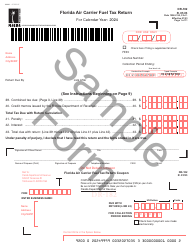

This version of the form is not currently in use and is provided for reference only. Download this version of

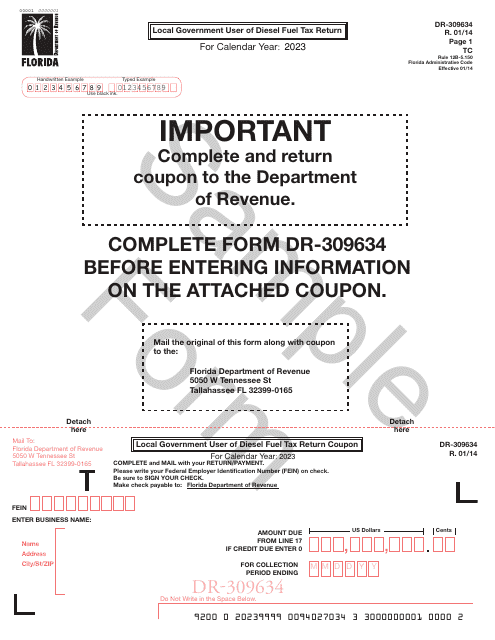

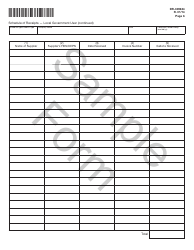

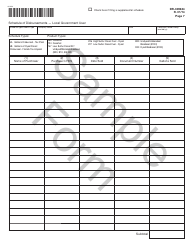

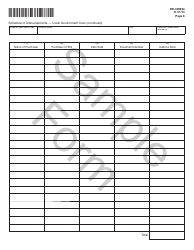

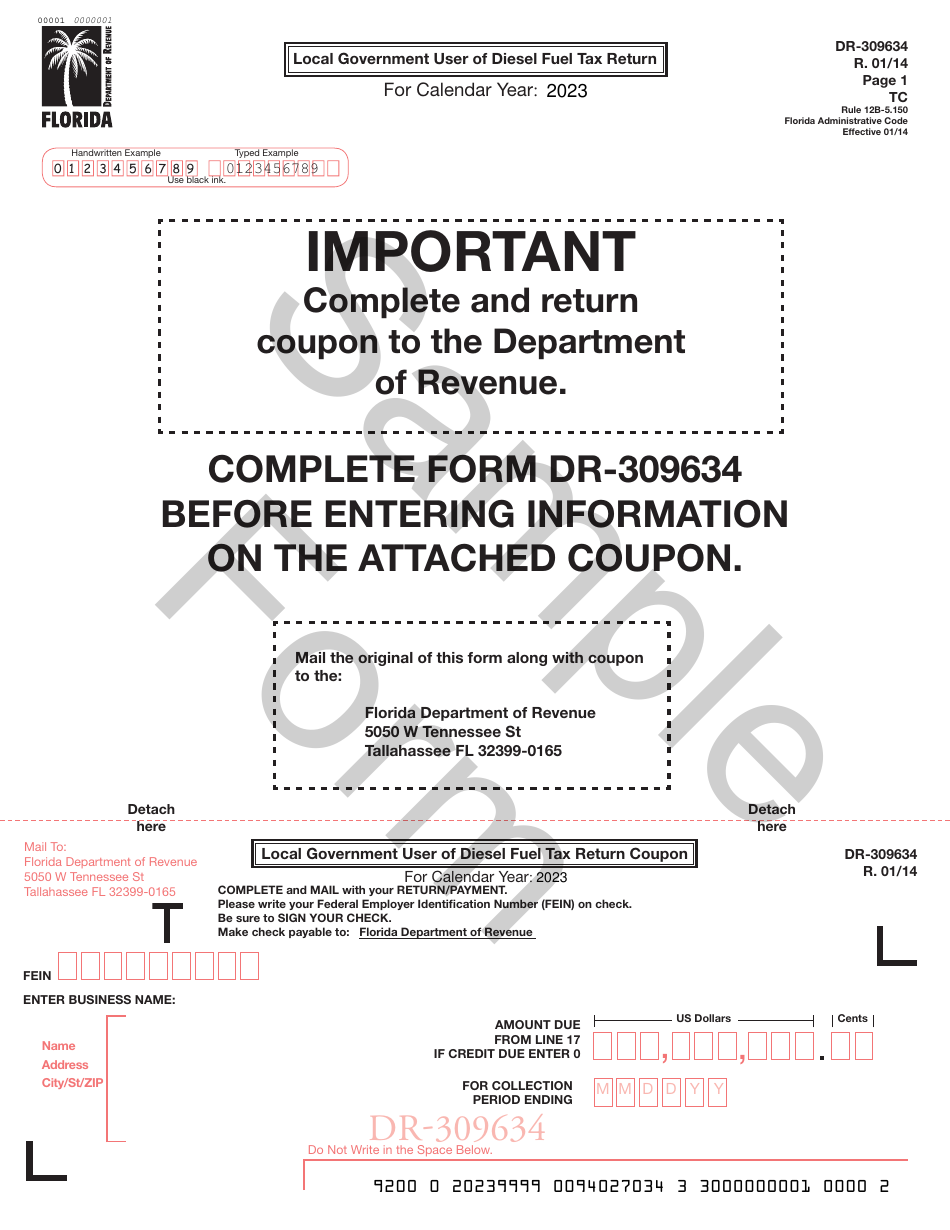

Form DR-309634

for the current year.

