This version of the form is not currently in use and is provided for reference only. Download this version of

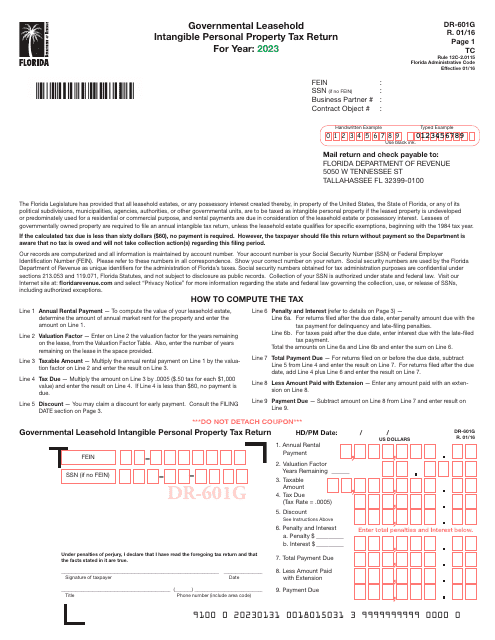

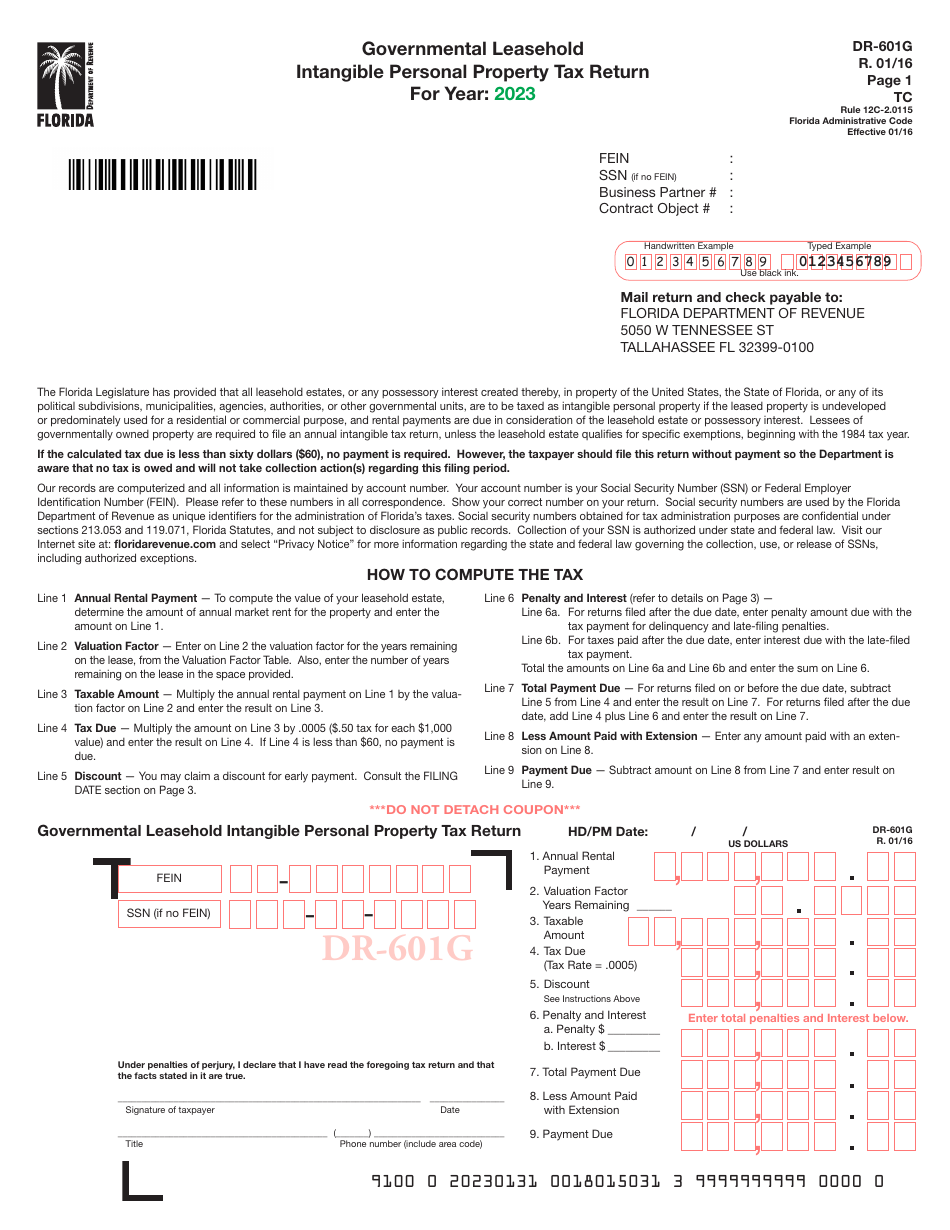

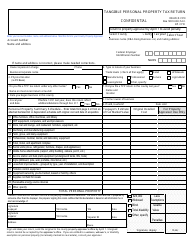

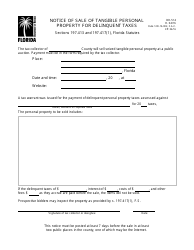

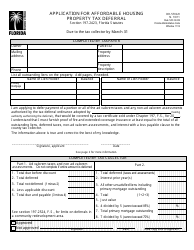

Form DR-601G

for the current year.

