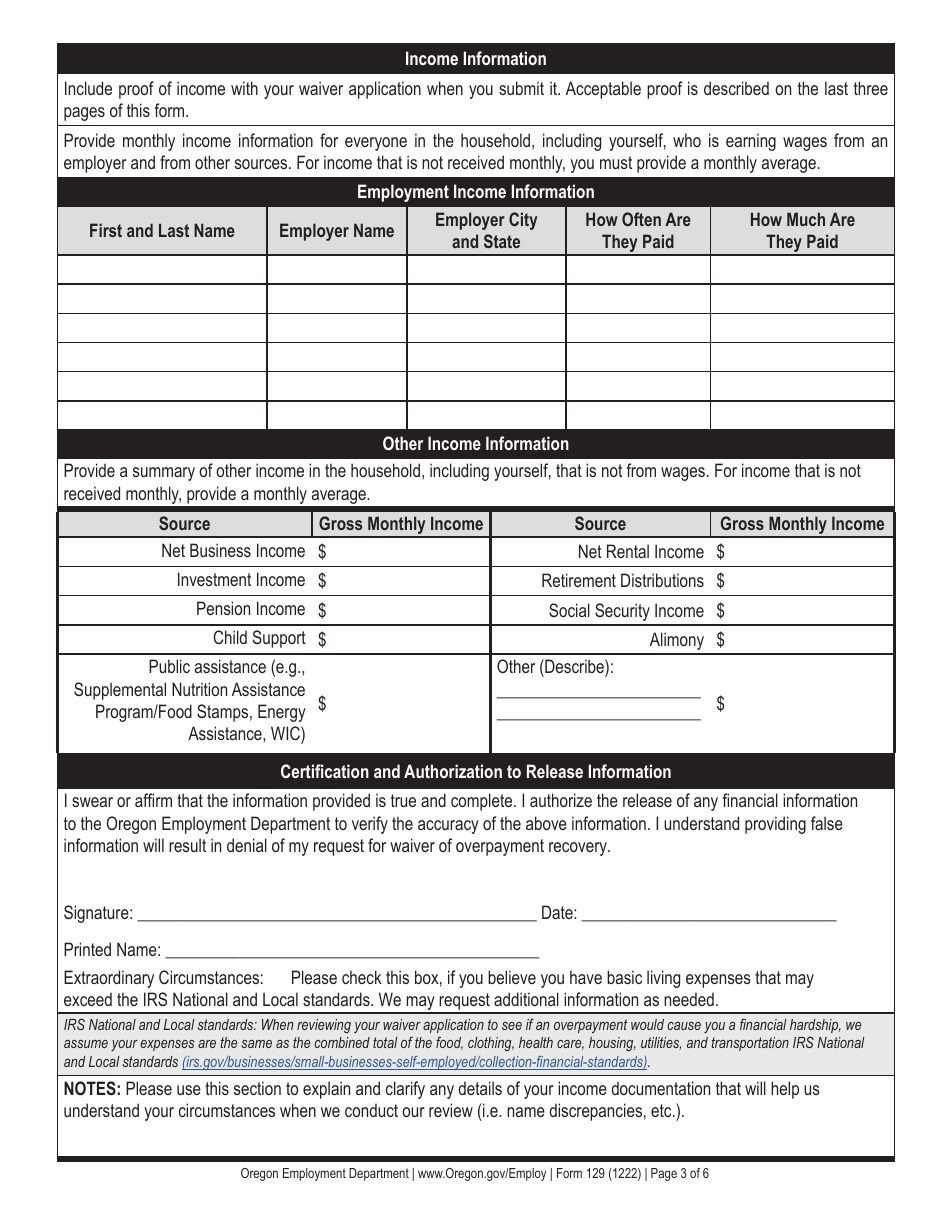

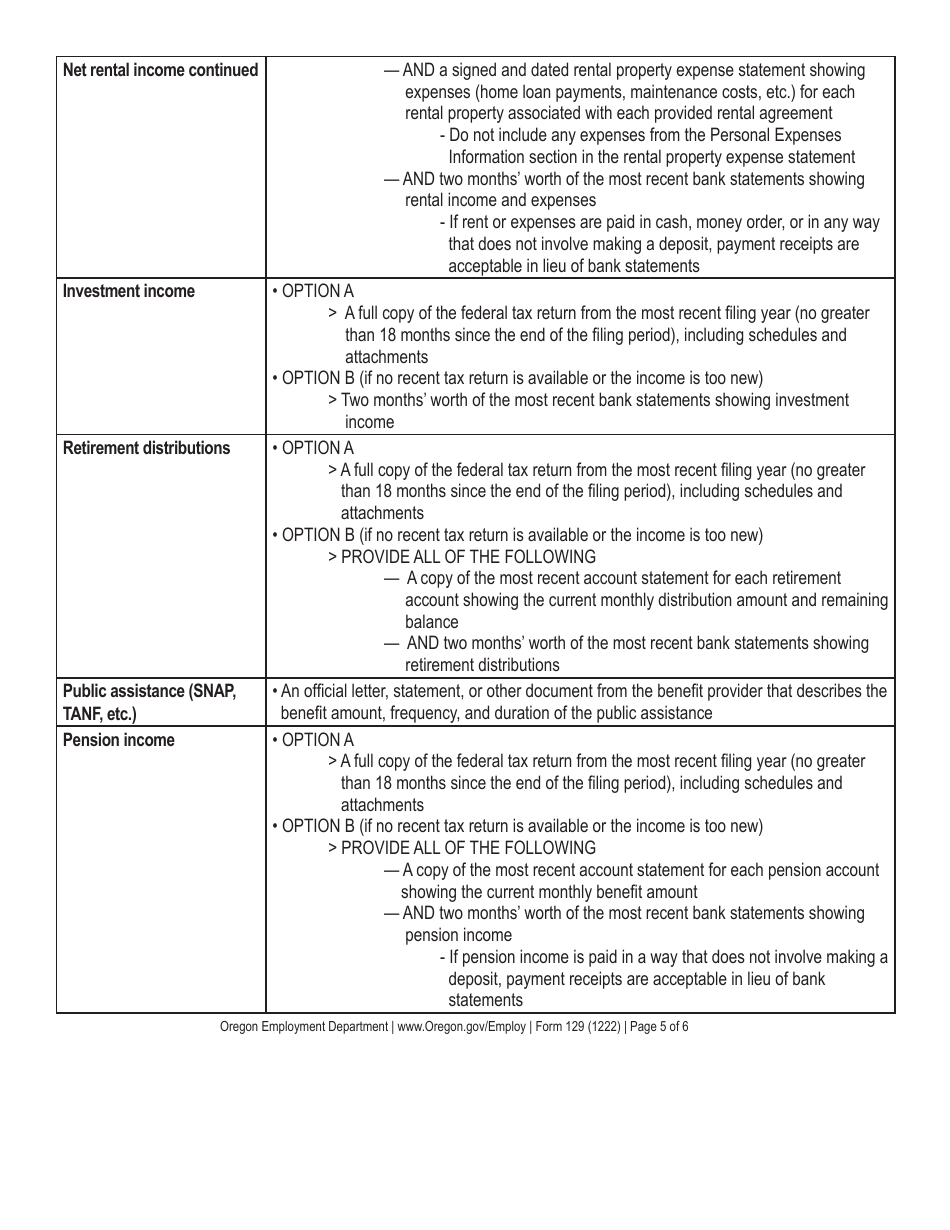

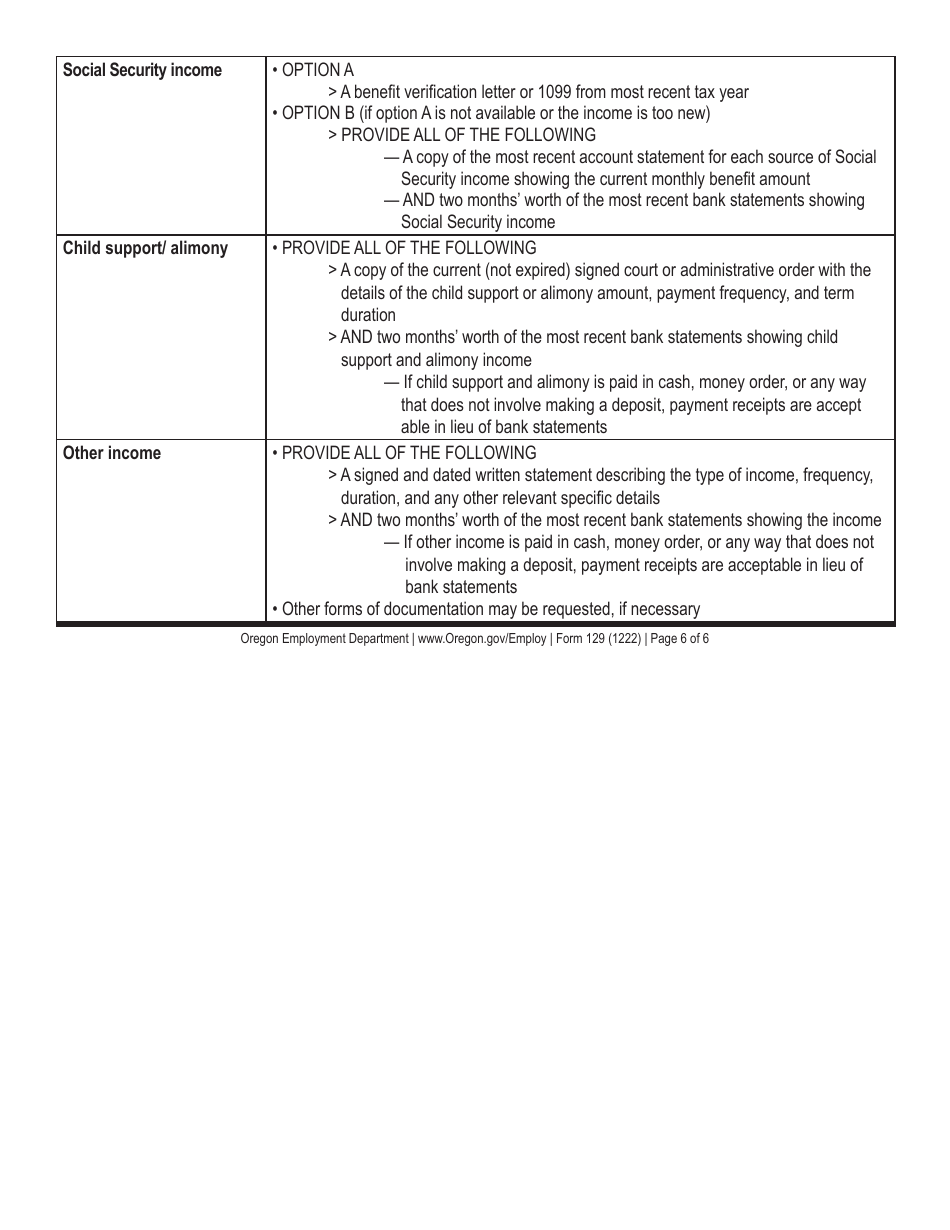

Q: What information is required on Form CAT539?

A: Form CAT539 requires information such as the taxpayer's name, contact information, tax account number, overpayment amount, and the reason for requesting a waiver.

Q: Is there a fee for filing Form CAT539?

A: No, there is no fee for filing Form CAT539.

Q: How long does it take to process Form CAT539?

A: The processing time for Form CAT539 varies, but it typically takes several weeks to receive a decision on the waiver request.

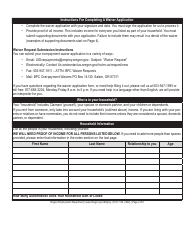

Q: Can I appeal if my waiver request is denied?

A: Yes, if your waiver request is denied, you have the right to appeal the decision.

Q: Are there any consequences for not filing Form CAT539?

A: If you do not file Form CAT539 and pay the overpayment amount, you may be subject to penalties and interest on the unpaid balance.

Q: Can I request a waiver for multiple overpayments on the same form?

A: Yes, you can request a waiver for multiple overpayments on the same Form CAT539.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Oregon Employment Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CAT539 (129) by clicking the link below or browse more documents and templates provided by the Oregon Employment Department.