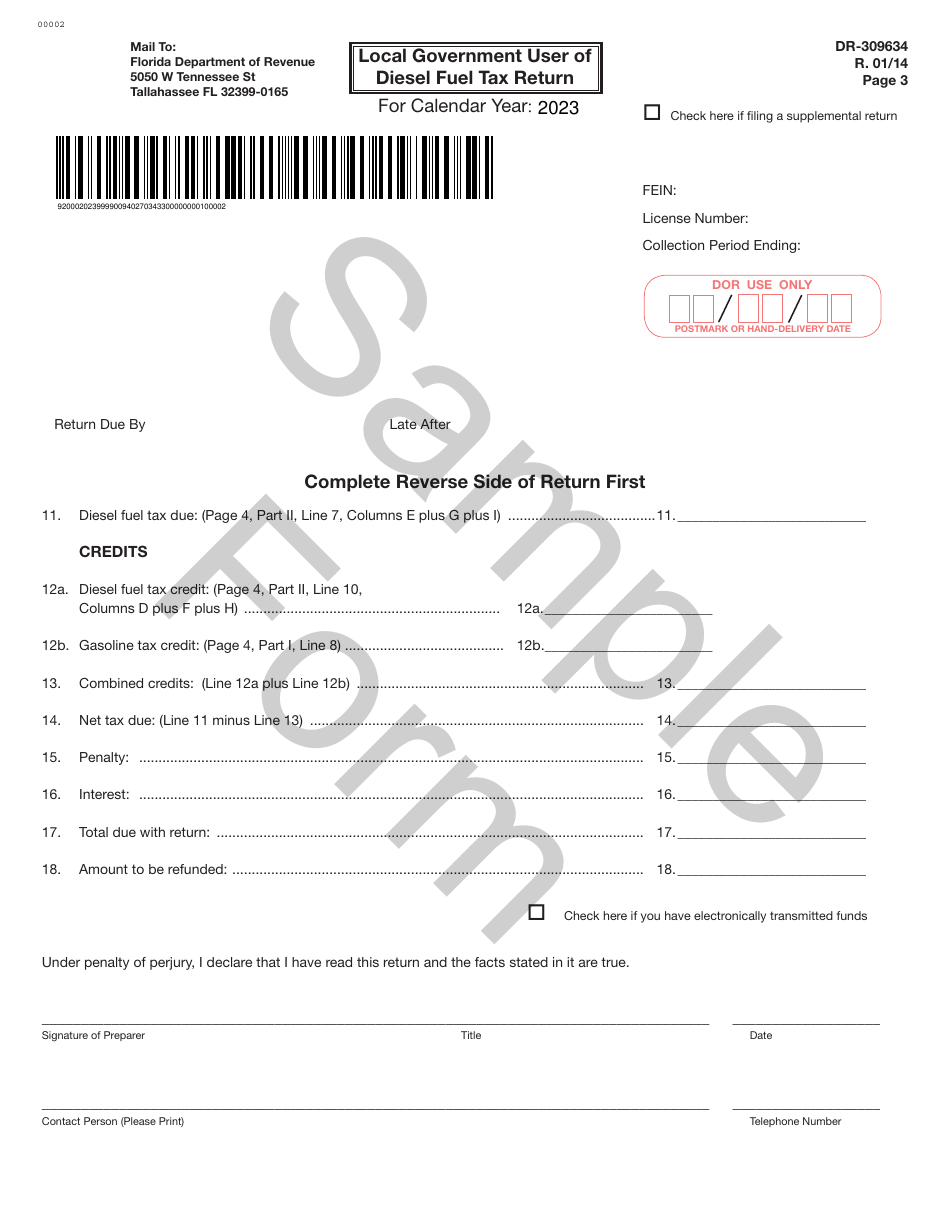

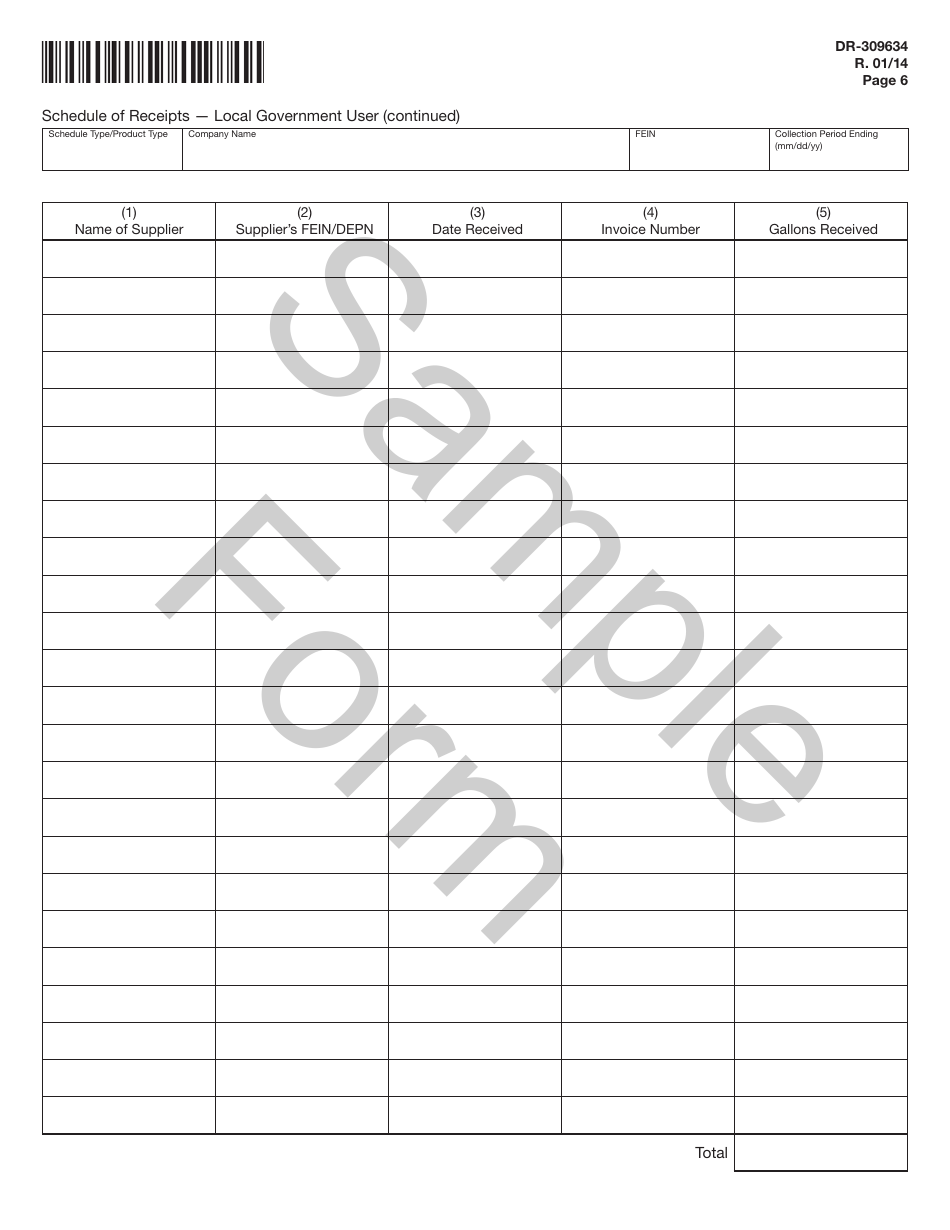

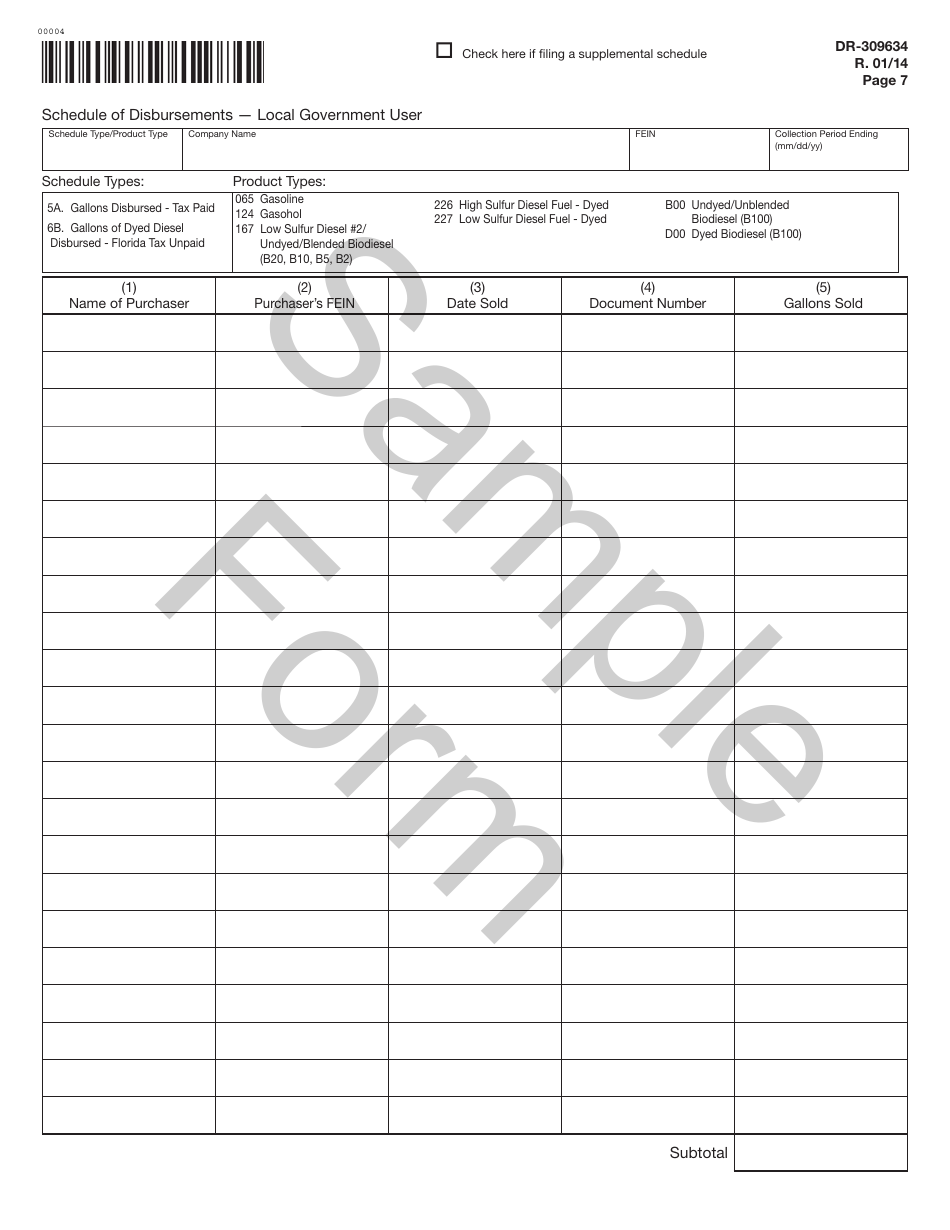

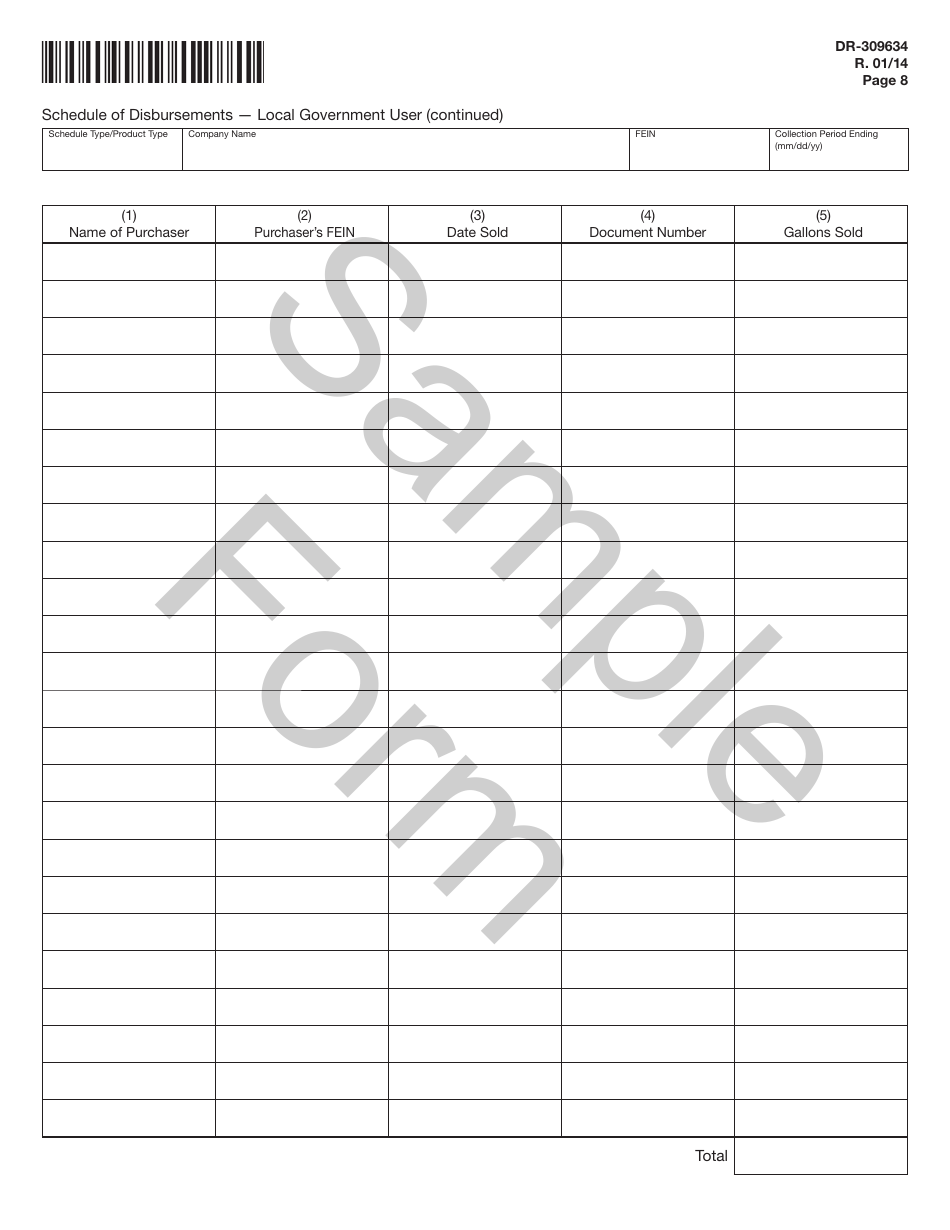

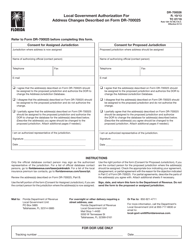

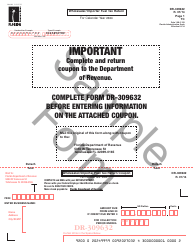

Form DR-309634 Local Government User of Diesel Fuel Tax Return - Sample - Florida

What Is Form DR-309634?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DR-309634?

A: Form DR-309634 is the Local Government User of Diesel Fuel Tax Return used in Florida.

Q: Who needs to file Form DR-309634?

A: Local governments in Florida that purchase diesel fuel need to file Form DR-309634.

Q: What is the purpose of Form DR-309634?

