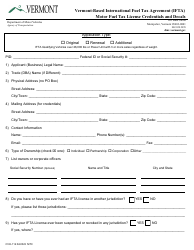

This version of the form is not currently in use and is provided for reference only. Download this version of

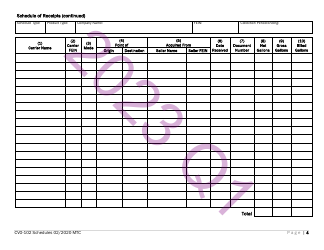

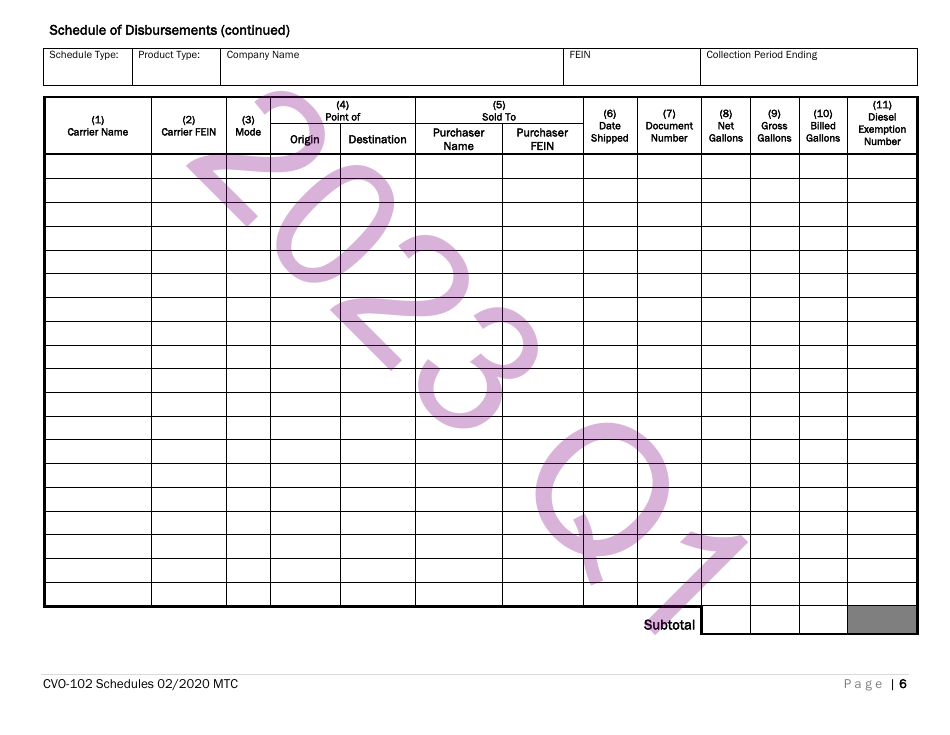

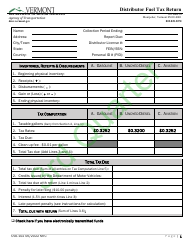

Form CVO-102

for the current year.

