This version of the form is not currently in use and is provided for reference only. Download this version of

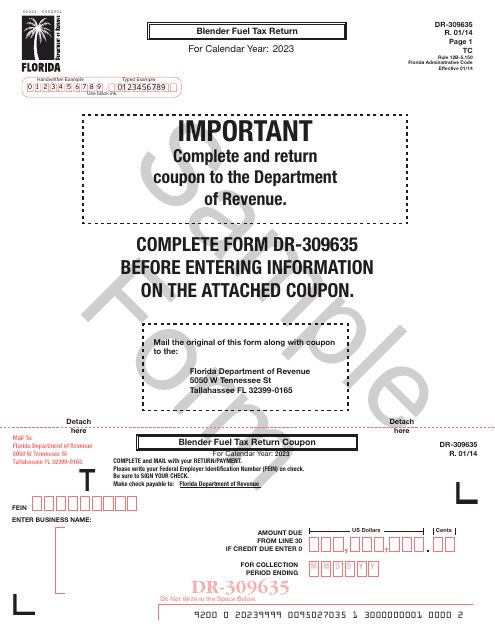

Form DR-309635

for the current year.

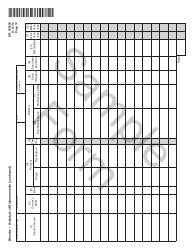

