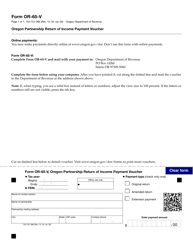

This version of the form is not currently in use and is provided for reference only. Download this version of

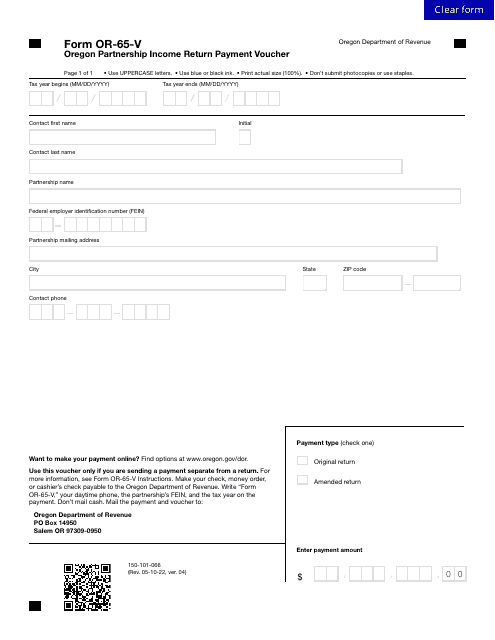

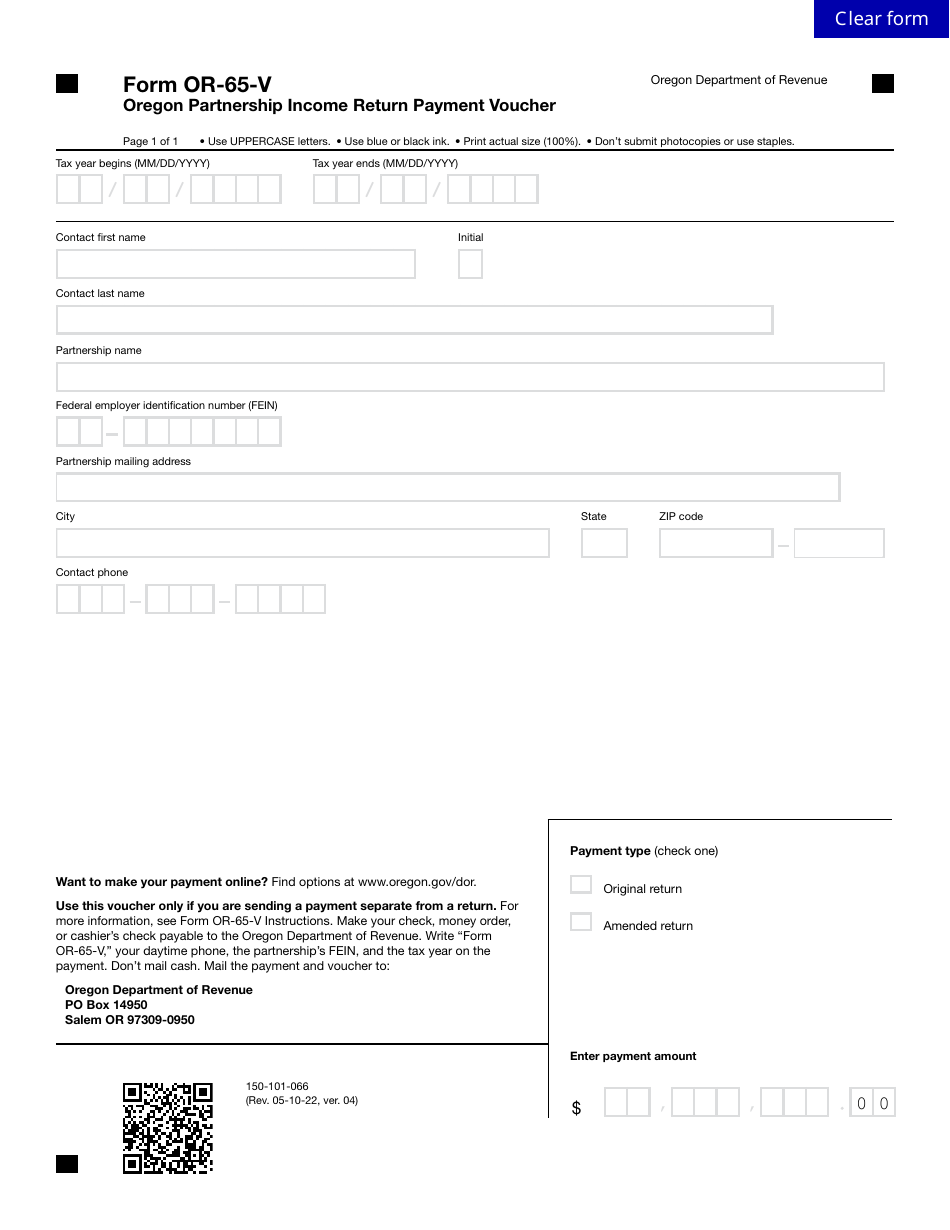

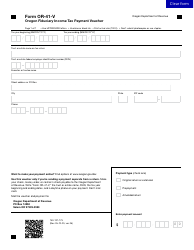

Form OR-65-V (150-101-066)

for the current year.

Form OR-65-V (150-101-066) Oregon Partnership Income Return Payment Voucher - Oregon

What Is Form OR-65-V (150-101-066)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-65-V?

A: Form OR-65-V is the payment voucher for Oregon Partnership Income Return.

Q: What is the purpose of Form OR-65-V?

A: The purpose of Form OR-65-V is to make a payment for the Oregon Partnership Income Return.

Q: What does the form number 150-101-066 represent?

A: The form number 150-101-066 represents the specific version of Form OR-65-V issued by the Oregon Department of Revenue.

Q: Who needs to use Form OR-65-V?

A: Partnerships in Oregon who are making a payment with their Partnership Income Return need to use Form OR-65-V.

Q: Is Form OR-65-V used for filing tax returns?

A: No, Form OR-65-V is not used for filing tax returns. It is only used for making payments.

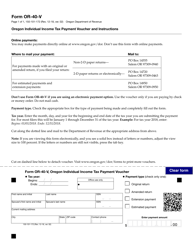

Form Details:

- Released on May 10, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-65-V (150-101-066) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.