This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

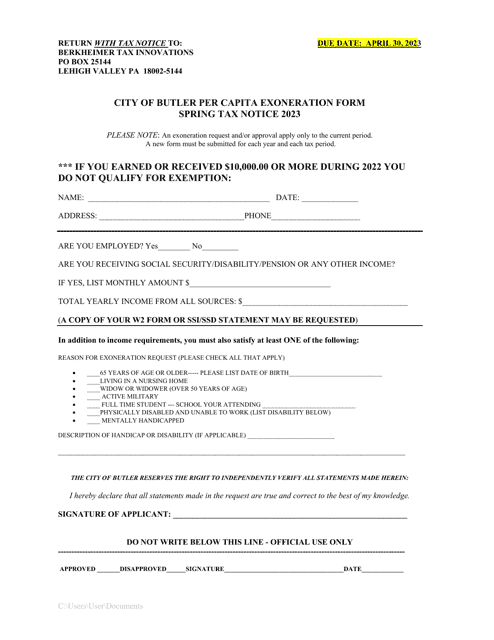

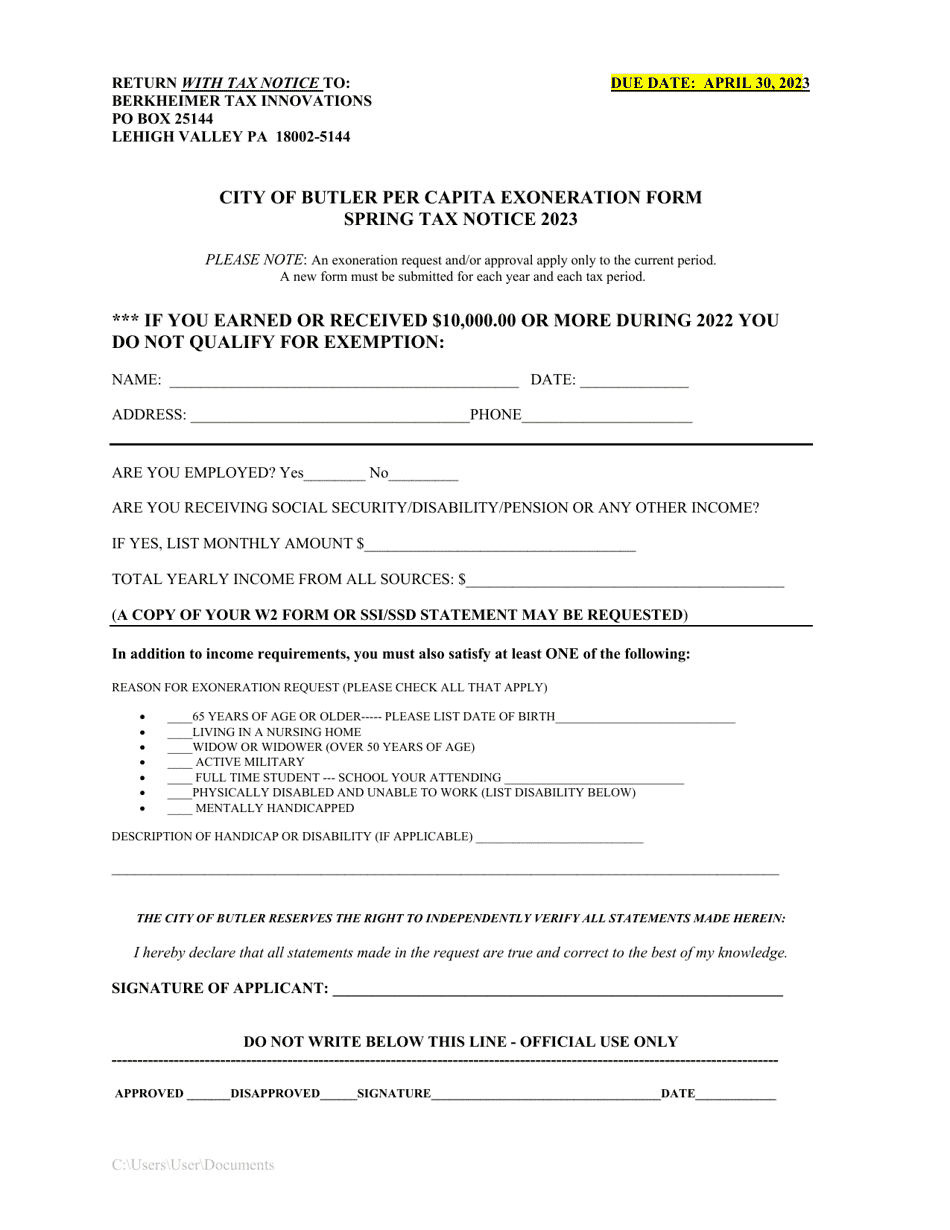

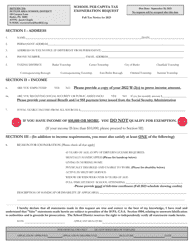

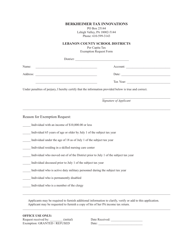

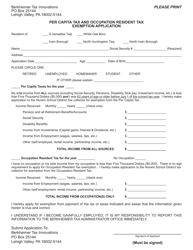

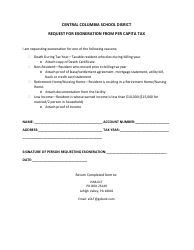

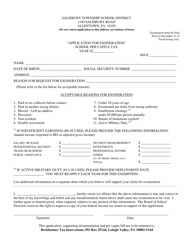

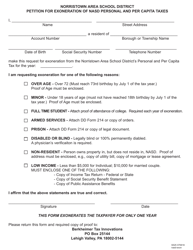

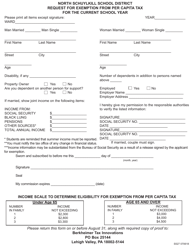

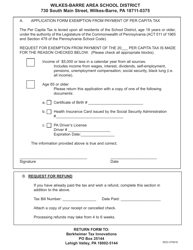

City of Butler Per Capita Exoneration Form - Pennsylvania

City of Butler Per Capita Exoneration Form is a legal document that was released by the Berkheimer Tax Administrator - a government authority operating within Pennsylvania.

FAQ

Q: What is the City of Butler Per Capita Exoneration Form?

A: It is a form used in the City of Butler, Pennsylvania to request exemption from per capita tax.

Q: What is per capita tax?

A: Per capita tax is a tax imposed on individuals based on their residency in a particular locality.

Q: Who needs to fill out the per capita exoneration form?

A: Residents of the City of Butler, Pennsylvania who are eligible for exemption from per capita tax.

Q: What are the eligibility criteria for per capita tax exemption?

A: Eligibility criteria may vary, but typically individuals with low income, disabilities, or certain exemptions specified by the city are eligible.

Q: Is there a deadline to submit the per capita exoneration form?

A: Yes, there is usually a deadline specified by the City of Butler for submitting the form. Contact their tax office for the specific deadline.

Q: What are the consequences of not paying per capita tax?

A: Non-payment of per capita tax may result in penalties, fines, or legal actions by the City of Butler.

Q: Are there any other taxes in the City of Butler?

A: Yes, there may be other local taxes in addition to per capita tax. Contact the City of Butler's tax office for more information.

Q: Can I appeal if my per capita exoneration form is denied?

A: Yes, you can usually appeal the decision if your per capita exoneration form is denied. Contact the City of Butler's tax office for the process.

Form Details:

- The latest edition currently provided by the Berkheimer Tax Administrator;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Berkheimer Tax Administrator.