This version of the form is not currently in use and is provided for reference only. Download this version of

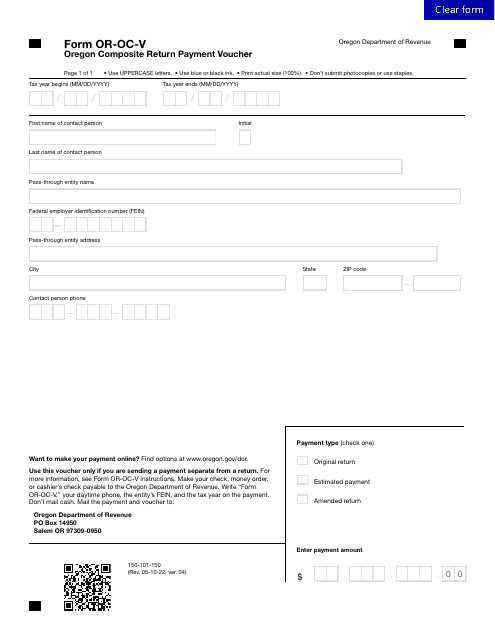

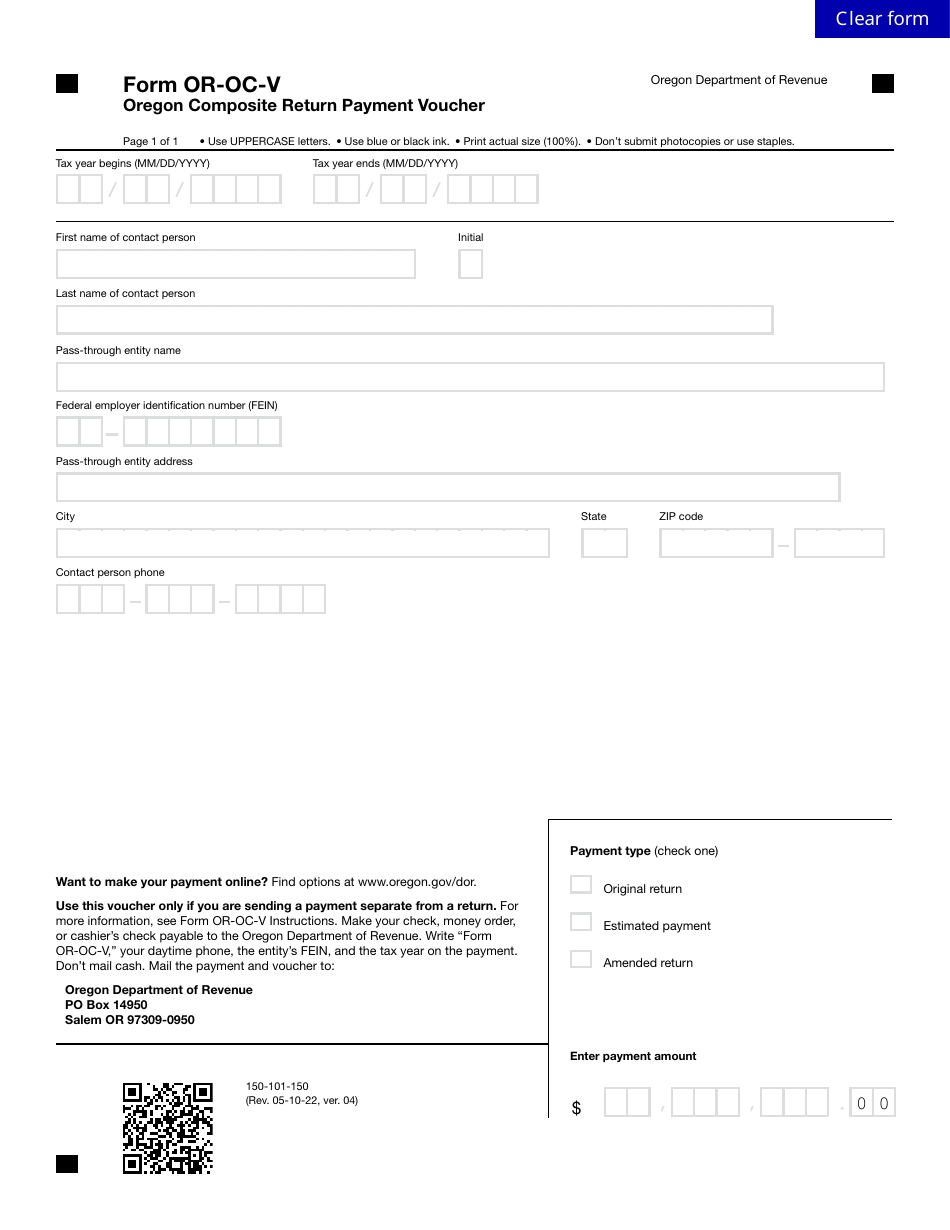

Form OR-OC-V (150-101-150)

for the current year.

Form OR-OC-V (150-101-150) Oregon Composite Return Payment Voucher - Oregon

What Is Form OR-OC-V (150-101-150)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-OC-V?

A: Form OR-OC-V is the Oregon Composite Return Payment Voucher.

Q: What is the purpose of Form OR-OC-V?

A: The purpose of Form OR-OC-V is to submit payment for the Oregon Composite Return.

Q: Who needs to use Form OR-OC-V?

A: Anyone who is filing the Oregon Composite Return and needs to make a payment with their return should use Form OR-OC-V.

Q: What information is required on Form OR-OC-V?

A: Form OR-OC-V requires information such as the taxpayer's identification number, tax year, payment amount, and contact information.

Q: What should I do with Form OR-OC-V once it is completed?

A: Once completed, Form OR-OC-V should be submitted along with the Oregon Composite Return and payment.

Form Details:

- Released on May 10, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-OC-V (150-101-150) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.