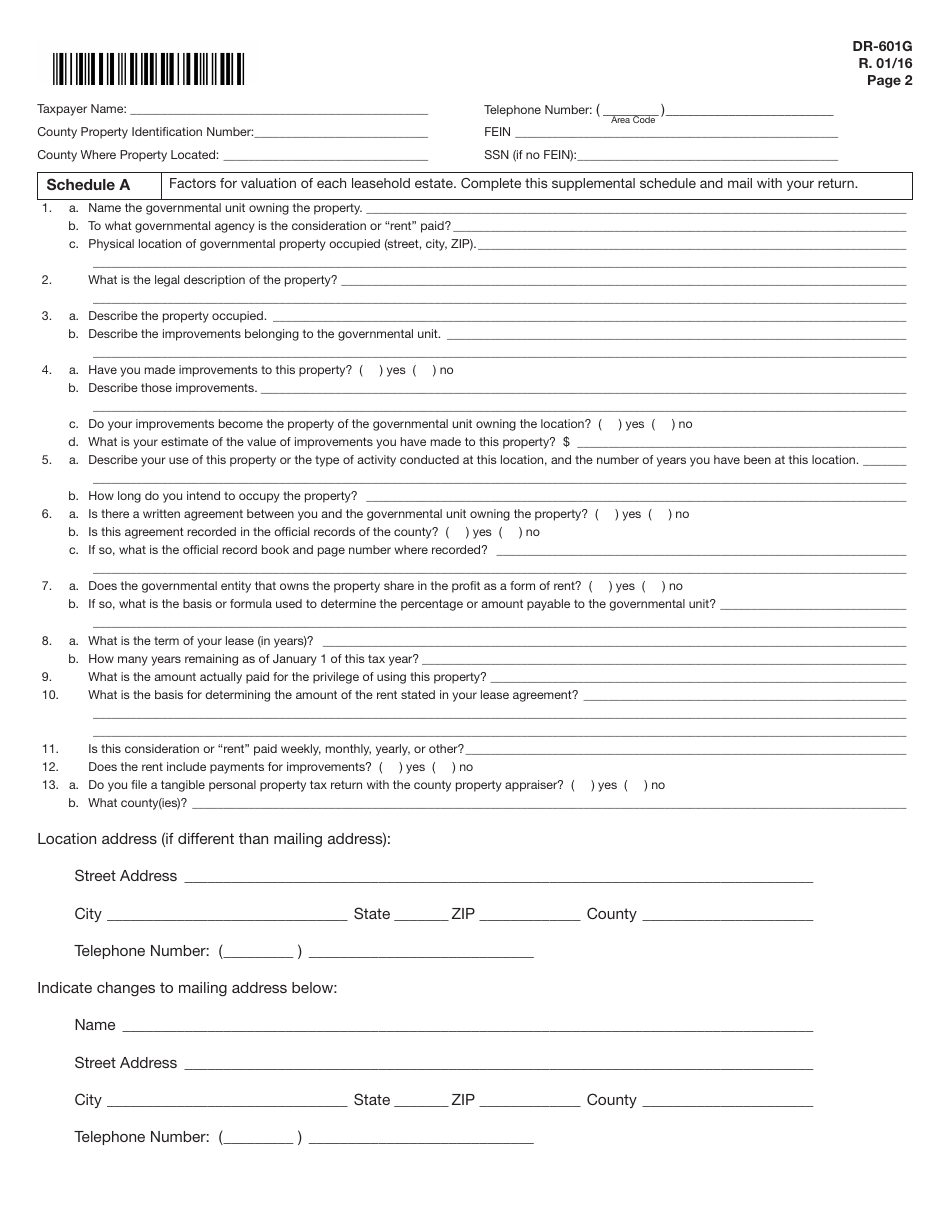

Form DR-601G Governmental Leasehold Intangible Personal Property Tax Return - Florida

What Is Form DR-601G?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

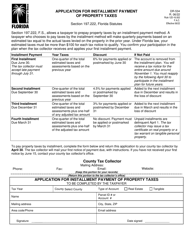

Q: What is Form DR-601G?

A: Form DR-601G is the Governmental Leasehold Intangible Personal Property Tax Return in Florida.

Q: Who needs to file Form DR-601G?

A: Those who own or lease government leasehold intangible personal property in Florida need to file Form DR-601G.