A: Form DR-309634 is used to report and pay the local government user of diesel fuel tax in Florida.

Q: When is Form DR-309634 due?

A: Form DR-309634 is due on a monthly basis by the 1st day of the month following the reporting period.

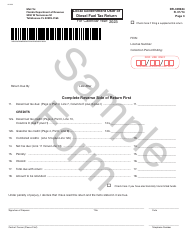

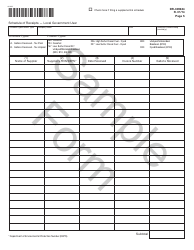

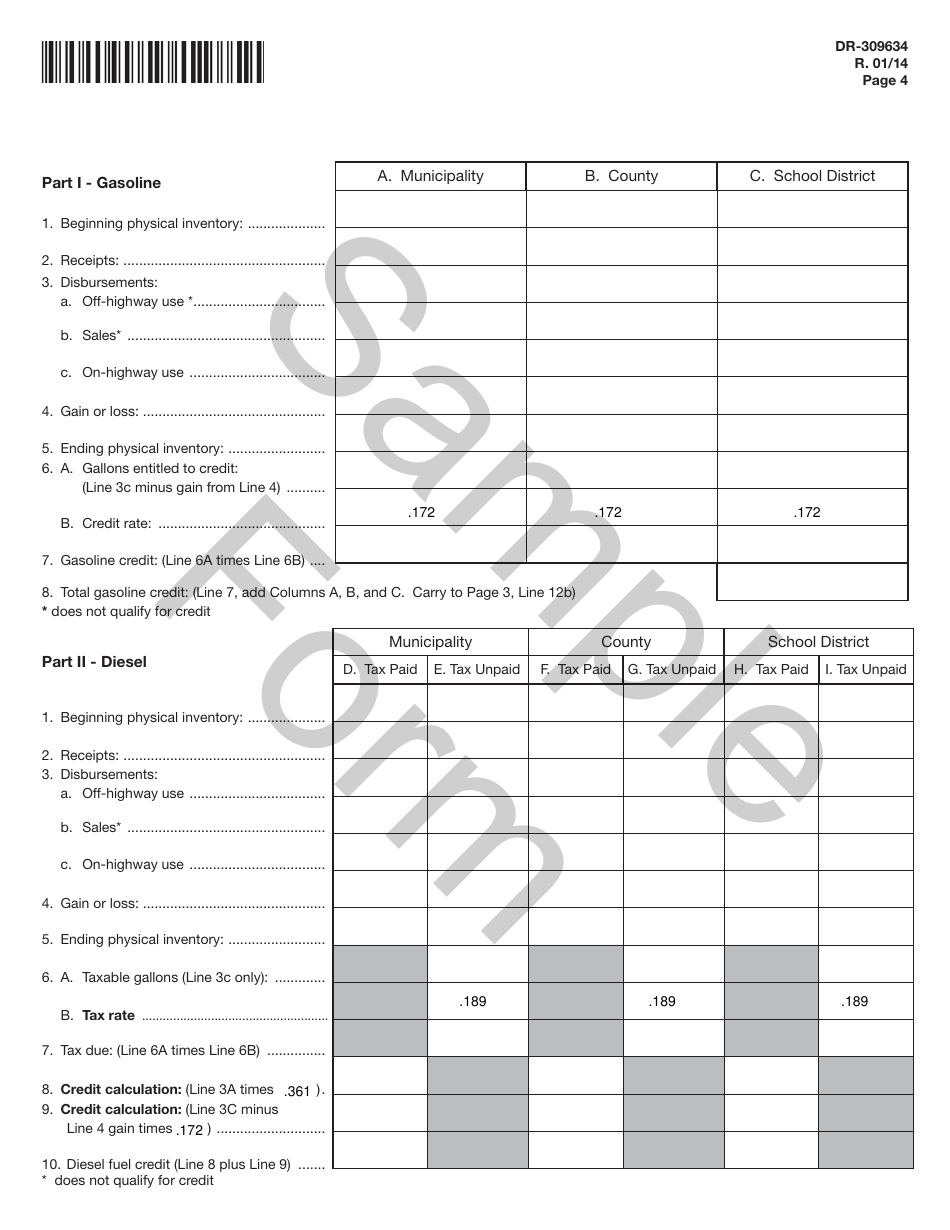

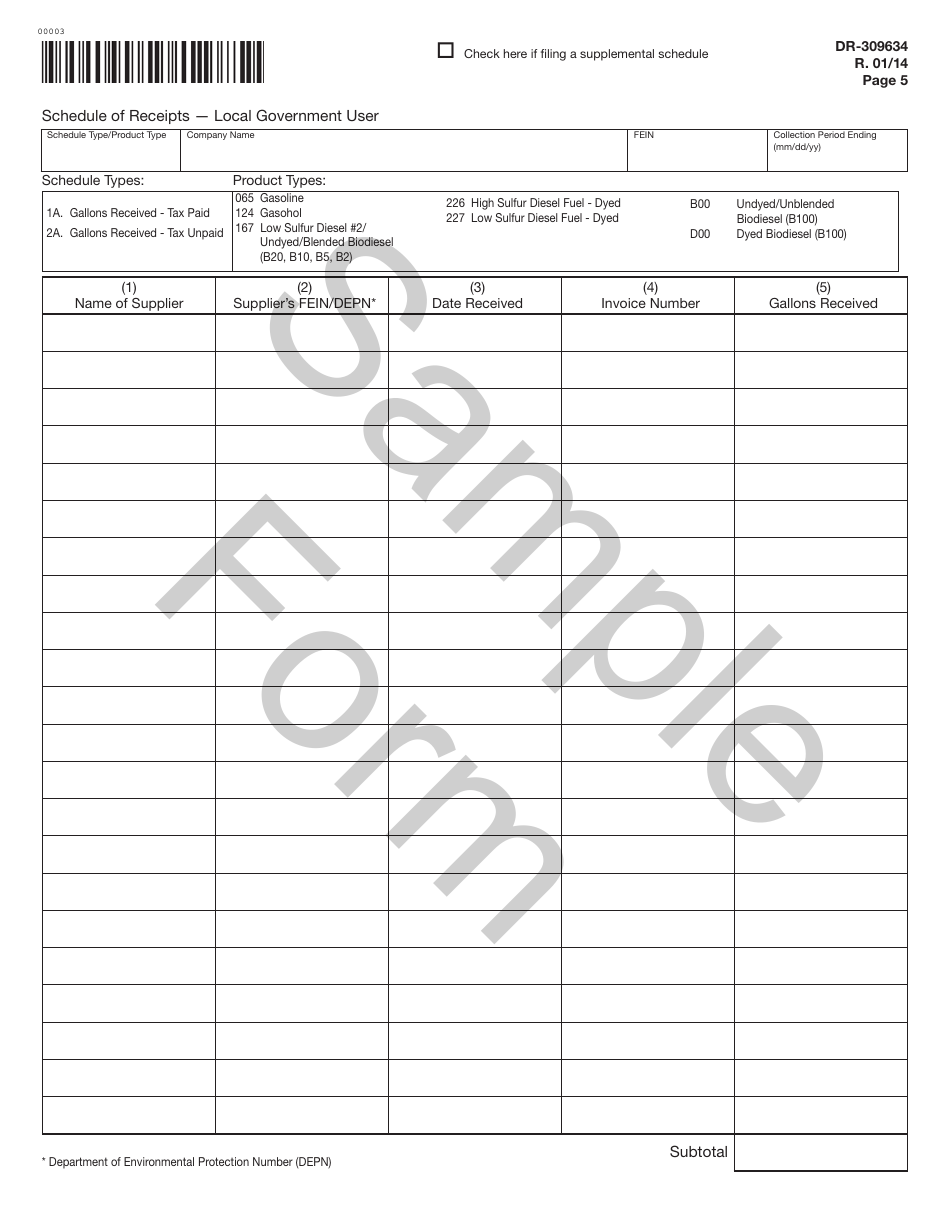

Q: What information do I need to fill out Form DR-309634?

A: You will need to provide information about the quantity and cost of diesel fuel purchased, as well as other relevant details.

Q: Are there any penalties for late filing of Form DR-309634?

A: Yes, there are penalties for late filing of Form DR-309634, including a late filing fee and interest on the tax due.

Q: Can I claim a refund on Form DR-309634?

A: No, Form DR-309634 is used for reporting and payment of the local government user of diesel fuel tax and does not allow for refunds.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-309634 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.