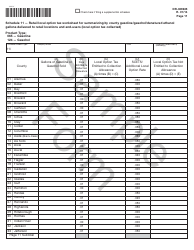

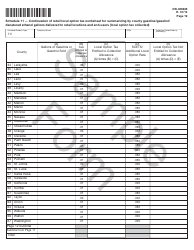

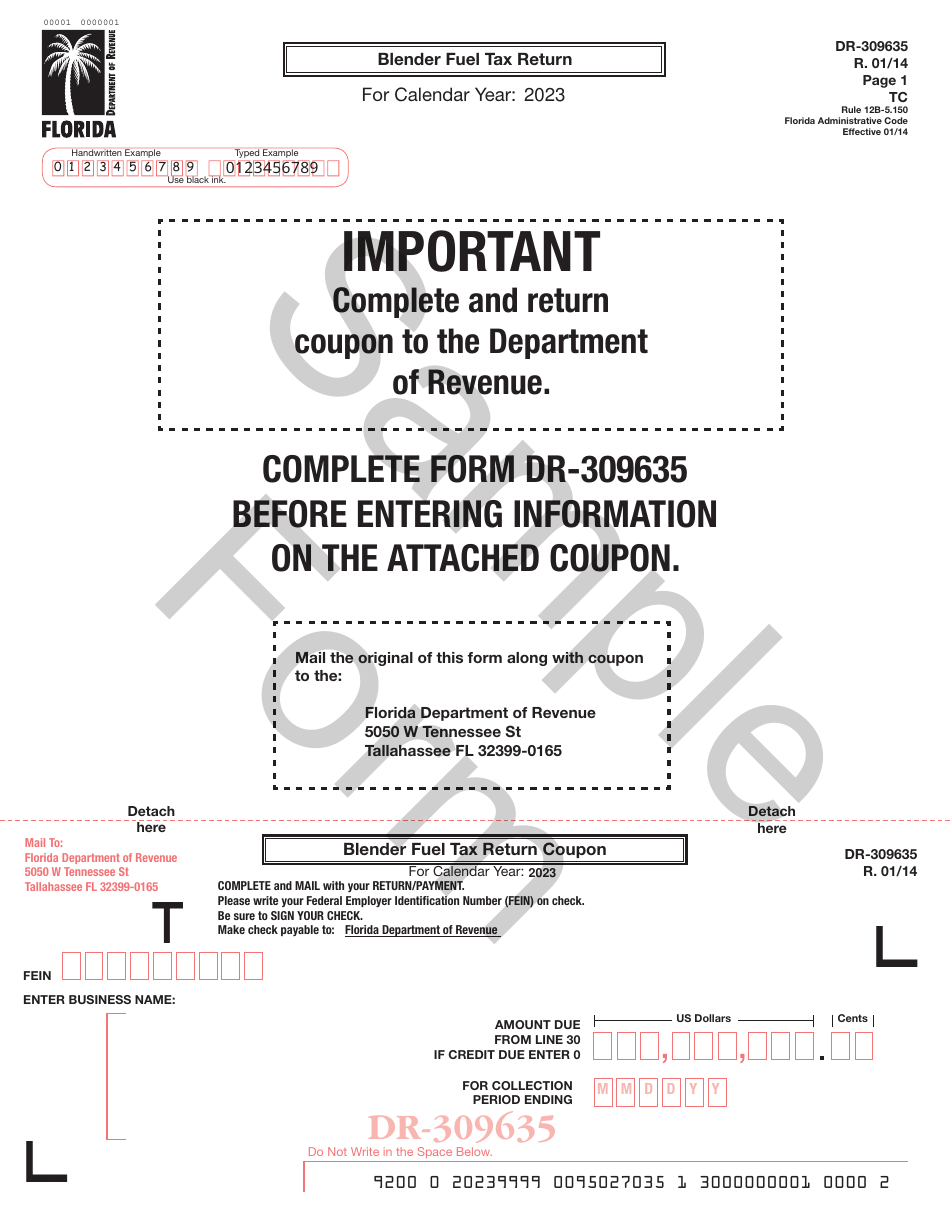

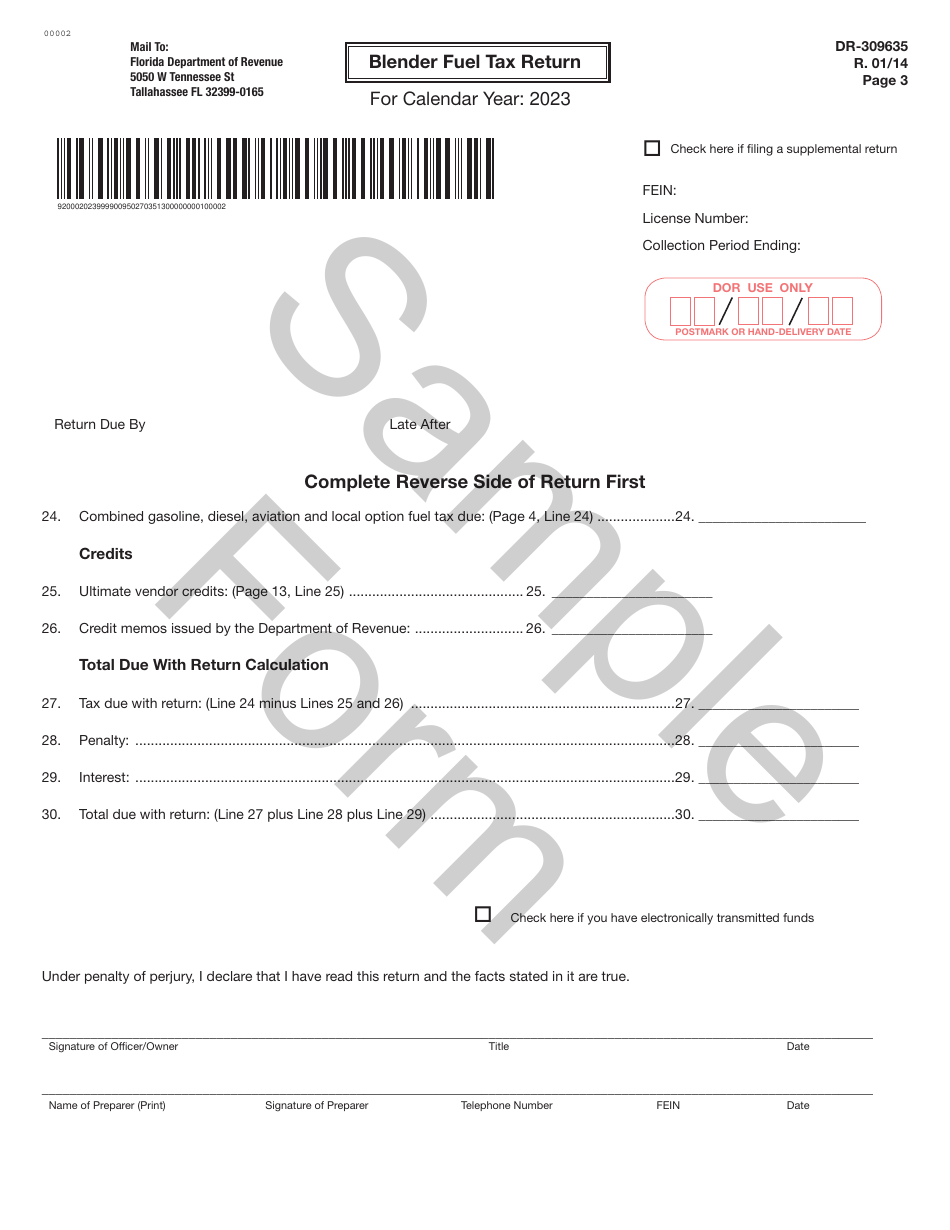

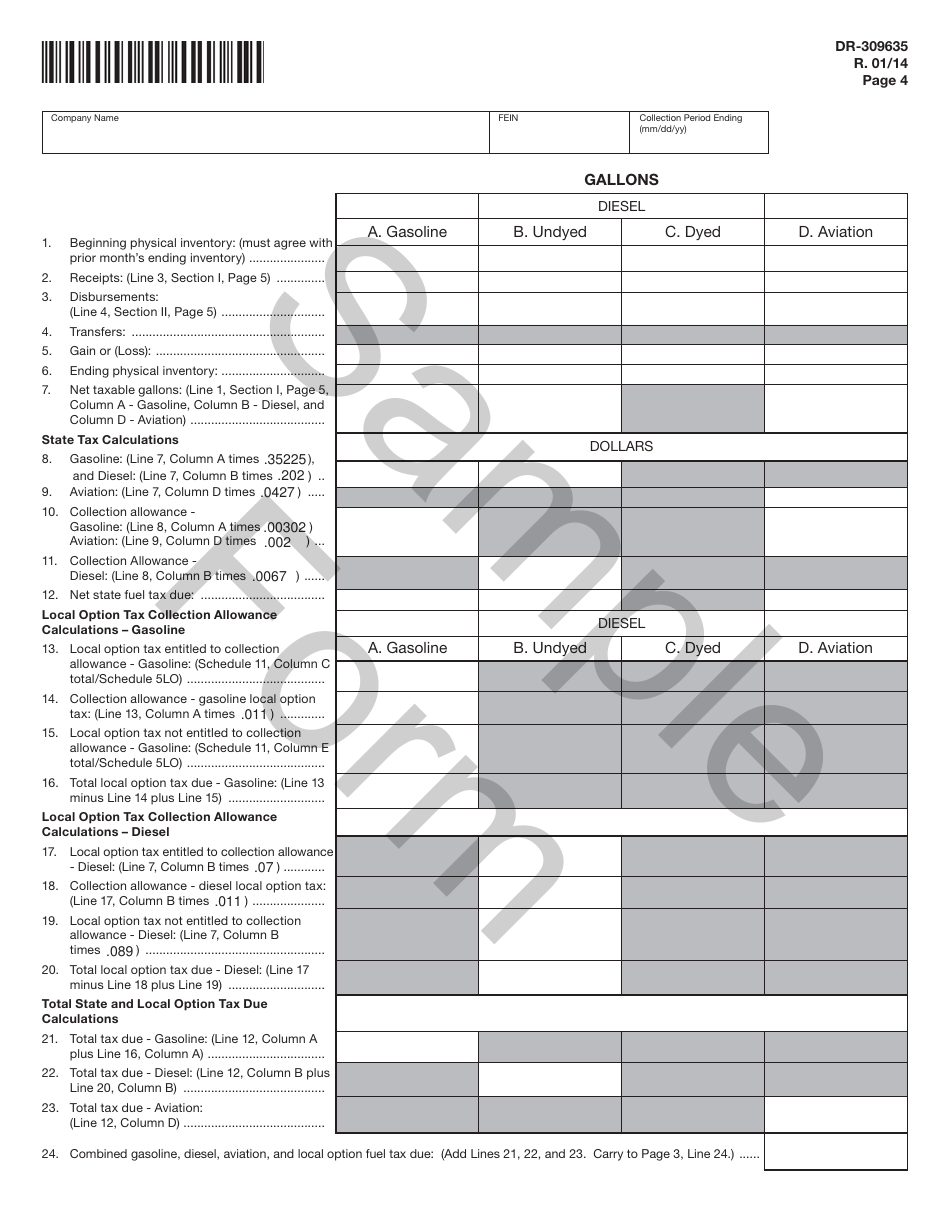

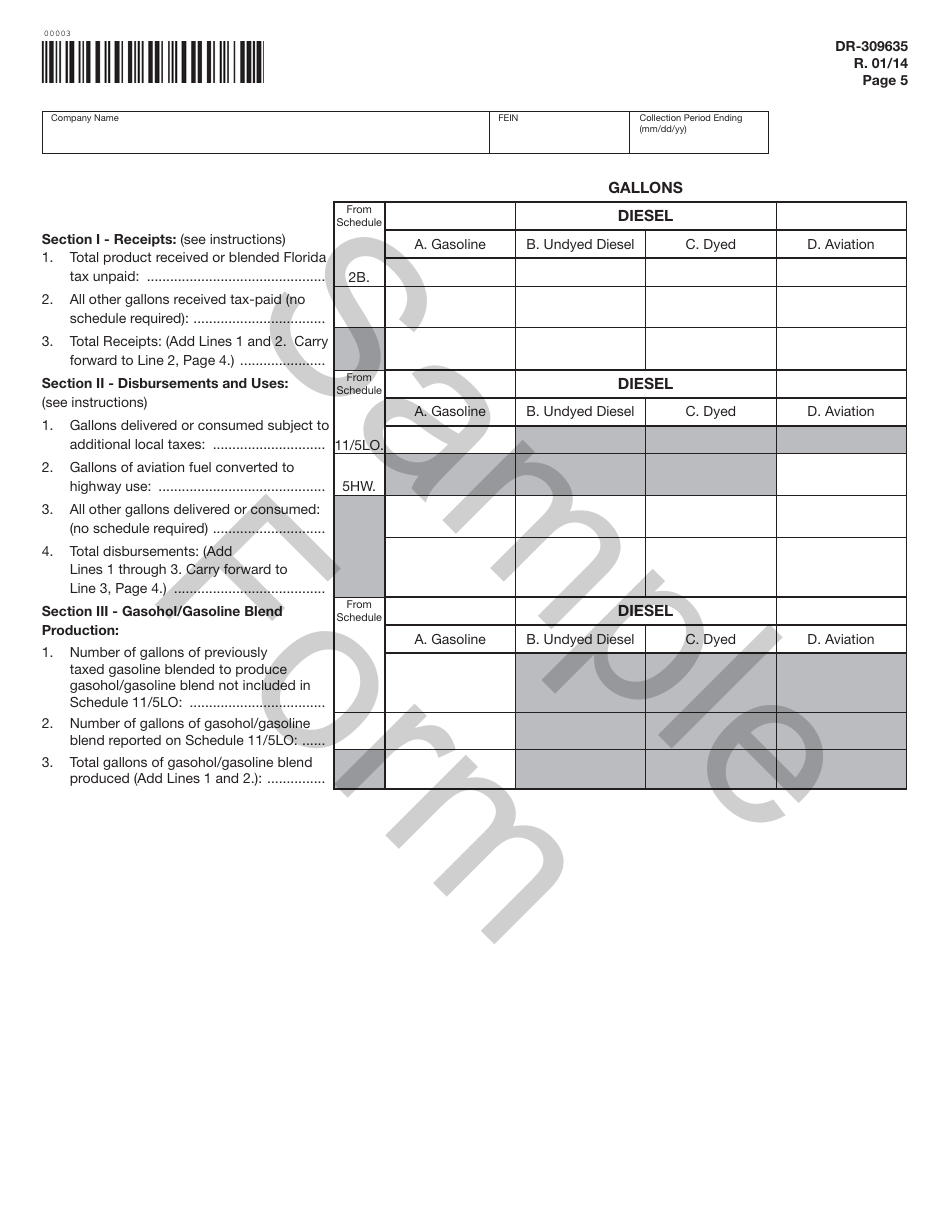