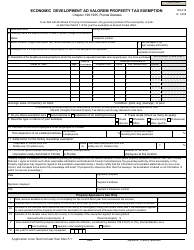

Q: What is government leasehold intangible personal property?

A: Government leasehold intangible personal property refers to leasehold interests in governmental-owned property if the lease term is longer than 30 years.

Q: What is the purpose of Form DR-601G?

A: The purpose of Form DR-601G is to report and pay taxes on government leasehold intangible personal property in Florida.

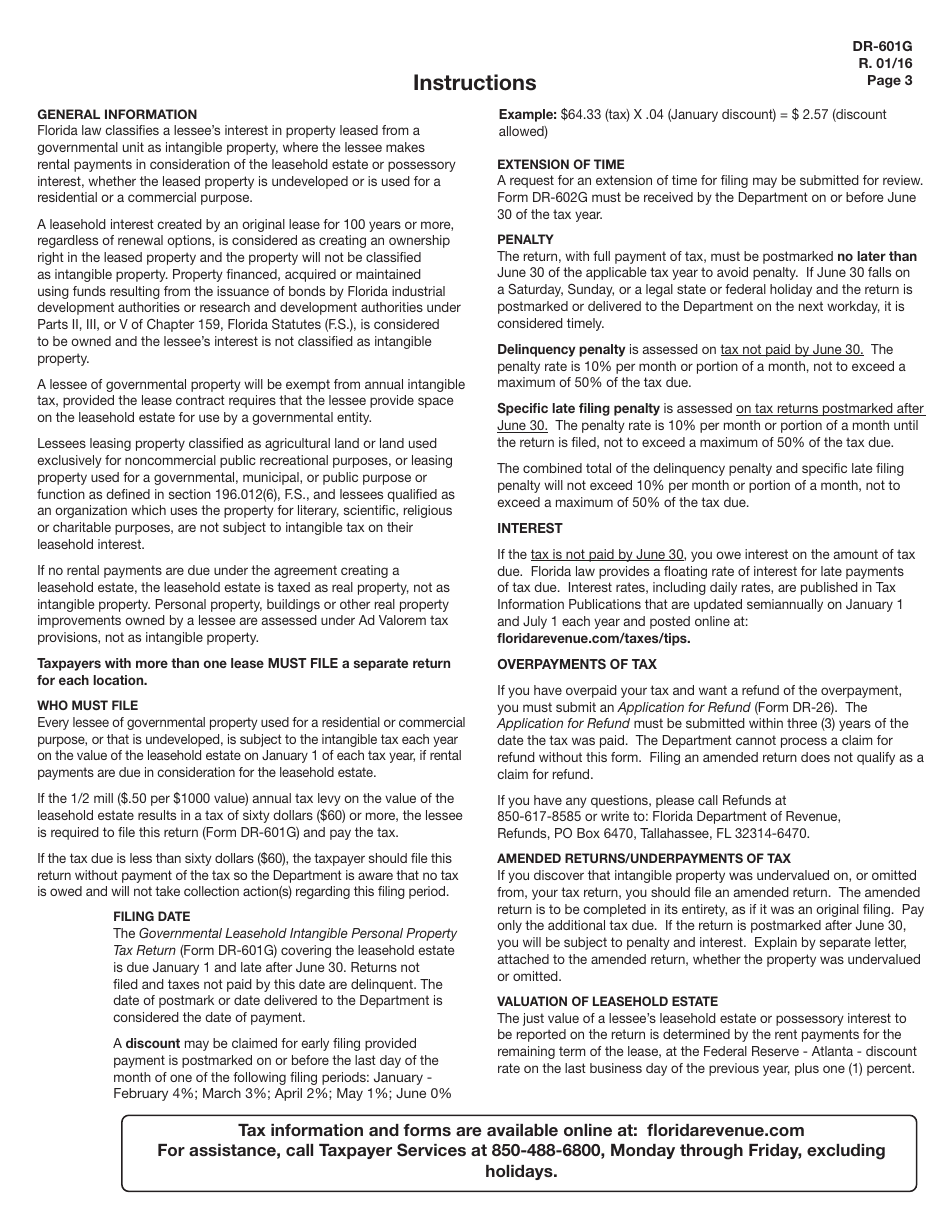

Q: When is Form DR-601G due?

A: Form DR-601G is due by April 1st of each year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing, including a 10% penalty on the tax due.

Q: Are there any exemptions or deductions available for this tax?

A: No, there are no exemptions or deductions available for the government leasehold intangible personal property tax in Florida.

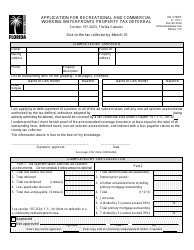

Q: Who should I contact for more information about Form DR-601G?

A: You can contact the Florida Department of Revenue for more information about Form DR-601G.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-601G by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.