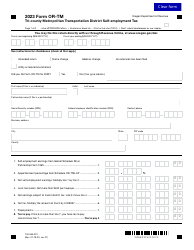

This version of the form is not currently in use and is provided for reference only. Download this version of

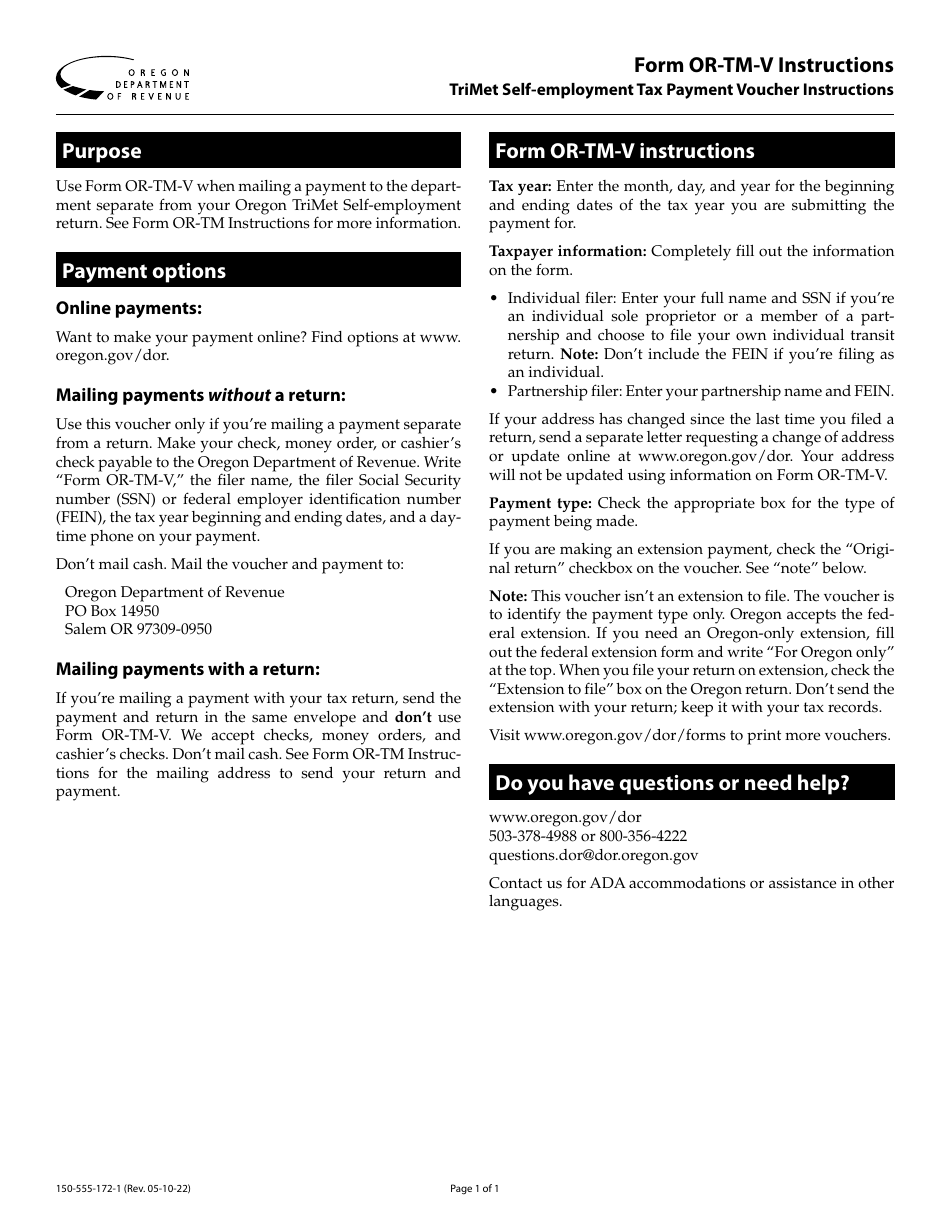

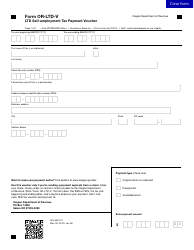

Instructions for Form OR-TM-V, 150-555-172

for the current year.

Instructions for Form OR-TM-V, 150-555-172 Trimet Self-employment Tax Payment Voucher - Oregon

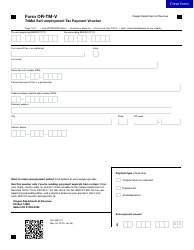

This document contains official instructions for Form OR-TM-V , and Form 150-555-172 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-TM-V (150-555-172) is available for download through this link.

FAQ

Q: What is Form OR-TM-V?

A: Form OR-TM-V is the Oregon Trimet Self-employment Tax Payment Voucher.

Q: What is the purpose of Form OR-TM-V?

A: The purpose of Form OR-TM-V is to make self-employment tax payments to Trimet in Oregon.

Q: Who should use Form OR-TM-V?

A: Self-employed individuals who are subject to Trimet taxes in Oregon should use Form OR-TM-V.

Q: How do I fill out Form OR-TM-V?

A: You need to provide your personal information, self-employment income, and calculate the amount of self-employment tax owed.

Q: When is the deadline to file Form OR-TM-V?

A: Form OR-TM-V must be filed and payment must be made by the due date, which is typically the last day of the month following the end of the tax quarter.

Q: What happens if I don't file Form OR-TM-V?

A: Failure to file Form OR-TM-V and make the required payment may result in penalties and interest.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.