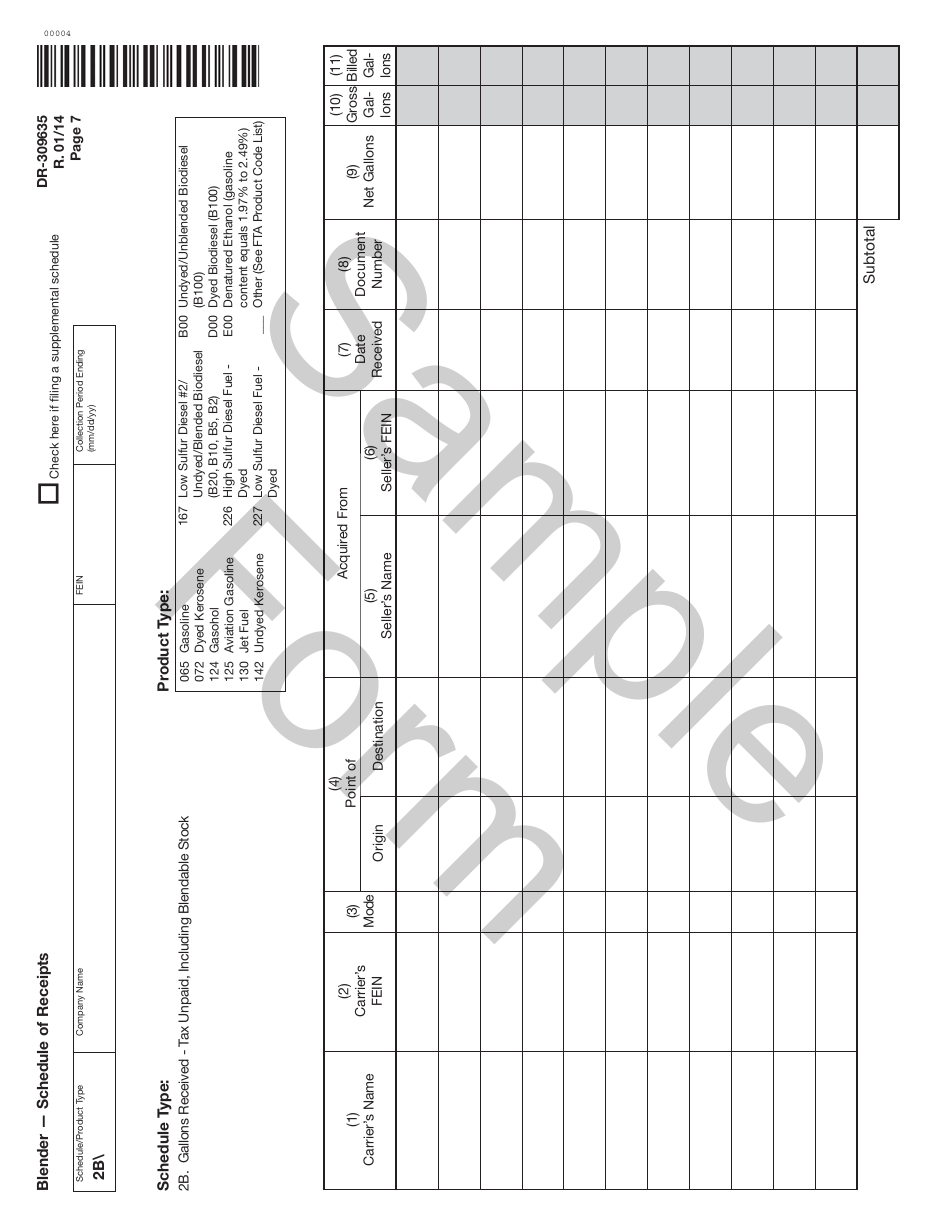

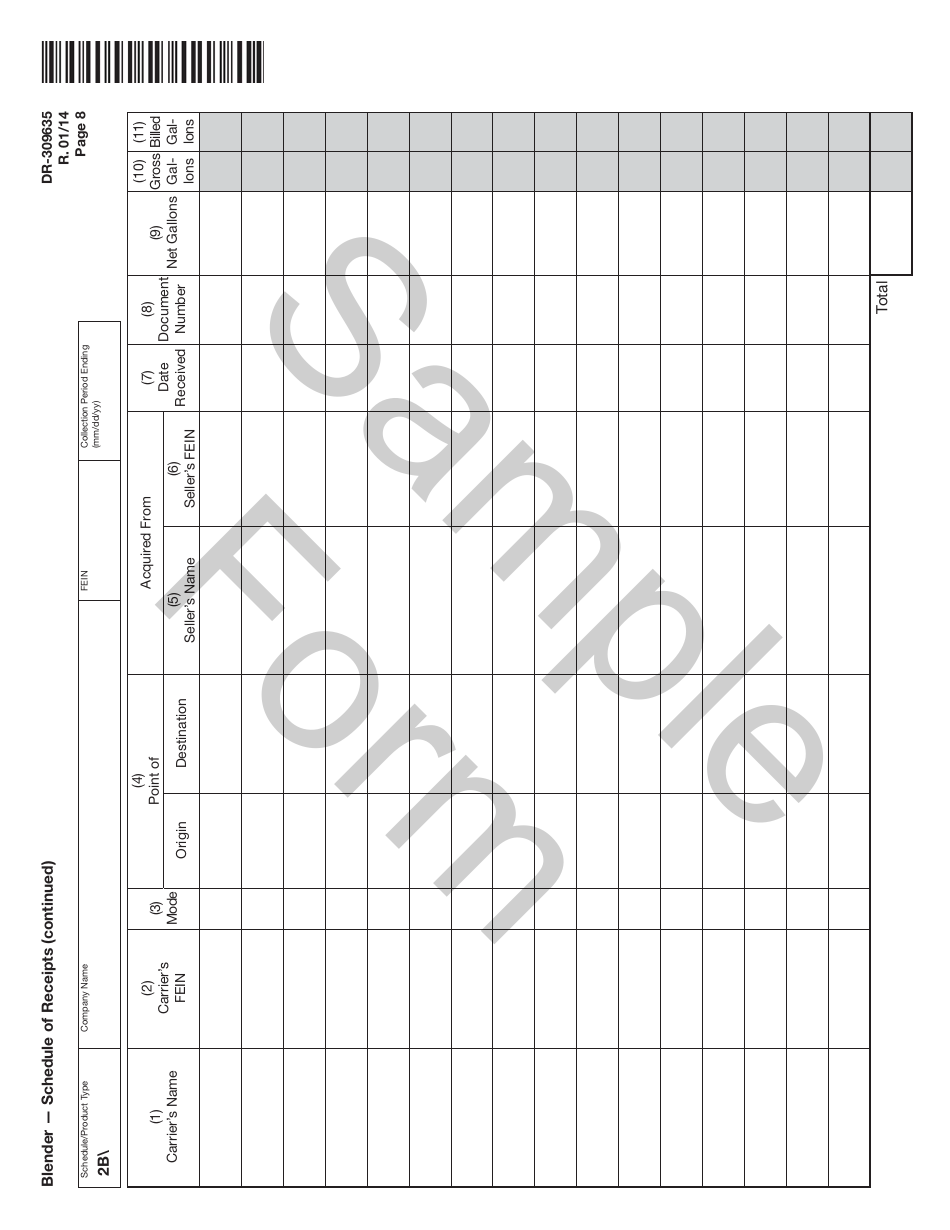

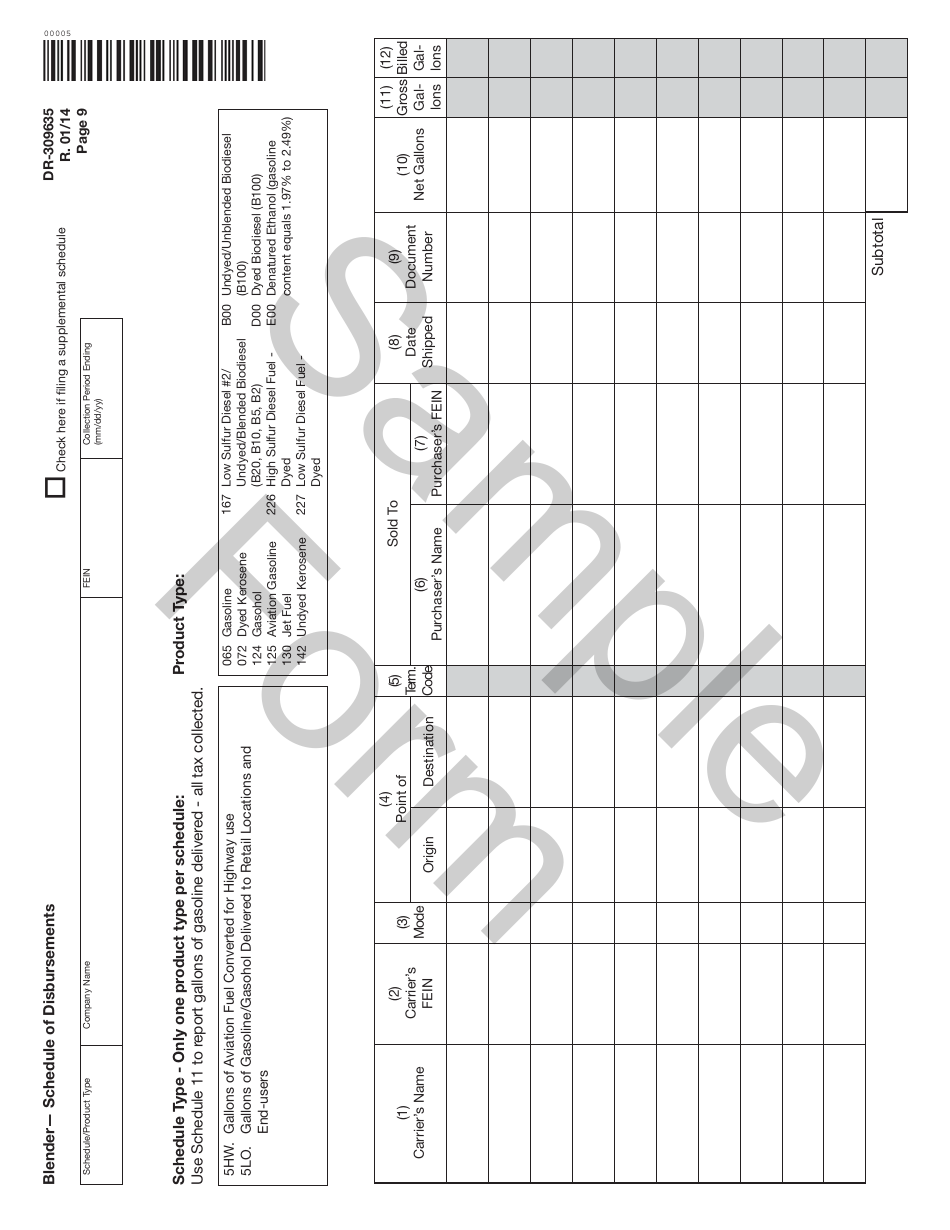

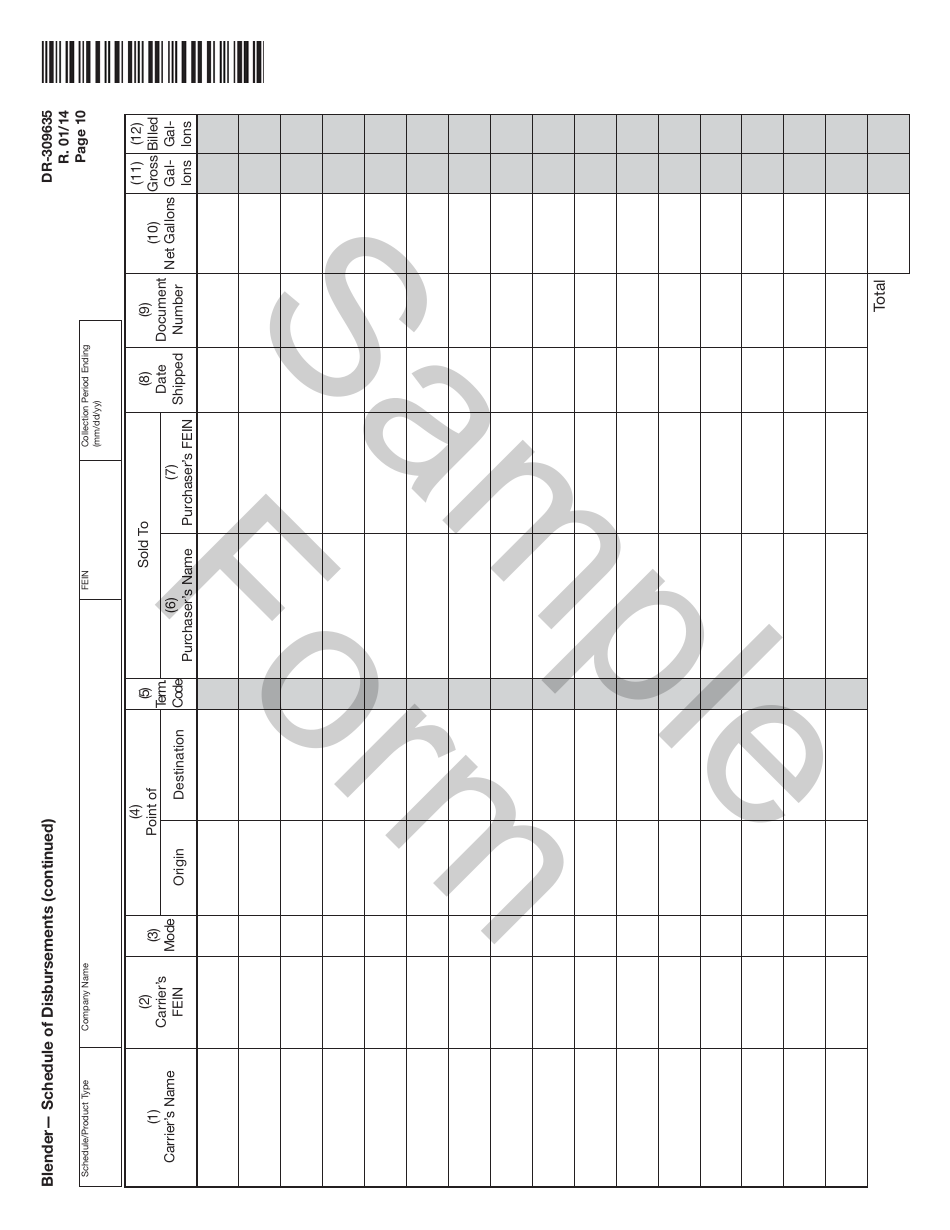

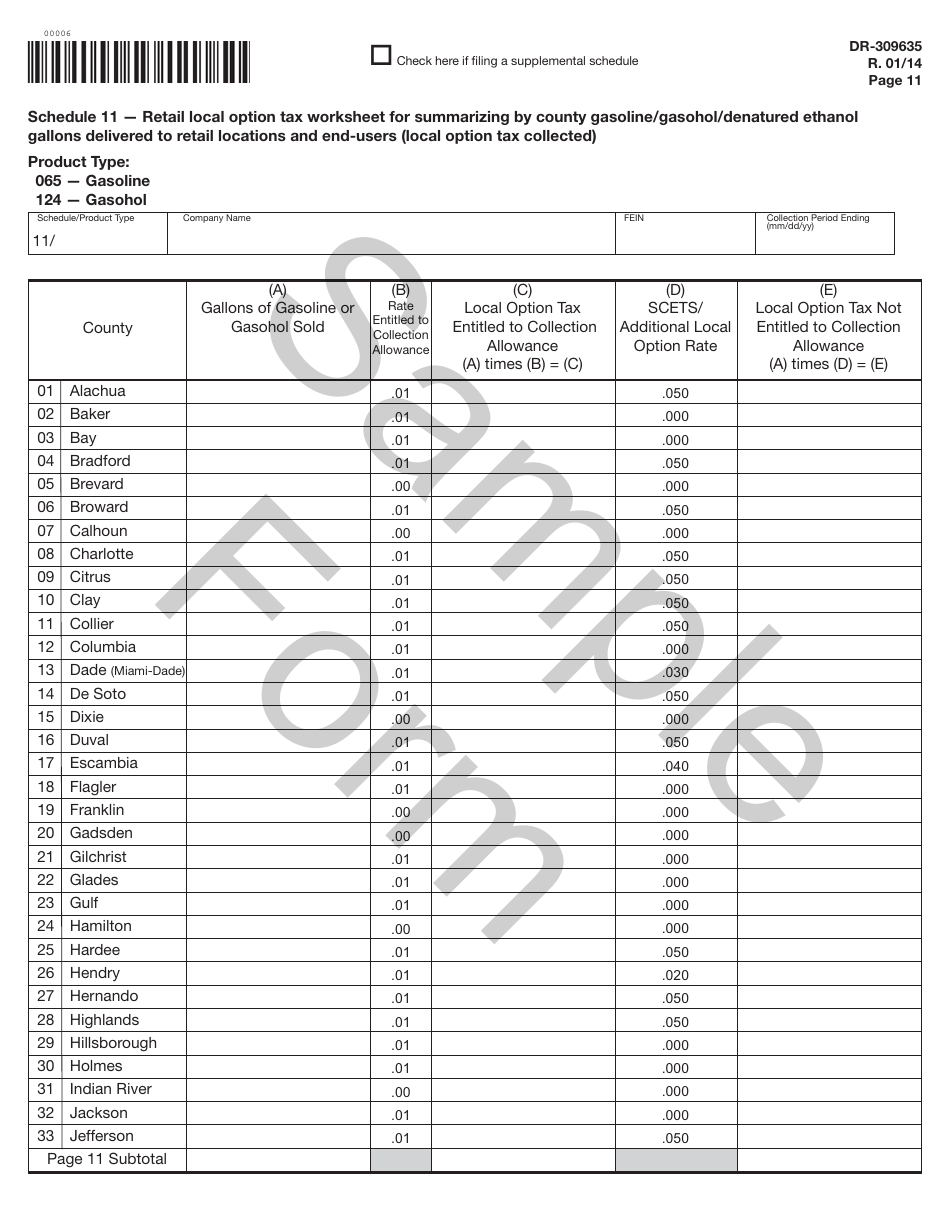

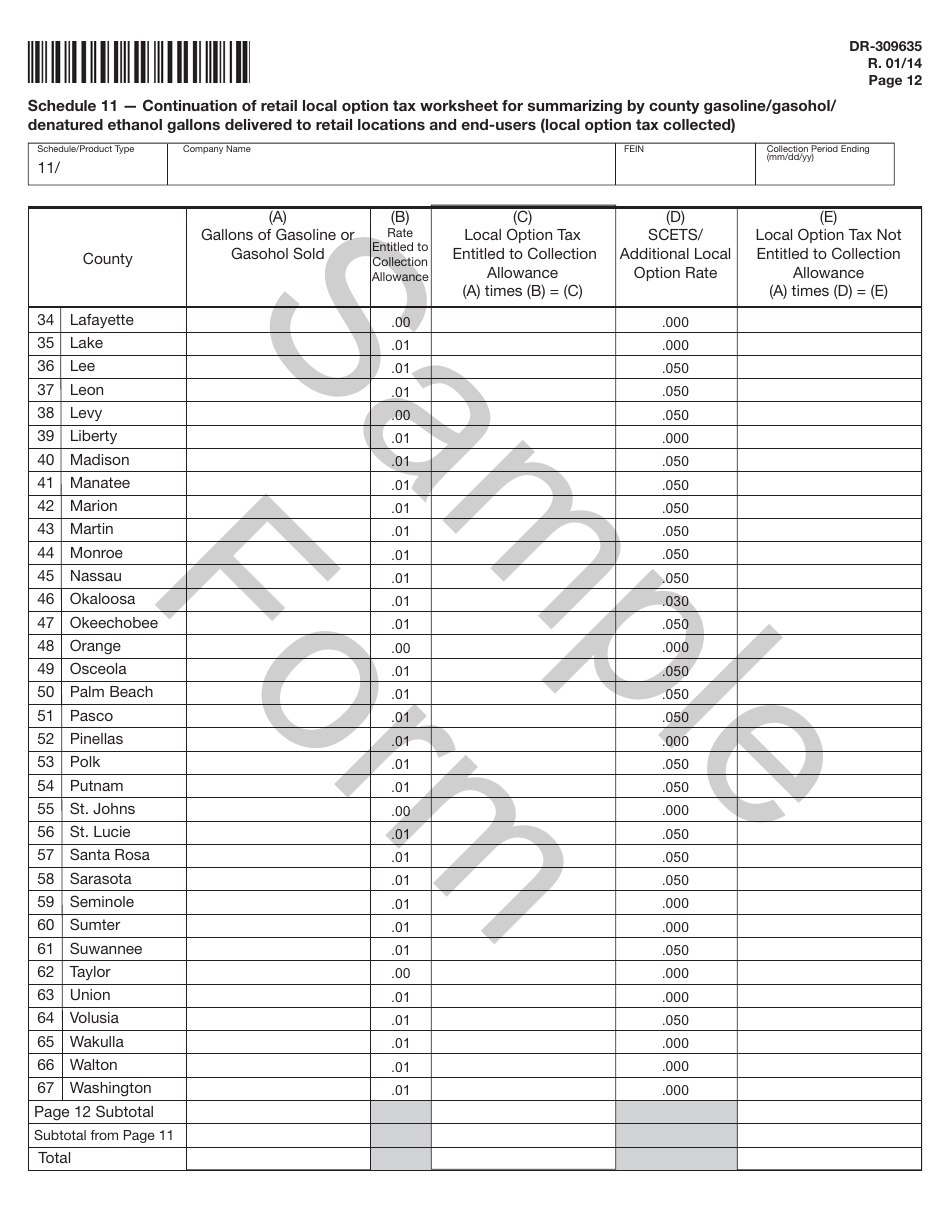

