This version of the form is not currently in use and is provided for reference only. Download this version of

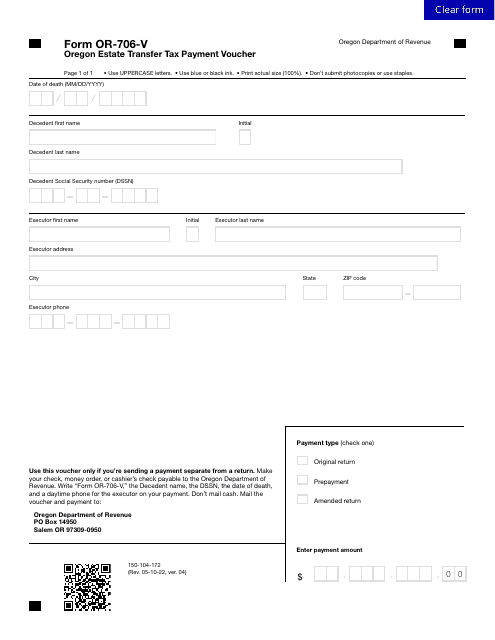

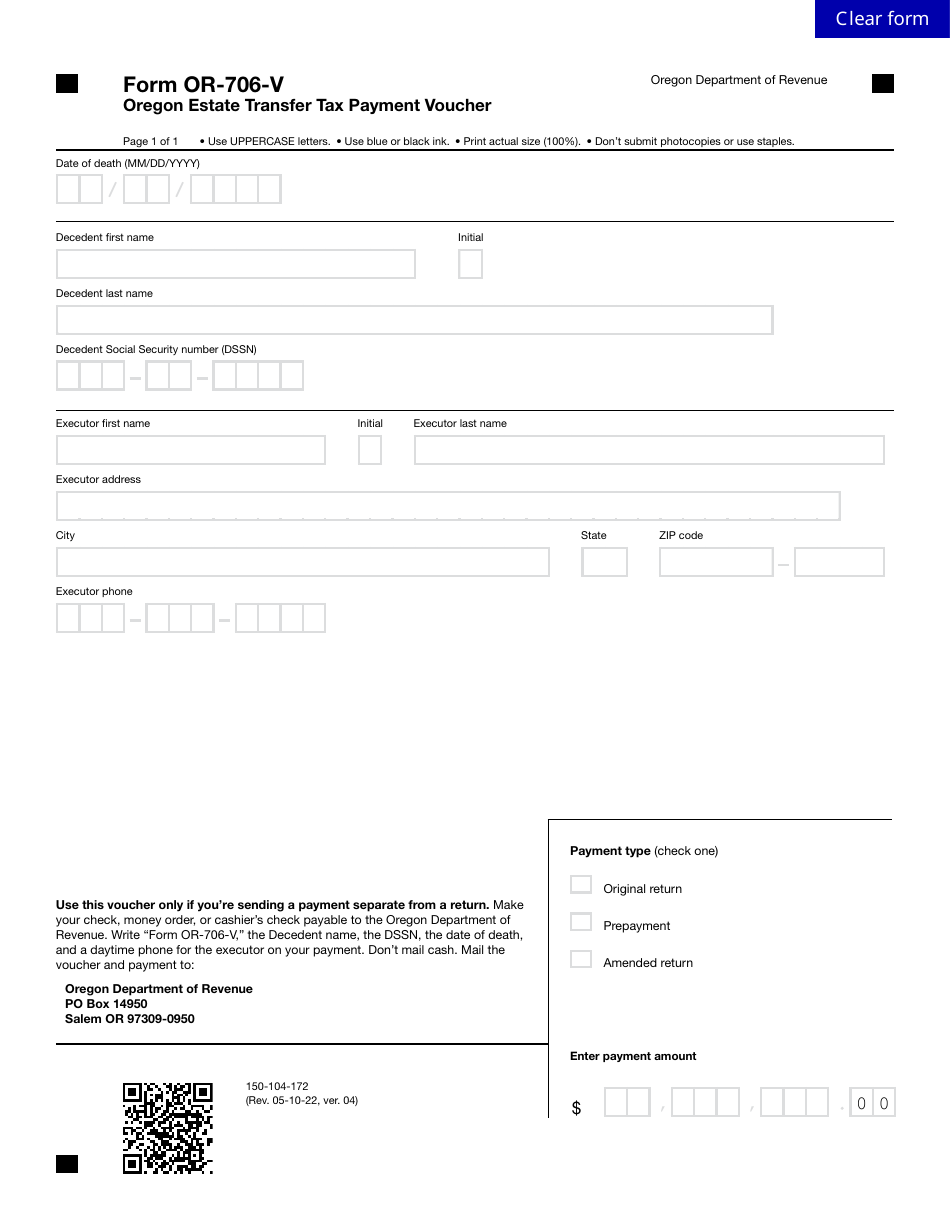

Form OR-706-V (150-104-172)

for the current year.

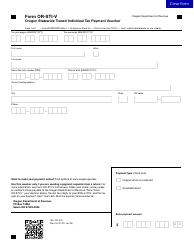

Form OR-706-V (150-104-172) Oregon Estate Transfer Tax Payment Voucher - Oregon

What Is Form OR-706-V (150-104-172)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-706-V?

A: Form OR-706-V is the Oregon Estate Transfer Tax Payment Voucher.

Q: What is the purpose of Form OR-706-V?

A: The purpose of Form OR-706-V is to make a payment for Oregon Estate Transfer Tax.

Q: What is the form number for Form OR-706-V?

A: The form number for Form OR-706-V is 150-104-172.

Q: When is Form OR-706-V due?

A: Form OR-706-V is due on the same day as the Oregon Estate Transfer Tax return.

Q: What happens if I don't file Form OR-706-V?

A: If you fail to file Form OR-706-V or make the payment, you may be subject to penalties and interest.

Q: Is Form OR-706-V only applicable for Oregon residents?

A: No, Form OR-706-V is applicable for both Oregon residents and non-residents who owe estate transfer tax to Oregon state.

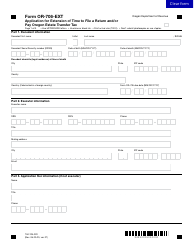

Form Details:

- Released on May 10, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-706-V (150-104-172) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.