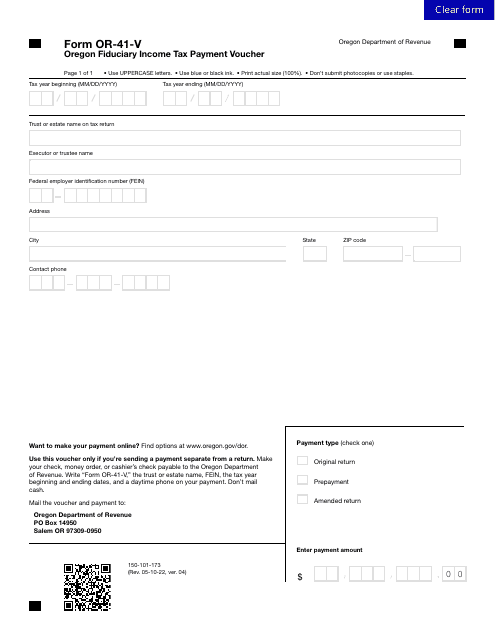

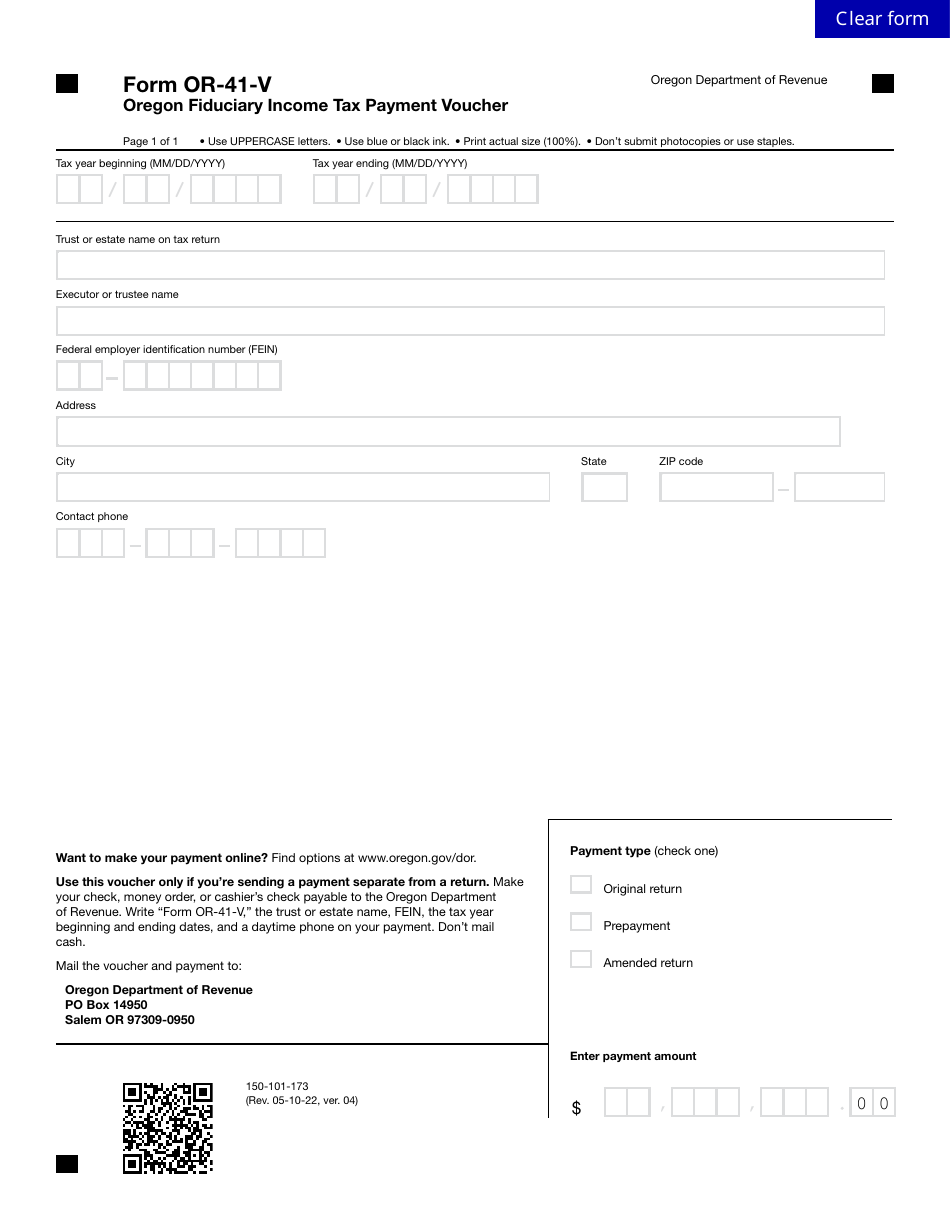

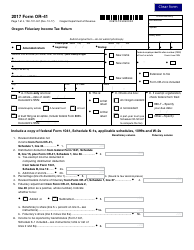

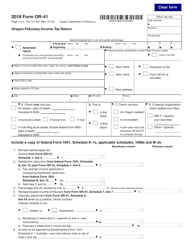

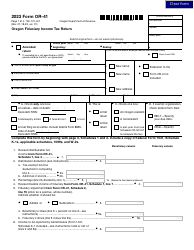

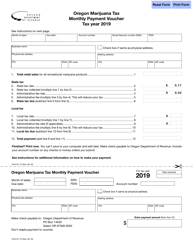

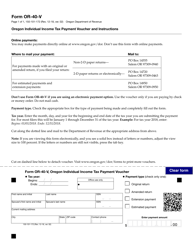

Form OR-41-V (150-101-173) Oregon Fiduciary Income Tax Payment Voucher - Oregon

What Is Form OR-41-V (150-101-173)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-41-V?

A: OR-41-V is the Oregon Fiduciary Income Tax Payment Voucher.

Q: What is the purpose of OR-41-V?

A: The purpose of OR-41-V is to make a payment for Oregon Fiduciary Income Tax.

Q: What is the form number for OR-41-V?

A: The form number for OR-41-V is 150-101-173.

Q: When should I use OR-41-V?

A: You should use OR-41-V when making a payment for Oregon Fiduciary Income Tax.

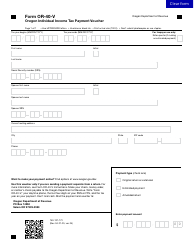

Form Details:

- Released on May 10, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-41-V (150-101-173) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.