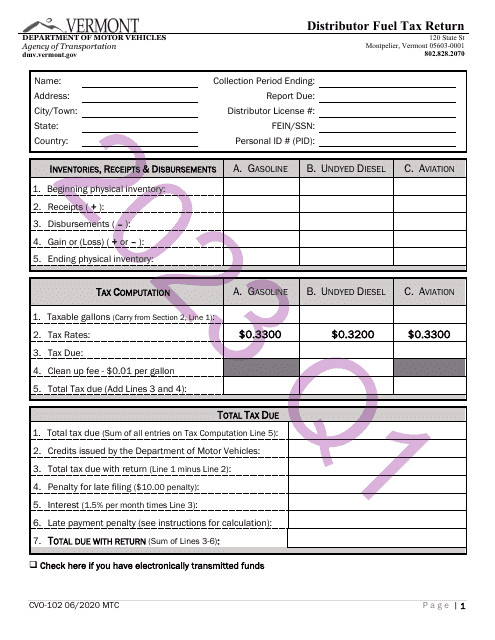

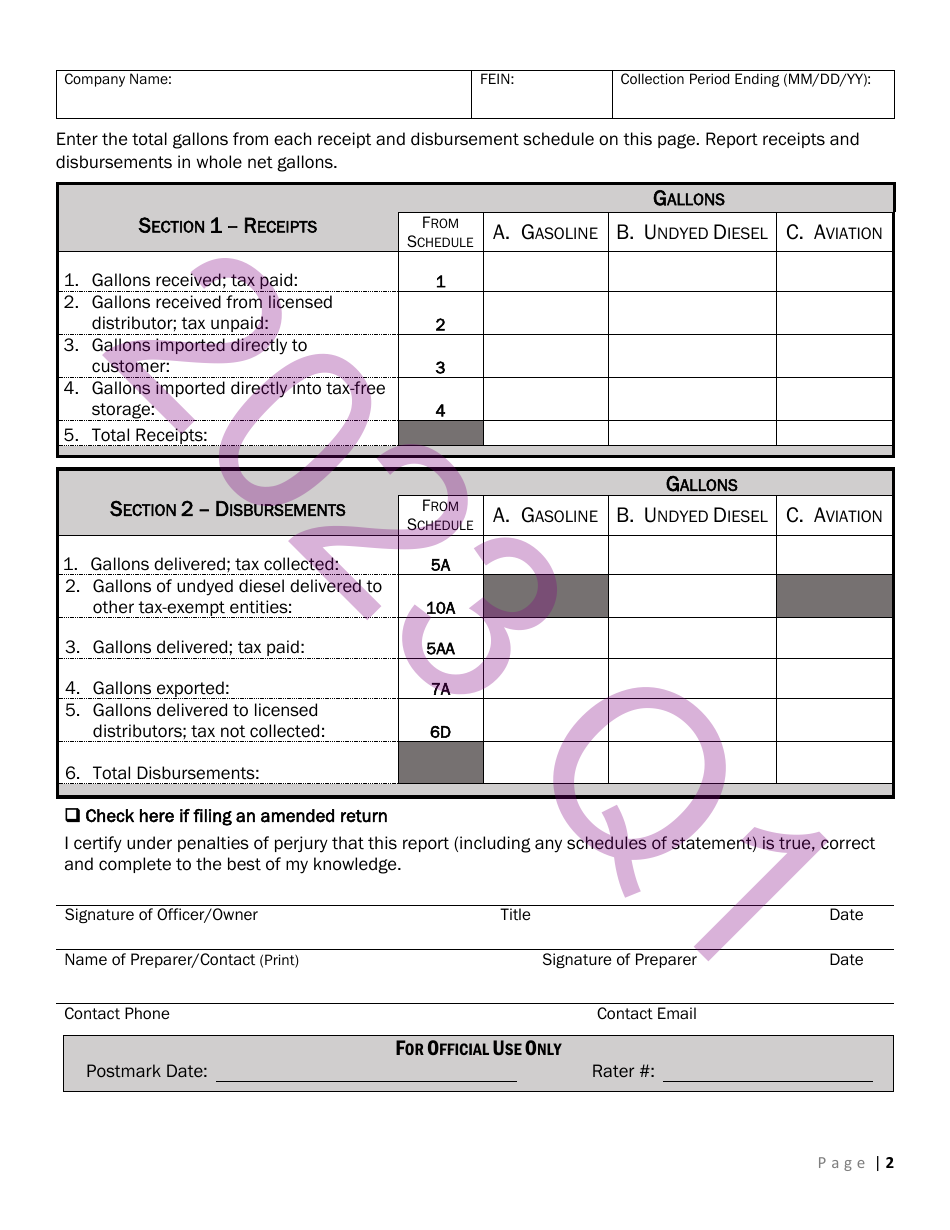

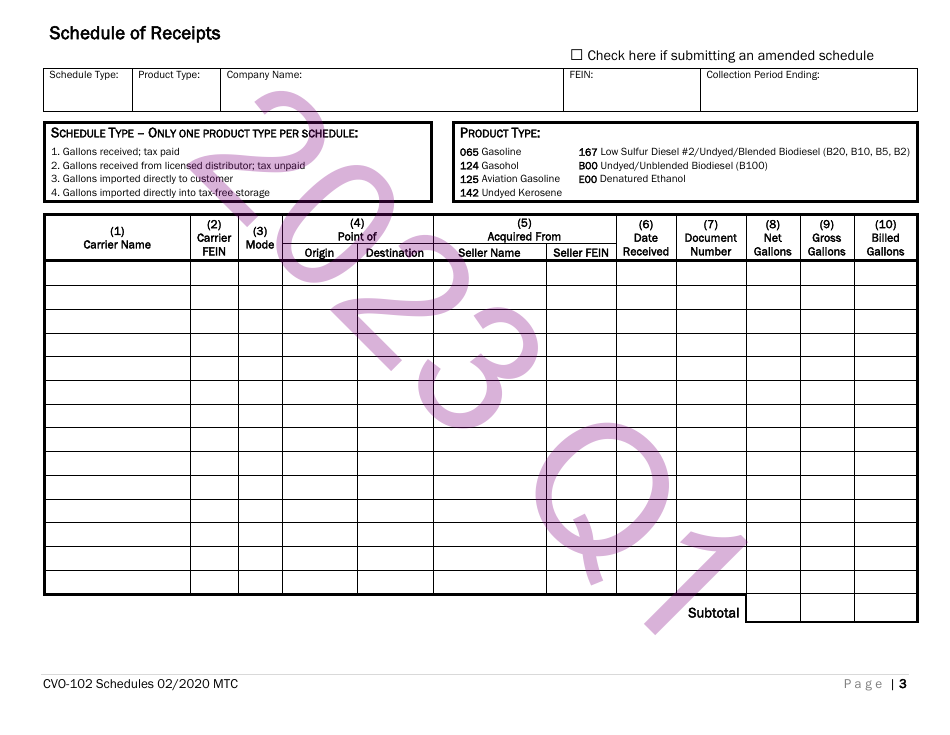

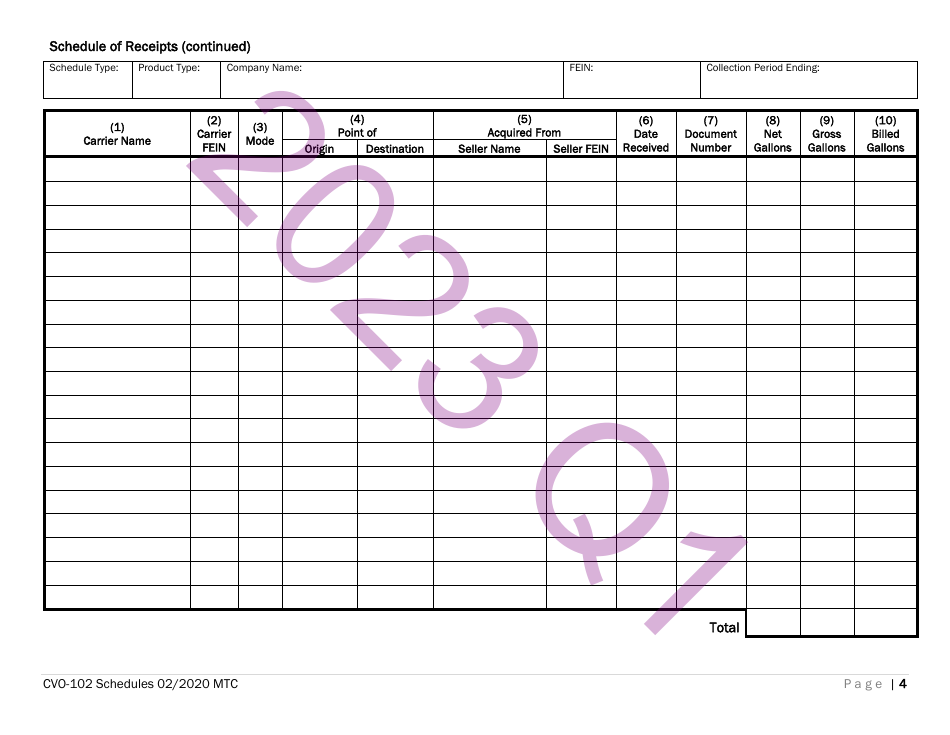

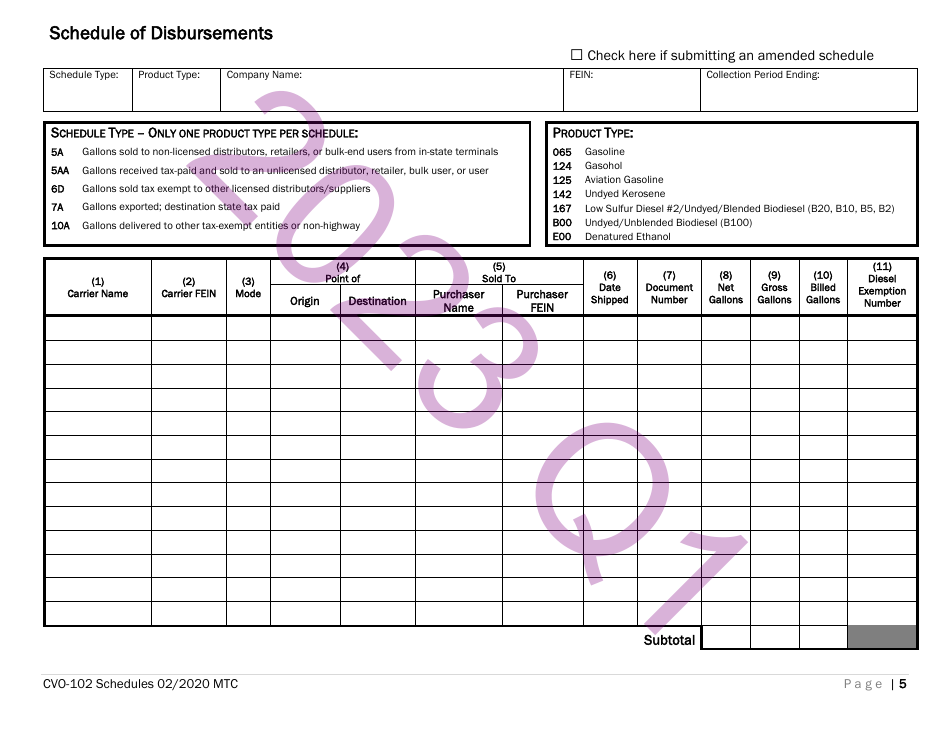

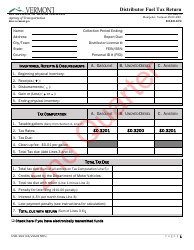

Form CVO-102 Distributor Fuel Tax Return - Quarter 1 - Vermont

What Is Form CVO-102?

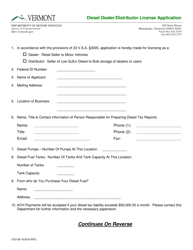

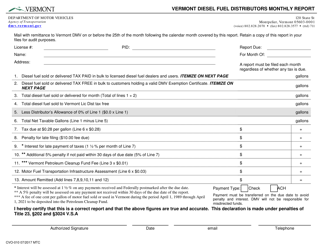

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return.

Q: What is the purpose of Form CVO-102?

A: The purpose of Form CVO-102 is to report and pay fuel taxes for distributors in Vermont.

Q: Which quarter does Form CVO-102 cover?

A: Form CVO-102 covers Quarter 1 (January to March) of the tax year.

Q: Who should file Form CVO-102?

A: Distributors of fuel in Vermont should file Form CVO-102.

Q: What taxes are reported on Form CVO-102?

A: Form CVO-102 reports the Vermont fuel tax and the incorrect fuel use tax.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.