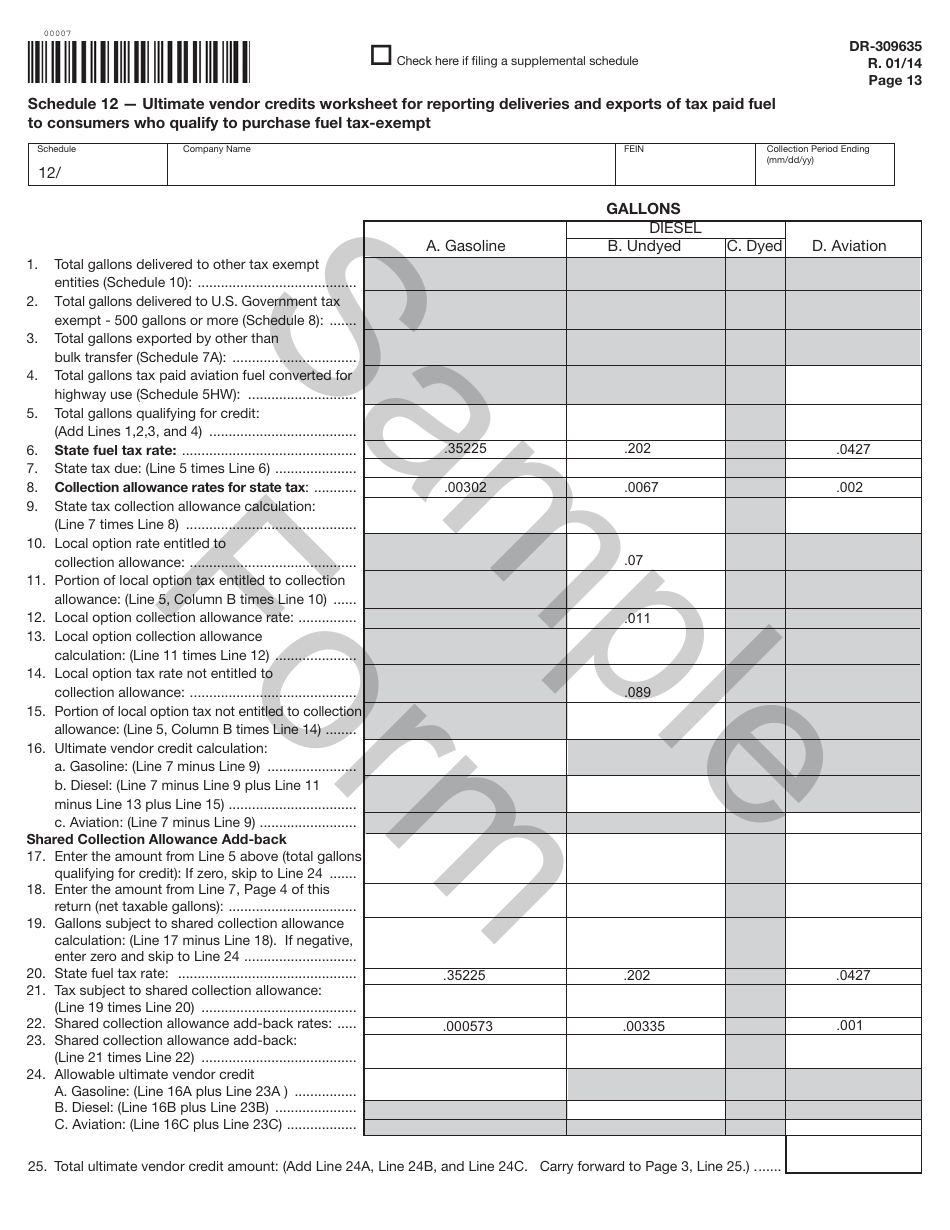

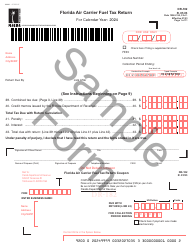

Form DR-309635 Blender Fuel Tax Return - Sample - Florida

What Is Form DR-309635?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-309635?

A: Form DR-309635 is a Blender Fuel Tax Return.

Q: What is the purpose of Form DR-309635?

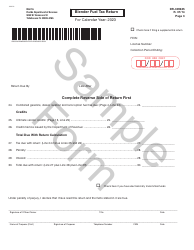

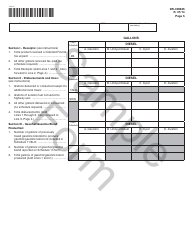

A: The purpose of Form DR-309635 is to report and pay the blender fuel tax in Florida.

Q: Who needs to file Form DR-309635?

A: Blenders of fuel in Florida need to file Form DR-309635.

Q: What is the due date for filing Form DR-309635?

A: The due date for filing Form DR-309635 is the 1st day of the month following the reporting period.

Q: Are there any penalties for late filing of Form DR-309635?

A: Yes, there are penalties for late filing of Form DR-309635. It is important to file the return on time to avoid penalties.

Q: What if I have questions about Form DR-309635?

A: If you have questions about Form DR-309635, you can contact the Florida Department of Revenue for assistance.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-309635 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.